- Bitcoin Mining Hashprice is stabilized at $ 48 despite increasing difficulty and falling transaction costs.

- A projected difficulty of 4.3% can solve a short -term margin.

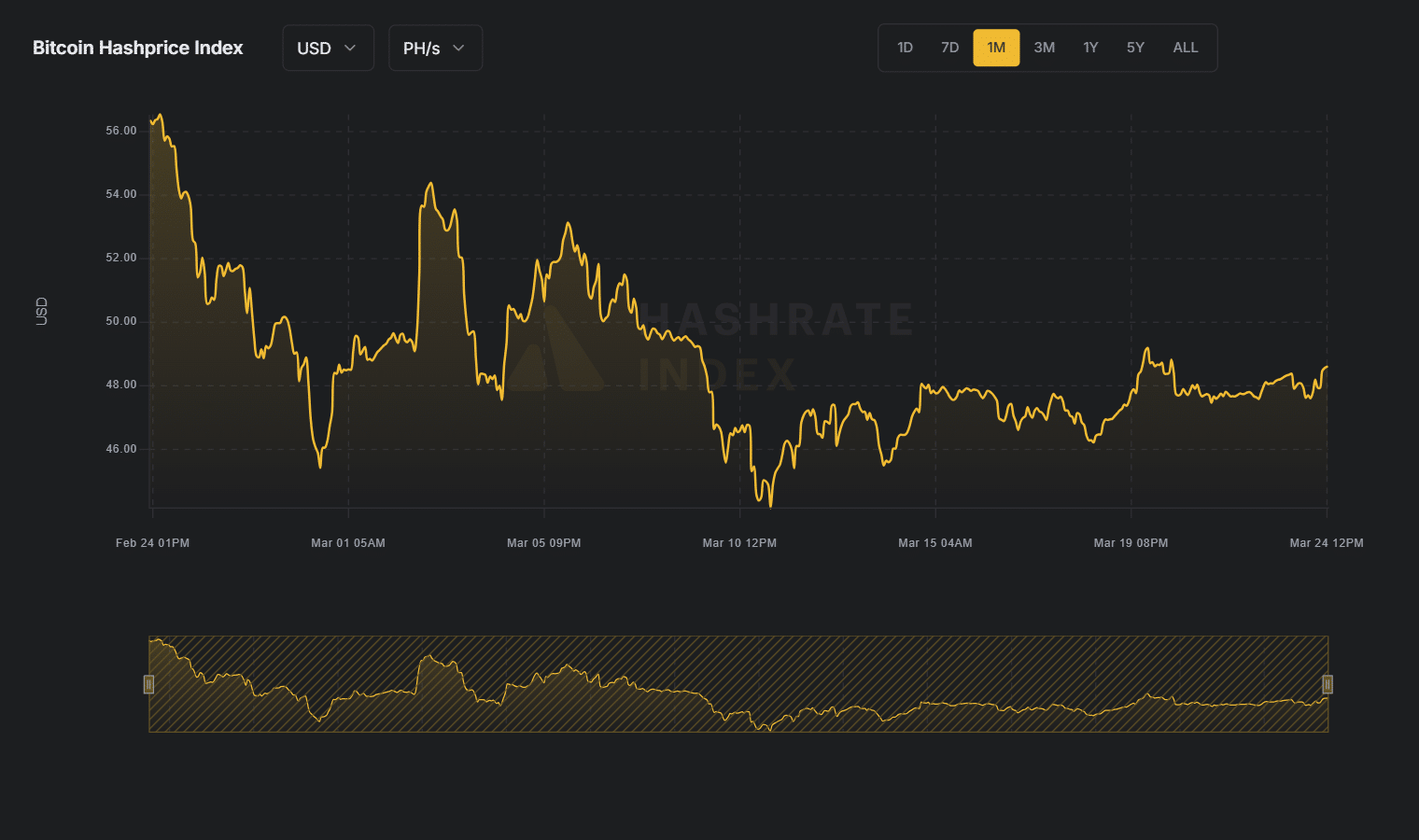

Bitcoin’s [BTC] Mininghashprice is stabilized at $ 48 per petahash per second (pH/s), after a difficulty of 1.4% to 113.76 trillion at block 889.081 on March 23.

Source: Hashrate Index

The increase came when the Networkhashrate dropped below 800 EH/s, which reduced a short increase to 840 eh/s earlier this month.

That is not the only profitability of the miner.

A price recovery, but not in print

The price of Bitcoin fell to $ 80,000 on 10 March and recovered on March 24 to $ 85,172. But the hashprice remains under the threshold of $ 50 where many miners trust sustainable operations.

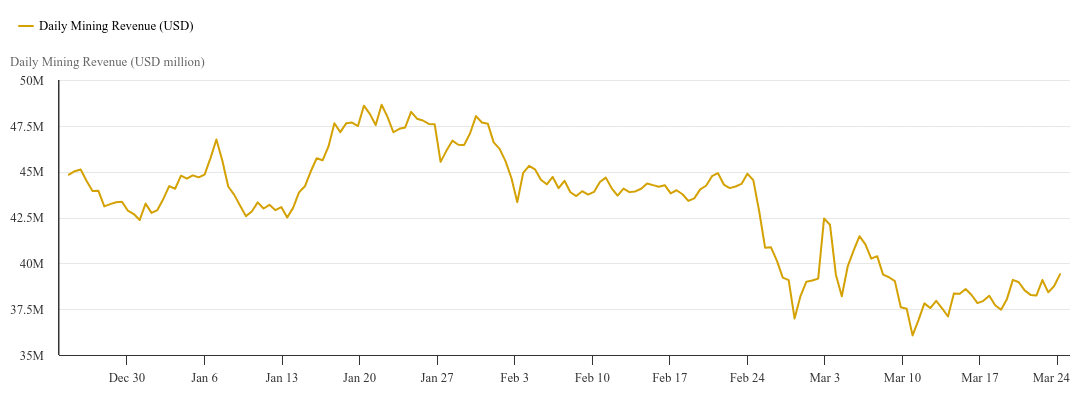

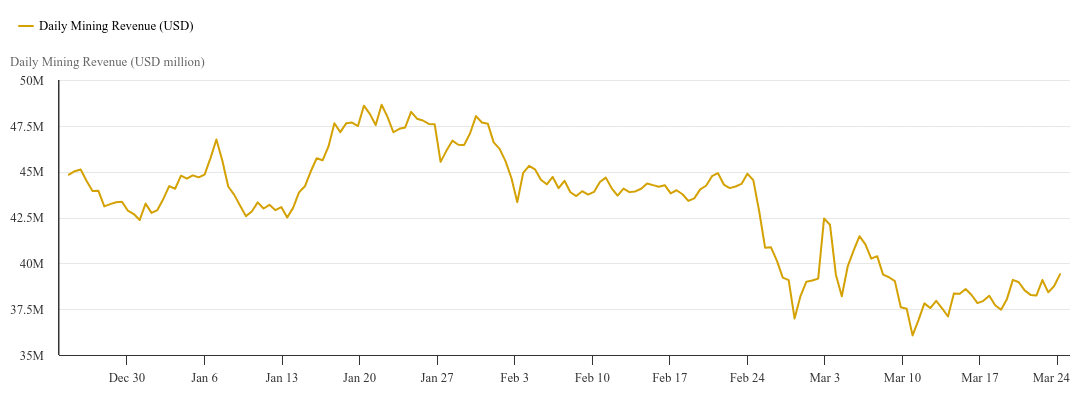

Daily mining income reaches $ 39.23 million, a slight rebound of the $ 36.27 million low earlier in the month.

Source: Braiins

Nevertheless, sales have fallen by 17% since December, when miners earned more than $ 47 million every day.

Costs disappear, margins disappear faster

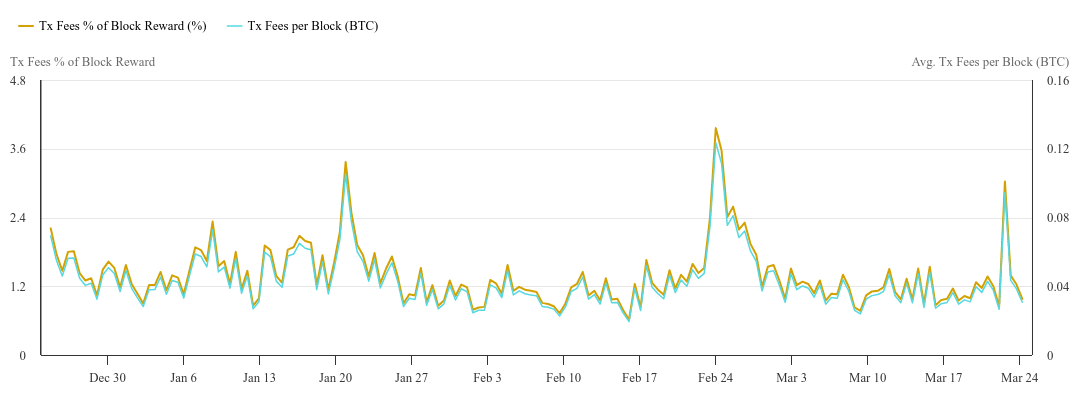

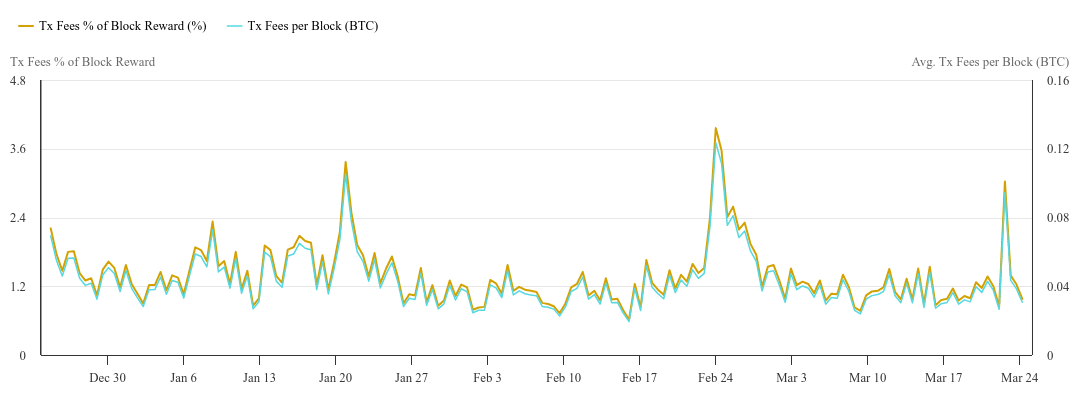

The income of transaction costs have also dried up.

From 24 March, the reimbursements were only 1.12% of the block reward, the lowest share since January 2022. Income per block costs are now on average 0.04 BTC, which means that an important income flow for miners is removed during price weakness.

Source: Braiins.

The pressure has pushed many operators into efficiency upgrades.

Machines of older generations such as the Antminer S19 XP and S19 Pro now deliver $ 0.088 and $ 0.067 per kilowatt hour, which falls under typical electricity interest rate in many regions.

That is thousands of units that run the risk of becoming unprofitable. In the meantime, newer models continue to perform.

According to Braiins, Rigs such as the Antminer S21 Hyd still deliver more than $ 4.50 in daily income, which provides greater margin protection under the current hashprice conditions. But the difficulty increases things.

Difficult climbs, but timing betrays the miners

The Bitcoin Protocol calibrates the difficulty around the 2,016 blocks again. The newest increase reflects the past network activity, not the current delay.

This timing gap has confronted miners with increasing difficulty, just like Hashrate Falls.

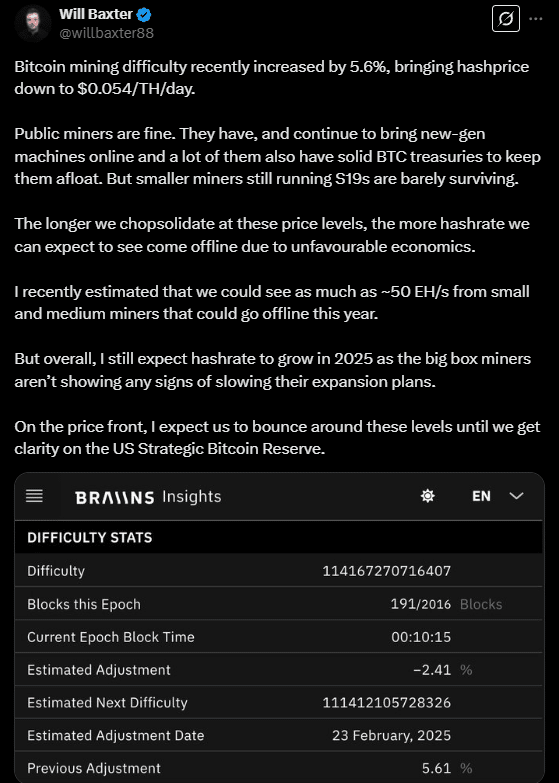

Will Baxter, EVP at Braiins, confirmed That difficulty recently rose by 5.6%and has Hashprice to $ 0.054/Th/day.

Source: X

He noted that public miners remain isolated by newer hardware and treasury companies, while smaller miners still use S19s “hardly survive”.

“The longer we cut aside at these price levels, the more hashrate we can expect we come offline.”

Baxter estimated ~ 50 eh/s small and medium -sized mining capacity could be closed this year.

Nevertheless, he expects hashrate growth in 2025 while “Big Box Miners” continue to expand.

Relief on the horizon?

The following adjustment, projected before April 7, can fall the difficulty by 4.3% to 108.86 trillion.

That prediction corresponds to the current average block time of 10.45 minutes, which exceeds the target and indicates a downward herkalibration.

Still, miners remain divided.

Institutional players with modern rigs and cheap electricity continue to work. Others with Older hardware And higher costs are scaled back, as shown in the falling hashrate.

Without a price rebound or a peak of transaction costs, Hashprice can remain under pressure.

The upcoming difficulty adjustment will be crucial in shaping short-term margins-especially with the next half that is expected within a year, which will further reduce the block announcements.