- Bitcoin’s hash price has hit a record low, fueling fears of a new round of miner crisis.

- Network difficulty has increased by 10% and daily miner revenue has decreased by 50%.

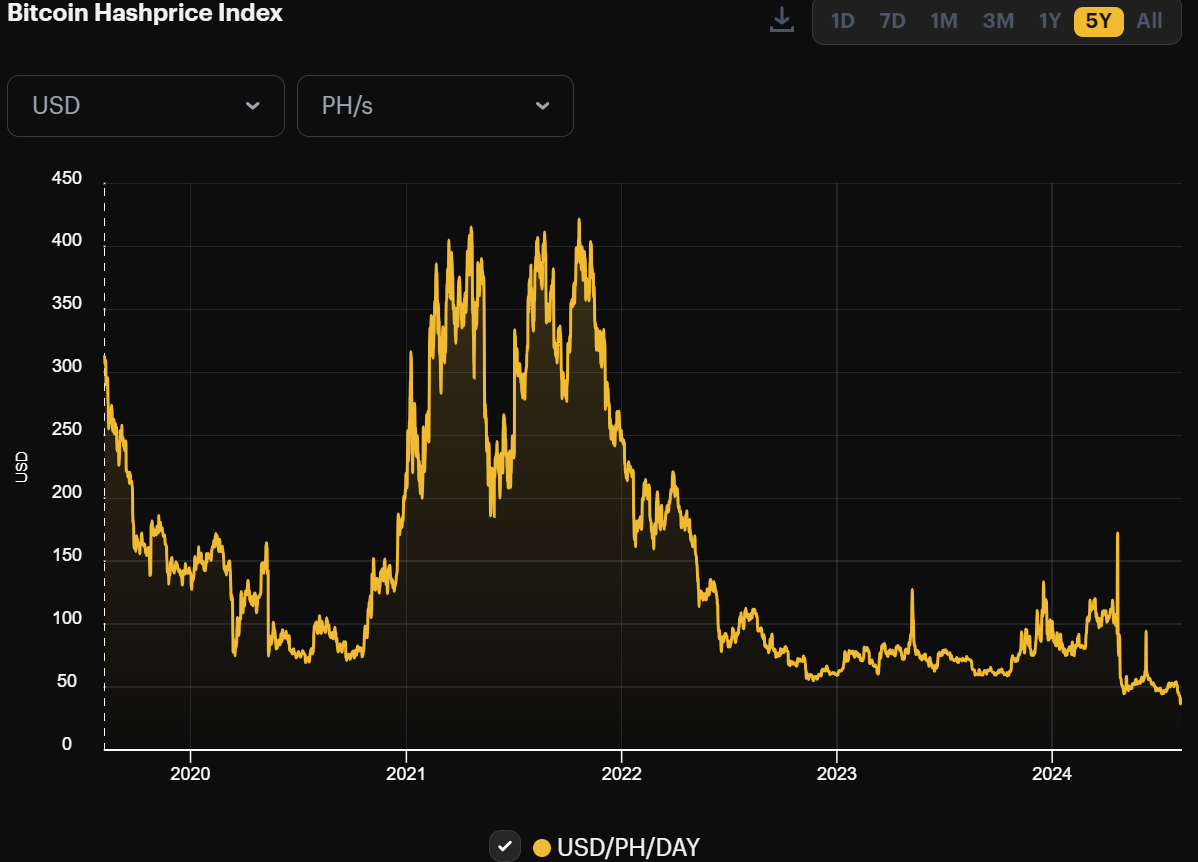

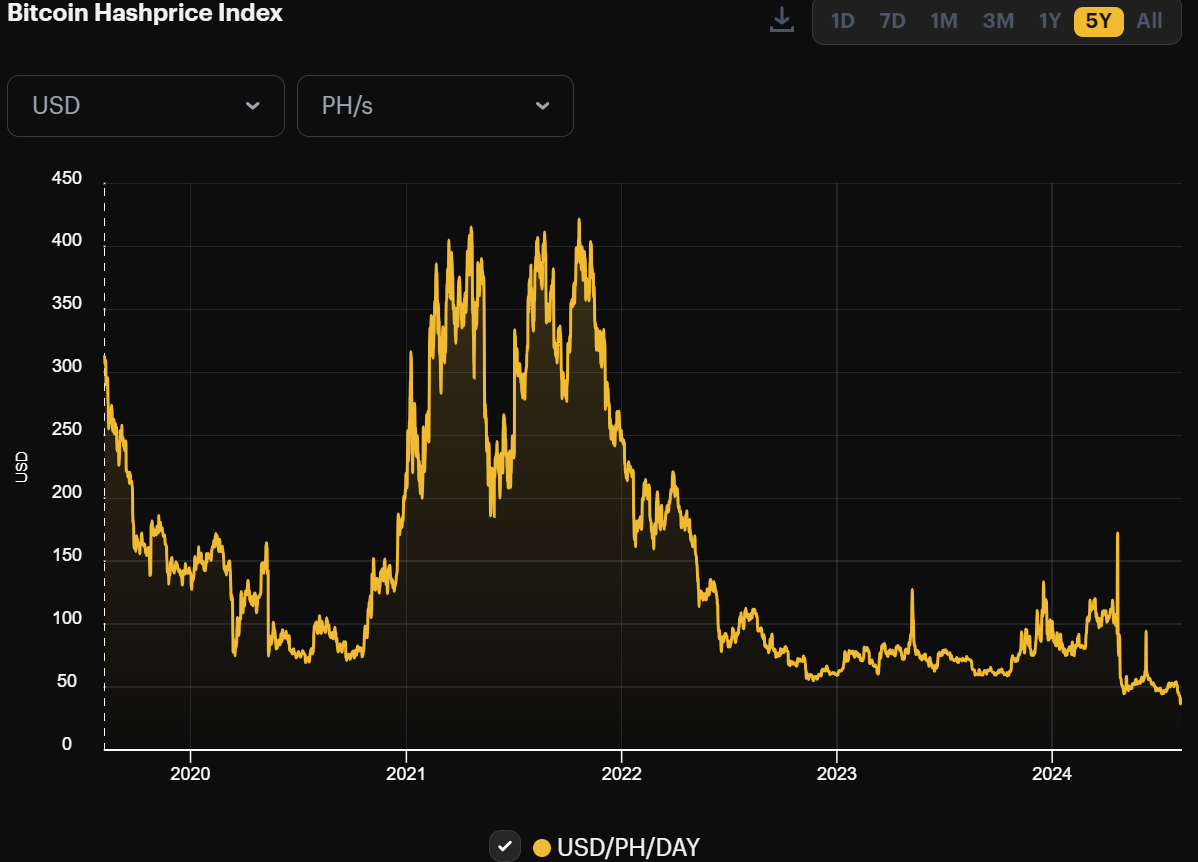

Bitcoins [BTC] The hash price, which tracks miners’ earnings, has fallen to a record low, raising fears that BTC miners could face another profitability crisis.

According to the Hashrate Index factson August 8, the hash price dropped to $40 per unit of computing power per day.

This was even lower than the crypto winter of 2022, which hit a low of $60 per unit amid a massive BTC miner crisis.

Source: Hashrate index

With the hash price falling, BTC Miner’s daily revenue also dropped from $40 million on July 29 to around $24 million on August 7, according to YCharts. facts.

The difficulty of the Bitcoin network is increasing

Miners’ problems have been exacerbated by rising BTC network problemswhich reached a record high of 90 trillion in August, up from 80 trillion in mid-July.

This means that the computing power required to mine BTC or find a block has increased by almost 10%.

This could put a lot of pressure on small-scale miners and push them to sell their BTC holdings to cover operating costs or close down.

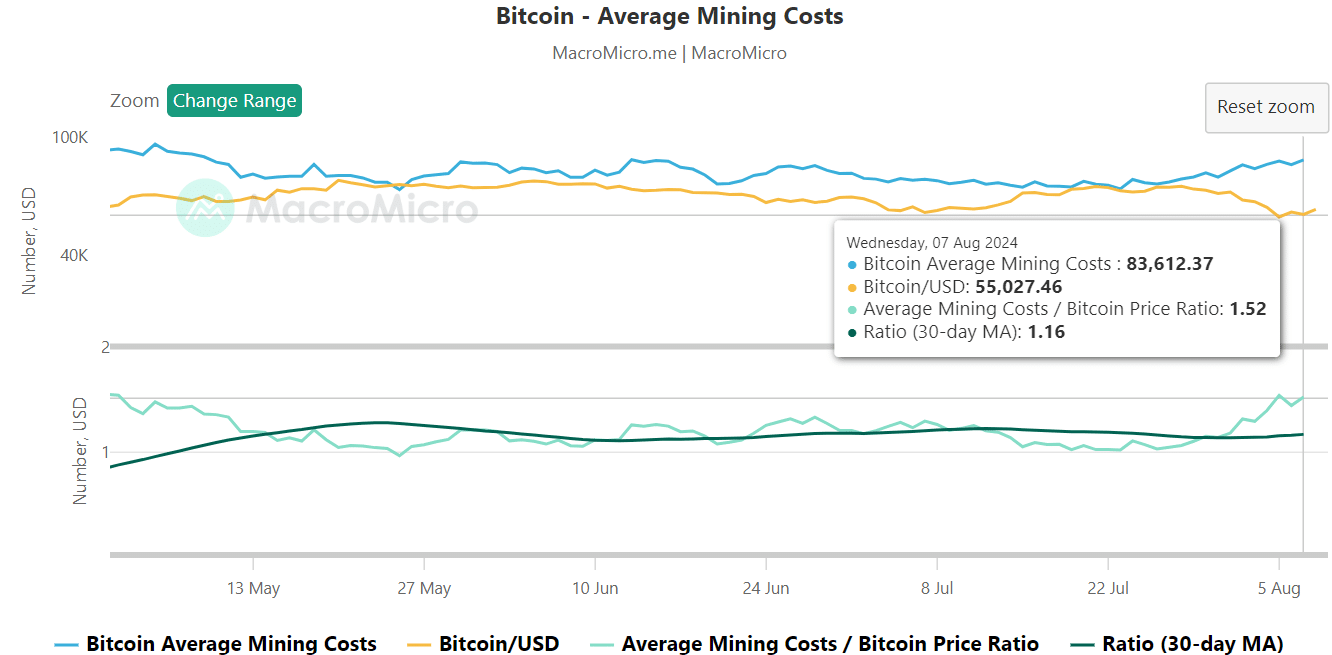

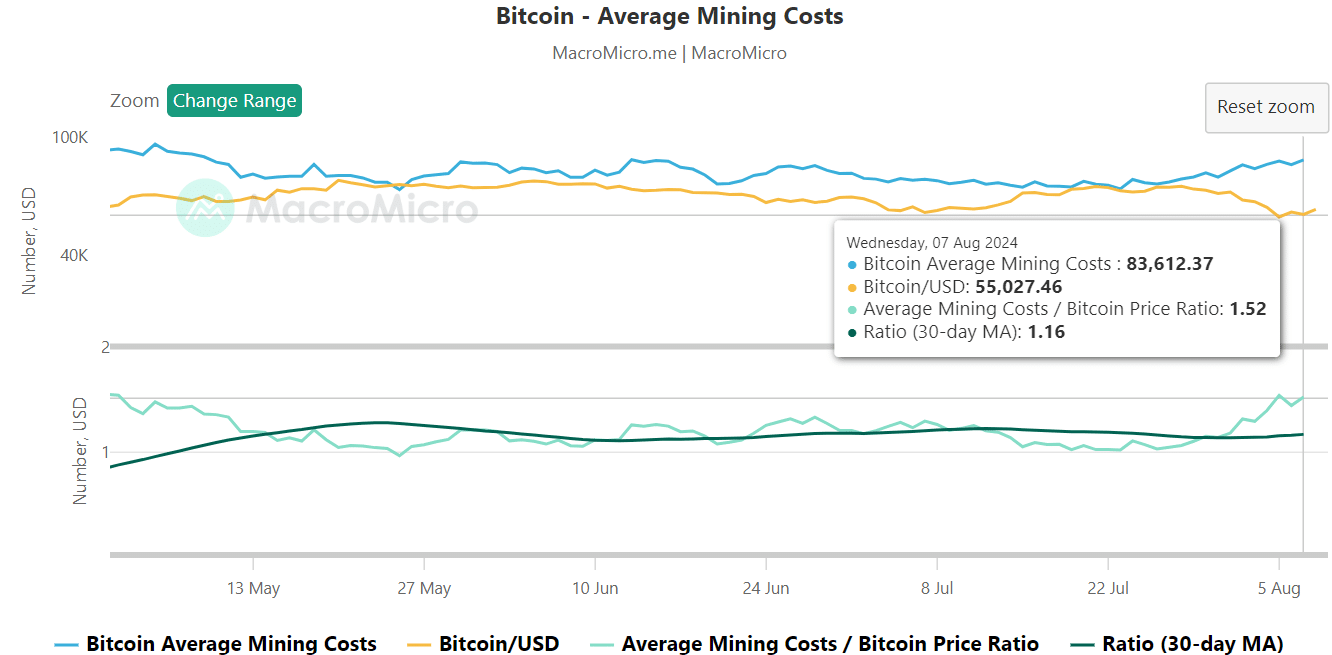

As of August 7, the average mining cost was $83.6K, against the BTC price of $55K, per MacroMicro facts. That’s a whopping +$23K shortfall.

Source: MacroMicro

However, well-scaled and optimized miners, such as Marathon Digital, have an average mining cost of $43,000.

According to the founder of CryptoQuant Ki Young Juthis meant that all they could worry about was if BTC fell below price for far too long.

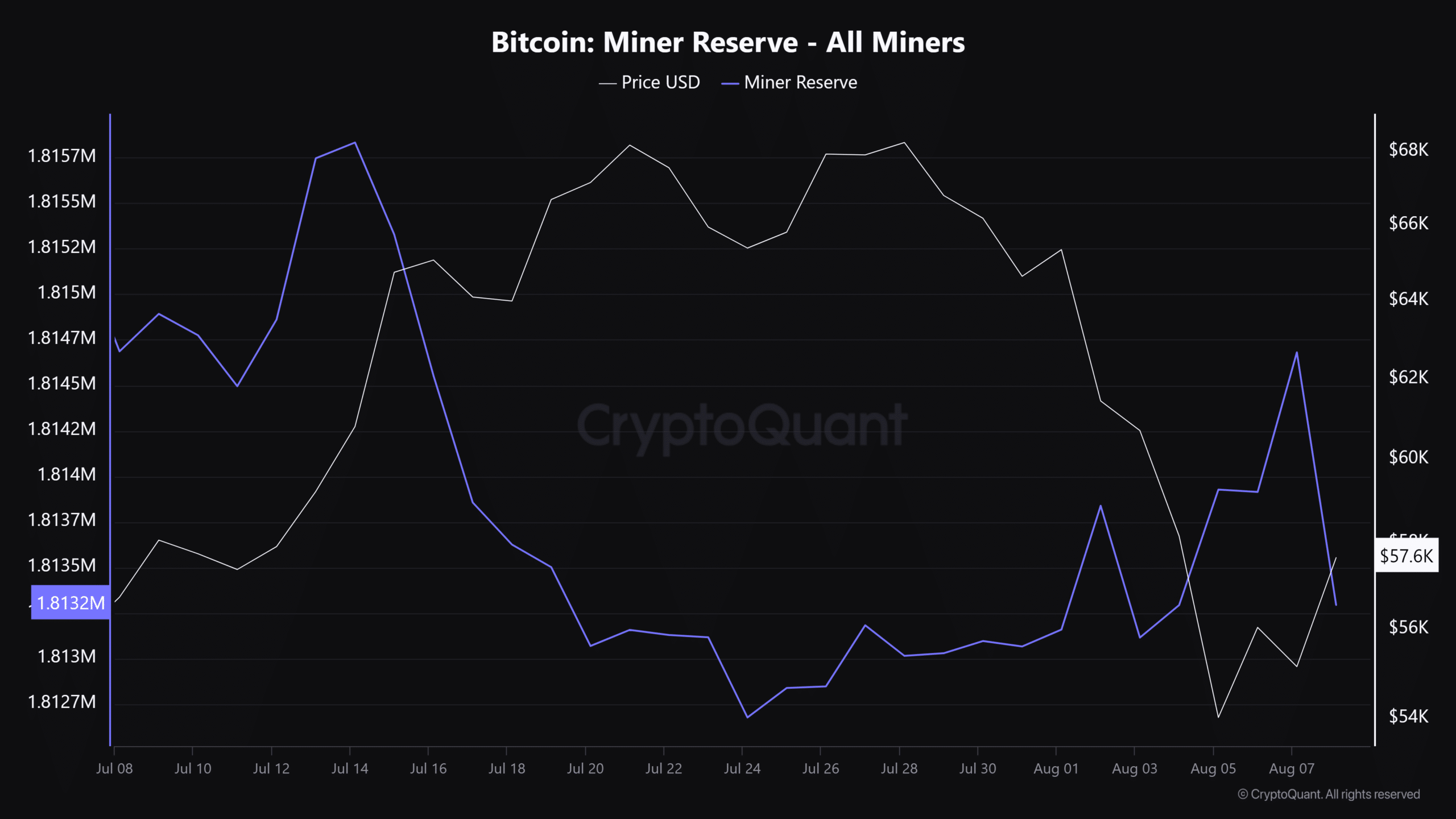

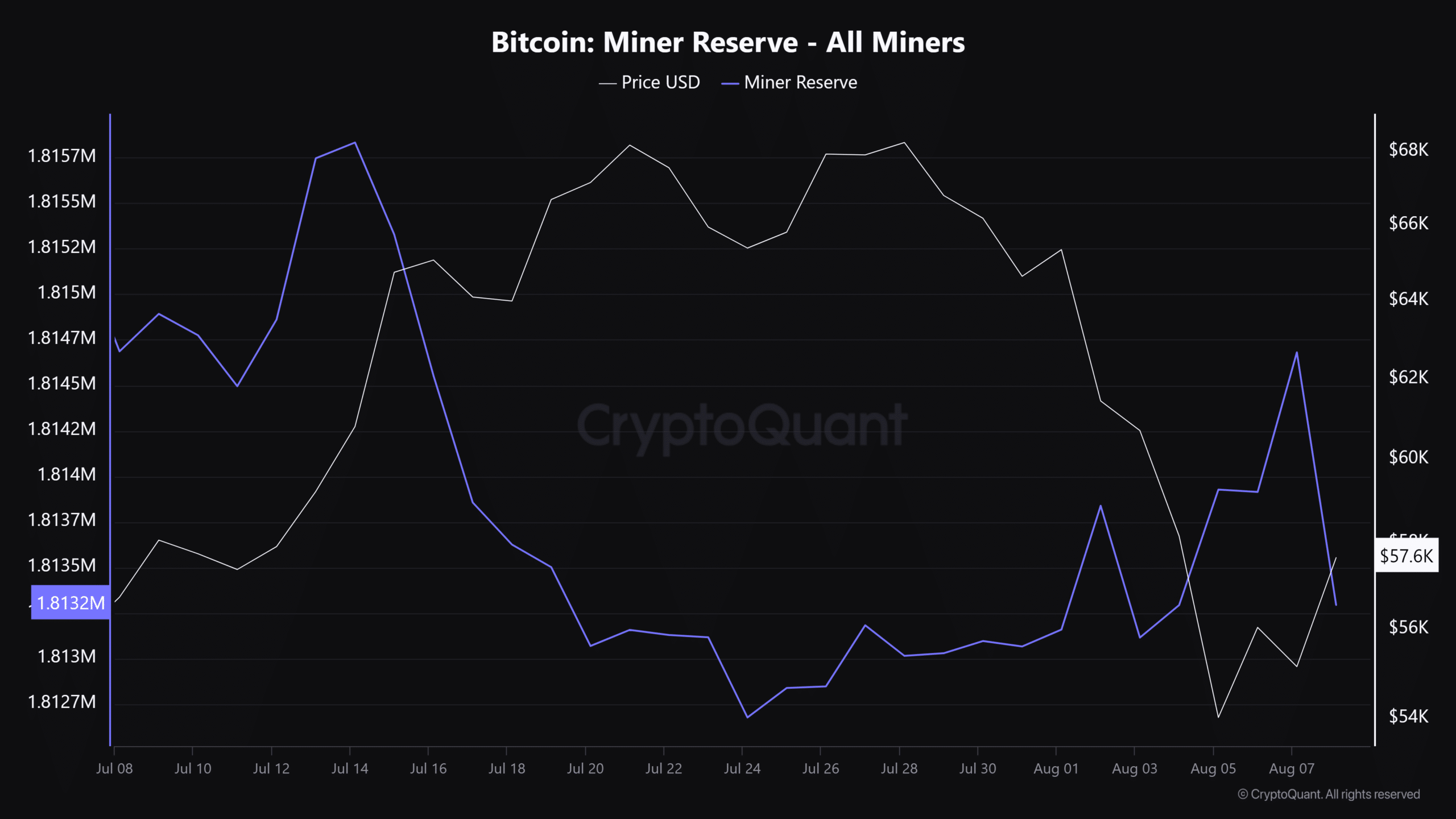

Source: CryptoQuant

Meanwhile, the BTC Miner Reserve fell by more than 1,100 BTC on August 7, indicating that some miners have sold some of their holdings.

Is your portfolio green? Check out the BTC profit calculator

The statistic tracks BTC miners’ total holdings, which have increased since late July. It indicates that they held on even during last week’s dump.

However, sell-offs by miners could also put pressure on BTC prices. At the time of writing, BTC was trading above $58,000 and could be eyeing the previous low at $60,000. However, a continued dumping of miners could derail the recovery.