- Falling Bitcoinnet -Delta suggests that Koper Momentum weakens despite the aggressive long exposure above $ 88,000.

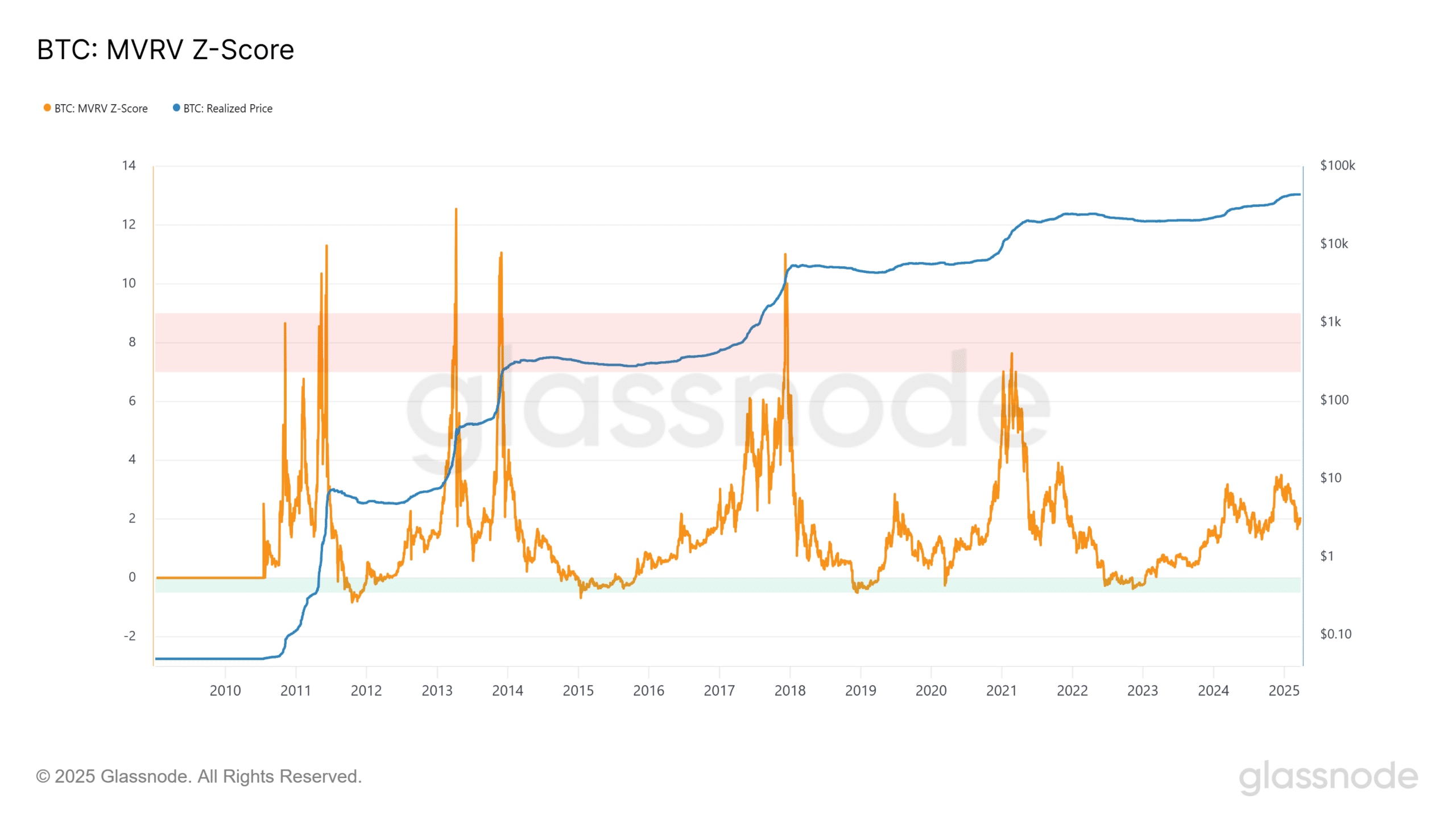

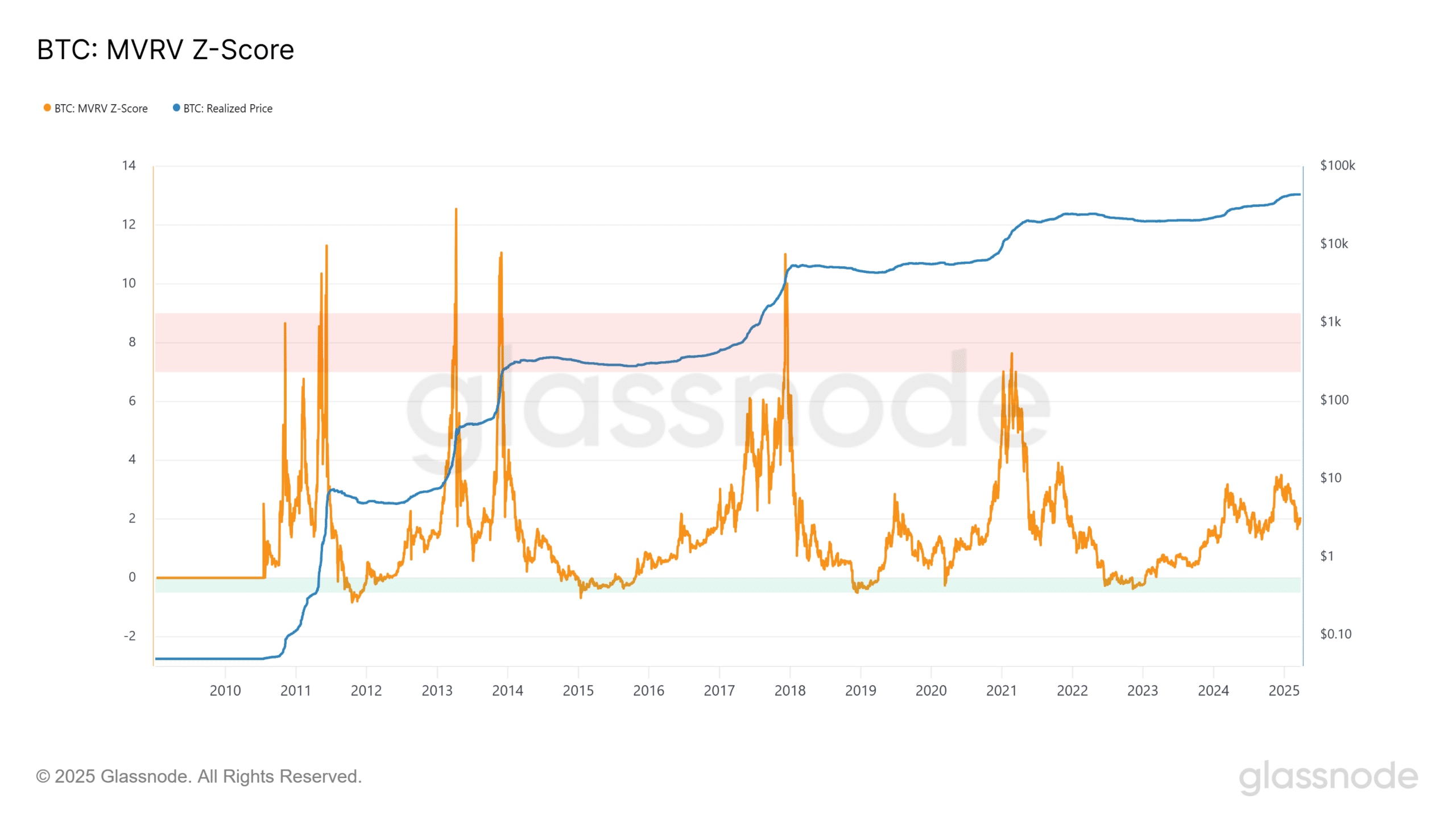

- The realized price continues to rise, but MVRV Z-score suggests that the market is cooling, not capitulating.

Bitcoin’s [BTC] Recent market activity emphasized a growing risk for traders who held long positions as the price action was tightened in the vicinity of a critical level.

The zone of $ 84,000 has become the centerpiece for institutional positioning and derived structure. If violated, it can cause rapid sale.

Warning signals on the horizon

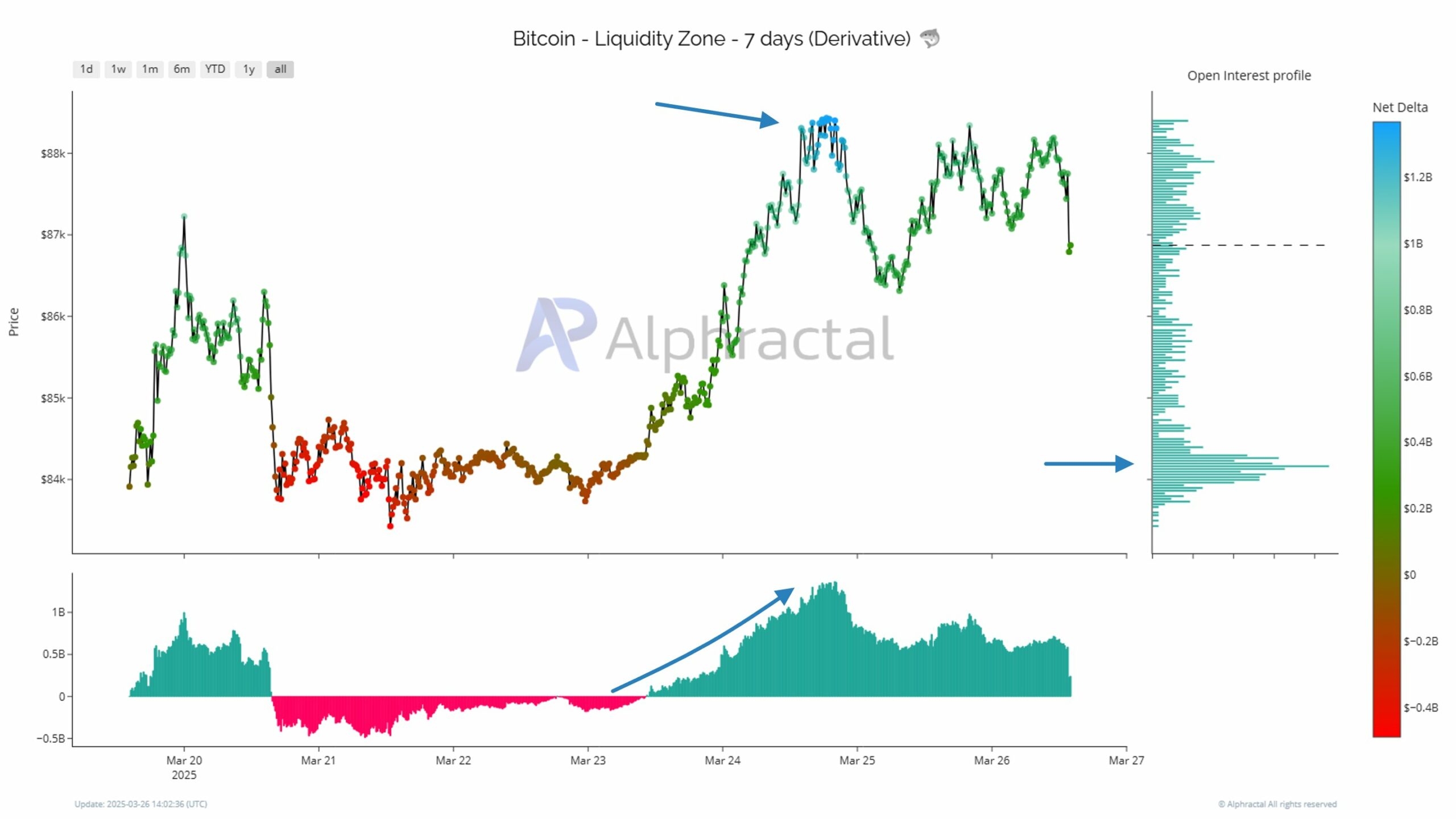

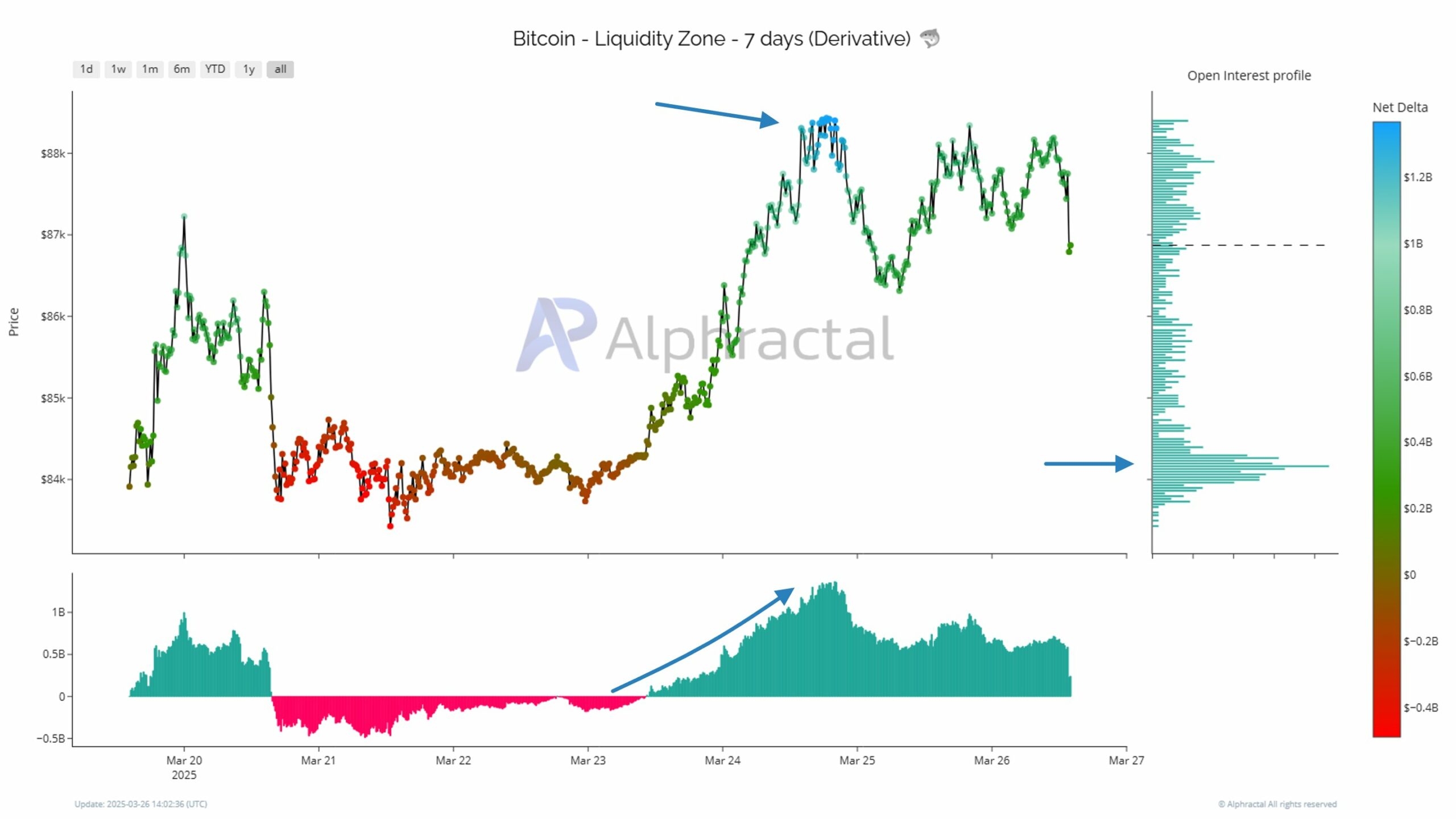

Data of Alfractal Show rising open interest and increasing inflow into exchanges, pointing to increased liquidation risk.

Source: Alphractal X

As illustrated in the graph, we can see how the price of Bitcoin has risen above $ 88,000 before we hold.

Many traders entered long positions during this movement, expect continuation. The open interest profile shows a structure of lifting tree positions near that price.

Buyers showed up – but then walked back

As the prices delayed above $ 88k, the Net Delta began to fall. This hints with buyers who lose control despite constant long exposure.

If the price is sharply reversing, the $ 84,000 zone becomes a battlefield. Traders who entered lungs above $ 88k may be confronted with liquidation if prices fall below this level.

The level of $ 84k has the highest concentration contracts, making it an excellent liquidity zone.

This zone functions both technical support and a potential liquidation trigger. If prices fall under it, market makers can speed up the movement by exploiting trapped lung.

That breakdown can lead to a wave of forced selling.

These events happen when livered long positions stop stop losses or liquidation thresholds. Such an activity often benefits traders who hold short positions, especially if they are introduced at higher levels.

Sales signals crawl into it

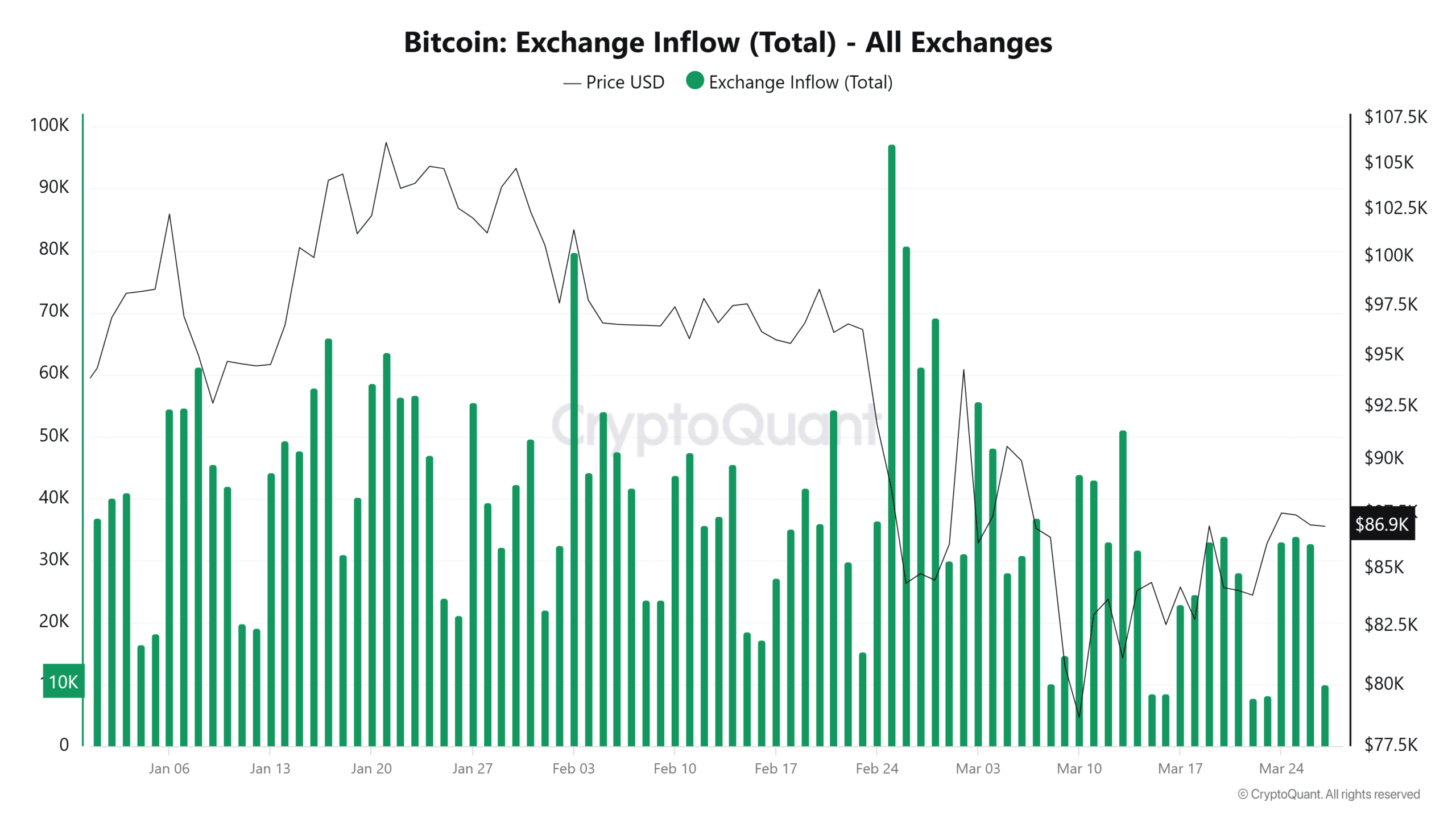

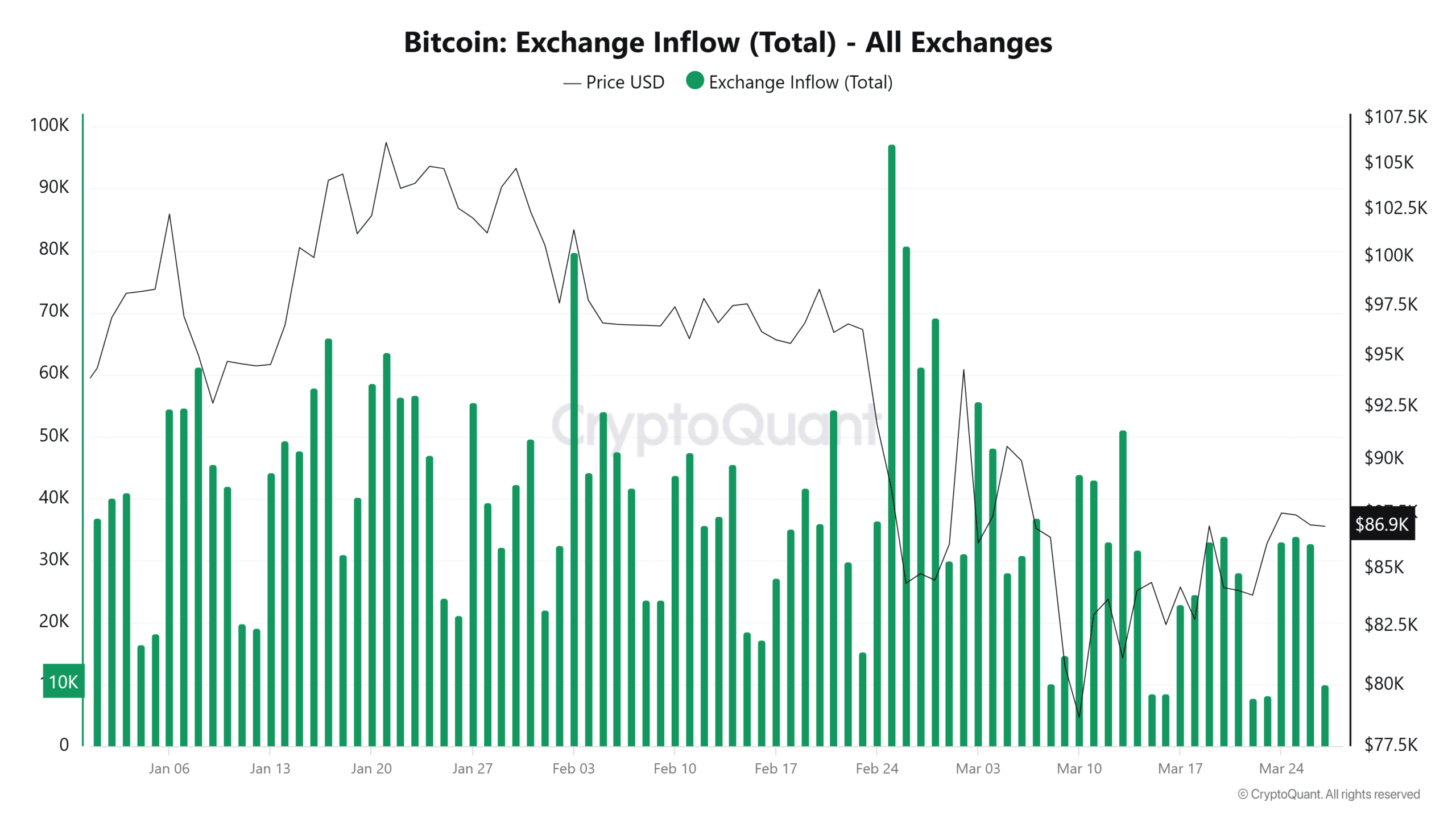

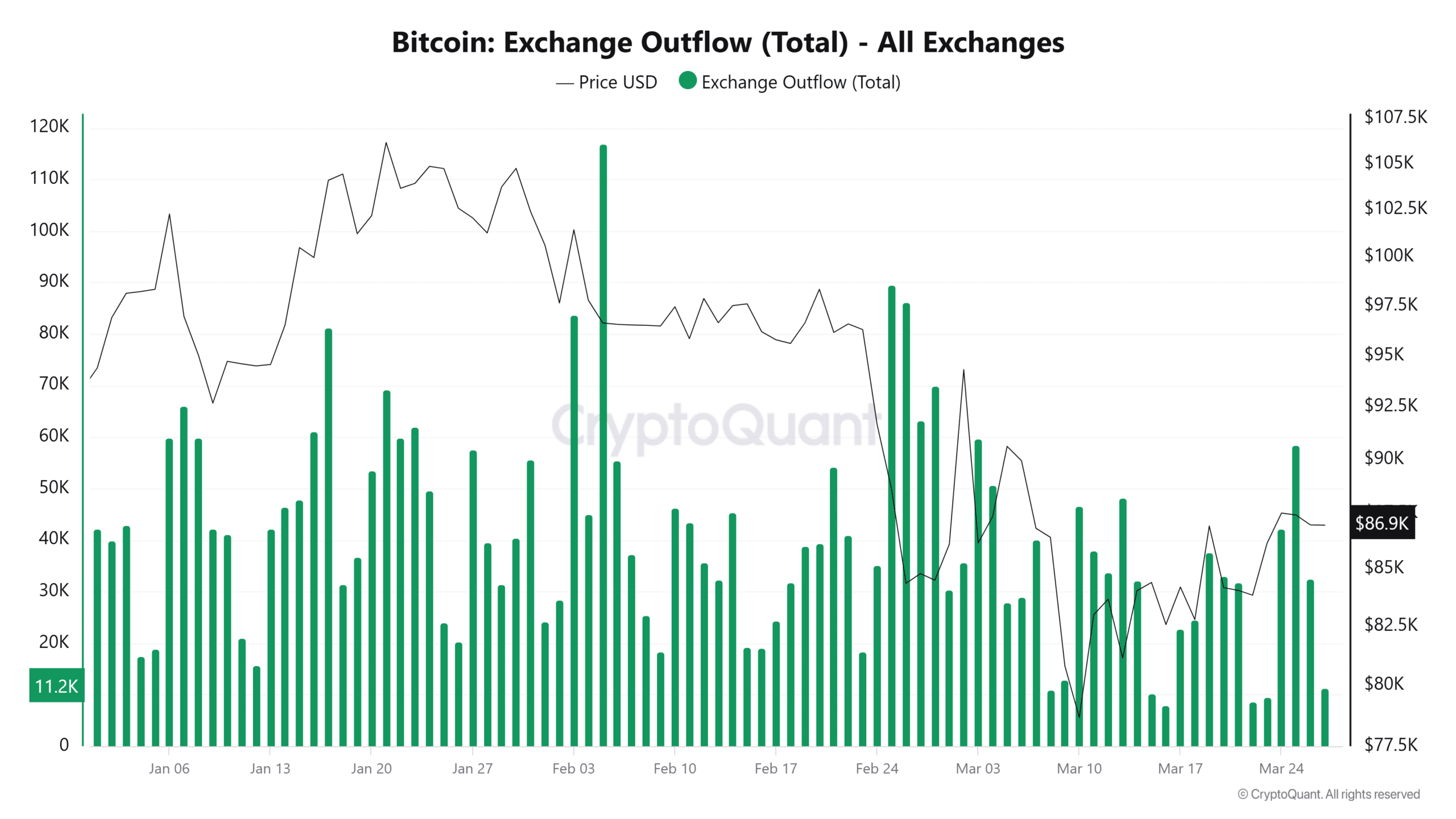

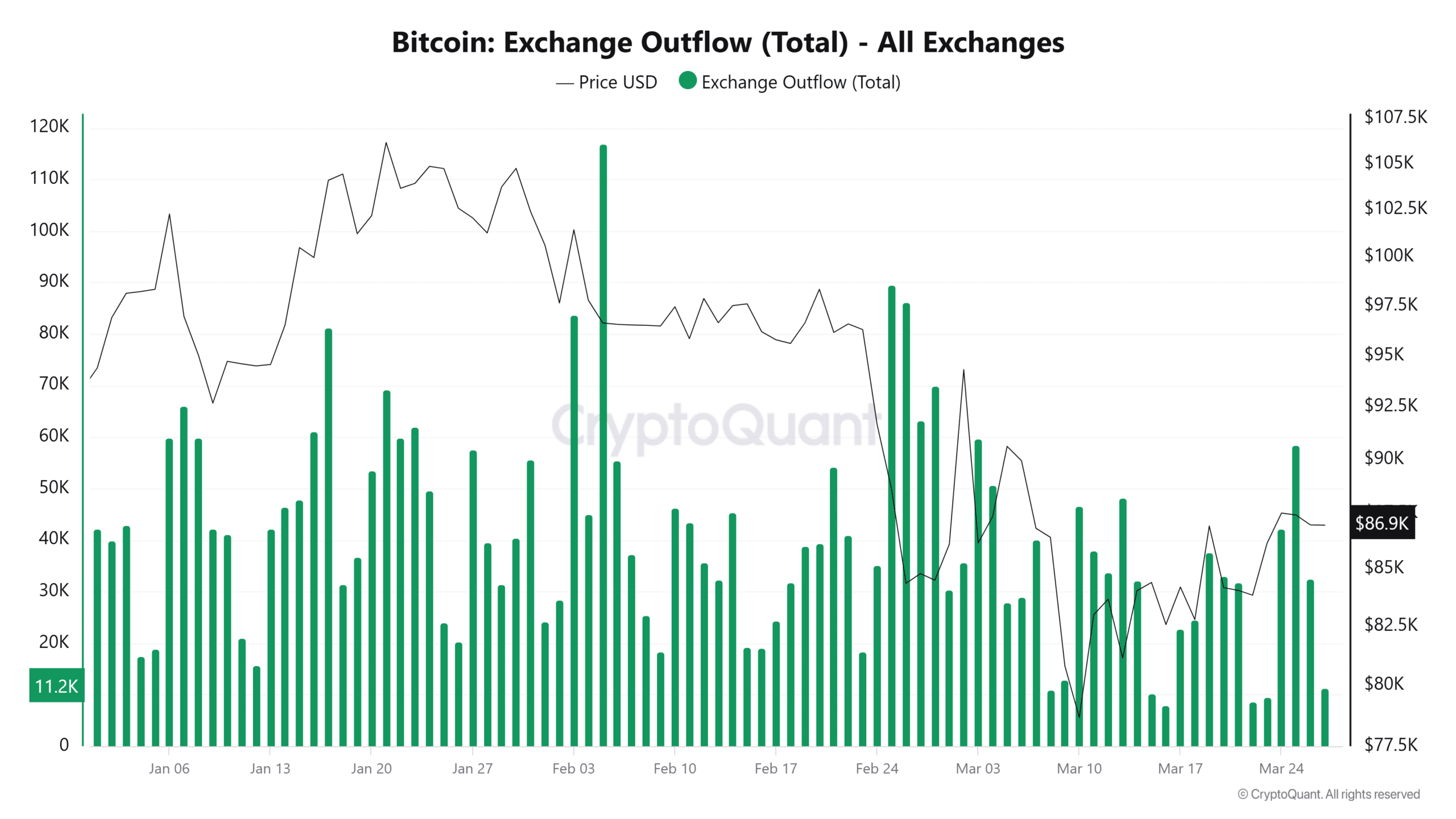

As a supplement to the structural risk, data is from cryptoquant, which shows an increase in Bitcoin that will be transferred to exchanges in March. These intervening signal historical intention to sell.

Source: Cryptuquant

Between January and March 2025, the price moved from a highlight from $ 105,000 to $ 86,911. At that time, large intake spikes took place on days with increased volatility.

For example, the March 3 saw 31,152 BTC transferred to exchanges when Bitcoin was priced at $ 84,311. This reinforces the meaning of the $ 84k zone.

By March 27, the inflow fell to 10,053 BTC. Although lower, this gives hesitation instead of renewed optimism. A failure to break higher can cause new inflow.

Source: Cryptuquant

In the meantime, the outflows of 86,230 BTC fell in February to 10,186 BTC by March 27. This indicates reduced accumulation and growing caution.

With long -term holders who withdraw, bullish support may be weakened.

Bitcoin Hodlers brakes

Graphs of Glassnode show that the realized price of Bitcoin steadily rose from $ 33,149 in November 2024 to $ 43,696 in March 2025.

Source: Glassnode

However, the MVRV Z score fell from 3.42 to 1.99 in the same period. The divergence suggests a reduced speculative excess, not complete capitulation. Historically, scores above 5 mark; 2 implies mild overvaluation.

This is the line – which first blinks?

Bitcoin acts near $ 86,000 and has $ 84,000 above support. Exchange data show cautious accumulation, while derivatives reflect heavy long exposure.

Indicators in chains point to weakening momentum. A break under $ 84,000 could cause liquidations. Shorts above $ 88,000 can benefit.

But a strong defense could maintain the bullish structure of higher lows. Markets are now looking at this zone for the next big movement.