- Crypto investment products saw outflows worth $206 million.

- LTC and LINK outperformed Bitcoin due to the halving and interest rate speculation.

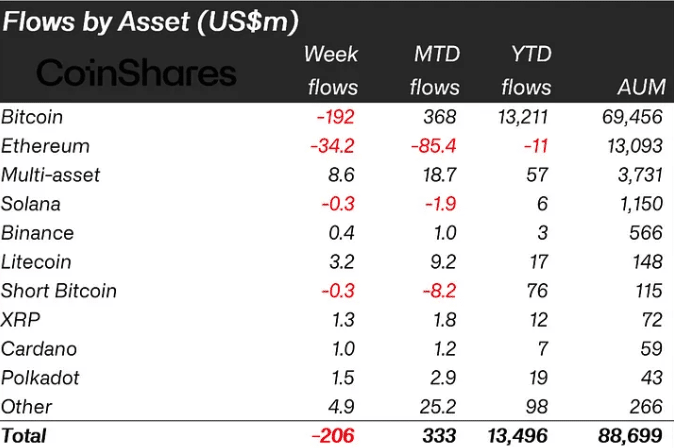

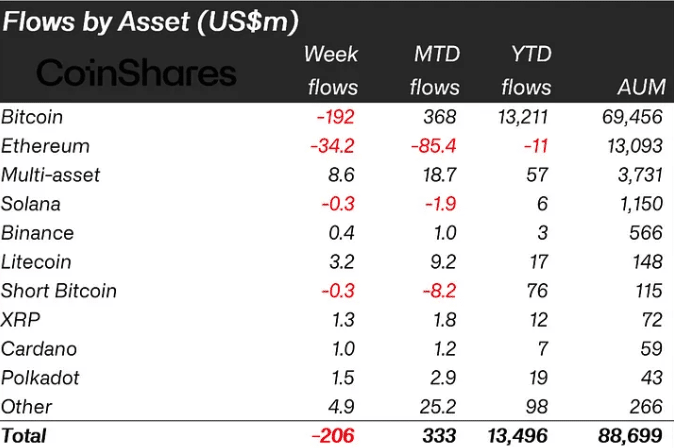

A total of $206 million flowed from crypto investment products last week, CoinShares revealed. According to the report Bitcoin [BTC] the outflow was worth $192 million, while Ethereum [ETH] amounted to $34.2 million.

Many altcoins including Litecoin [LTC] and ChainLink [LINK] have registered significant inflows within the same time frame.

Investors are concerned about the future of BTC

According to AMBCrypto’s assessment, Litecoin had an inflow of $3.2 million. Chainlink, on the other hand, recorded $1.7 million. Moreover, there were reasons why total investments had more outflows than inflows.

First, the report noted that investors were concerned about the effect the fourth Bitcoin halving on April 19 would have on miners.

Source: CoinShares

Therefore, they thought it was better to stay away from BTC and probably return when the market calmed down. In recent articles, AMBCrypto reported how miners have been selling off their coins since their rewards were halved.

It was therefore no surprise that the outflow increased for the second week in a row. Another reason why Litecoin and Chainlink top Bitcoin could be because of interest rates.

Lately there has been speculation that the Fed will keep interest rates at high levels. This has reduced investor appetite for riskier assets. Coin shares is noted,

“The data suggests that interest from ETP/ETF investors continues to decline, likely amid expectations that the Fed will keep interest rates at these high levels for longer than expected.”

LINK may remain at the top, but LTC…

If sentiment does not change, both BTC and ETH could continue to face further disinterest. For Litecoin and Chainlink, their respective price performance could have played a role in the surge in inflows.

At the time of writing, LTC was changing hands for $84.89. This was an increase of 3.97% in the past seven days. LINK also performed similarly as its price rose 6.18%.

If you compare its performance with that of ETH and BTC, you will see that the two largest cryptocurrencies lagged behind. Should prices remain unimpressive, the new week’s flow could also be negative.

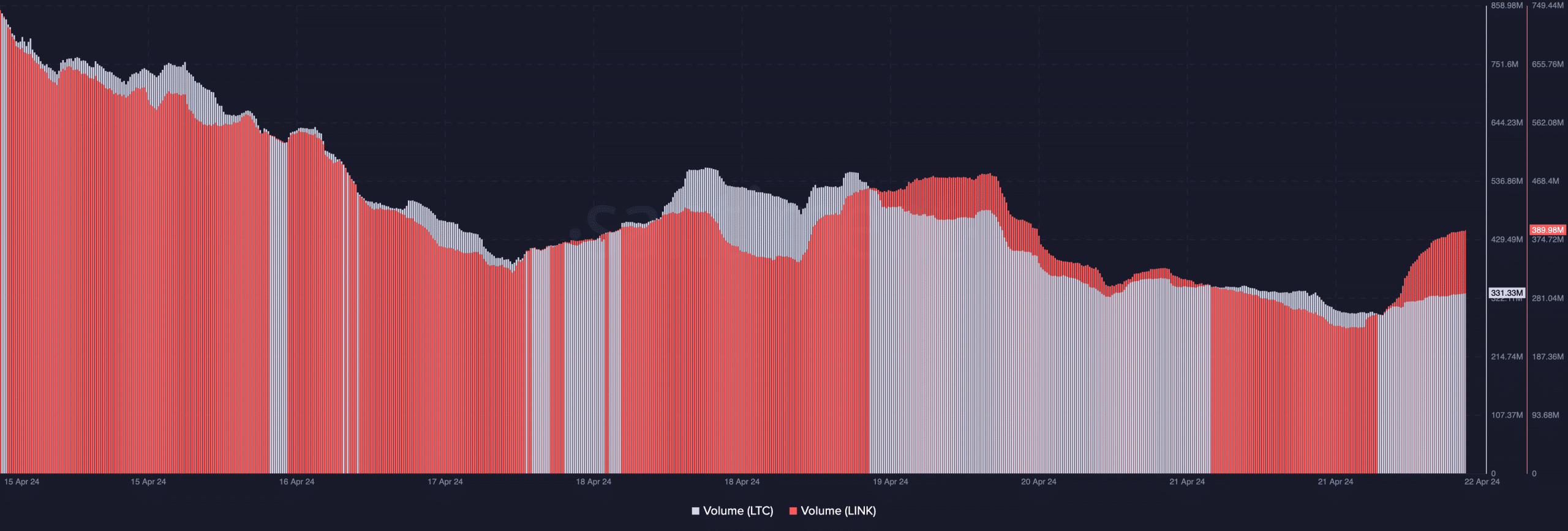

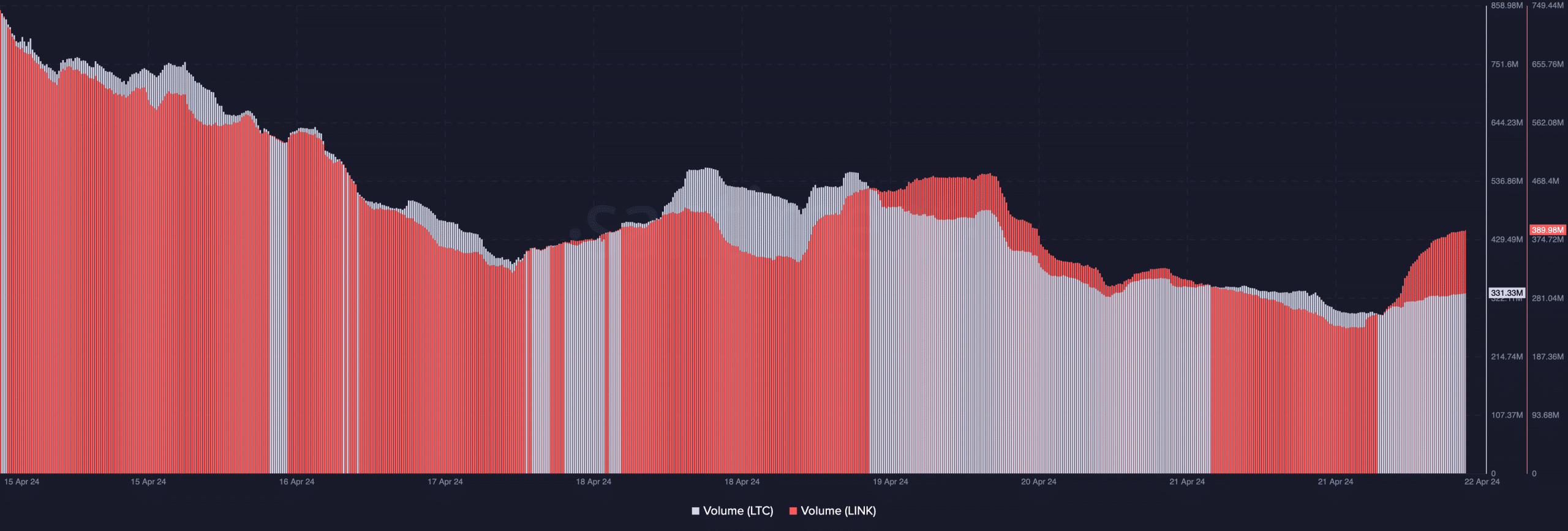

Meanwhile, we looked at the volume of Chainlink and Litecoin determine interest in cryptocurrencies. According to data obtained by AMBCrypto from Santiment, both volumes have fallen from the highs they reached seven days ago.

However, there has been a slight increase in the past 24 hours. For LINK, the increase could create a further uptrend for the price as it has also risen over the past 24 hours.

Source: Santiment

But LTC may not get that benefit, as the rising volume could serve as a force for the downtrend the price experienced. If this continues throughout the week, Chainlink could potentially be among the top inflows again.

In a related development, CoinShares explained that investor fears could soon come to fruition. According to the research team, Bitcoin miners could shift their focus from the coin to AI.

Is your portfolio green? Check out the Litecoin Profit Calculator

The report, that was published on April 19 stated that the reason for the prediction was that the halved rewards would no longer cover the miners’ costs. Hence,

“We expect a shift to AI in energy-safe locations due to the potential for increased revenue, with companies such as BitDigital, Hive and Hut 8 already generating revenue from AI.”