- Miners have invested in more efficient machines to tackle financial stress after the halving.

- The sell-off by miners has increased in recent months.

With less than three days to go for the crucial Bitcoin [BTC] After the halving, the focus has shifted to miners and their economic sustainability in the aftermath.

What now for miners after the halving?

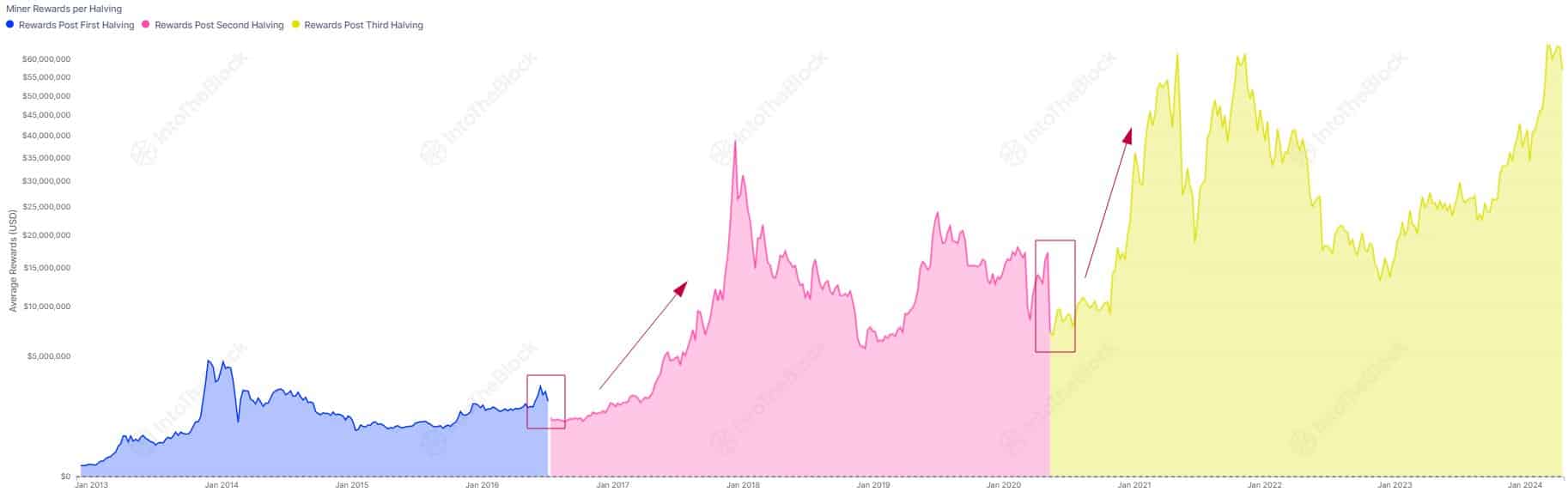

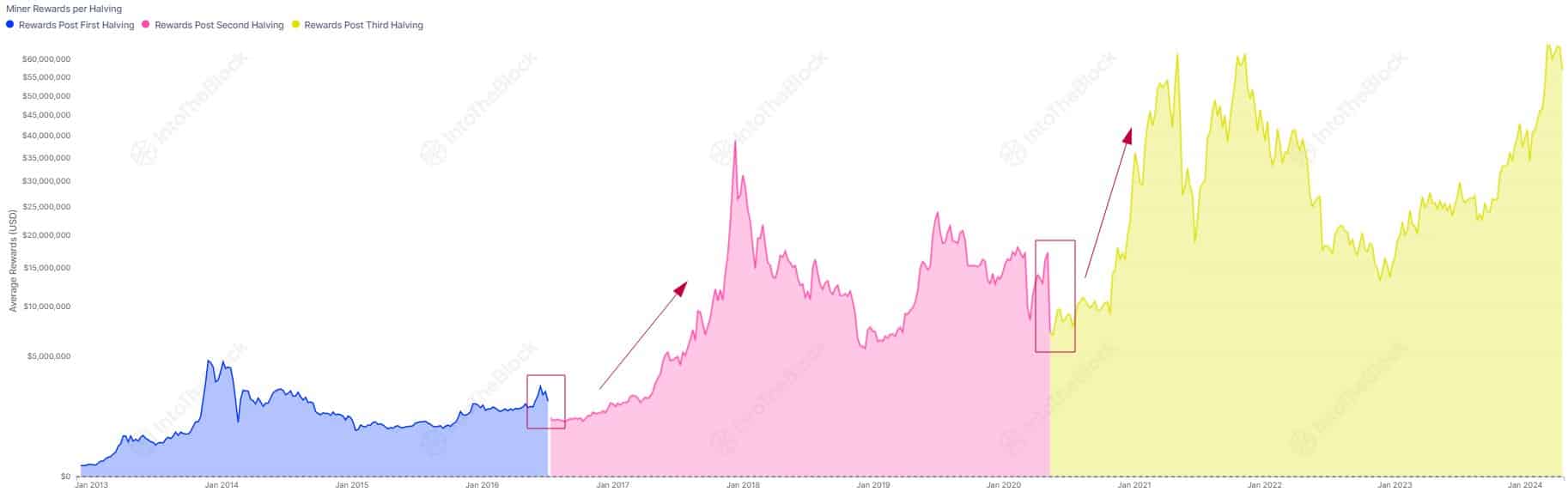

Historically, miners’ revenue streams take a big hit immediately after the halving, due to the halving of block rewards. This was illustrated by an on-chain analytics company InTheBlok.

Source: IntoTheBlock

However, the pain was observed to be temporary as the king coin gradually increased in value after the quadrennial event.

The July 2016 halving was followed by a threefold increase in the value of BTC over the next twelve months. Similarly, the last halving in May 2020 saw AMBCrypto explode by 500% the following year, AMBCrypto noted using CoinMarketCap facts.

Because miner revenues are positively correlated with Bitcoin’s price, it has historically risen to new highs within a year of the halving.

Miners preparations before halving

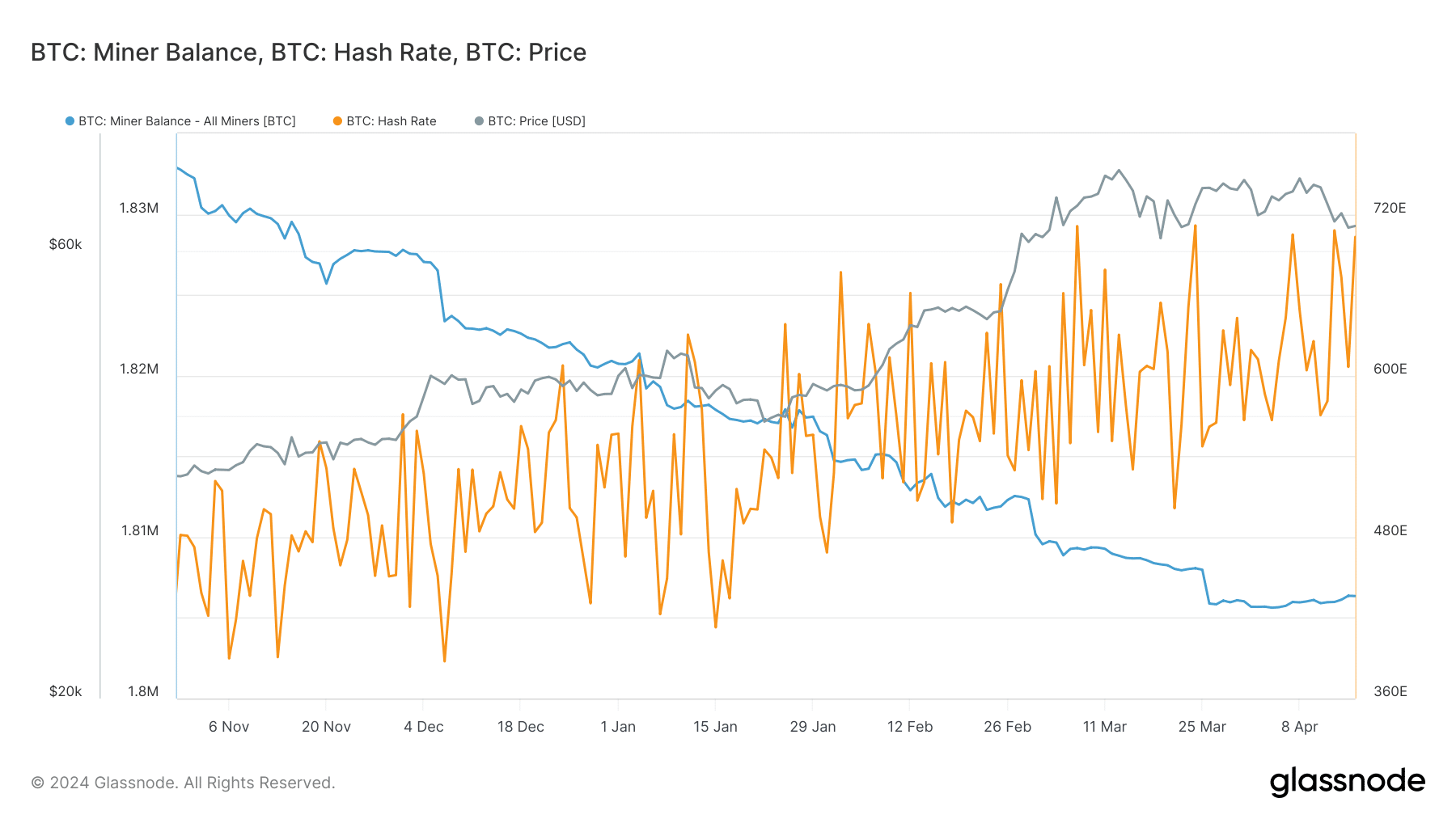

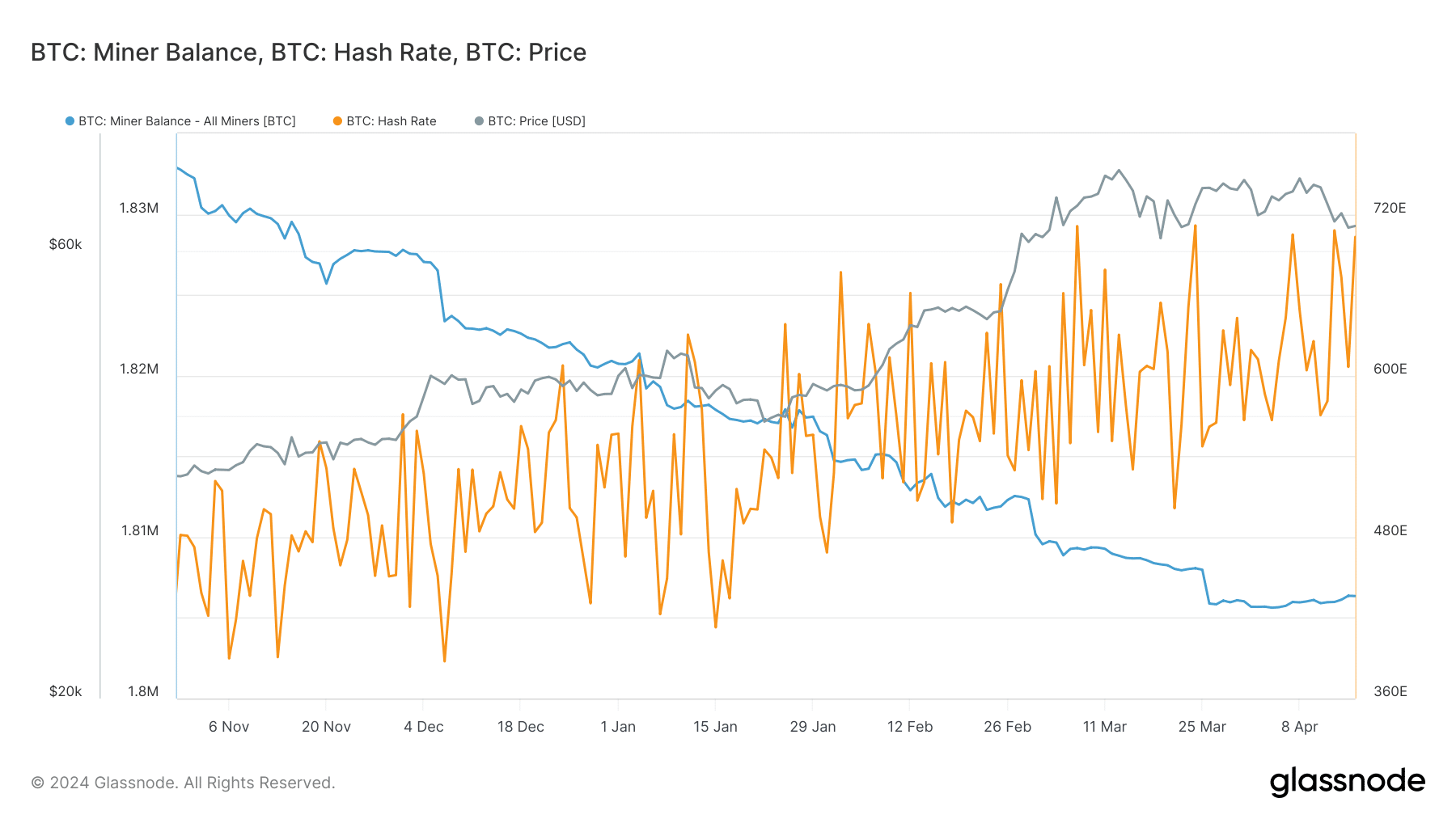

In recent months, Bitcoin’s hash rate, a measure of miners’ computing power, has been rising, AMBCrypto noted using Santiment’s data.

This may be due to miners investing in more efficient machines that generate a higher hash rate per unit of electricity consumed.

Such steps become necessary because the halving would double the cost for miners to break even.

Source: Glassnode

Additionally, miners have been steadily liquidating their Bitcoin holdings in recent months, which will likely provide money to invest in more advanced machines. The decline in the number of coins in miners’ wallets hinted at this deduction.

Is your portfolio green? Check out the BTC profit calculator

Bitcoin was trading in the $63k zone at the time of writing, per CoinMarketCapafter significant downside volatility in the run-up to the halving.

Overall, such supply shocks could prove beneficial for Bitcoin’s long-term value, provided demand for the asset remains robust.