- BTC funding rates hit a multi-month high.

- BTC investors piled into the coin, hinting at a possible upcoming price rise.

Bitcoin [BTC] has once again managed to cross the $65k resistance level after falling below it a few days ago. This recent price increase must have fueled bullish sentiment in the market.

The better news was that a key metric hit a multi-month high, further indicating a huge increase in positive sentiment around the king coin.

Bitcoin reaches new highs

BTC’s price action has been green in recent days as the price has risen over 4% over the past seven days.

At the time of writing this was the king’s coin trade at $65,561.08 with a market cap of over $1.3 trillion.

The king coin’s trading volume also increased as its price rose, which generally acts as a basis for a bull rally.

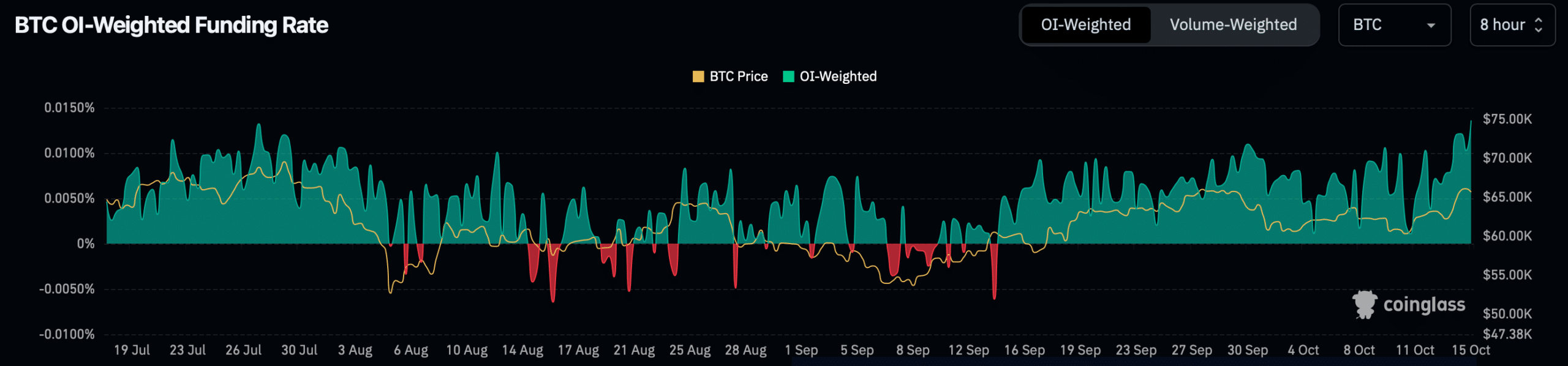

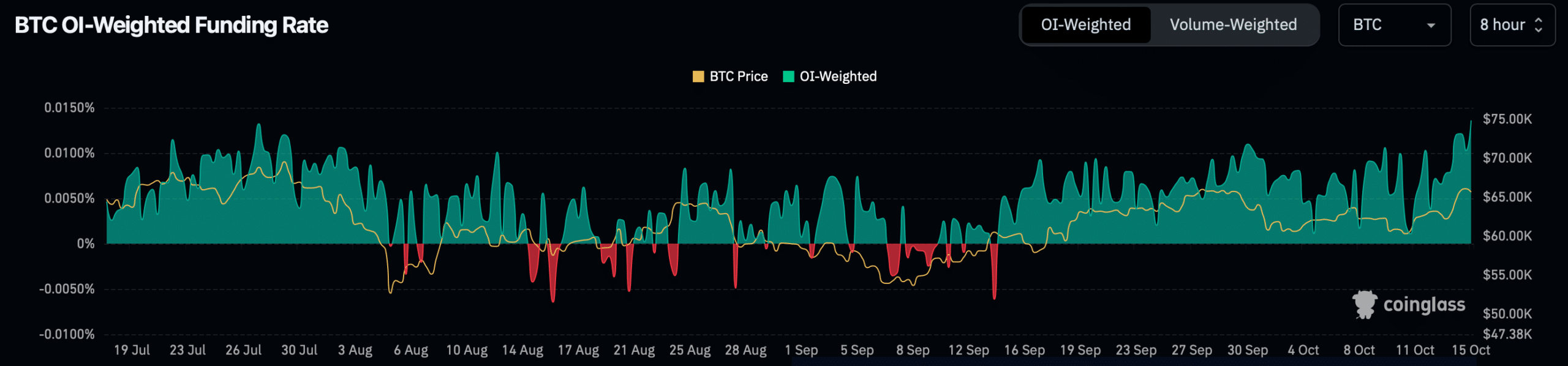

While all this was happening, BTC futures were hitting new highs. For starters, BTC funding rates hit multi-year highs.

When funding rates rise, it means more money is flowing into a network, indicating a rise in bullish sentiment.

Source: Coinglass

Apart from that, Ali, a popular crypto analyst, recently posted a tweet revealing another achievement in the future.

According to the tweet, BTC Open Interest across all exchanges just hit a new all-time high of $19.75 billion! A spike like this often indicates major price movements, with more capital at stake.

Therefore, AMBCrypto planned to check the King Coin’s on-chain data to find out if this renewed interest in BTC would result in a sustained price increase.

What’s next for BTC?

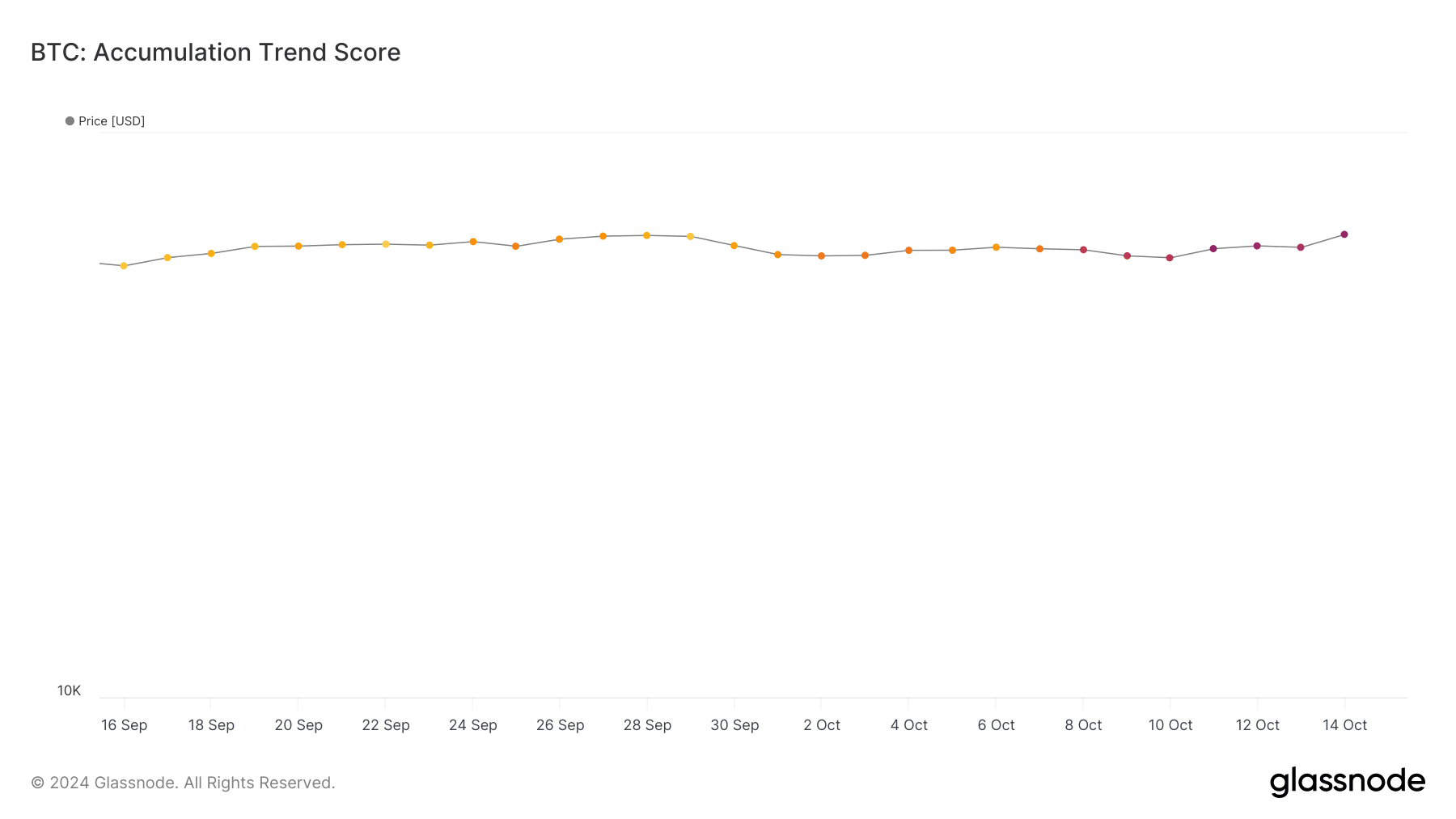

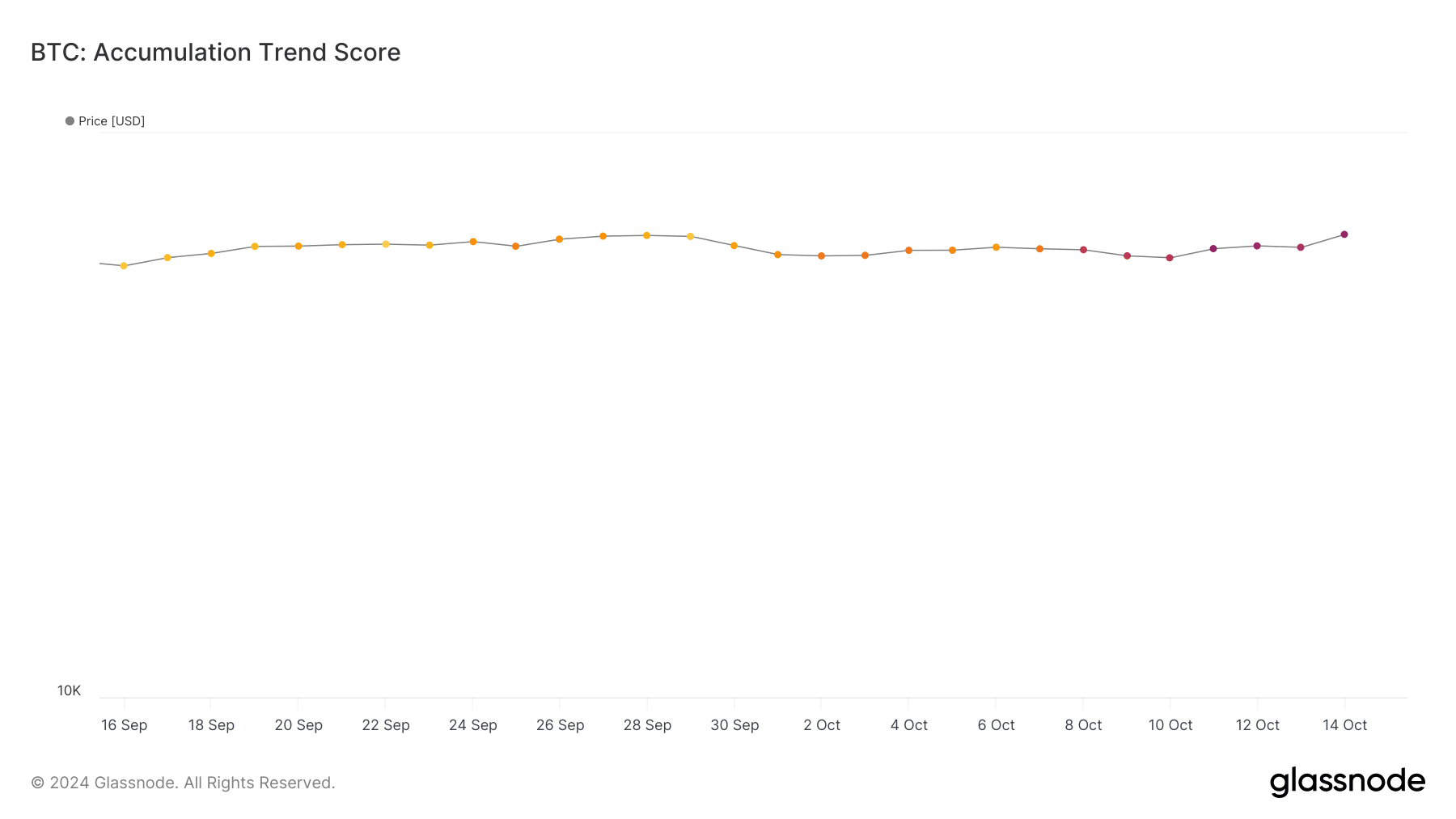

According to our analysis of Glassnode data, investor interest in BTC was also reflected in accumulation. We found that BTC’s accumulation trend score rose from 0.2 at the end of September to 0.6 in October.

First of all, the accumulation trend score is an indicator that reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 1 means that buying pressure is increasing.

Source: Glassnode

However, not everything was in Bitcoin’s favor.

AMBCrypto’s look at CryptoQuant’s facts revealed that the net deposit of BTC on the exchanges was high compared to the average of the past seven days, indicating that selling pressure has increased in recent days.

Whenever selling pressure increases, it signals a price correction.

Realistic or not, here it is PEPE’s market cap in terms of BTC

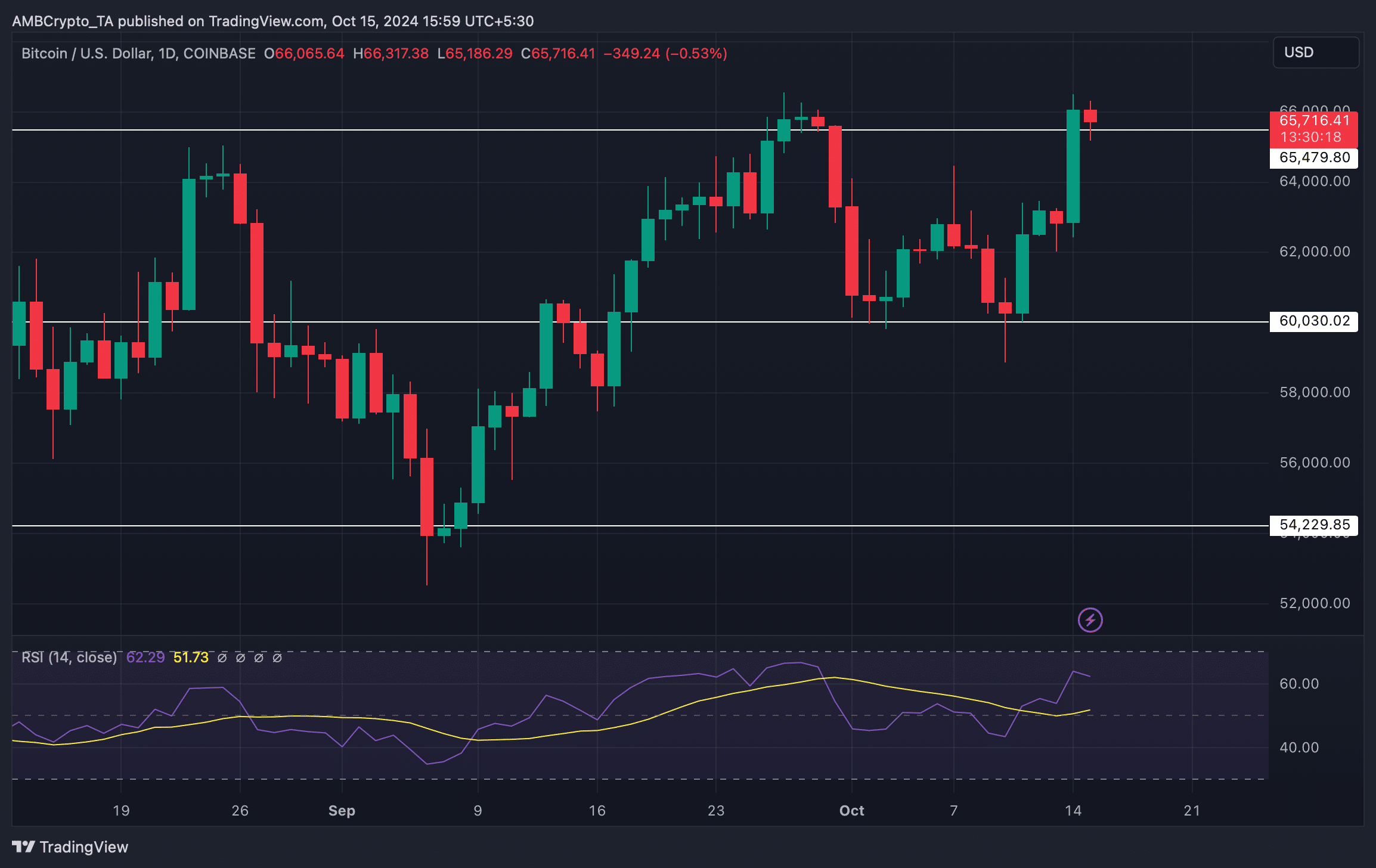

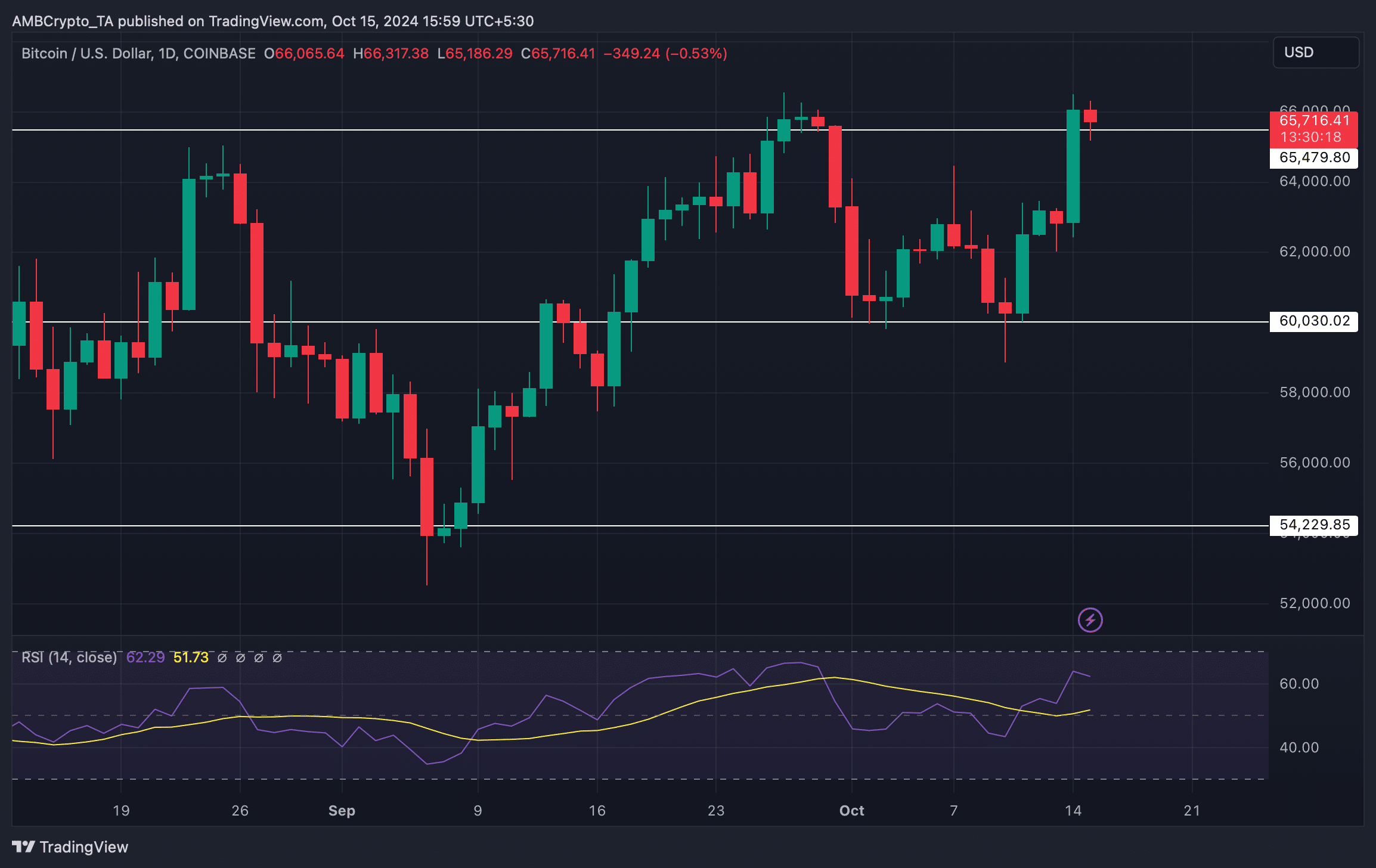

That’s why AMBCrypto reviewed BTC’s daily chart to better understand what to expect. We found that after breaking through resistance, BTC turned the same level into support.

However, the Relative Strength Index (RSI) registered a decline. This suggested that BTC might not maintain its support.

Source: TradingView