- Bitcoin showed strong bullish signals, with high dominance and investor confidence at an extreme level.

- The bullish trends showed signs of continuing, but volatility risks persisted due to exchange rate behavior.

Bitcoin [BTC] continues to show strong bullish signs, with the Fear and Greed Index reaching an extreme greed level of 83. This indicates high investor confidence and growing optimism in the market.

At the time of writing, Bitcoin was trading at $98,503.78, down 0.85% in the past 24 hours. While this suggests a strong bullish trend, it raises questions about Bitcoin’s ability to maintain this momentum or face a market correction.

Bitcoin Fear and Greed Show…

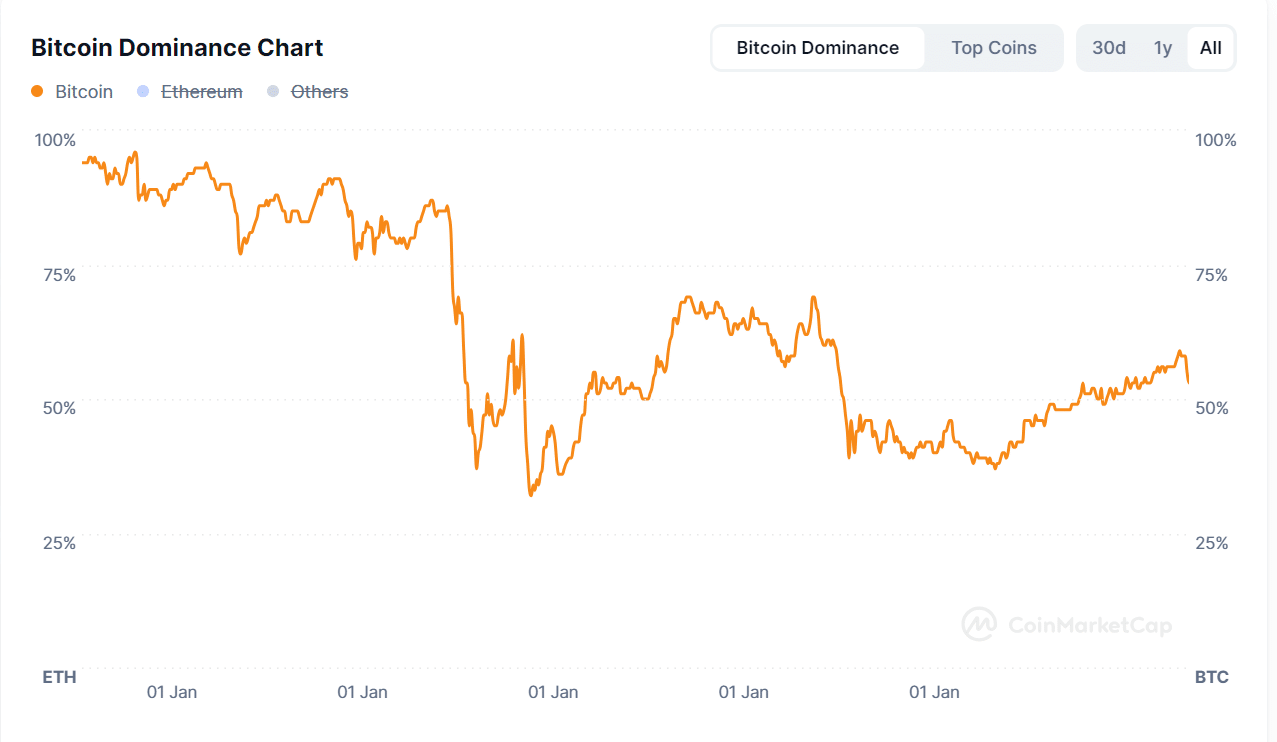

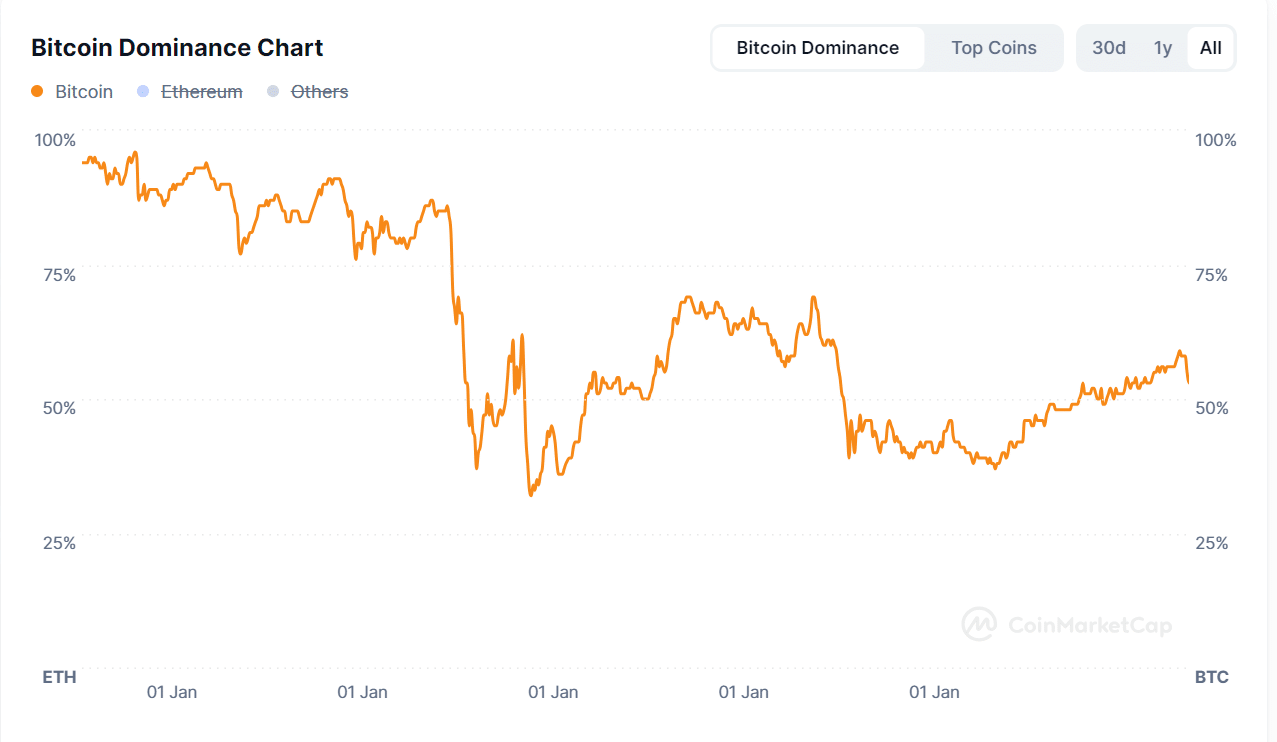

Bitcoin’s dominance stood at 54.5% at the time of writing, reflecting its significant influence on the overall crypto market. However, it saw a daily decline of -3.5%, indicating a potential shift in interest in altcoins.

This suggests that other cryptocurrencies could gain strength, which could impact Bitcoin’s dominance in the coming days.

Therefore, closely monitoring Bitcoin dominance will provide insight into market trends and any changes in dominance dynamics.

Source: CoinMarketCap

An increase in optimism among investors

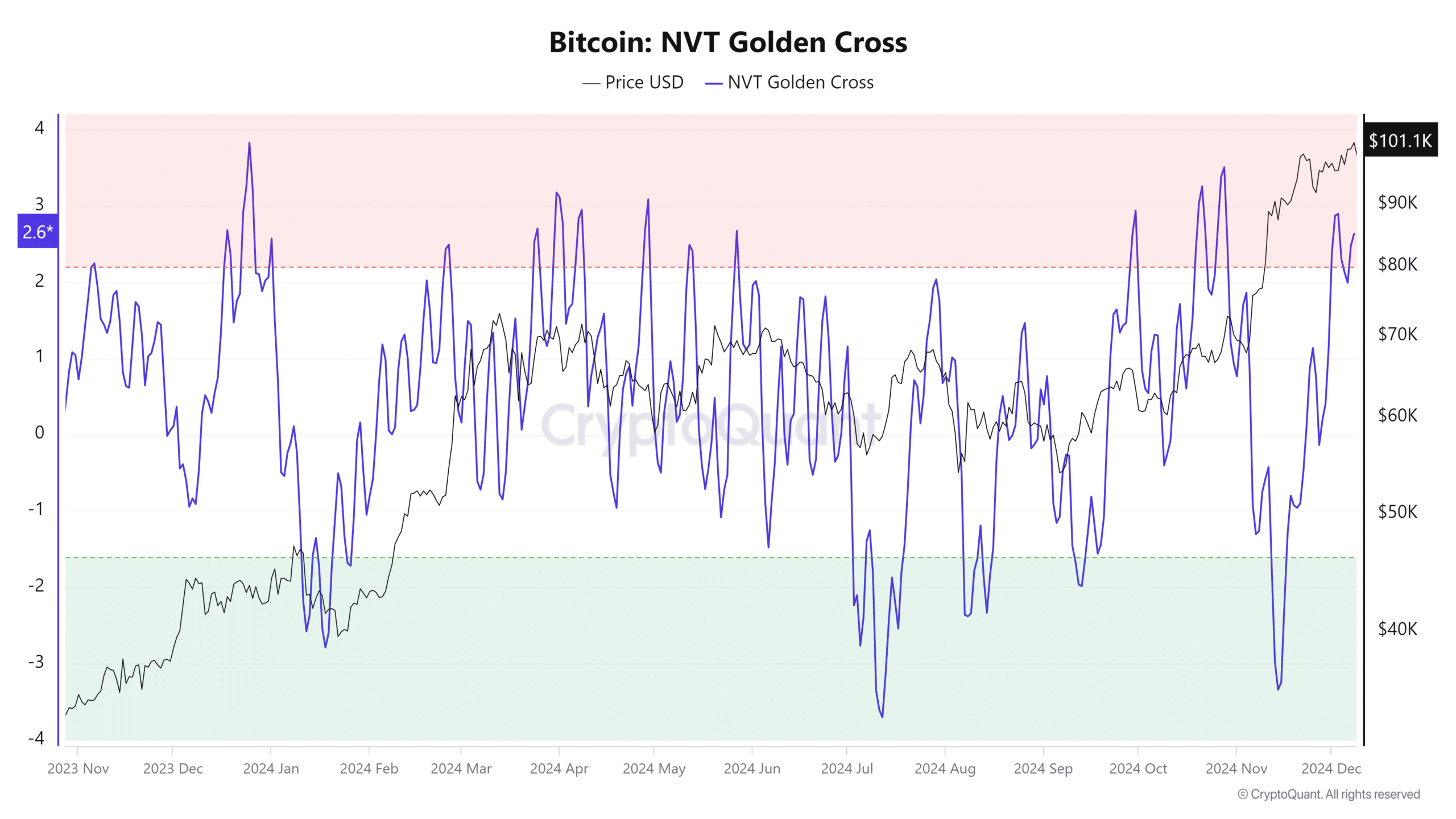

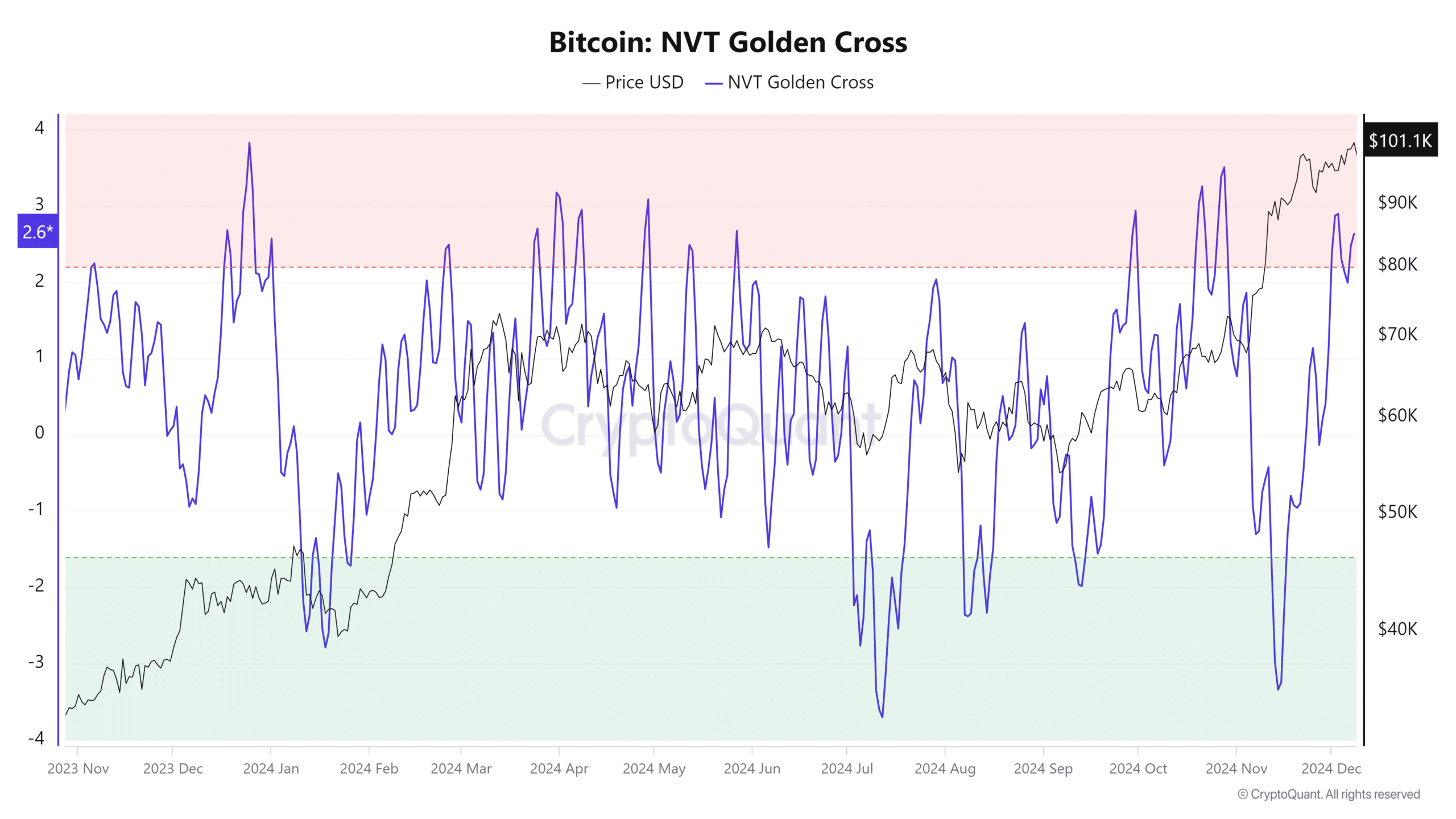

Bitcoin’s Network Value to Transaction (NVT) gold cross saw a remarkable increase of 7.84% in one day, reaching 2.6. This increase indicates growing investor interest in Bitcoin’s valuation compared to transaction volume.

Such a rise usually indicates bullish sentiment and increased confidence in the market’s prospects. Furthermore, it suggests that Bitcoin’s network metrics could attract more investors, further driving up prices.

Source: CryptoQuant

THIS reinforces the bullish sentiment

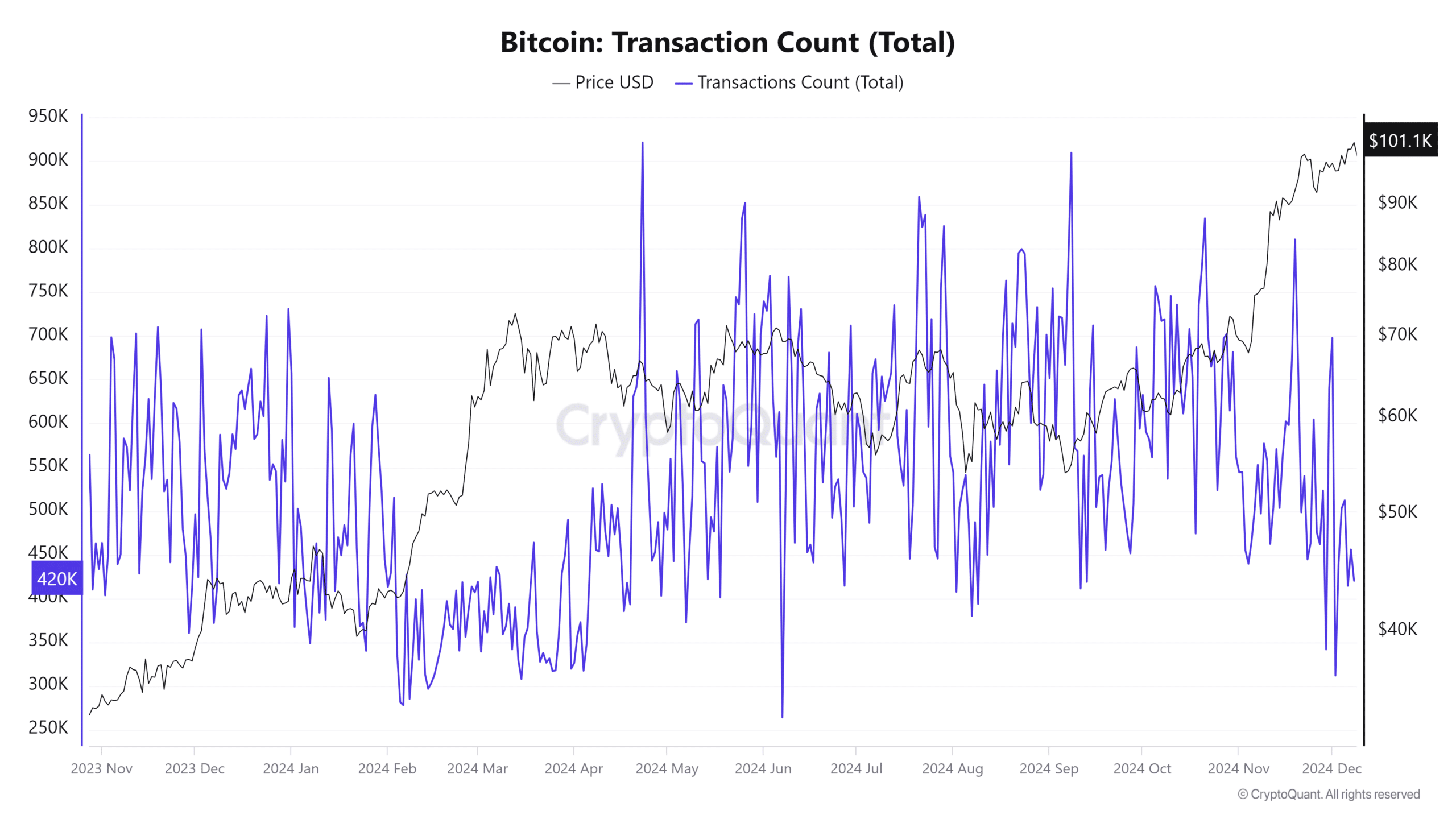

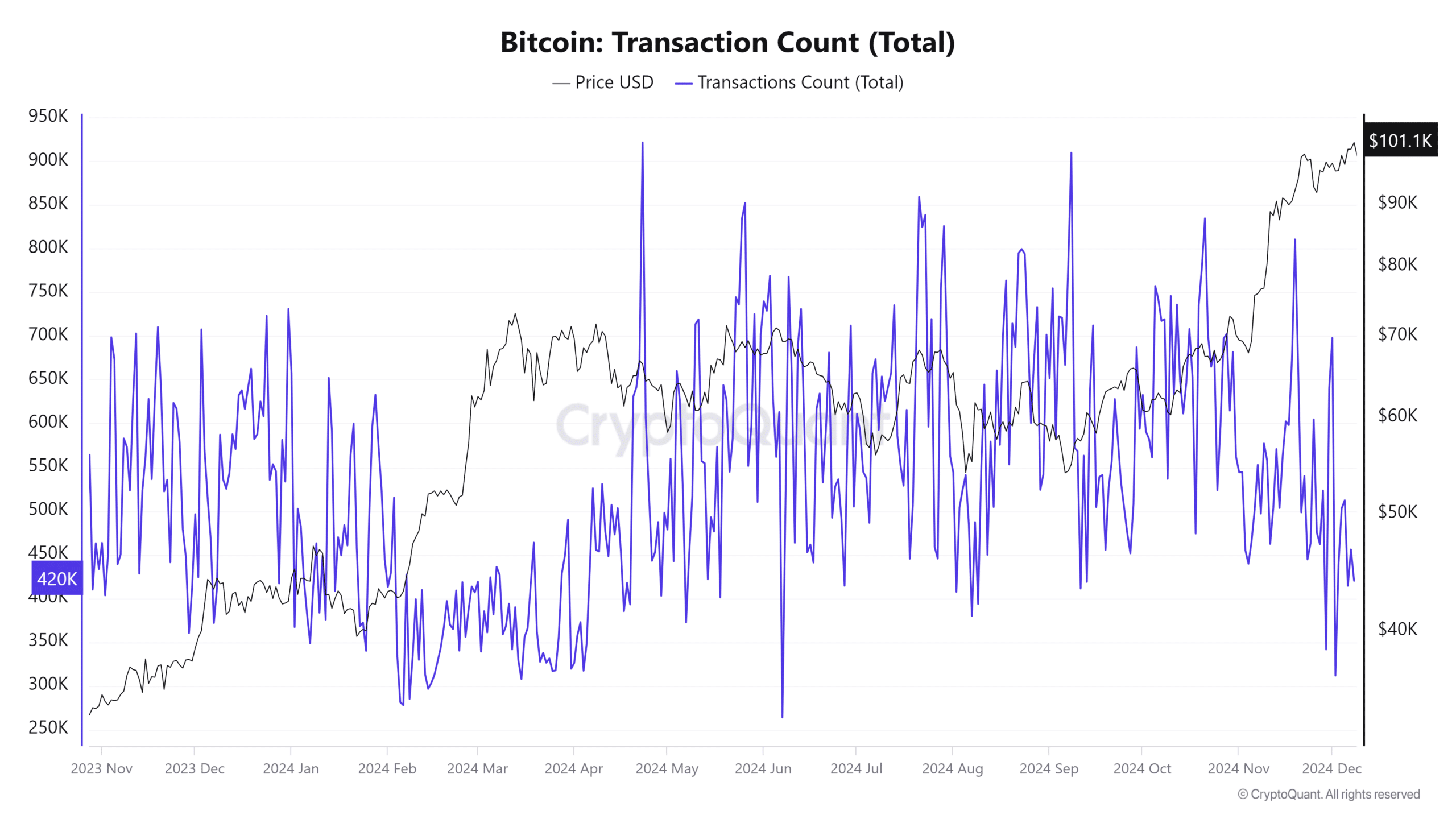

Bitcoin’s transaction count saw a daily increase of 0.94%, reaching 428,184,000 transactions. The increase in activity highlighted a more active BTC network and greater engagement among users.

Such activity indicated increased investor interest and a greater likelihood of continued bullish trends.

Therefore, a higher number of transactions strengthened Bitcoin’s position in the market and supported the overall bullish outlook.

Source: CryptoQuant

Investor confidence is growing

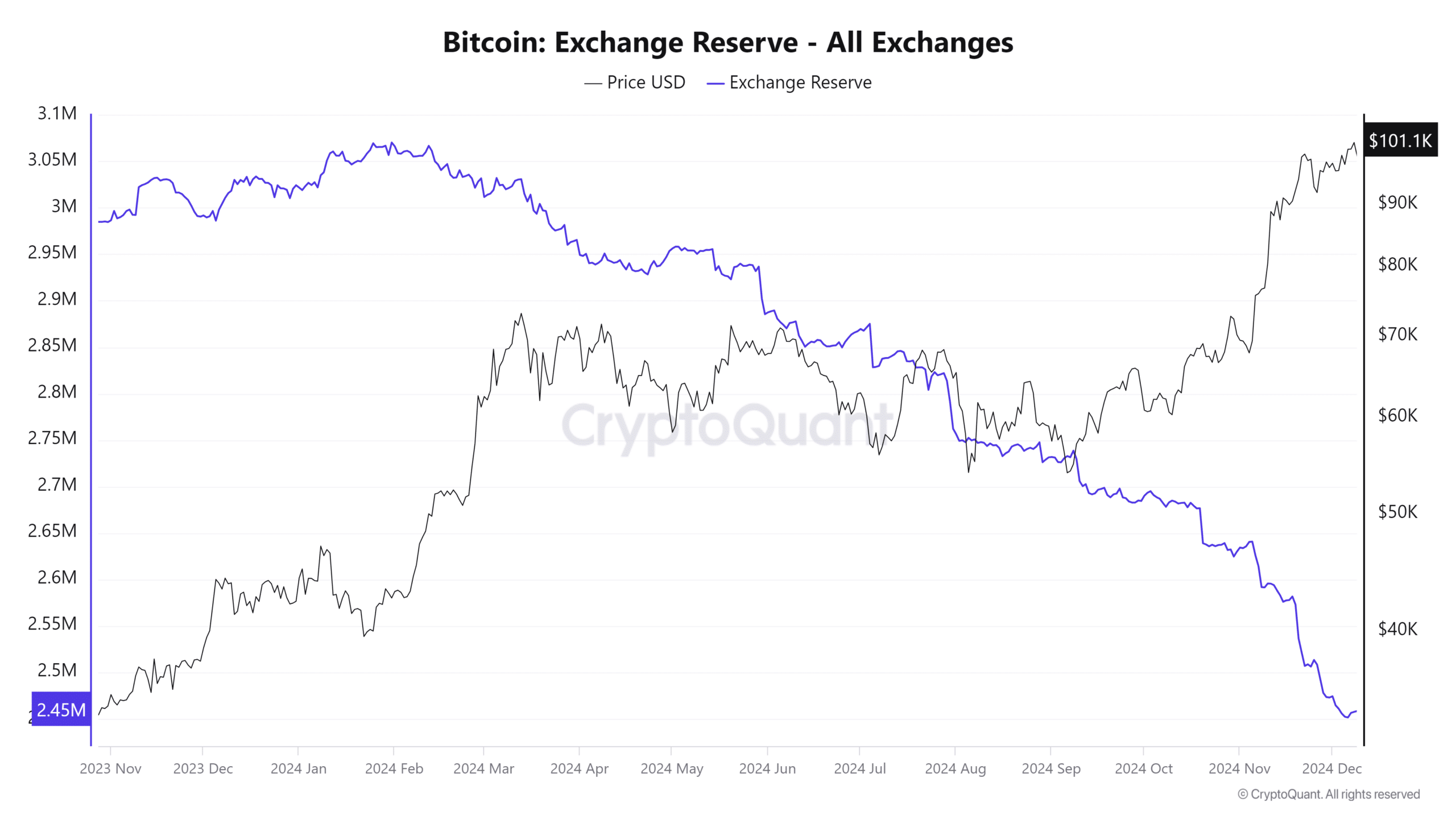

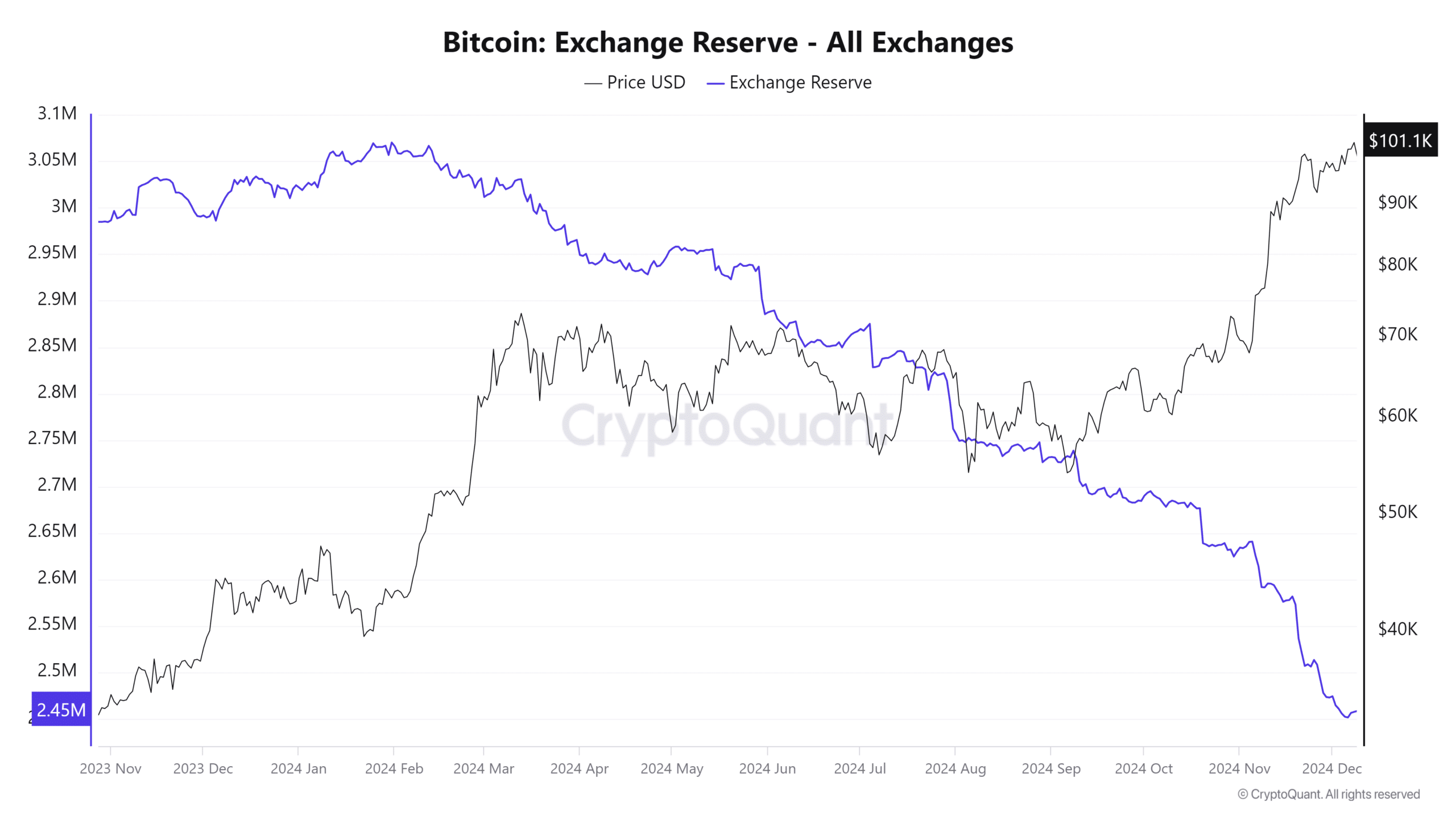

Bitcoin exchange reserves fell 0.04% in 24 hours, now at 2.4573 million BTC at the time of writing.

This trend shows that BTC holders are increasingly moving their assets off exchanges, possibly into wallets or long-term storage. Such a move reduces selling pressure in the market and strengthens bullish sentiment.

Source: CryptoQuant

Bullish investors hold firm

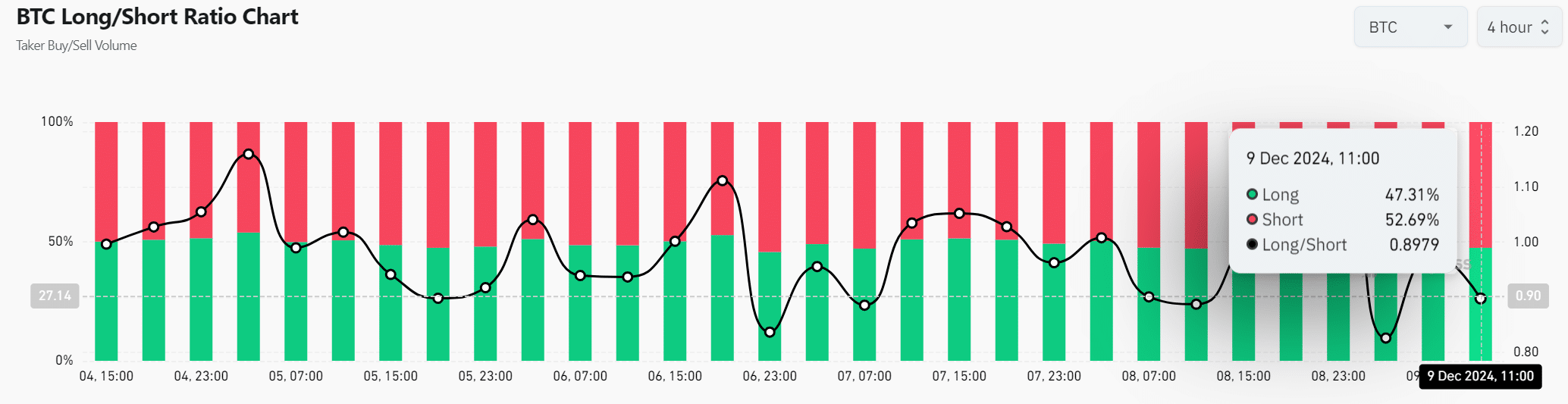

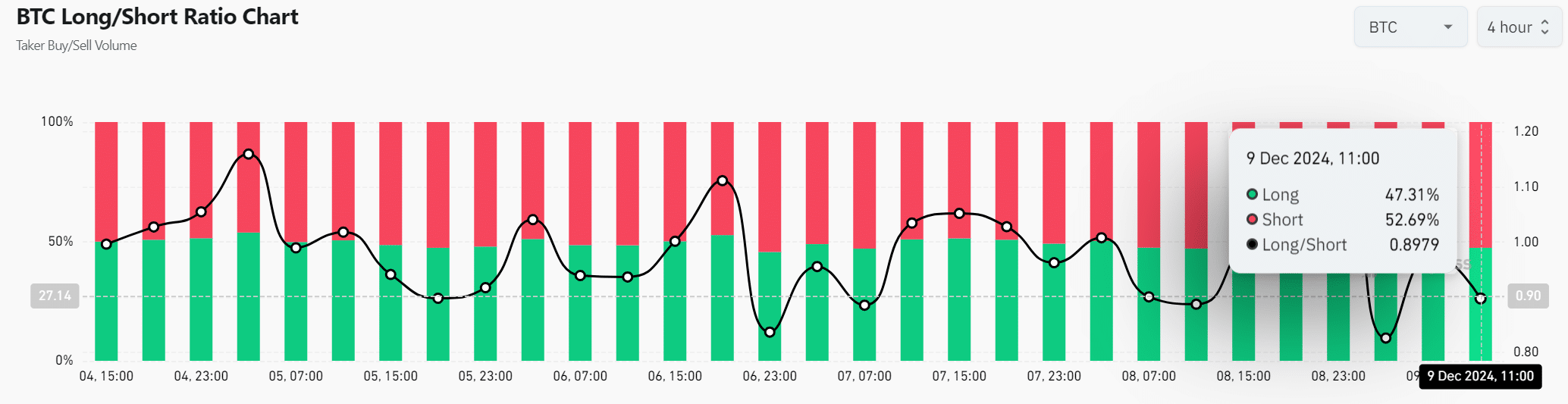

Bitcoin’s Long/Short ratio was 47.31% long and 52.69% short, resulting in a ratio of 0.8979. These figures show that short sellers still have a small advantage, but the high long-term interest rates reflect strong bullish sentiment.

Therefore, BTC remains resilient, with a positive outlook despite market fluctuations.

Source: Coinglass

Bitcoin’s Fear and Greed Index at 83 indicates an extremely bullish market outlook.

Read Bitcoin’s [BTC] Price forecast 2024–2025

However, as recent figures show a mix of gains and declines in dominance, transaction numbers and currency reserves, a correction remains possible.

Therefore, Bitcoin could continue its bullish run if current trends continue, but traders should remain vigilant about the potential market volatility.