- Bitcoin found some support at the level of $ 74.5k.

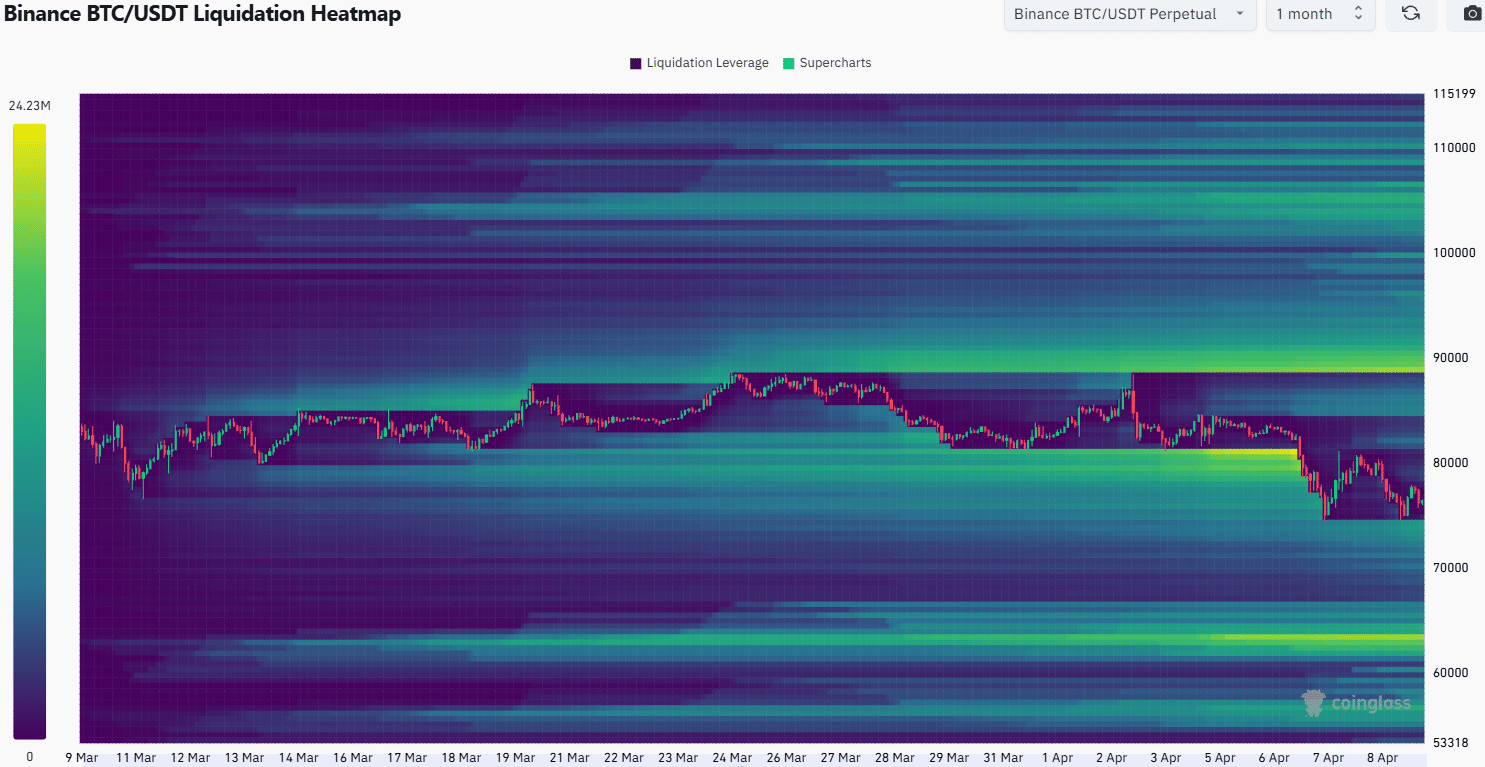

- The price campaign at the end of March could repeat itself, based on instructions of the liquidation heat jap.

Bitcoin [BTC] Fell below $ 80k mark on April 6 and reached $ 74.5k on 7 April, a date that sent shock waves at the world markets.

The leading crypto cannot be called resilient at the moment – it might already be in a bear market.

The strategy of Michael Saylor remained on the sidelines during the recent big dip, so we made the headlines again, but this time for a lack of activity in the market.

Bitcoin could consolidate for a while

Source: BTC/USDT on TradingView

The Bearish market structure was reinforced when the recent lower layer was broken at $ 78.6k on 7 April. The price has not formed and bounced, so a new swing low was not yet set.

The RSI on the daily graph fell lower to show a growing bearish momentum. Although the trade volume has been applied higher in the last ten days, the BBV remained without a trend during this period.

This showed that the OBV did not indicate the overwhelming sales pressure, as we saw at the end of February.

This was just a vague spark of hope. The 61.8% Fibonacci racement level at the $ 74.4k region would be tested again as support. It was unclear whether BTC Bulls could defend this level.

Source: BTC/USDT on TradingView

Zoom in on the 4-hour graph and we discovered that there was some room for hope. The $ 75.1k and the $ 80k levels seemed to form a short -term range for Bitcoin.

Both the OBV and the RSI have made higher lows during the recent retest of the low of the range.

This exaggerated bullish divergence unveiled the potential for a bullish momentum in the short term. However, it was not strong enough to reverse the downward trend or the recent losses.

The idea of consolidation came from the heat of 1 month liquidation. In the second half of March, BTC traded above $ 82k short -term support. It gave time for a structure of long liquidations around $ 81.1k.

Likewise, the price of Bitcoin can stabilize above $ 74.5K. This was to build long liquidations in the south before they hunt their hunting.

Traders must be prepared for BTC to dive under $ 74.5k, because the uncertainty increases every day.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer