- BTC failed to rally despite a dovish FOMC meeting on July 31.

- The July Jobs report on Friday could increase volatility and determine the next BTC price direction.

Bitcoin [BTC] decoupled from US stocks after a dovish FOMC meeting on Wednesday, August 1, falling below $65,000 as shares hit record highs.

The Fed kept rates unchanged as expected at its recent meeting, but Chairman Jerome Powell signaled a likely rate cut in September.

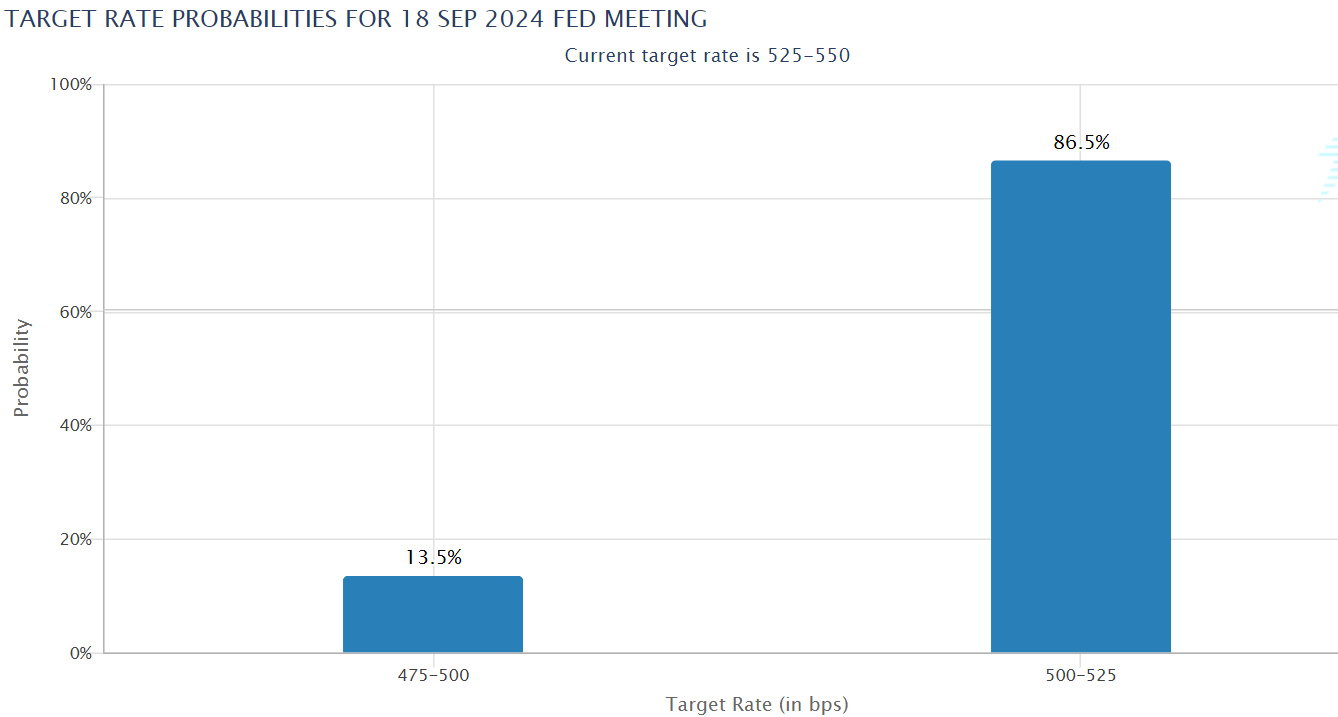

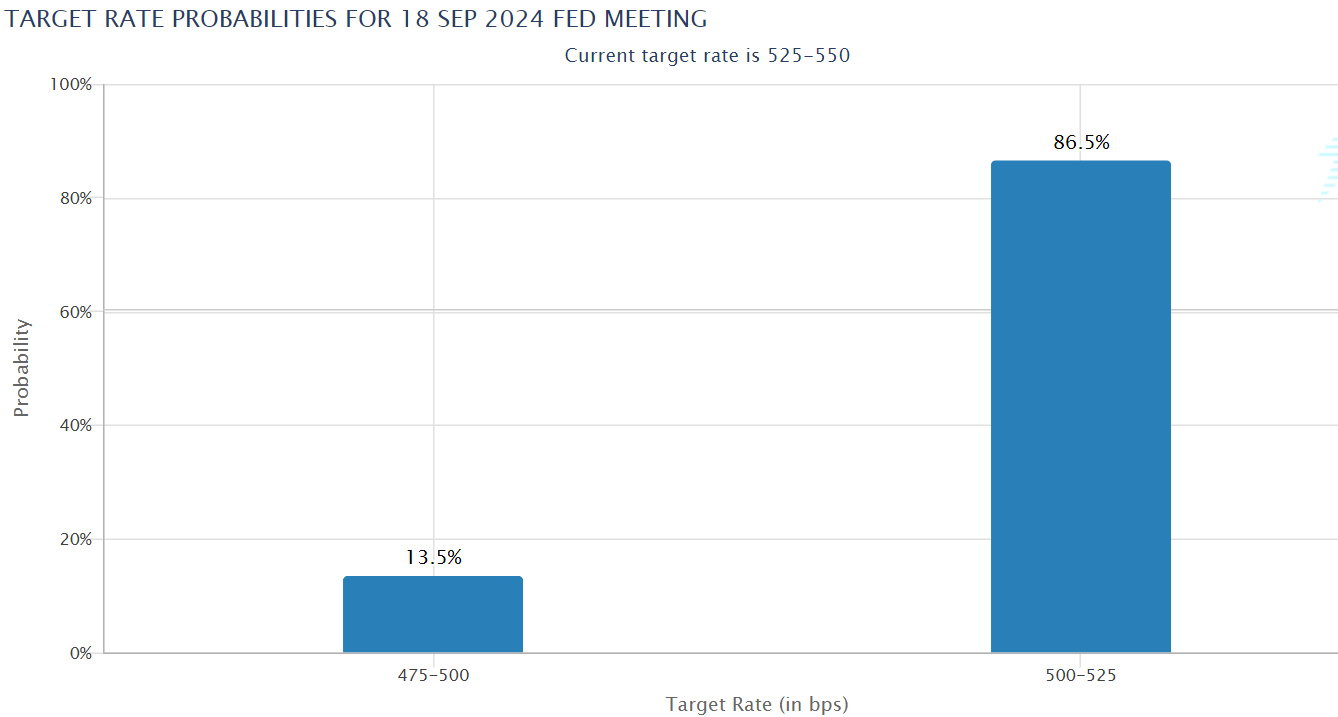

At the time of writing, interest rate traders are now pricing 86.5% chances of a rate cut in September, a general bullish signal that boosted US stocks.

Source: CME Fed Monitoring Tool

Why Didn’t Bitcoin Follow the US Stock Rally Given the Fed’s Dovish Announcement?

Galaxy’s Mike Novogratz blames the US government

Mike Novogratz of Galaxy Digital agreed that the US government could be the market risk factor. He argued that the US could sell Bitcoin for political reasons after Trump announced he would create a strategic reserve.

“I agree that it feels like someone is leaning on $BTC. No idea, but it could be the US Marshall’s office. They report to DOJ…I wish they wouldn’t sell.”

QCP Capital strengthens a similar market warning tied to the US government’s move of $2 billion in BTC last week.

“The recent move of $30,000 worth of Silk Road BTC by the US government has introduced uncertainty to the cryptocurrency market.”

As a result, QCP Capital predicted that BTC could remain range-bound after failing to reach the high of $70,000.

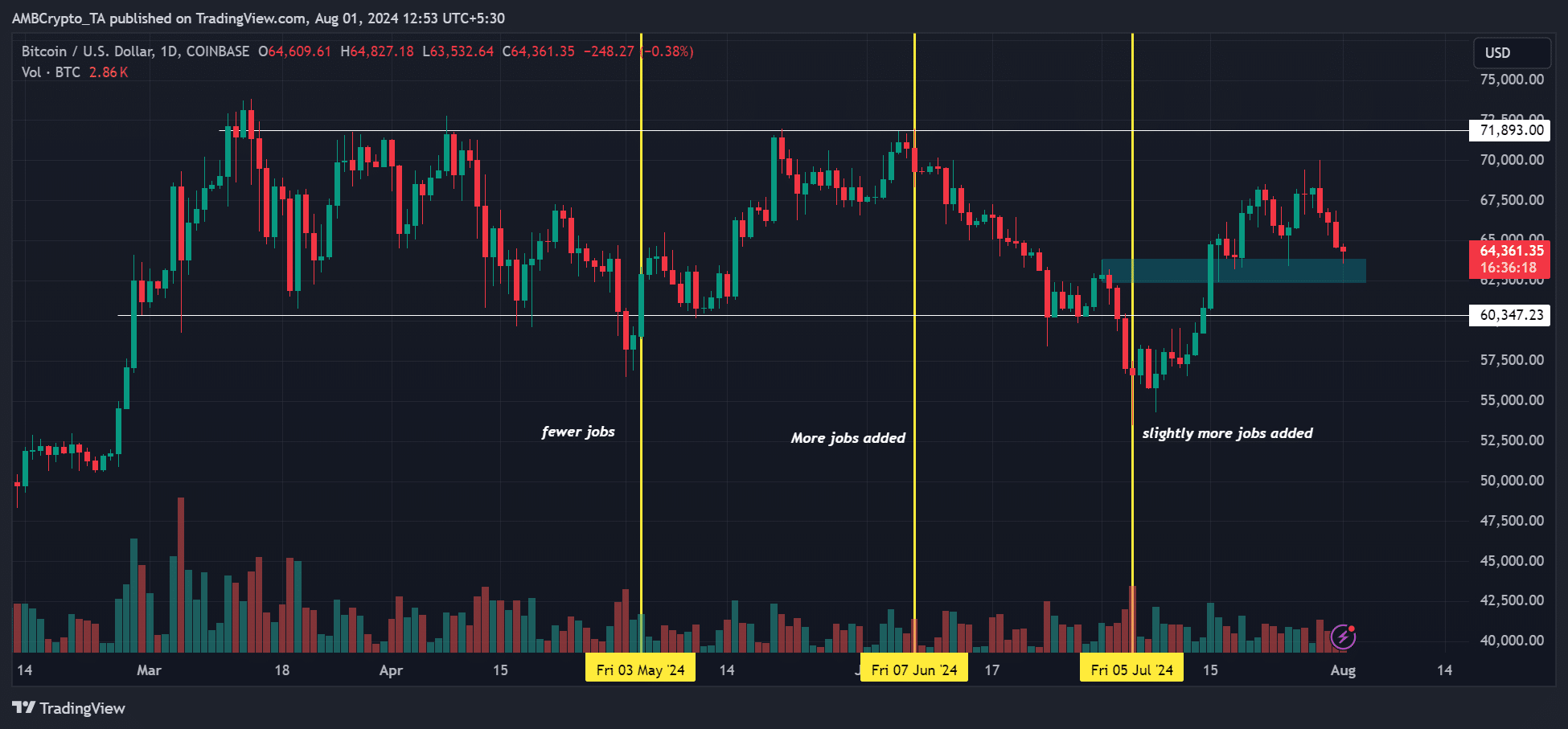

That said, the next market move could be the July 2024 US jobs report, which will be released on Friday (August 2).

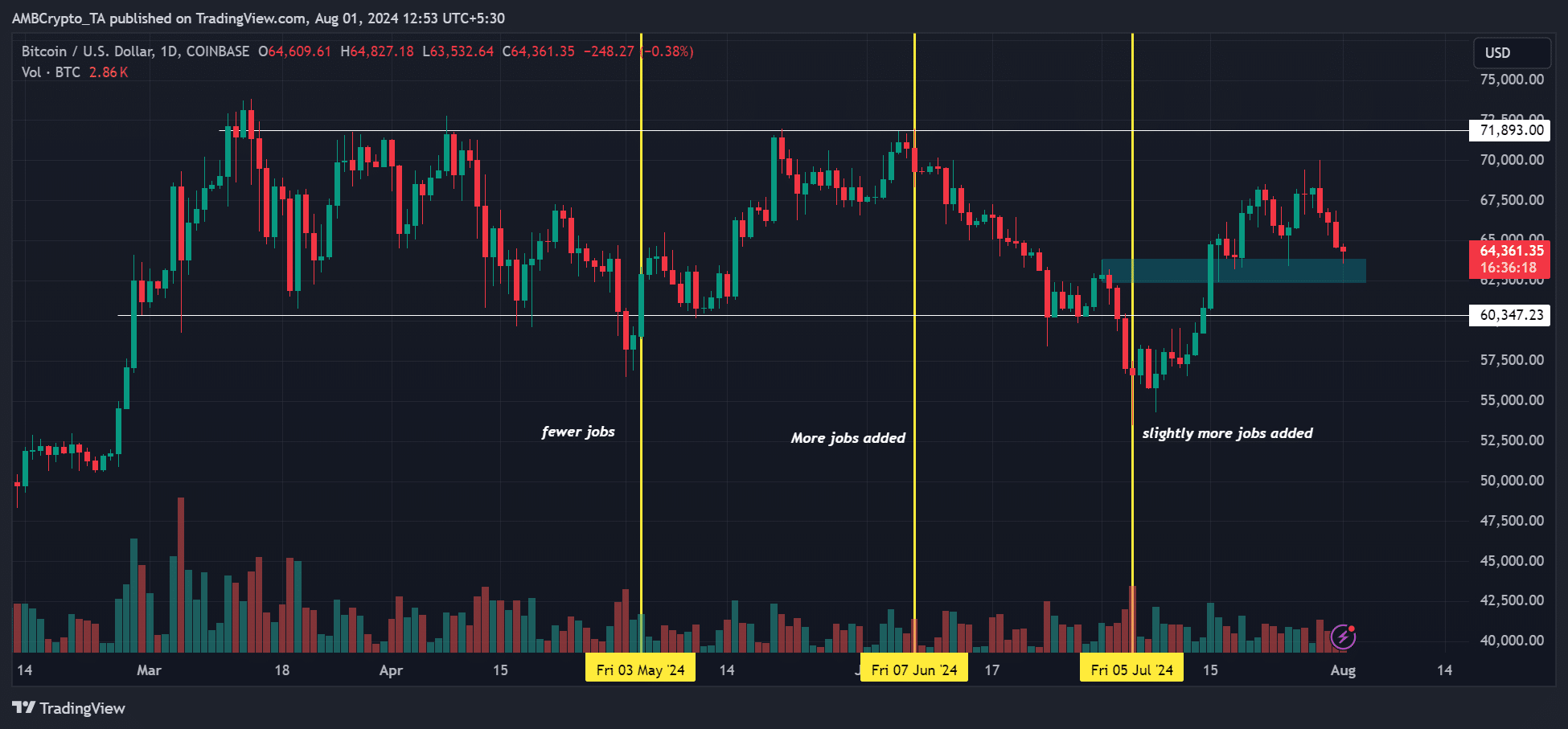

Based on the previous jobs reports, fewer jobs scenarios were consistent with a rally for BTC as they reinforced the cooling US labor market and supported the Fed’s likely rate cut.

Source: BTC/USD, TradingView

Such a scenario occurred in the April Jobs report, which was published on May 3, giving BTC an increase of around 6%.

The subsequent jobs reports released in June and July caused BTC to fall after showing an improvement in the US labor market.

So, a cooler Jobs report on Friday could give BTC a boost to reverse recent losses. However, a better jobs report, with more job additions, could drag the index even lower.

Quinn Thompson of the crypto hedge fund Lekker Capital shared the same prospects. While he acknowledged how crucial Friday could be for markets, he maintained a positive outlook for the second half of 2024.

‘I remain positive about the macro outlook for the medium term (second half of 2024). I expect tomorrow’s FOMC/Friday’s NFP to be the two most important events of the week.”

At the time of writing, BTC was trading below $65,000 and could only recover from the short-term support near $65,000, marked as cyan, if Jobs’ report favors bulls.

So, macro factors and US politics still influence the price of BTC, and it is worth monitoring these fronts for risk management.