- Bitcoin fell lower after softer CPI data in June.

- Analysts claimed that a bullish reversal was likely for BTC.

On June 11, Bitcoin [BTC] reflected losses in US equity stocks, especially Big Tech, after a softer CPI (Consumer Price Index) in June.

BTC failed to regain the $60,000 level and fell below $58,000 following the inflation data.

The June CPI facts was cooler at 3.0%, compared to 3.3% in May, meaning the total weighted consumer price for a basket of goods and services fell slightly.

Will a likely Fed rate cut in September boost Bitcoin?

Softer inflation in June could confirm the recent disinflation trend, raising the likelihood of Fed rate cuts later this year. This could be positive for risky assets, including the crypto market.

However, after the CPI data, investors Reportedly left Big Tech stocks, dropping along with BTC as they conquered US small-cap stocks.

Interestingly, Quinn Thompson, founder of crypto hedge fund Lekker Capital, claimed that “small-cap outperformance” could still strengthen Bitcoin’s recovery. He noticed,

“The outperformance of small caps usually coincides with the strength of cryptocurrencies. Let’s see if the macro can overpower the surplus of #Bitcoin supply.”

Source: X/Quinn Thompson

The above chart shows a positive correlation between the performance of small caps, followed by iShares Russell 2000 ETF (IWM), and BTC.

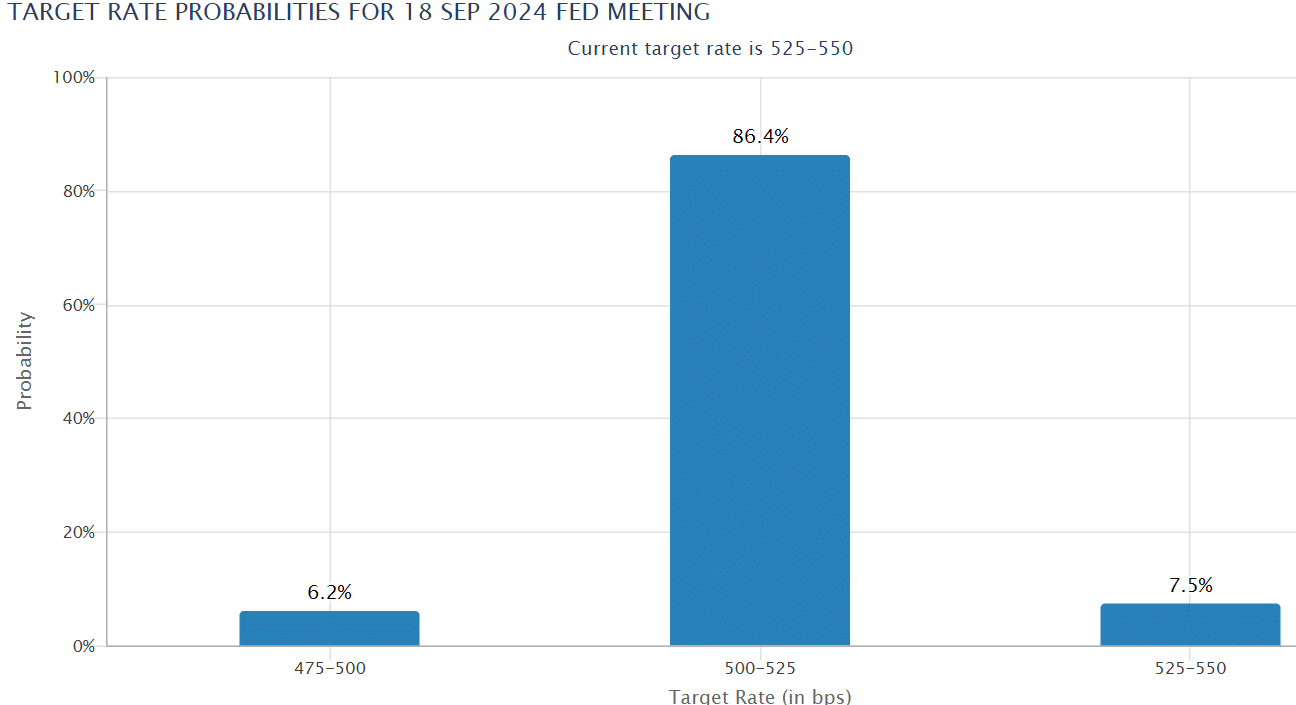

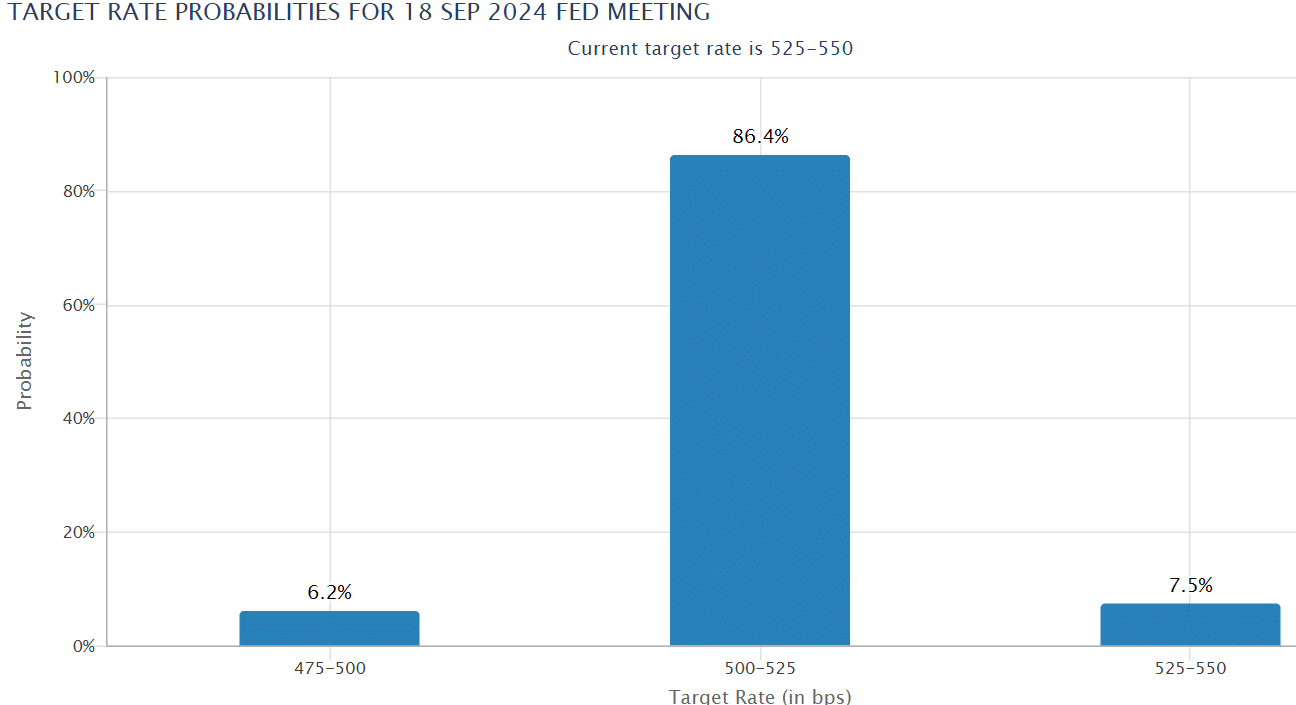

In the meantime, the chances of Fed rate cuts in September rose above 80% at the time of writing, reflecting softer inflation in June.

Source: CME Fed Watch tool

However, the improving macro outlook could be dented by the glut of Bitcoin supply, especially the German government sell-off, as warned by Thompson.

But from July 12th German possessions were less than 10,000 BTC of the 50,000 BTC held in mid-June, meaning supply pressure could ease significantly next week.

So, what’s next for the BTC price in the short term?

BTC’s next price target

Based on a likely upcoming decrease in supply pressure Ethereum [ETH] ETF and softer CPI, QCP Capital analysts projected that BTC could rise above its current sideways movement.

According to renowned BTC analyst Stock money lizardsa retest of $50,000-52,000 could be possible before reaching the $64,000 target.

Source: X/Stockmoney Lizard