- Bitcoin is floating just under closed short liquidation clusters between $ 83,100 and $ 83,500

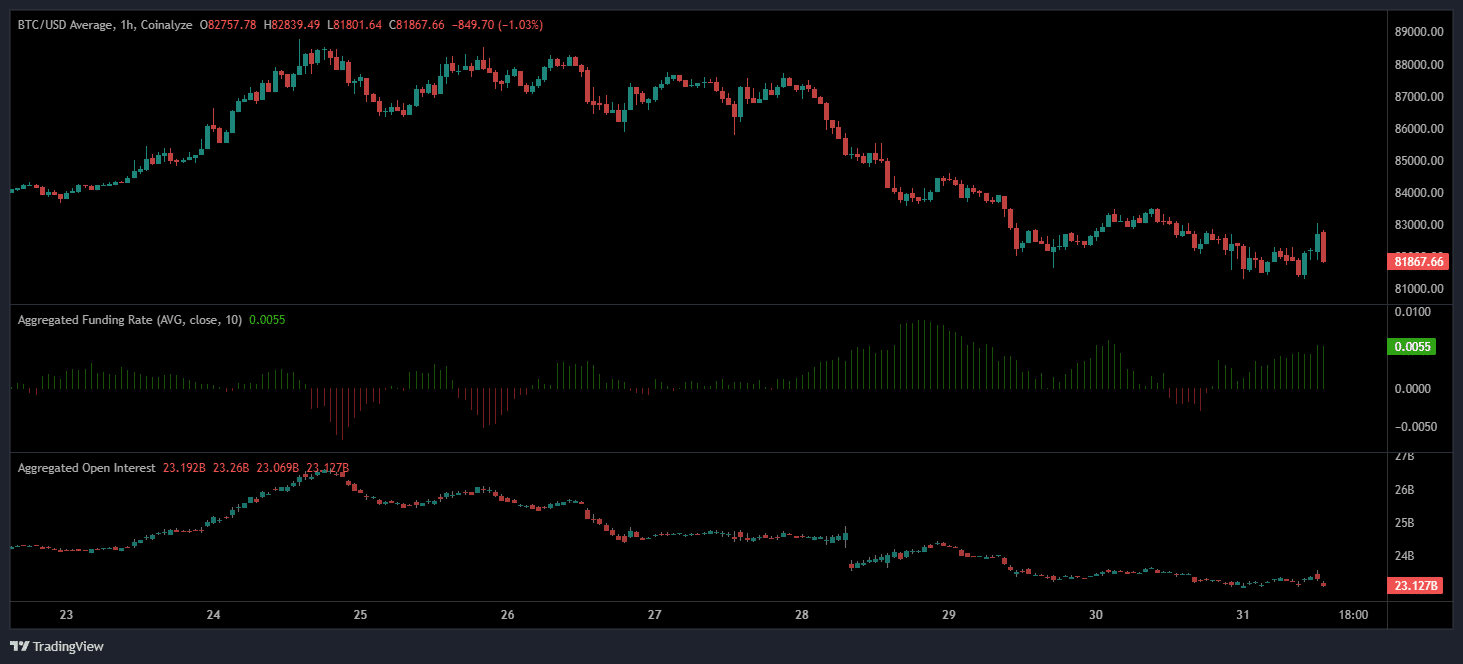

- Open interest rate fell by 9%in one week, with the emphasis on the exit or liquidation pressure of traders

Bitcoin [BTC] A critical threshold is approaching, with his prize now close to tightly packed short liquidation levels.

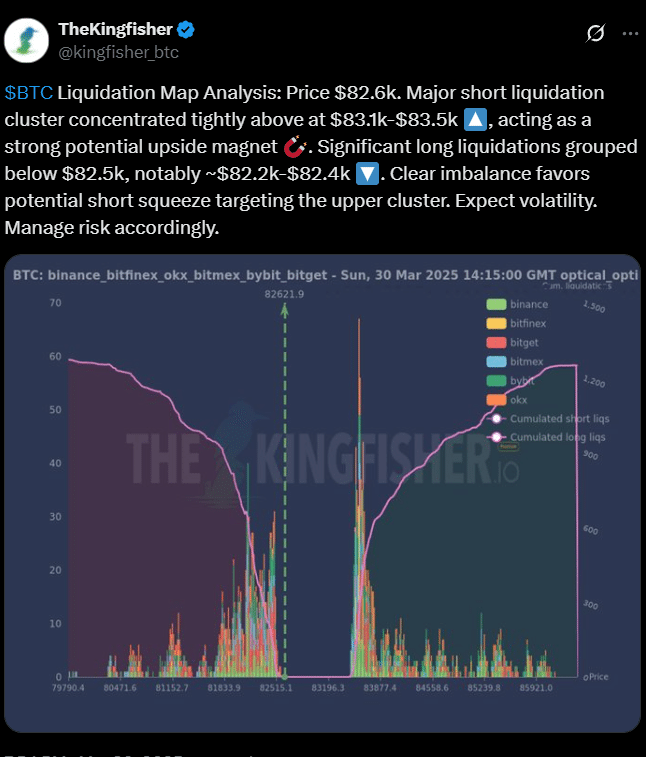

In fact, on March 30, Thekingfisher placed Bitcoin at $ 82,621.9, with the cryptocurrency placed between two opposite liquidation zones in the charts.

Source: X

At the time of writing, the short position cluster was between $ 83,100 and $ 83,500, while the long liquidations extended below $ 82,400. This compression is the stage for further volatility on the graphs.

Wait a squeeze to happen?

Zooming in on the map structure, the imbalance seemed to be clear.

The short liquidation band was only 0.6-1.1% above the place. In the meantime, long exposure seemed to be more scattered. This creates an asymmetrical printing zone that prefers bulls when the upper limit is violated.

Now consider how this unfolds on trading platforms.

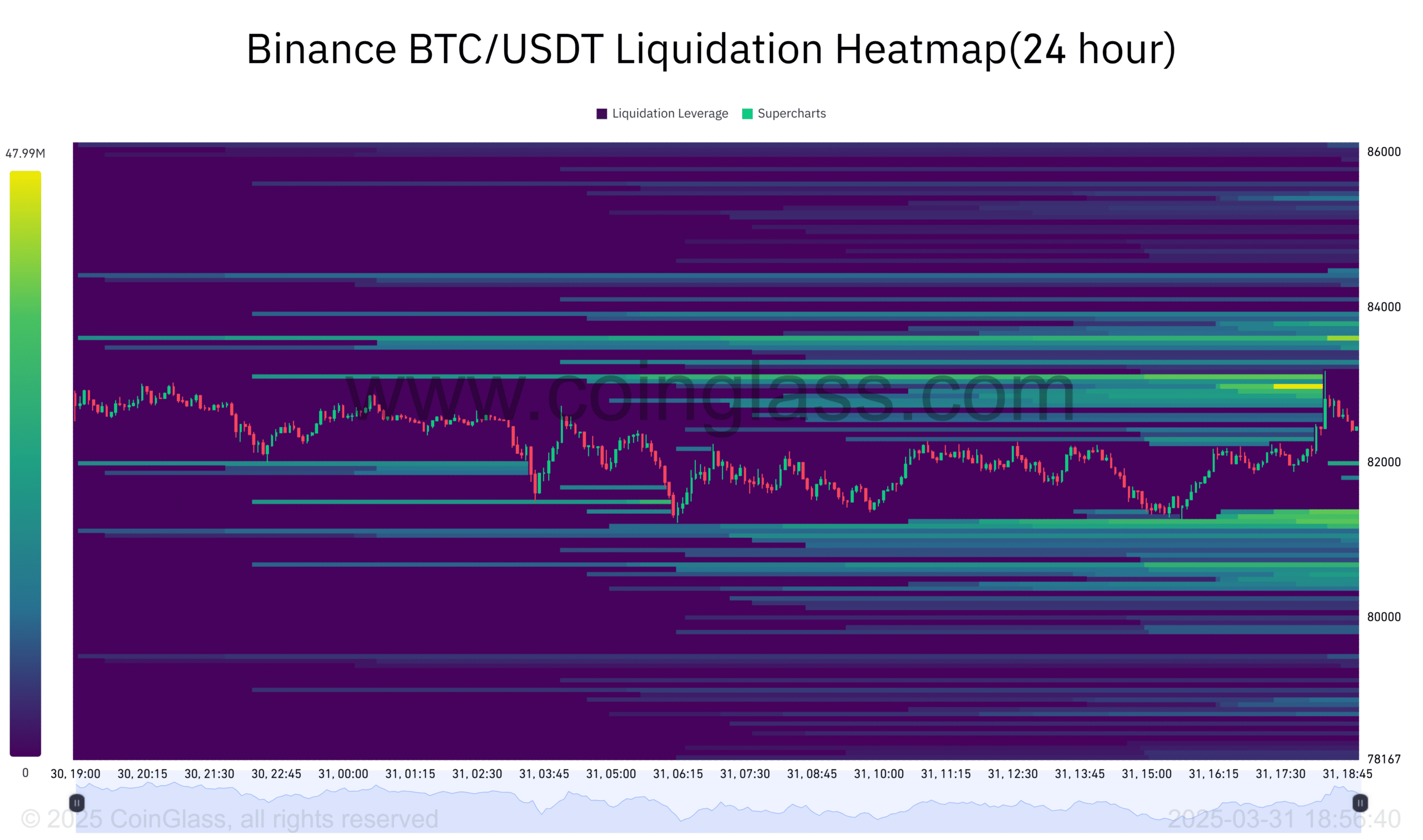

Binance and Bybit emphasized the most concentrated short positions, based on color -coded zones in the heat folder. This proposed platform -specific risk. When the price starts to rise, these clusters can first activate stop-outs-bitcoin in a forced buying cycle.

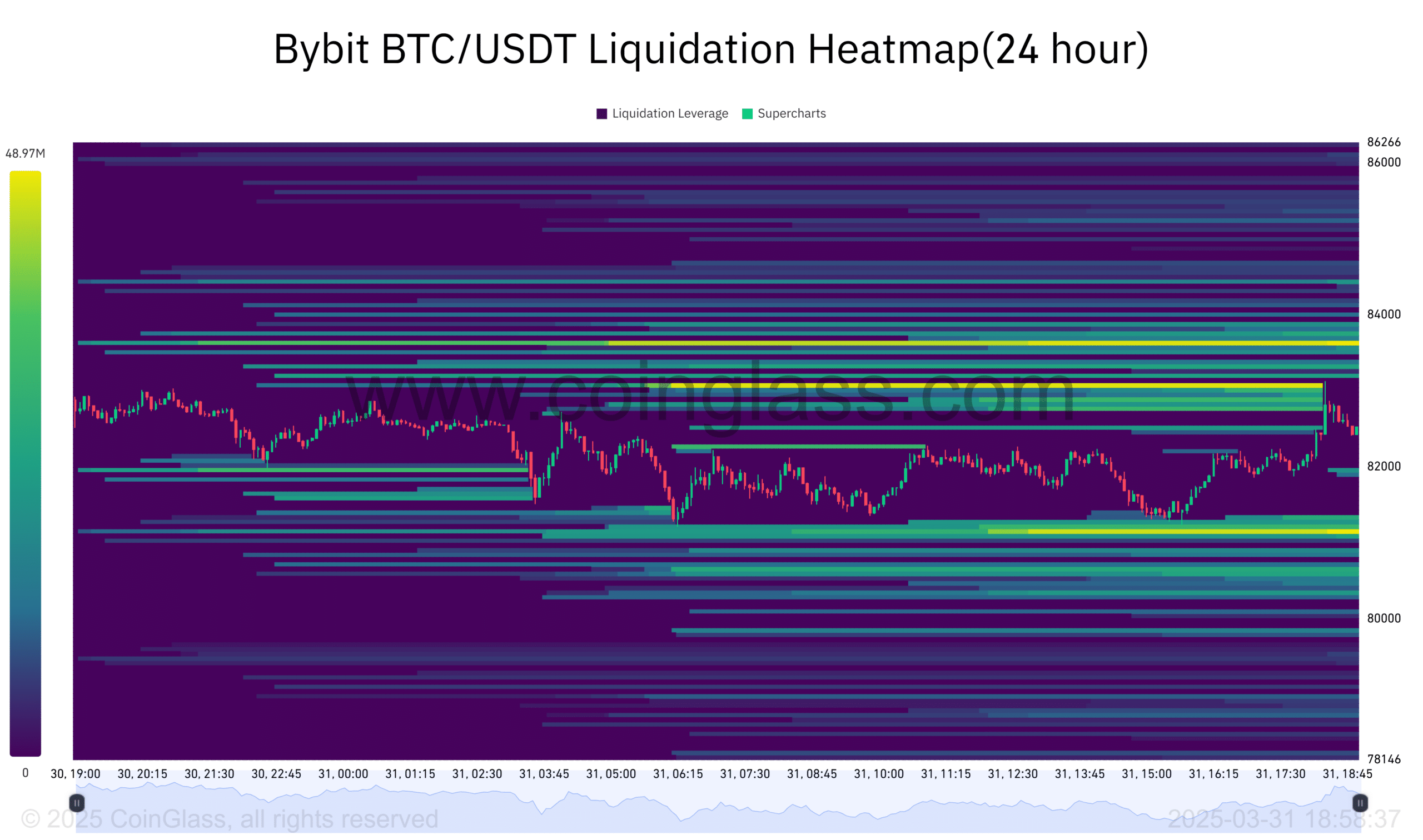

Support for this setup also comes from Intraday HeatMap activity.

Source: Coinglass

Coinglass -data also showed that Bitcoin rose from $ 80,673 to $ 83,618 on March 31. Liquidation lever rose to $ 35.43 million during this movement. However, the timing was not random, because most activity took place between 3:15 and 18:30.

A Golf … or just the start?

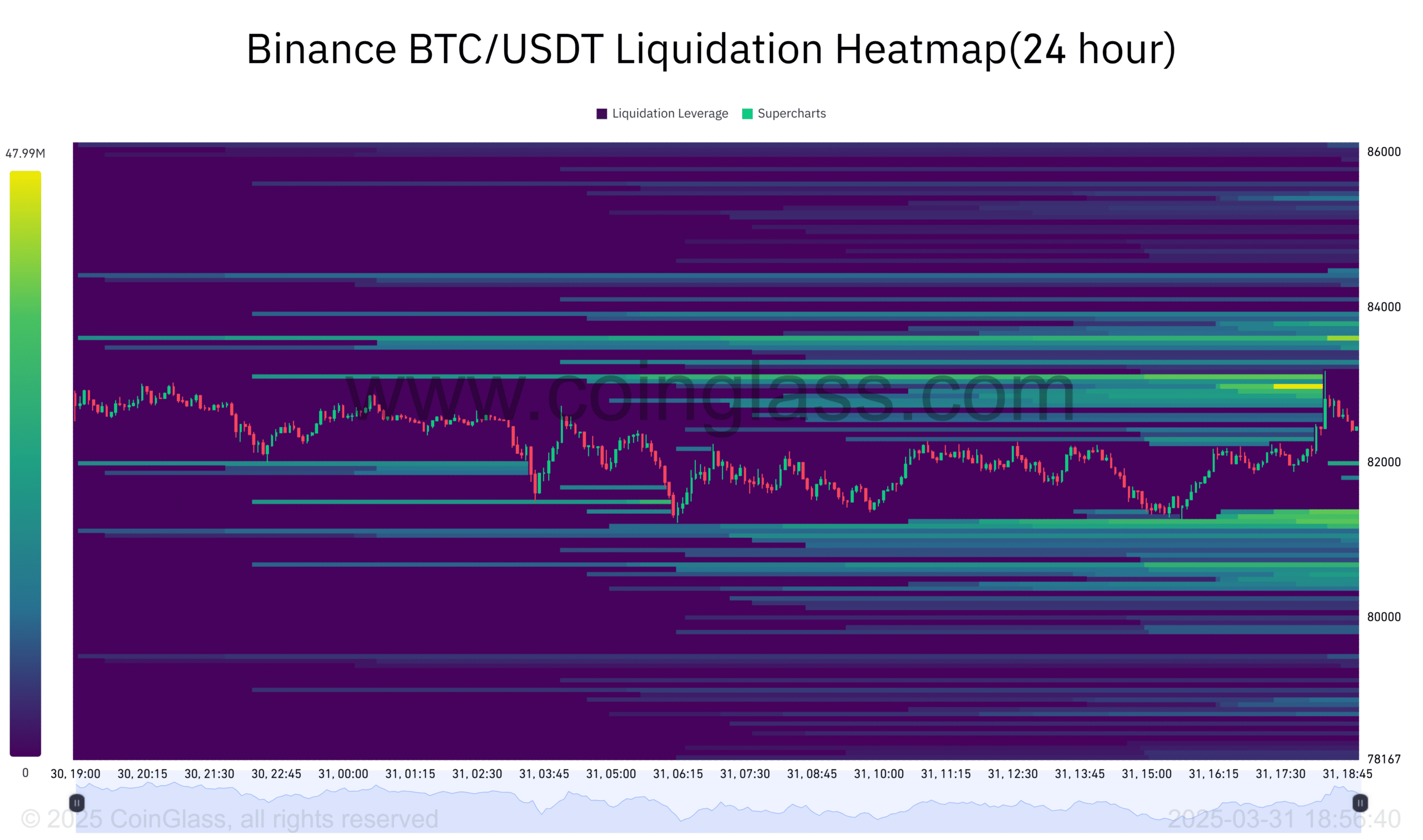

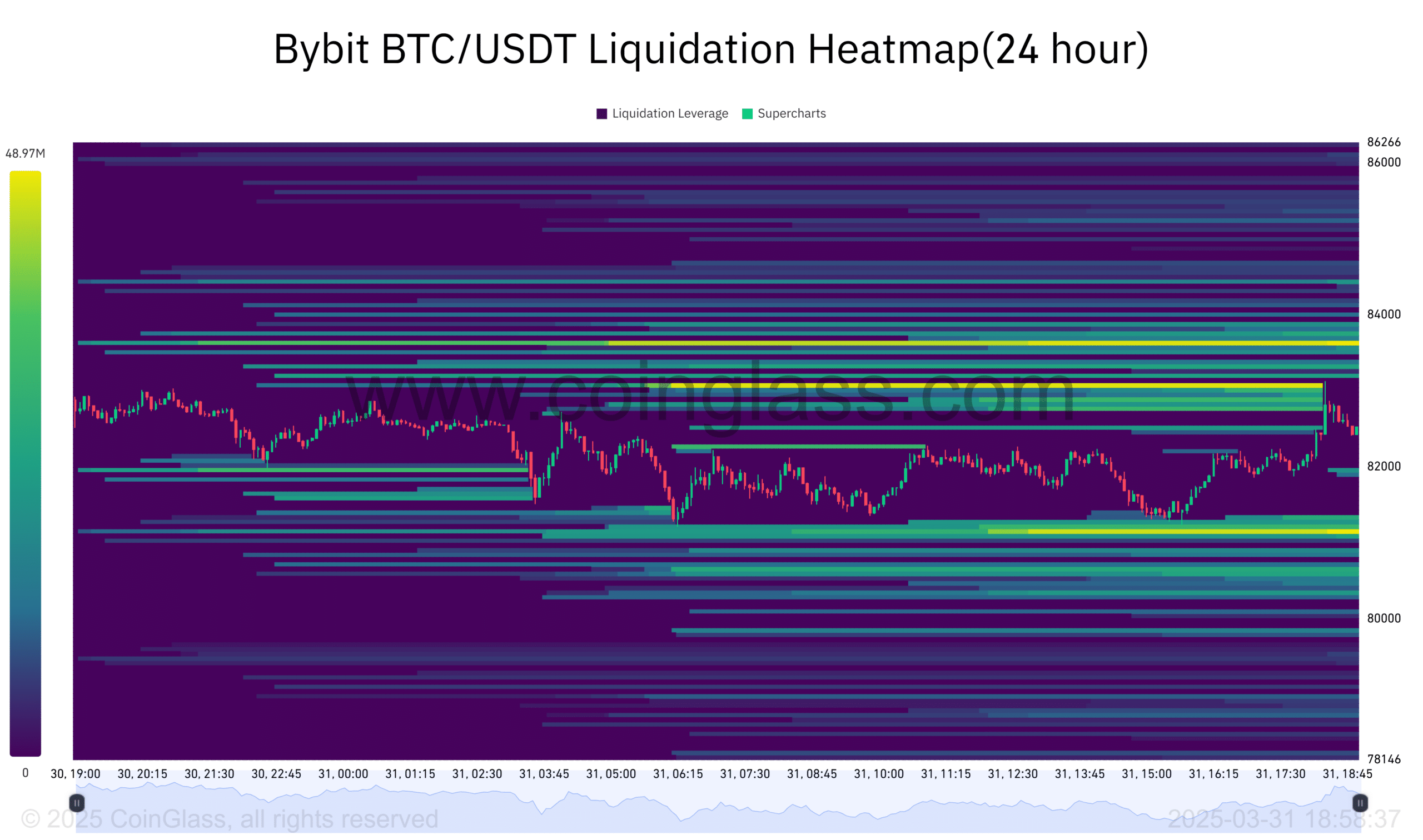

Place in the numbers of Bybit and the signal reinforced.

In fact, a separate heatmap registered the peak of the session at $ 83,642. Liquidation lever reached $ 48.98 million, with more than 70% of the total liquidations packed between $ 81,000 and $ 83,600.

Source: Coinglass

This seemed to confirm that the leverage functions were stacked near the time levels of the press.

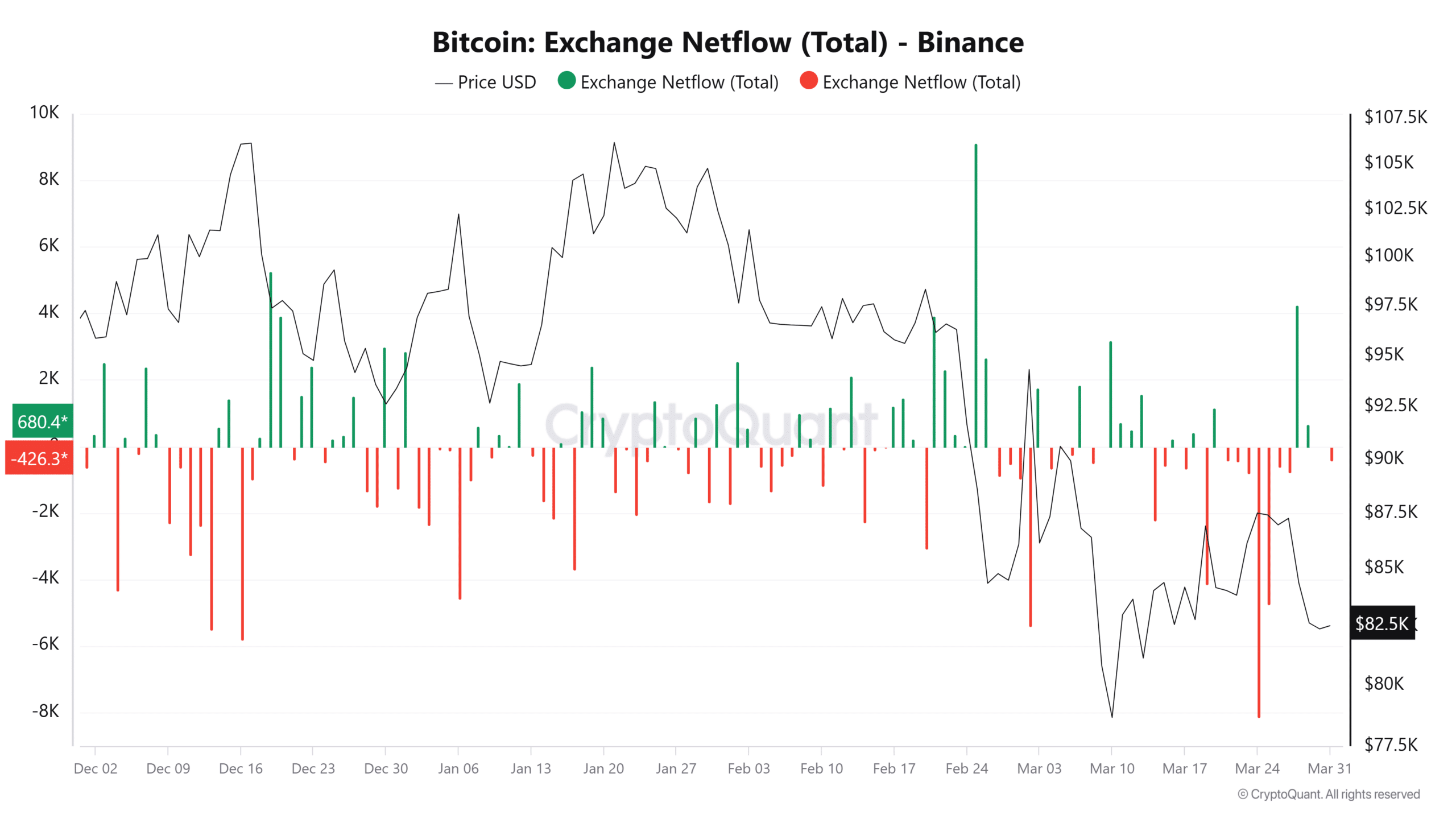

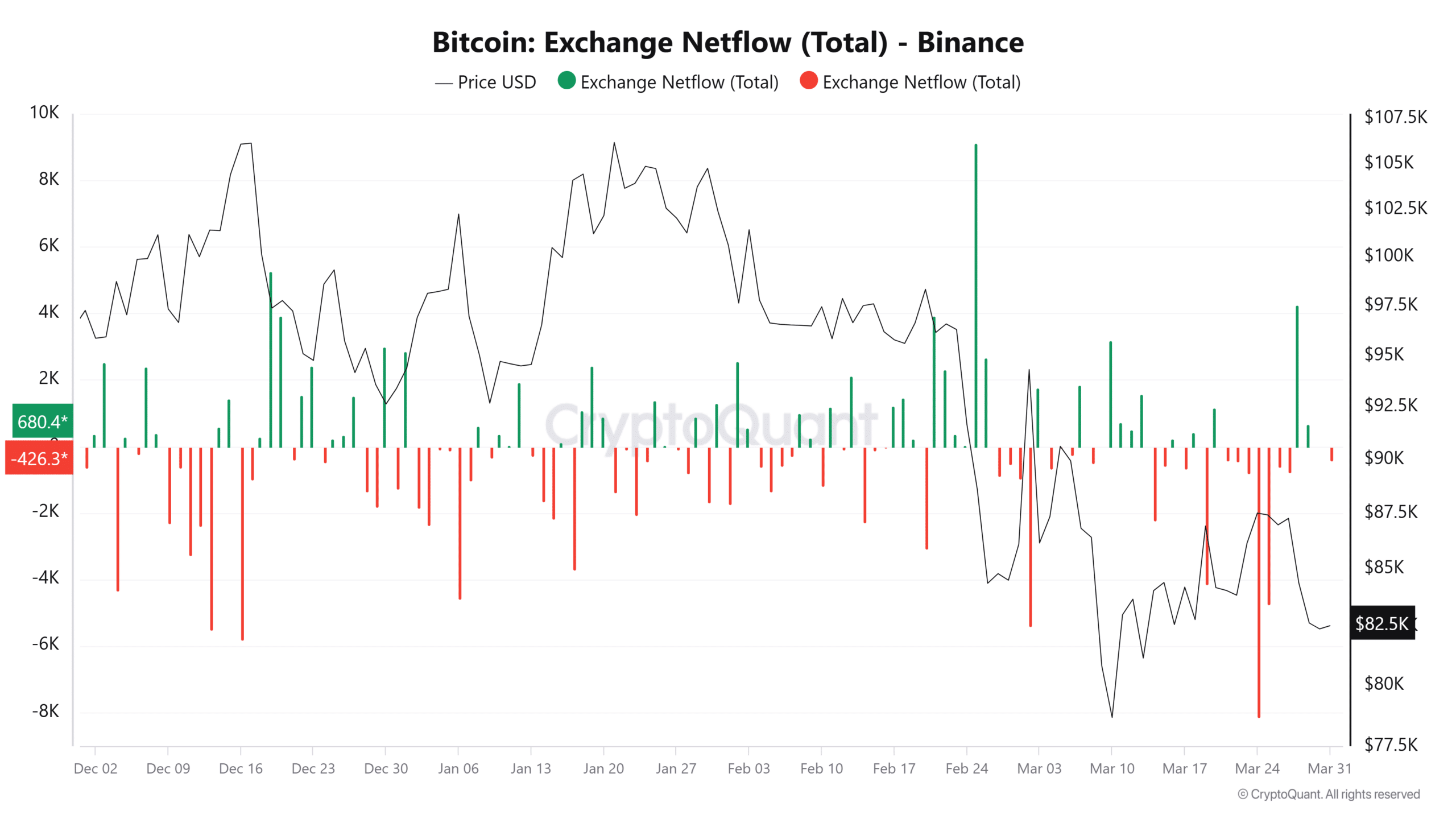

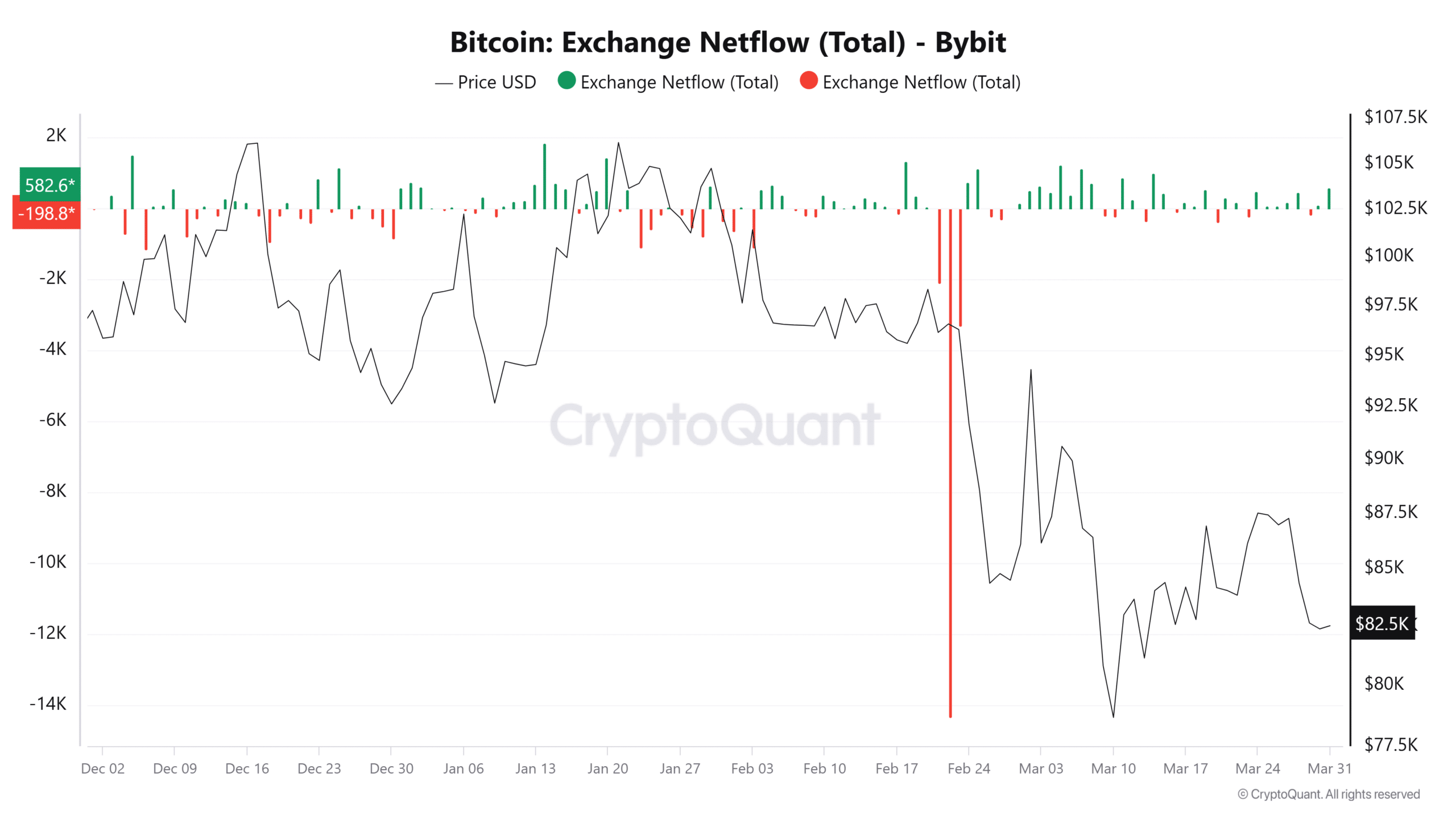

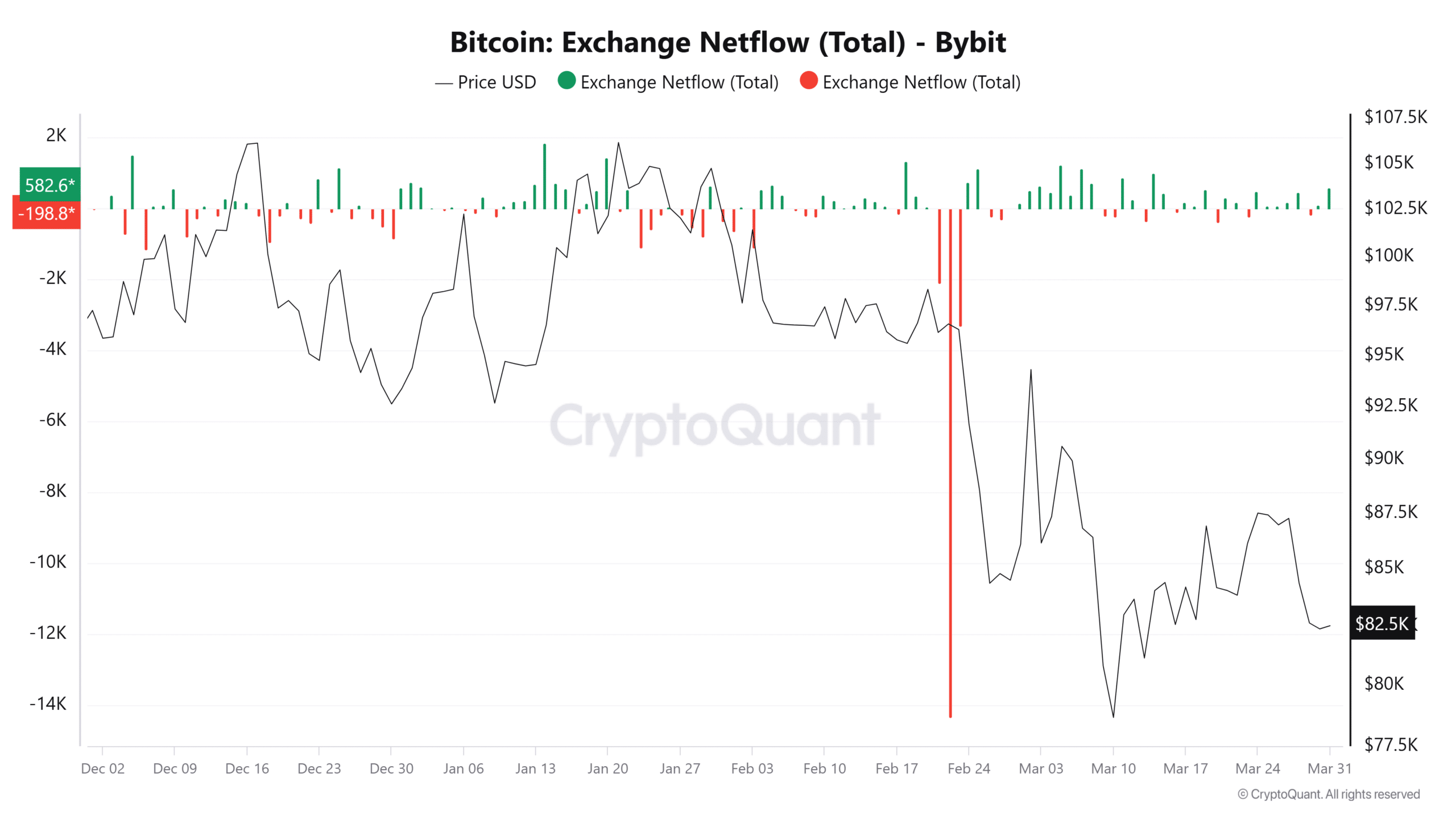

However, what is behind this leverage? Well, Netflows exchange can offer an indication.

According to Cryptoquant, for example, Bitcoin outflows have dominated Binance and Bybit since February.

Source: Cryptuquant

Traders attract assets in the midst of the falling prices of the cryptocurrency.

Source: Cryptuquant

Even after the influx of 4,258 BTC on March 28, the market remained under pressure-a sign that this was probably in the short term, not in the long term accumulation.

Look back to see ahead

Zoom further out and the price trend emphasized this sentiment.

Since a peak at $ 106,164 on January 21, Bitcoin has fallen by 22%and Mars has closed at $ 82,500. This decline seemed to be in line with persistent outsource and increasing liquidation events.

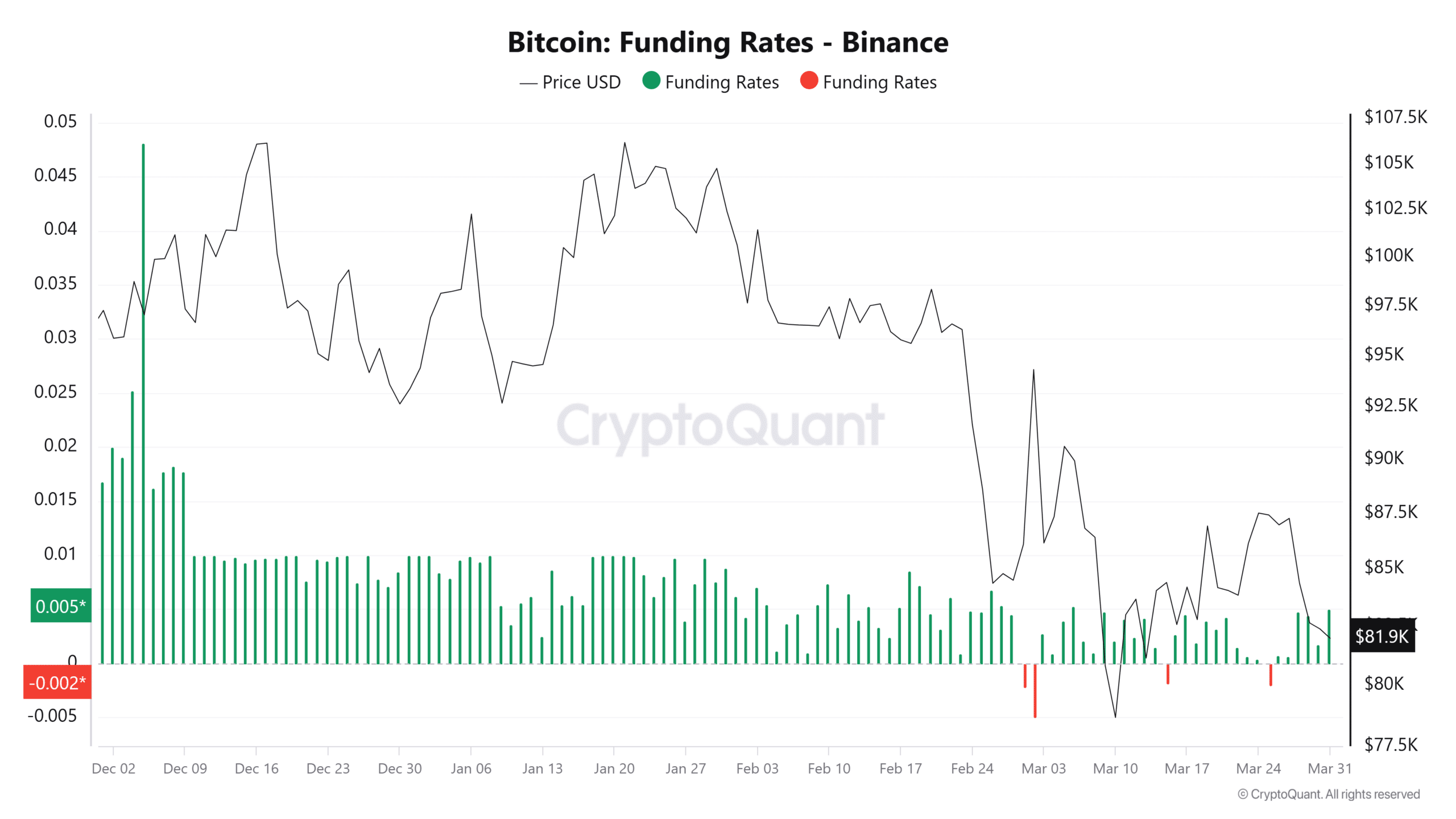

Then there is the financing percentage.

Source: Cryptuquant

Between 24-28 March, the rates were negative-somewhat short dominant sentiment. However, that turned around by March 30. Positive financing percentages now means increasing long exposure. It is an important sentiment shift. Shorts can close and lungs can start to enter again.

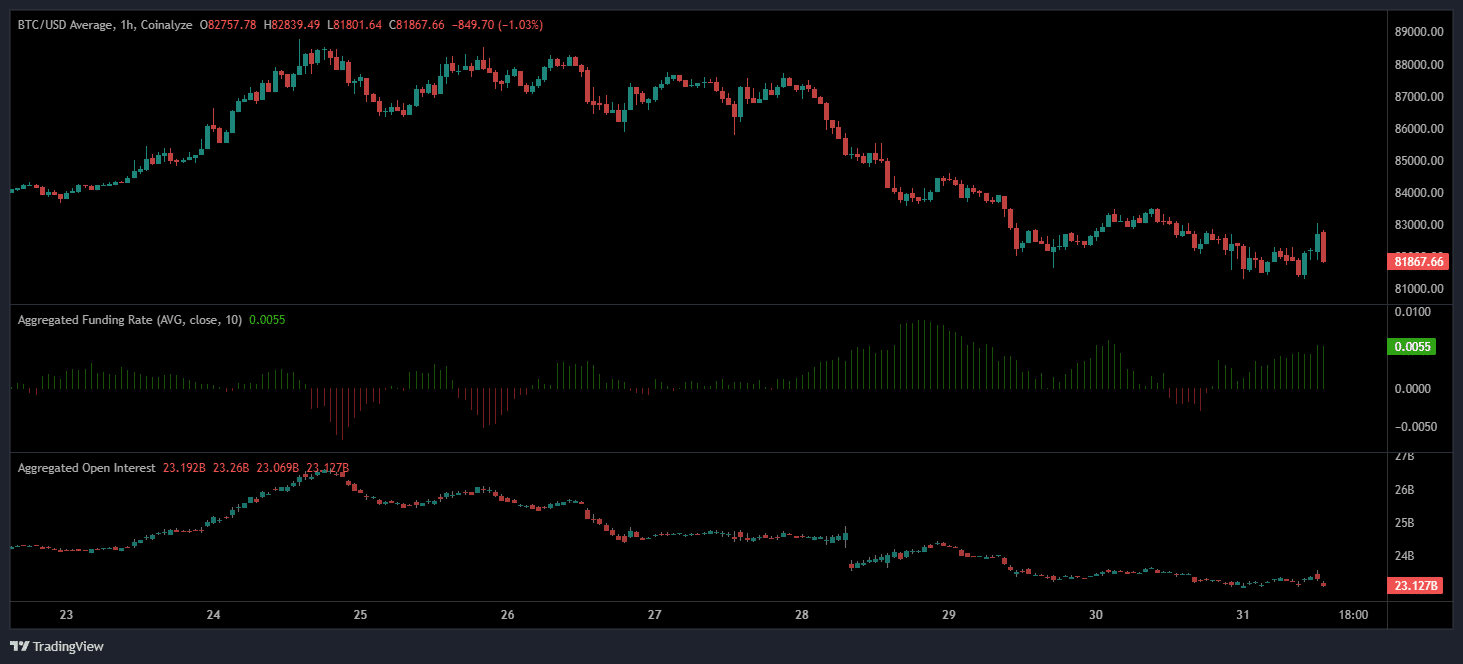

Combine this with open interest and sharpen the photo.

The calmness for the movement?

Open interest rate fell from $ 25.39 billion to $ 23.12 billion in the last week of March. The sharpest reject Came on March 28. That drop indicated large position closures or liquidations.

As the open interest rate drops and financing rises, it often marks the early stages of repositioning the market.

Source: Coinalyze

Shorts weighed heavier with 1.5-2x, so that a setup was historically linked to 60-65% upward volatility, according to the Visher. Current liquidation clusters meet that threshold, with a key resistance at $ 83,100.

A break above $ 83,100 can push Bitcoin to $ 83,500, with a low resistance that extends to $ 83,877. HeatMap data revealed minimal order friction in this range and looked like a previous short squeeze.

If Bitcoin did not know any resistance, Beerarish sentiment can return. Especially if the financing is negative or the inflow decreases. However, with compressed shorts, positive financing and aligned heat maps, the bias can lean bullish in the short term.

That is why market timing remains crucial. And the window for the top is narrowing.