- The price of Bitcoin has risen by more than 12% in the past seven days.

- Statistics suggested that BTC could turn bearish even before its ATH was retested.

Bitcoin [BTC] has finally entered the road to recovery as it has crossed the psychological resistance of $60,000. The price increase indicated a new test of the all-time high in the coming days.

However, the coin would face a roadblock immediately after its ATH as there would be a large increase in liquidations.

Bitcoin to retest its ATH?

CoinMarketCaps facts revealed that the price of BTC rose by double digits last week. To be precise, the king of cryptos witnessed a 12% price increase in the last seven days.

In the last 24 hours alone, the price of the coin has increased by more than 4%. At the time of writing, BTC was trading at $62,543.73 with a market cap of over $1.23 trillion.

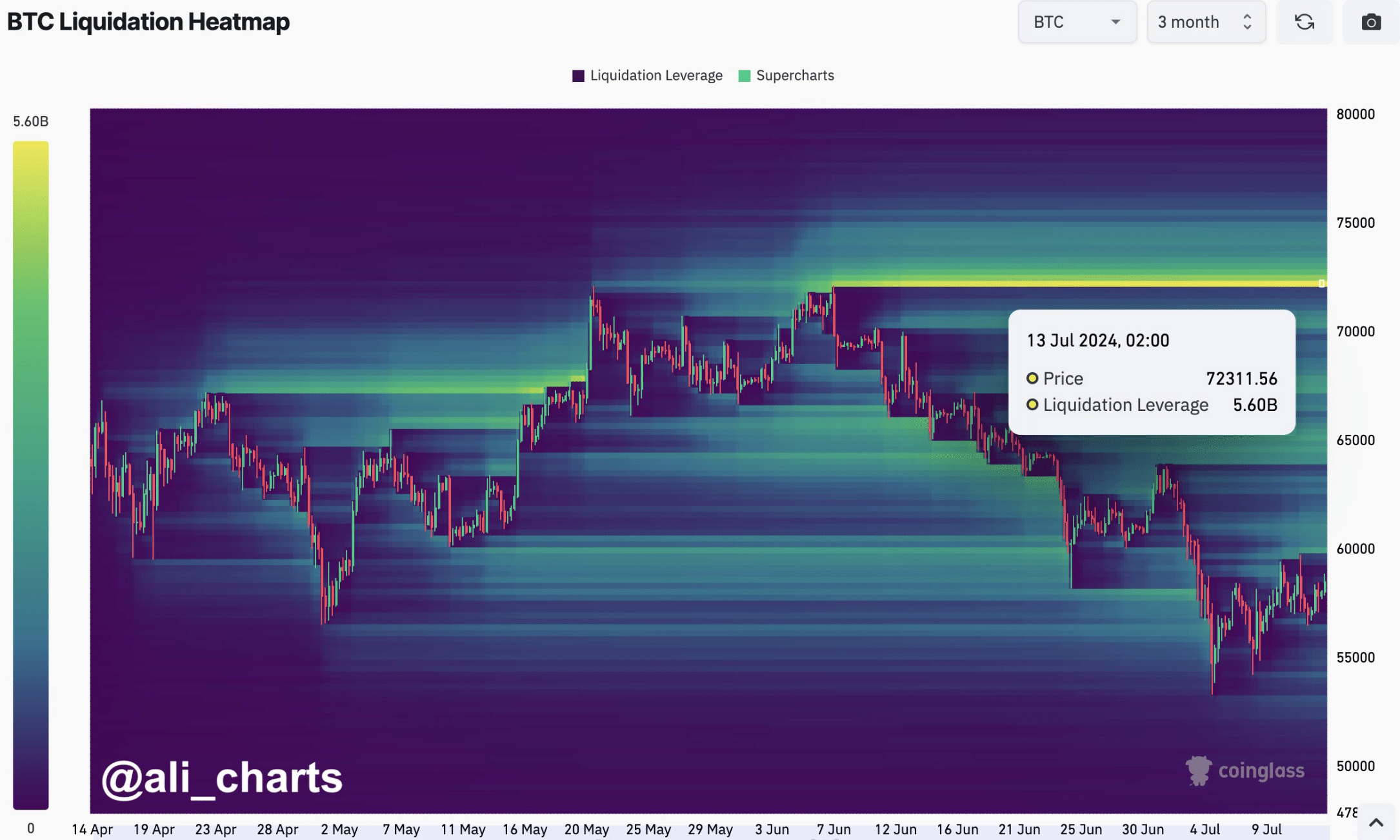

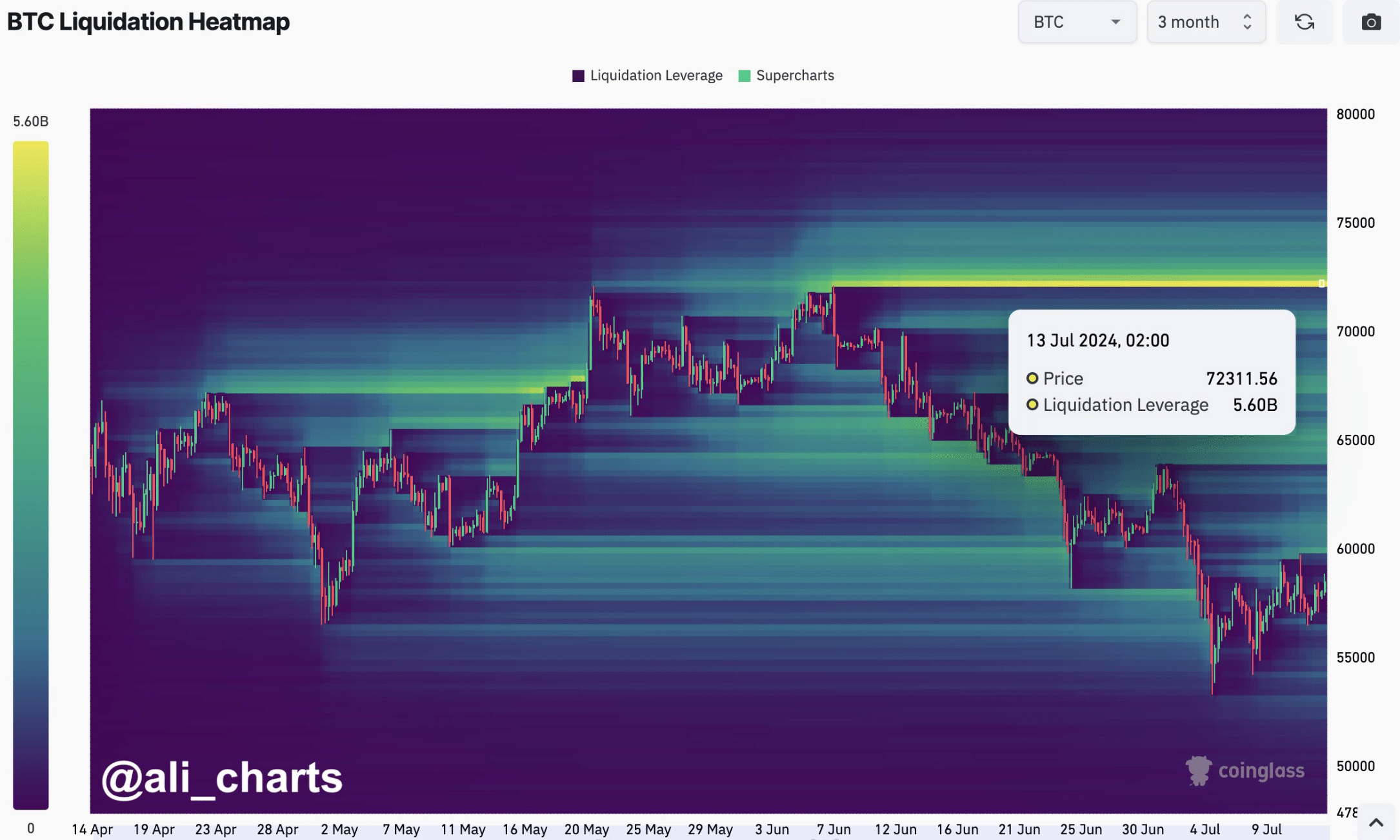

Meanwhile, Ali, a popular crypto analyst, posted one tweet point to an important development. According to the tweet, $5.60 billion in short positions will be liquidated if Bitcoin makes a U-turn to $72,300.

This suggested that the chances of BTC witnessing a price correction after reaching $72.3k were high.

When liquidation increases, it typically causes short-term price corrections. Therefore, investors may witness a slowdown or decline in BTC for a few days after it retests its all-time high in the coming weeks.

Source:

BTC’s way to $72k

Since there were chances that BTC would witness a price correction of $72,000, AMBCrypto planned to check its metrics to see if there were any other roadblocks before that point.

AMBCrypto’s analysis of CryptoQuant facts revealed that Bitcoin’s foreign exchange reserve has increased, meaning selling pressure on it increased.

The aSORP was red. This clearly suggested that more investors were selling at a profit. In the middle of a bull market, this could indicate a market top.

Additionally, the NULP revealed that investors were in a faith phase where they were currently in a state of high unrealized gains.

At the time of writing, BTC’s fear and greed index stood at 69%, indicating that the market was in a “fear phase.” When the metric reaches that level, it indicates a possible price correction.

Source: CFGI.io

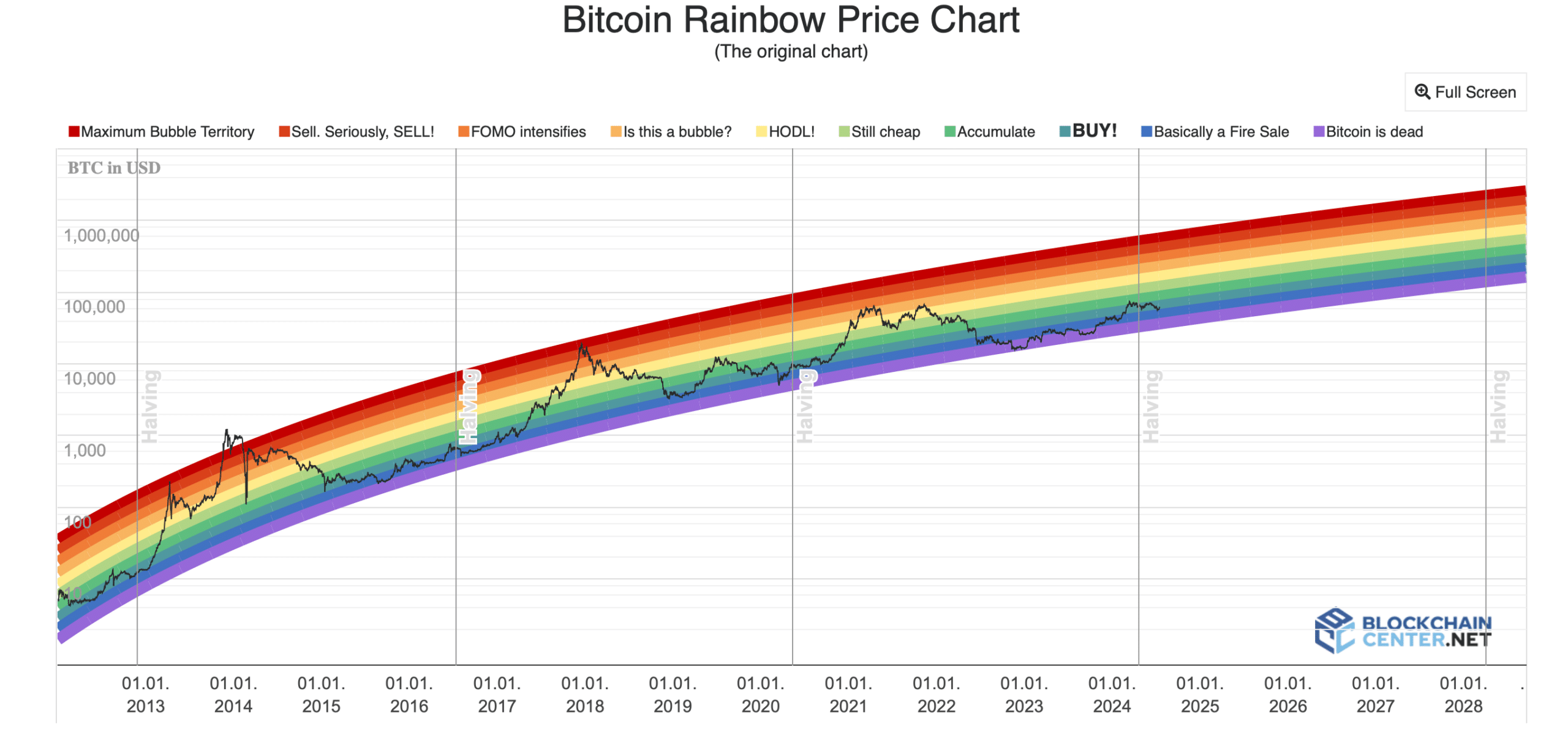

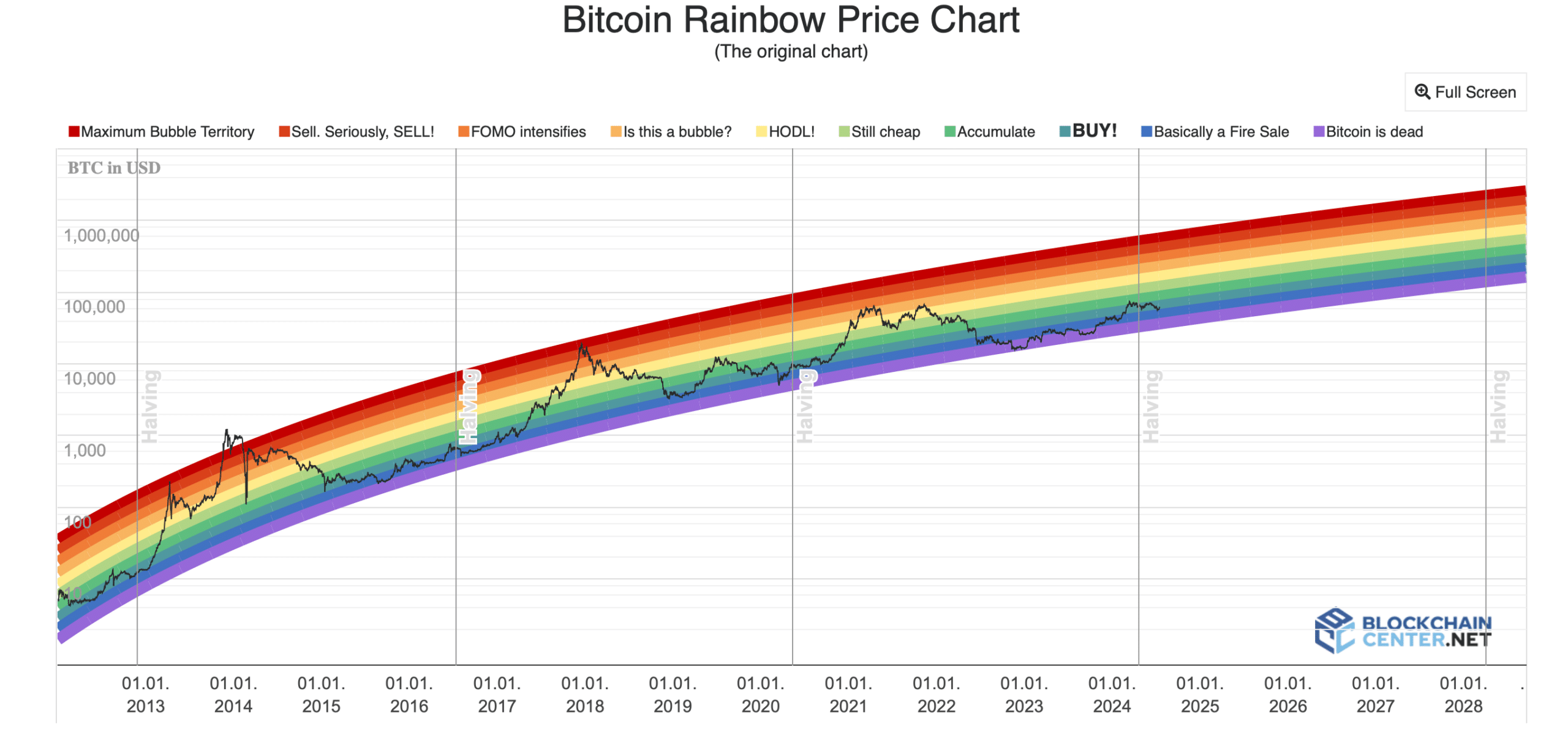

However, Bitcoin’s Rainbow Chart marked a buy signal. According to the metric, BTC was in the “BUY” phase, meaning there was still time for investors to accumulate BTC before it reaches new highs.

Source: Blockchaincenter

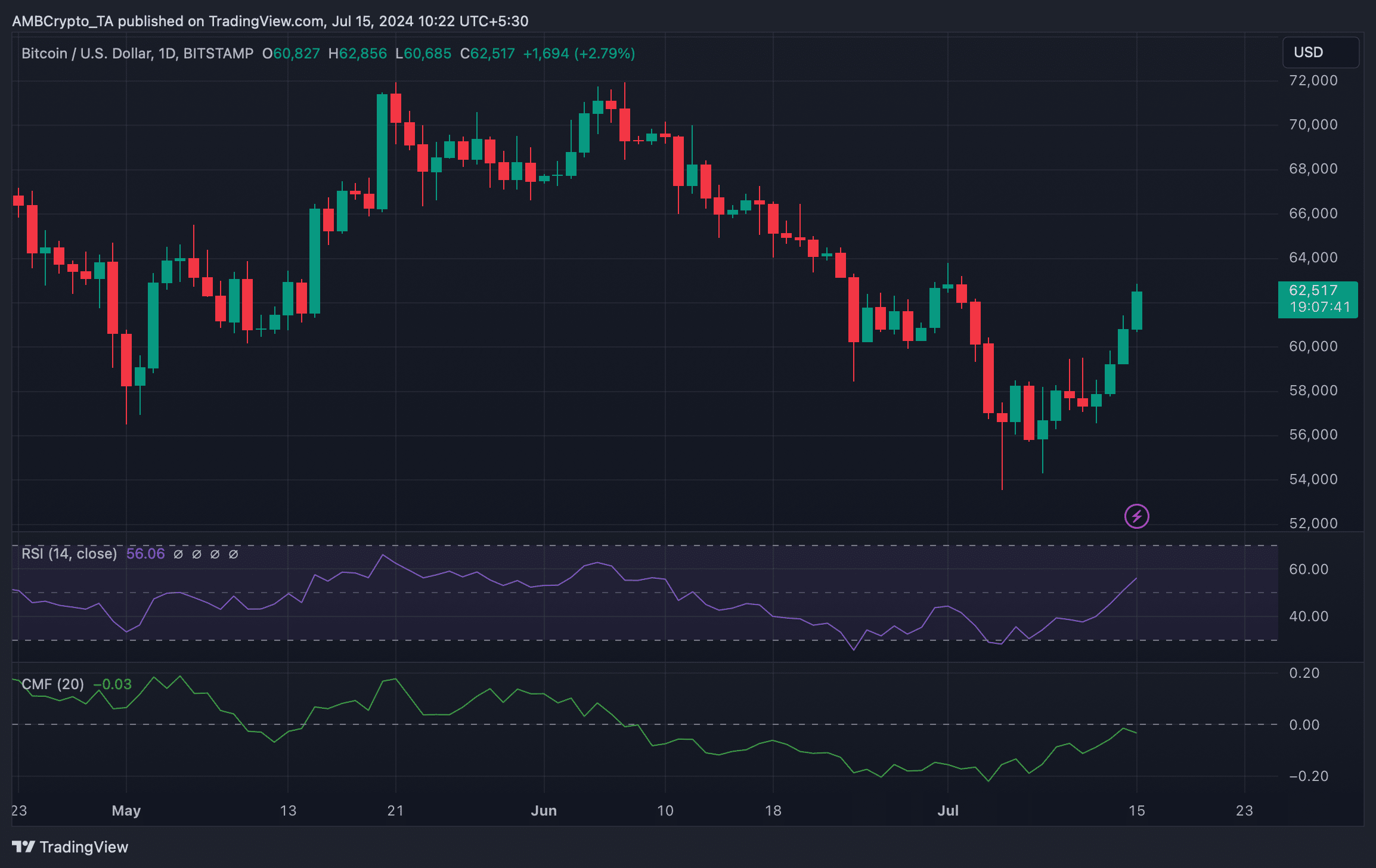

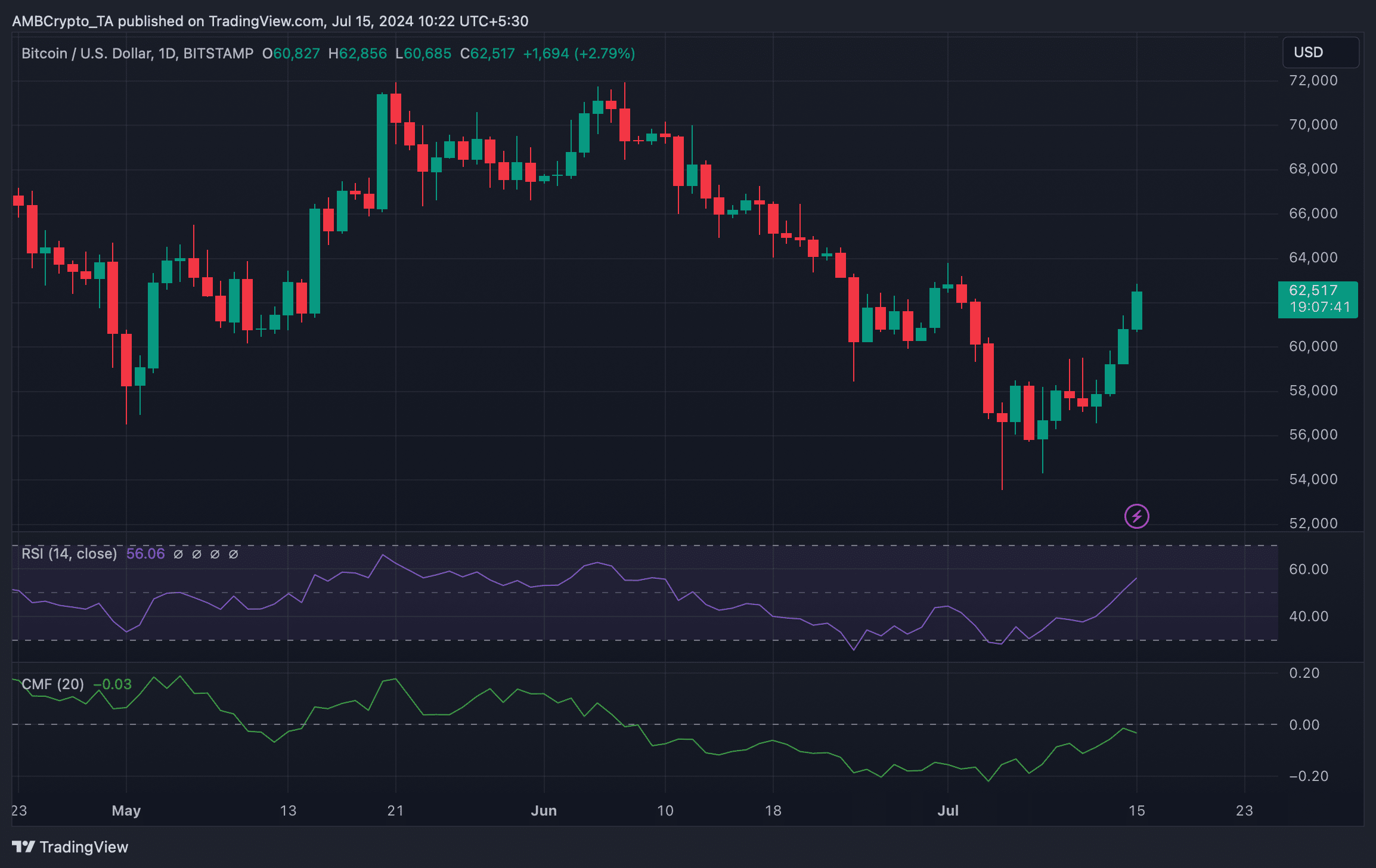

Next, we planned to look at the coin’s daily chart to better understand whether it was expecting a correction before restarting its journey to $72,000.

Read Bitcoin (BTC) price prediction 2024-25

We found that the Chaikin Money Flow (CMF) recorded a decline, indicating a price correction.

Nevertheless, the Relative Strength Index (RSI) remained bullish as it moved further north from the neutral point.

Source: TradingView