- Bitcoin acted at the low end of the historical seasonal range.

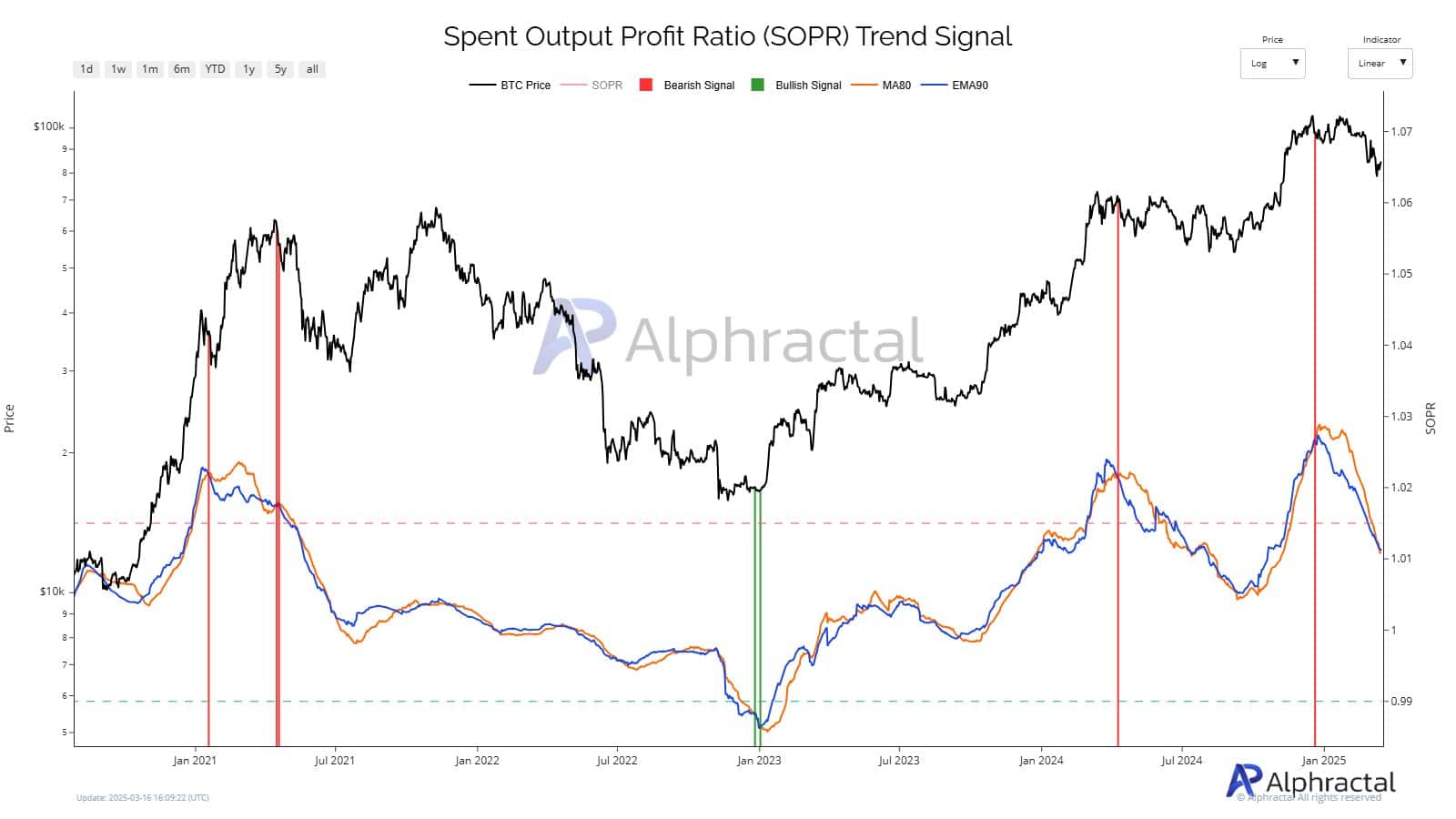

- Bitcoin Bulls defended the crucial weekly MA50 at $ 75.8k, because the Soprend trend indicated a long period of consolidation.

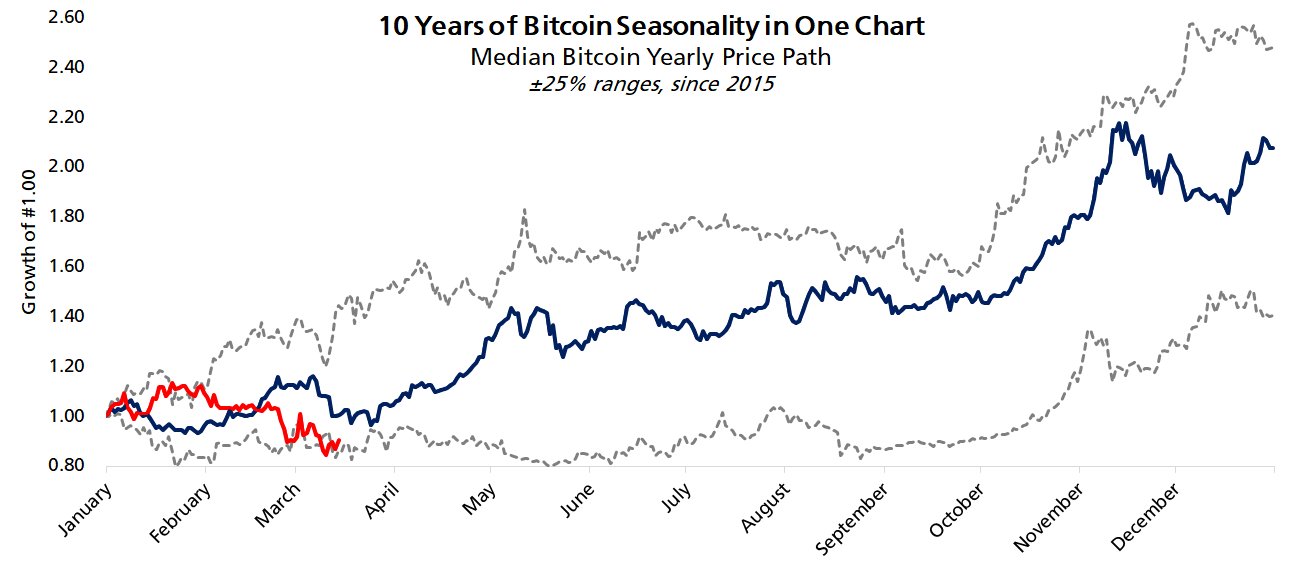

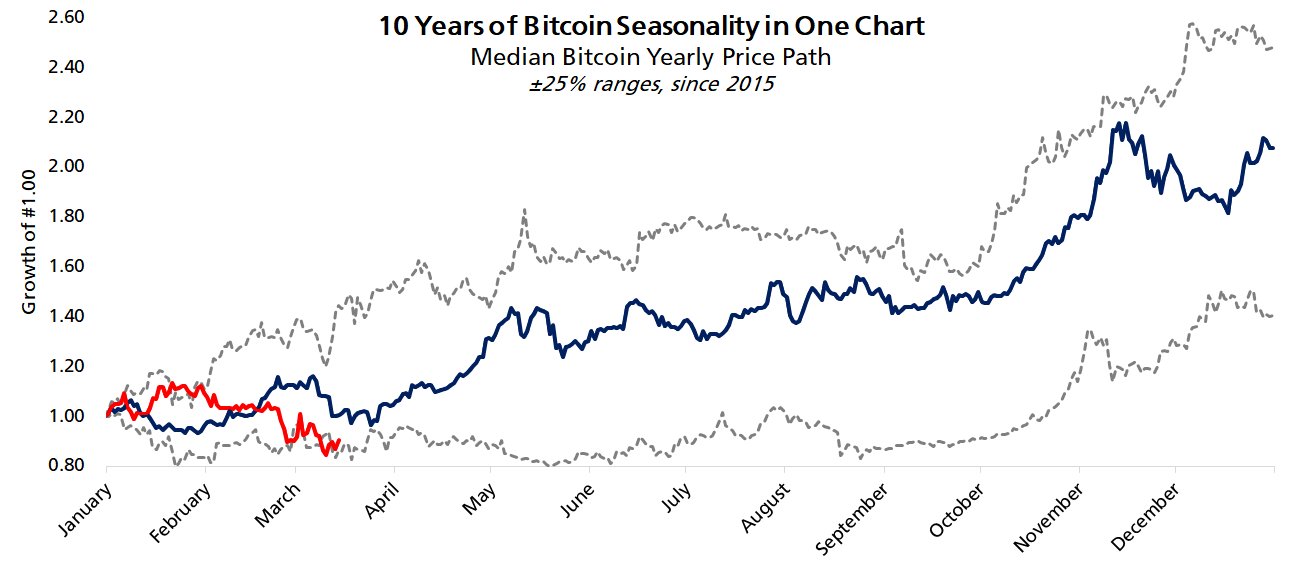

Analysis of Bitcoin [BTC] Since 2015, the cryptocurrency reached the most affordable price period, as indicated in the “10 years Bitcoin -Seisensbondheid in one graph. “

Historical data confirmed that BTC maintained the shortest growth range between 0.80 and 1.00 in January and February, precisely correlating with the current position.

Bitcoin showed his largest annual price changes during the time span from April to October, because these months created all changes in the market value.

From April the growth pattern continued to stabilize until October, where it continued its regular upward expansion of 1.40 to increase the price to 1.60.

Source: X

The current data suggests that Bitcoin could surpass his previous time by June 2025. The expected growth can achieve 2.00 or higher, with expected price levels between 2.20 and 2.60 from the end of 2024 to the beginning of 2025.

This projection is based on historical trends, where the seasonal increase in April and the momentum of October have often fueled considerable profit.

After June, the price of Bitcoin can stay under 1.20, unless April sees its usual upward trend, the weakness of the dollar stabilizes whether the investor interest rate increases.

Why a new ATC for BTC is possible for June

This new expected Bitcoin ATH can be supported by the fact that BTC bulls protect the essential 50 weekly advancing average (MA50) by keeping $ 75.8k. Currently the price floats around $ 83.1k, just above the MA50.

Source: TradingView

The first level of support has traditionally served as a rebound zone. Bitcoin, for example, rose from $ 67k in July 2024 to $ 83k in December, demonstrating a sustainable positive market movement.

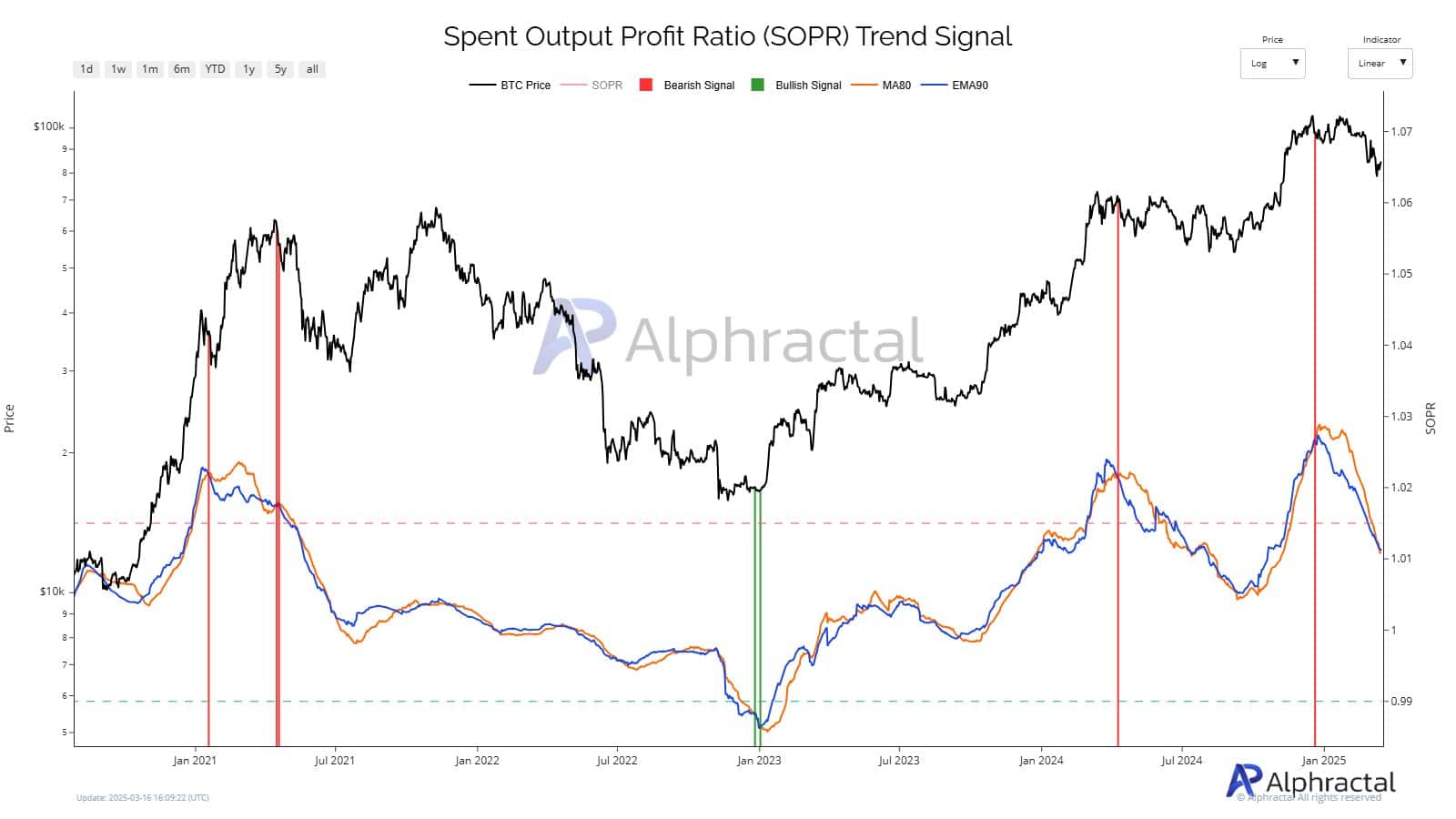

Further analysis of the trend signal for Best Output Profit Ratio (Sopr) suggests that Bitcoin could retain extensive stability. A decrease in SOPR from 1.07 to 1.00 in January 2025 indicates that buyers have stopped the profit increase.

Historically, when SOPR often reached around 1.00 as in mid-2023-the market often experienced the price increases. This pattern suggests that Bitcoin could possibly reach a new all time by June.

Source: Alfractaal

In addition, analyst Avocado reported that from March 2025 the financing percentages held a negative position of -0.02 because BTC traded around $ 83.6k.

In June 2024, a negative financing percentage of -0.02 led to a price increase, which pushes Bitcoin from $ 50k to $ 70k. A similar financing movement may stimulate the price of BTC above $ 100k.

However, if a long -term negative financing percentage coincides with a failure of the MA50 support, the price of BTC can fall to $ 70k. This scenario can also delay achieving a new of all time of all time.