- BTC LTHs are torn between selling and holding amid price volatility.

- Bitcoin remained below $60,000 at the time of writing.

Bitcoin’s Recent Rise [BTC] The volatility is evident as the price struggles to maintain the crucial $60,000 range.

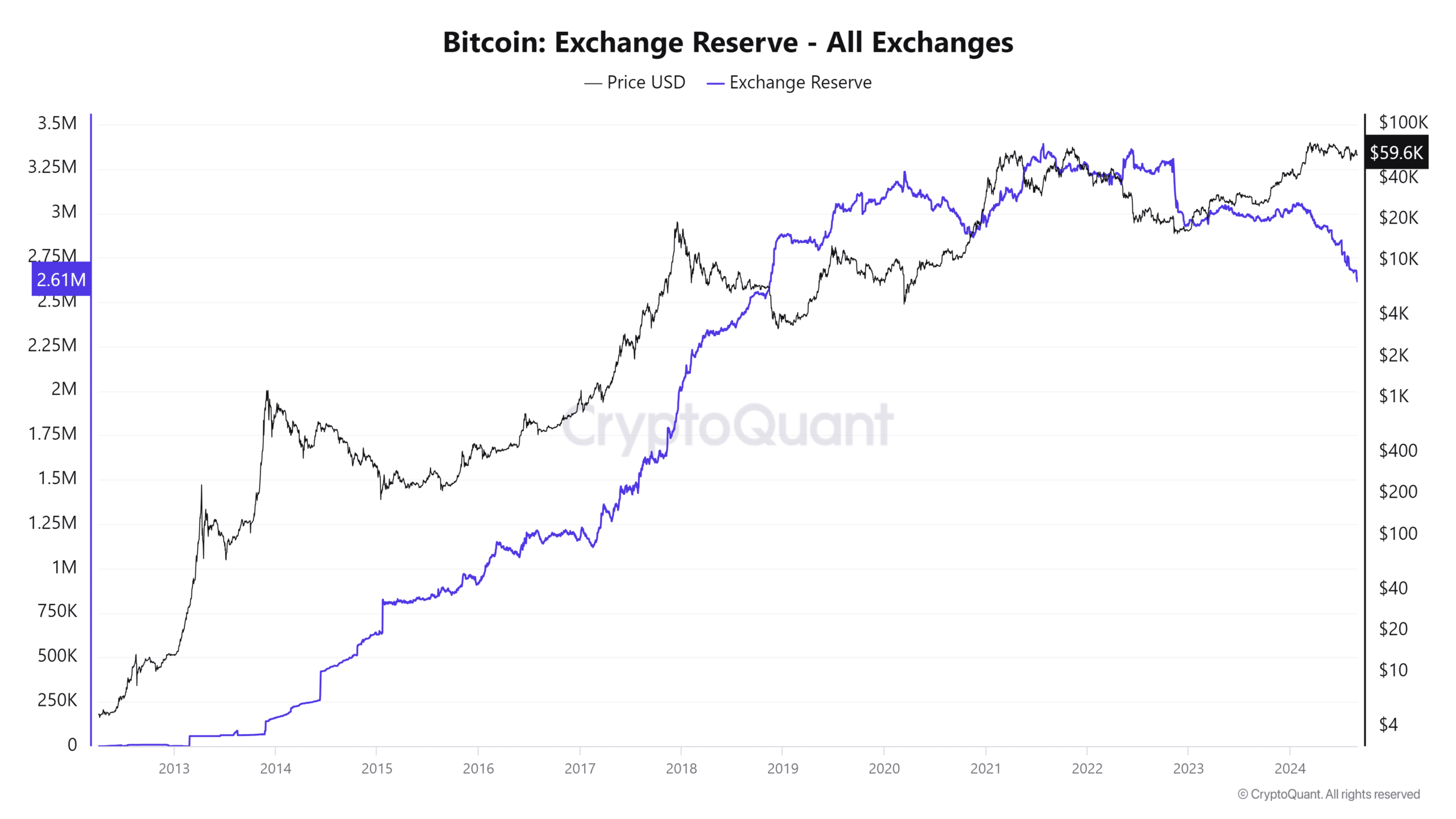

Despite these price fluctuations, a notable trend has emerged: Bitcoin exchange reserves have declined. This decline in foreign exchange reserves indicates that large holders, often referred to as “whales,” are increasingly unwilling to sell their Bitcoin.

Bitcoin exchange reserves hit another low

AMBCrypto’s analysis of Bitcoin’s foreign exchange reserves revealed that they have bottomed out again, continuing a significant downward trend that started early this year.

According to the graph on CryptoQuantreserves have fallen to approximately 2.6 million BTC. This was less than the more than 3 million BTC reserves recorded in January.

Moreover, this decline in foreign exchange reserves indicates a reduction in the liquidity available on the stock exchanges.

This reduction in liquidity could be a positive sign for Bitcoin’s price, as it indicates that fewer holders are looking to sell their BTC. The measure reduces selling pressure on the market.

Source: CryptoQuant

Moreover, the continued decline in foreign exchange reserves is likely driven by long-term holders (HODLers). This behavior reflects a strong belief in the future value of Bitcoin and an unwillingness to engage in short-term trading.

As the dominance of long-term holders increases, the market may become more stable and less prone to major panic selling.

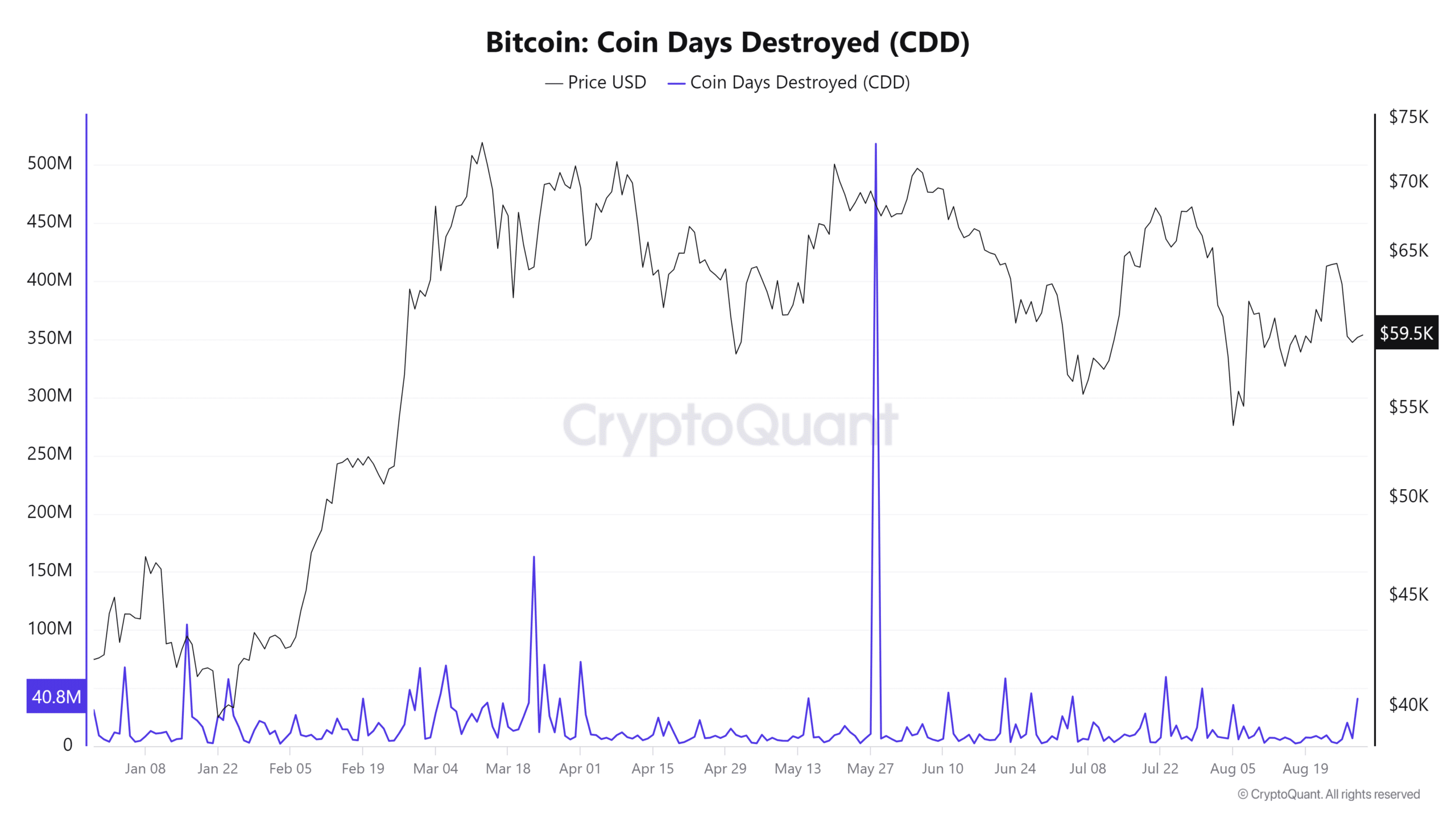

Comparing CDD to Bitcoin Exchange Reserves

The recent analysis of Bitcoin’s Coin Day Destroyed (CDD) metric alongside Bitcoin exchange reserves suggests an interesting difference. The CDD metric has seen a slight spike recently.

This contrasted with the previously stable trend that indicated long-term holders (LTHs) were not actively spending their coins.

The CDD metric tracks the movement of older Bitcoins that have accumulated “mint days” while remaining unspent. Each Bitcoin earns a ‘coin day’ for every day it is held in a wallet without being moved.

When these Bitcoins are eventually spent, the accumulated coin days are ‘destroyed’, hence the term ‘Coin Day Destroyed’.

Source: CryptoQuant

The recent rise in the CDD suggests that the recent volatility in Bitcoin’s price may have caused some long-term holders to move or sell their coins, breaking the previous holding trend.

This shift could be a response to market uncertainty or a strategic decision by some holders to profit from price movements.

BTC remains volatile

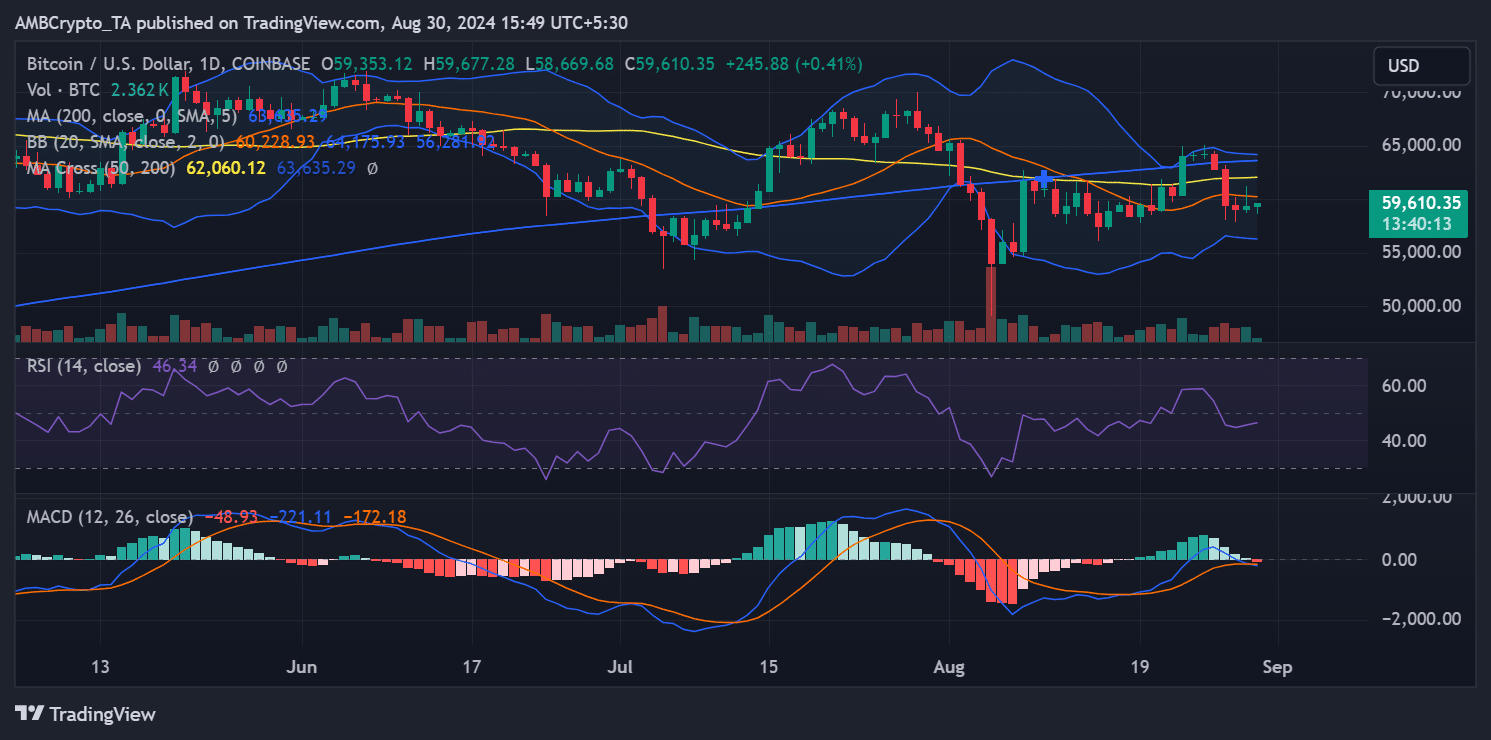

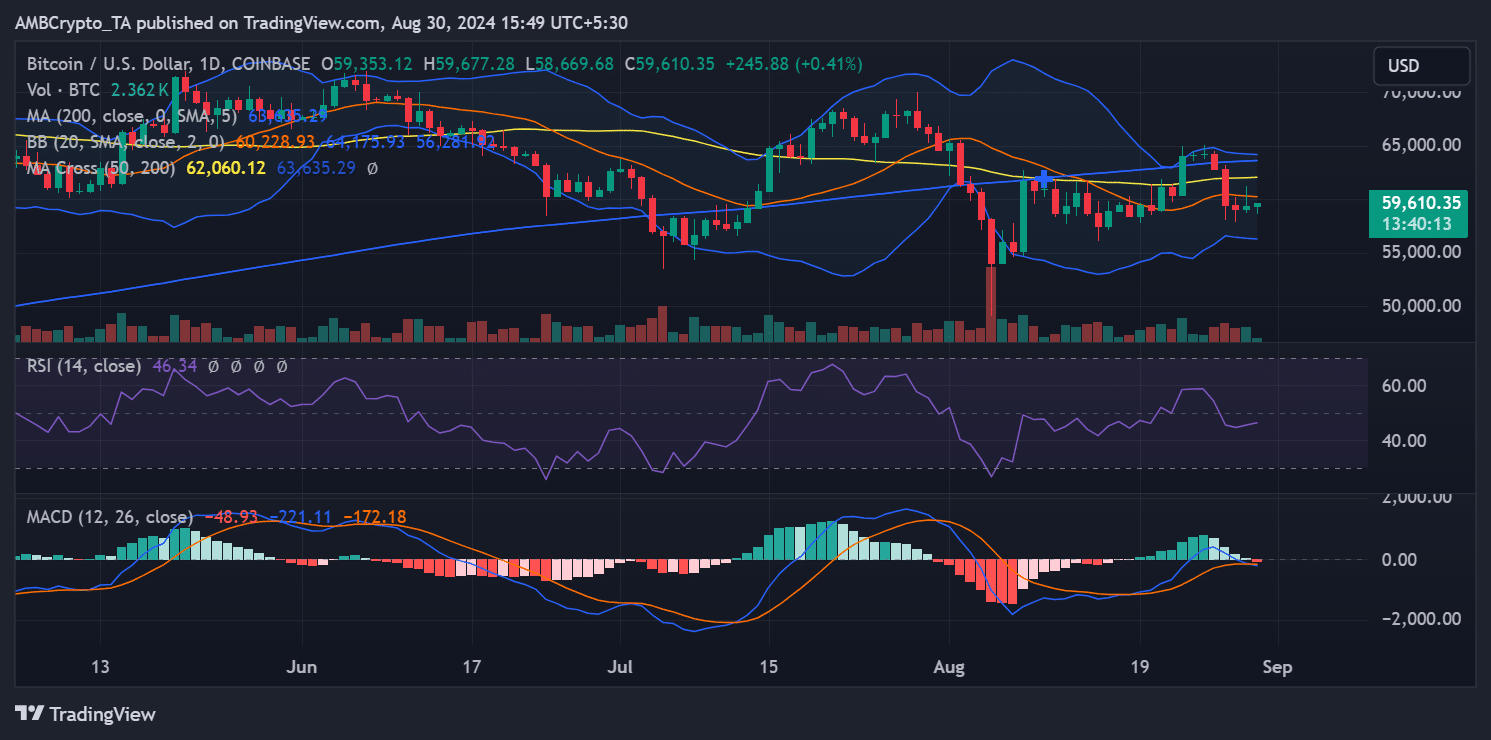

The recent analysis of Bitcoin’s daily price trend shows that Bitcoin rose to around $61,000 during the previous trading session. However, it could not hold this level and eventually closed the session at around $59,264.

This pattern of briefly reaching higher prices before retreating has been a consistent trend for Bitcoin in recent days, contributing to increased market volatility.

Source: TradingView

The extent of this volatility is further illustrated by the behavior of Bitcoin’s Bollinger Bands, a technical indicator that measures price volatility.

Read Bitcoin’s [BTC] Price forecast 2024-25

The ‘elasticity’ of the Bollinger Bands refers to their widening in response to increased price fluctuations. When the bands widen, it means higher volatility as the price moves more dramatically in either direction.

At the time of writing, Bitcoin is trading around $59,597, up slightly under 1%. The continued volatility, as evidenced by the Bollinger Bands, suggests that Bitcoin is experiencing significant short-term price fluctuations.