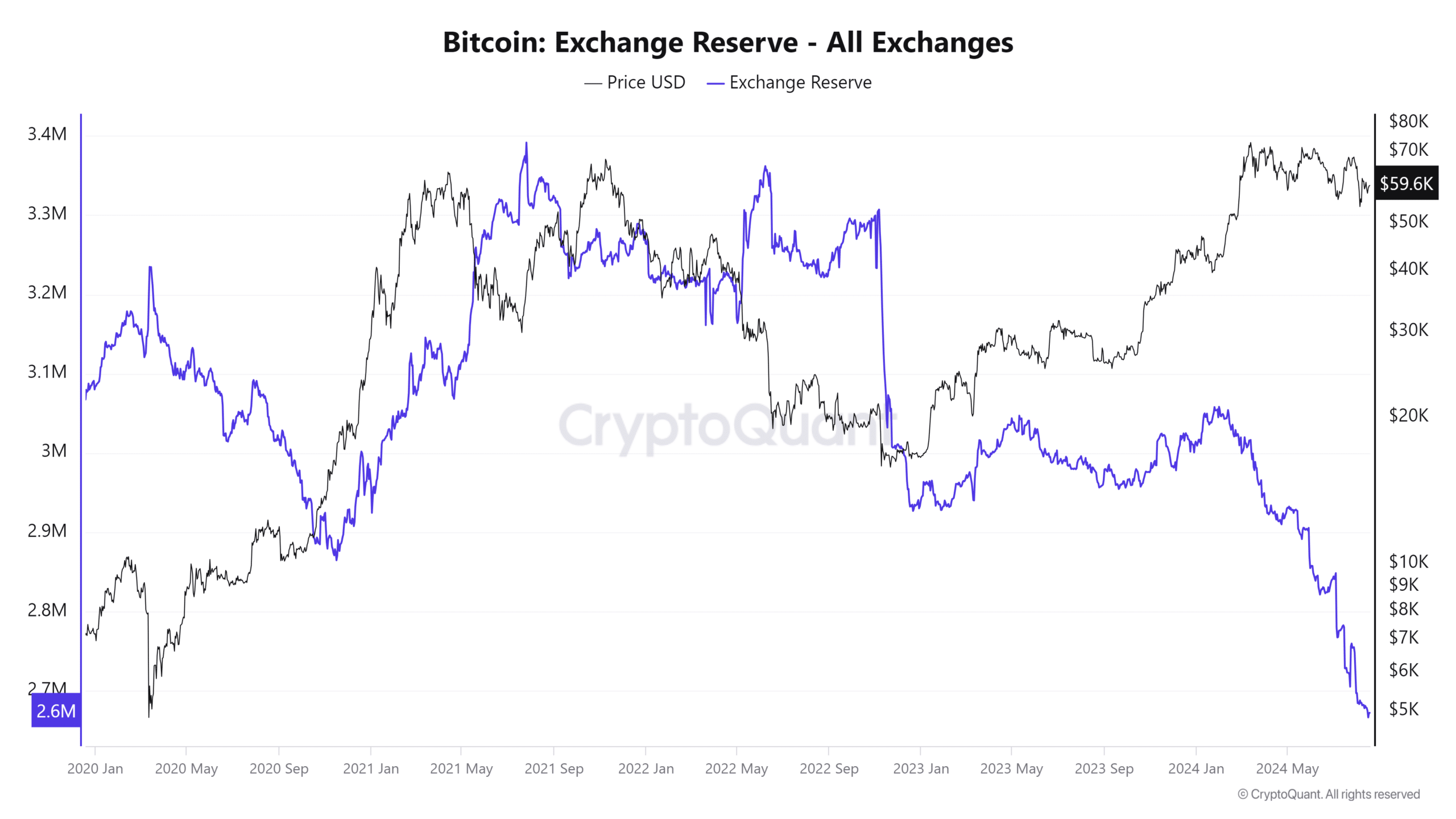

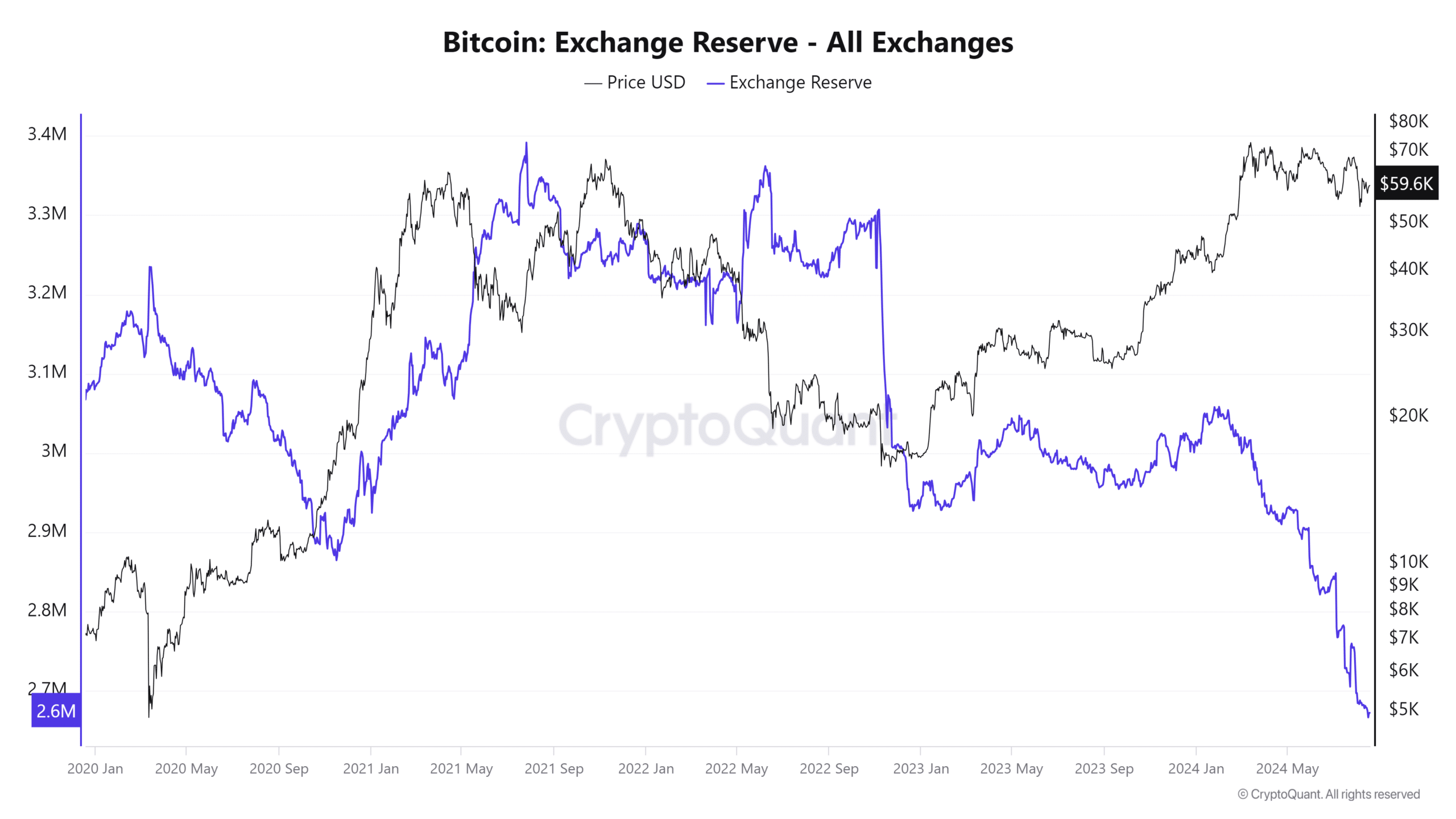

- The BTC exchange reserve dropped to approximately 2.6 million.

- This is the lowest level in more than four years.

Bitcoins [BTC] The exchange rate reserve recently fell to its lowest level in years, a significant development that comes at a time when BTC’s price is struggling to gain upward momentum.

While the current price action may seem worrying, this decline in foreign exchange reserves could be a positive signal for Bitcoin’s future price.

Bitcoin exchange reserves are falling

AMBCrypto’s analysis of Bitcoin’s foreign exchange reserves on CryptoQuant showed important developments, with reserves falling to the lowest level since 2020.

The chart indicated that Bitcoin reserves on the exchanges have fallen from over 3.2 million BTC at the beginning of 2020 to around 2.6 million BTC.

Exchange reserves represent the amount of Bitcoin held on exchanges and available for immediate trading.

When reserves are high, it indicates greater supply on the exchanges, which can lead to increased selling pressure and possibly lower prices.

Conversely, as reserves decrease, the supply available for trading decreases, which can support price increases due to reduced selling pressure.

Source: CryptoQuant

The continued decline in foreign exchange reserves likely indicates that investors are withdrawing their Bitcoin from exchanges to store it in private wallets.

This shift could lead to lower selling pressure on the market, creating a favorable environment for price increases.

Strikingly, the graph shows a sharp decline in foreign exchange reserves around the end of 2022 and mid-2023, coinciding with the rise in the price of Bitcoin.

This pattern supports the idea that lower foreign exchange reserves contribute to bullish price action. Reduced availability on exchanges can drive up prices if demand remains stable or increases.

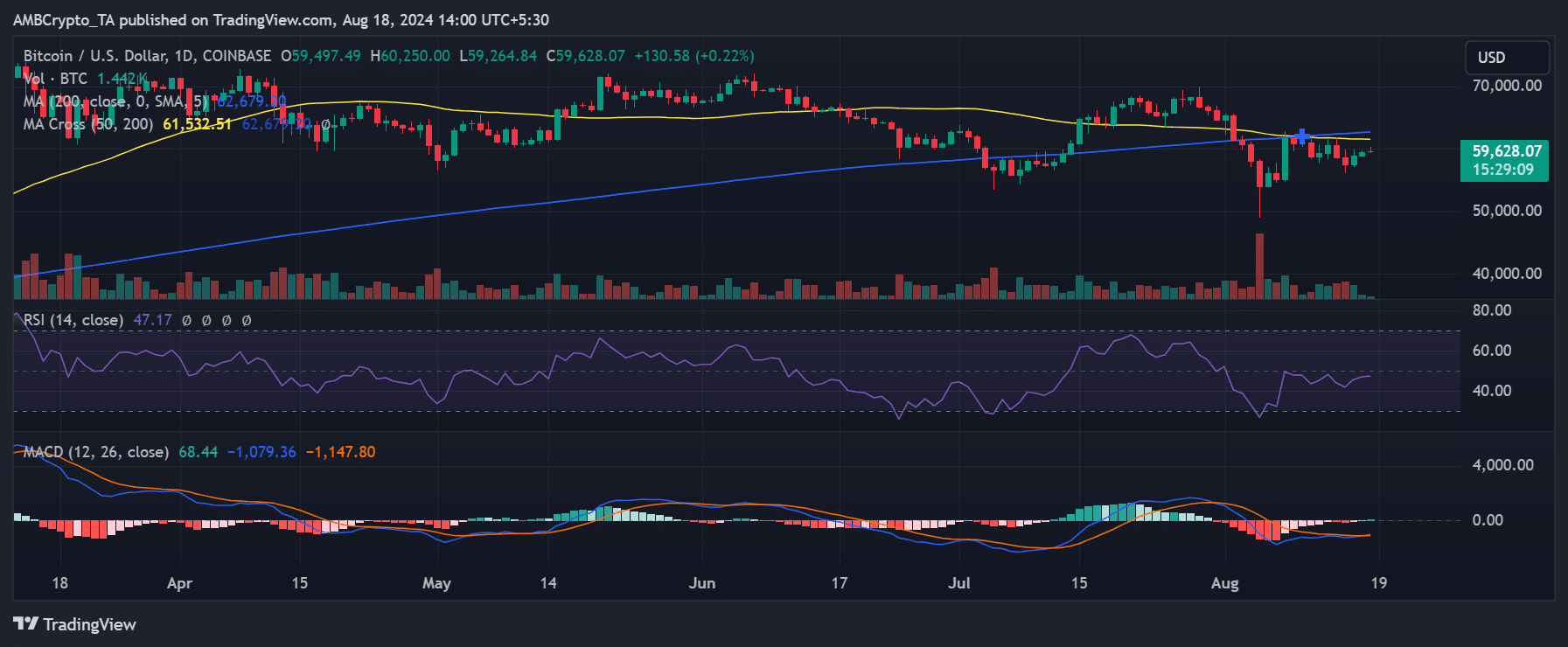

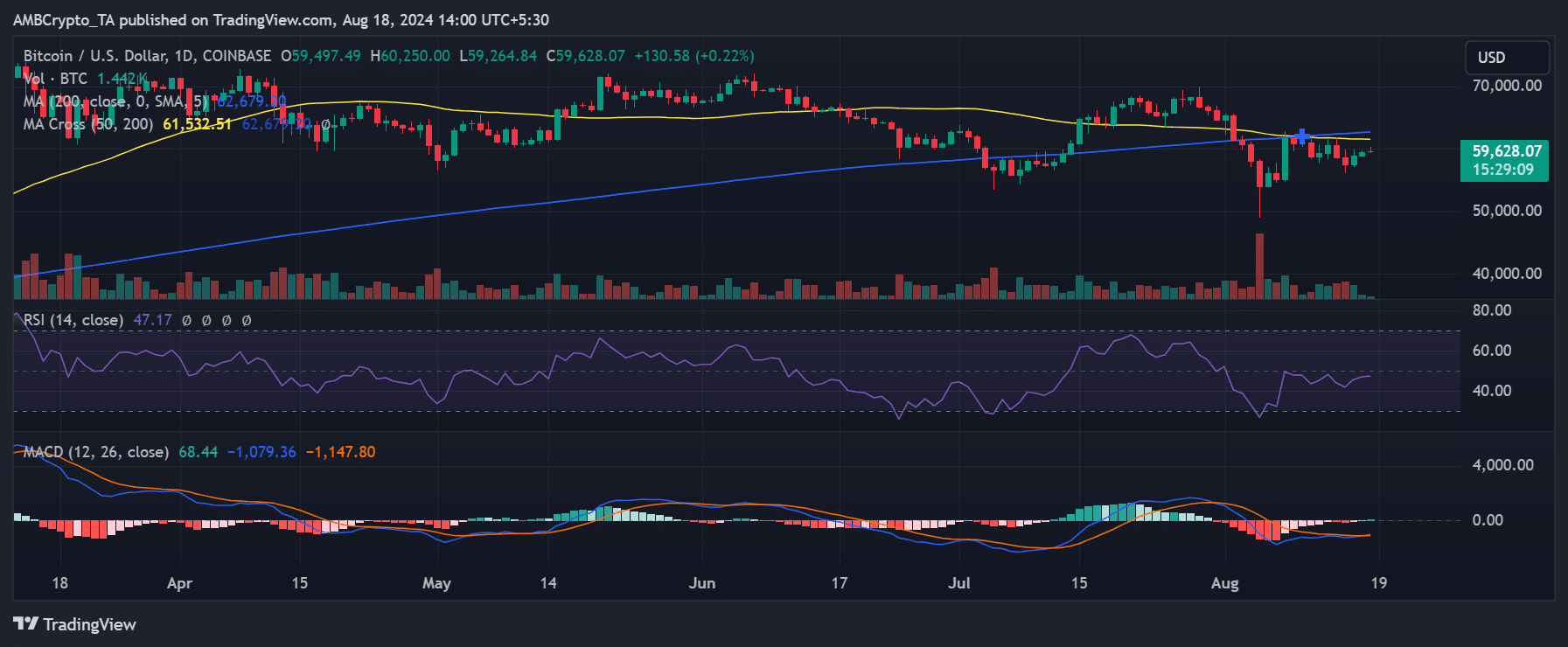

The current price development

According to AMBCrypto’s analysis, Bitcoin was trading at around $59,628.07 at the time of writing, showing a slight increase of over 0.22%.

However, it faced significant resistance at the $61,532.51 and $62,679.20 price levels, marked by the long and short moving averages (blue and yellow lines).

Source: TradingView

The Relative Strength Index (RSI) stood at 47.17, slightly below the neutral 50 level, indicating mild bearish momentum in the market.

Although the Moving Average Convergence Divergence (MACD) was positive at 68.44, the signal line remained negative at -1,147.80.

The MACD histogram indicated waning bearish momentum, but has not yet strengthened enough to indicate a bullish reversal.

How the reserve trend could affect BTC

Despite the current bearish indicators on the Bitcoin chart, the continued decline in foreign exchange reserves suggested that a different story could be unfolding.

Market participants moved their Bitcoin off exchanges, possibly for long-term holdings, which could reduce selling pressure and provide underlying support for the price.

If this trend of declining foreign exchange reserves continues, it could counterbalance the bearish technical situation.

Although technical indicators currently point to weakness, the reduced availability of BTC on exchanges could stabilize the price or even contribute to a gradual increase due to scarcity.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, if Bitcoin’s price continues to struggle below these moving averages and the RSI weakens further, there may still be room for a deeper decline before meaningful support is found.

While dwindling foreign exchange reserves may limit the severity of a potential sell-off, they may not prevent it entirely.