- Bitcoin exchange reserves fell to a five-year low, signaling a possible bullish rally.

- The majority of Bitcoin holders enjoyed the gains, adding to the positive sentiment in the market.

Bitcoin [BTC] remained in the news as it continued to show bullish momentum throughout the week.

The crypto market has witnessed a significant shift as BTC broke out of a crisis bullish flag pattern recently, raising hopes for further price growth.

From falling foreign exchange reserves to rising profits for holders, this is why the market is buzzing with optimism.

Bitcoin exchange reserves are plummeting

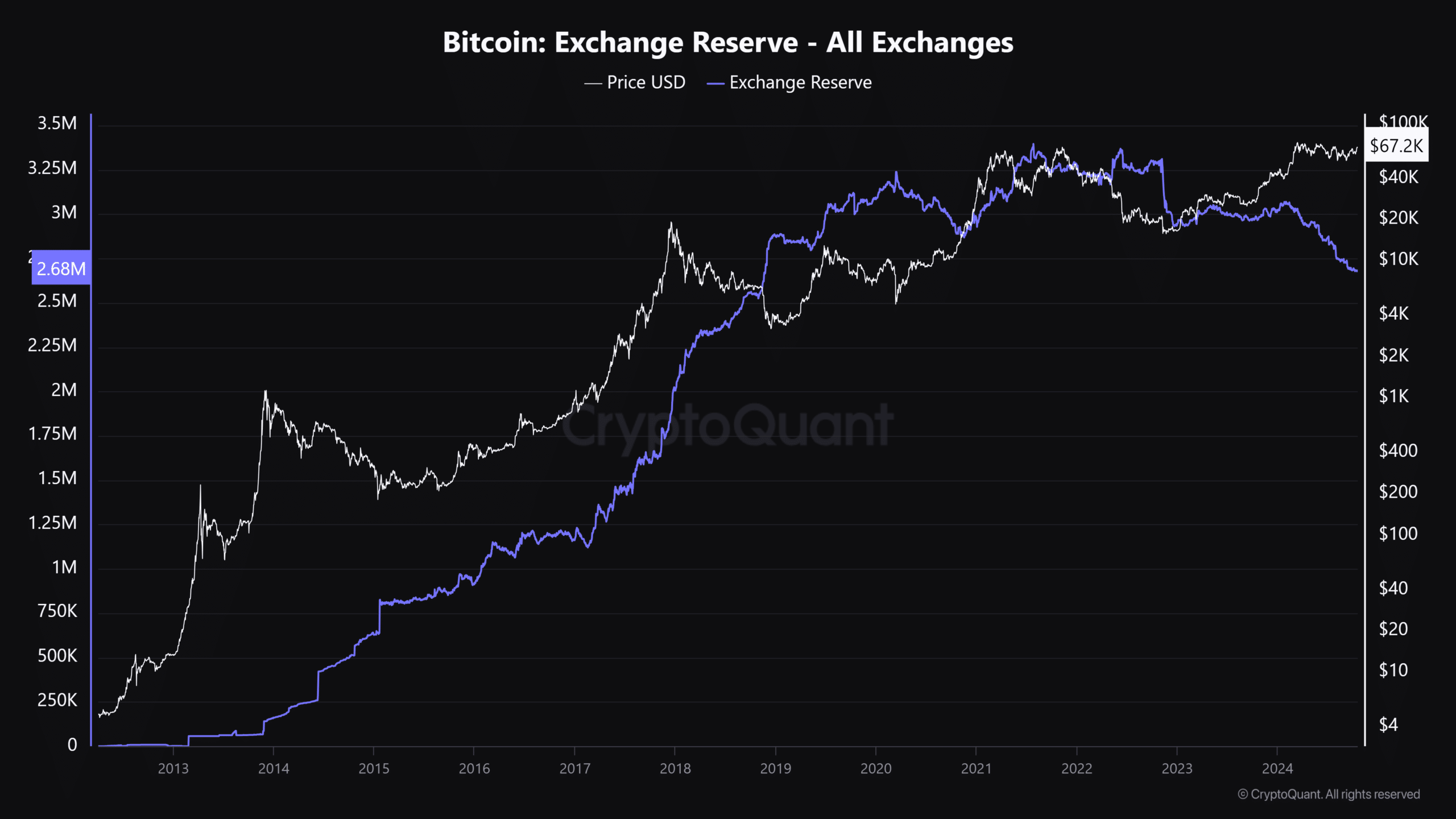

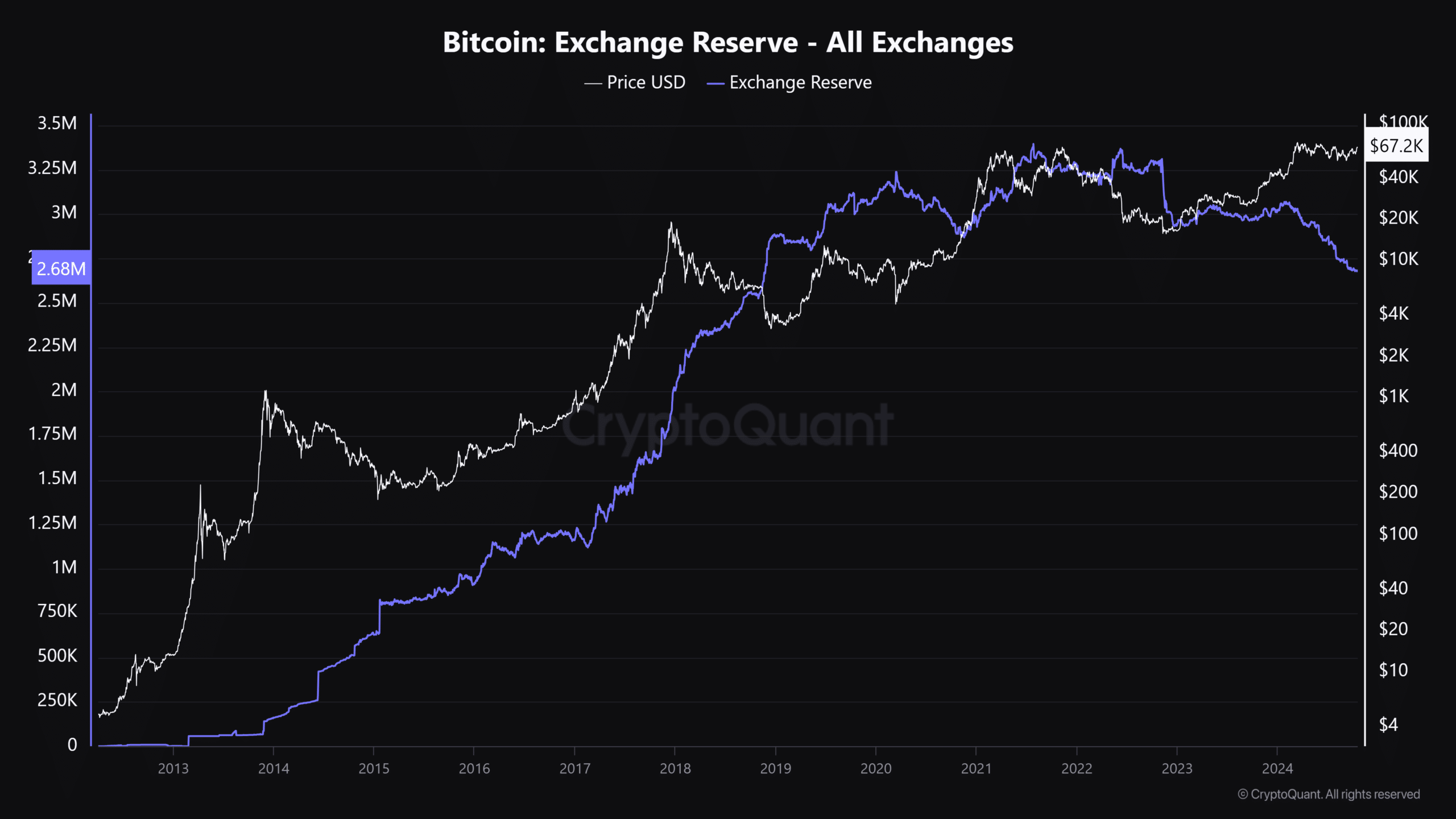

According to data from CryptoQuant, BTC reserves on exchanges have fallen to the lowest level since 2017. Historically, plummeting foreign exchange reserves have indicated increasing buying pressure.

For Bitcoin, given the current price rally, sentiment could point to a further price rally following the inflows.

Low reserves mean there is less BTC available for immediate liquidation, which could fuel price increases in the coming days.

Source: CryptoQuant

Net unrealized profit spikes

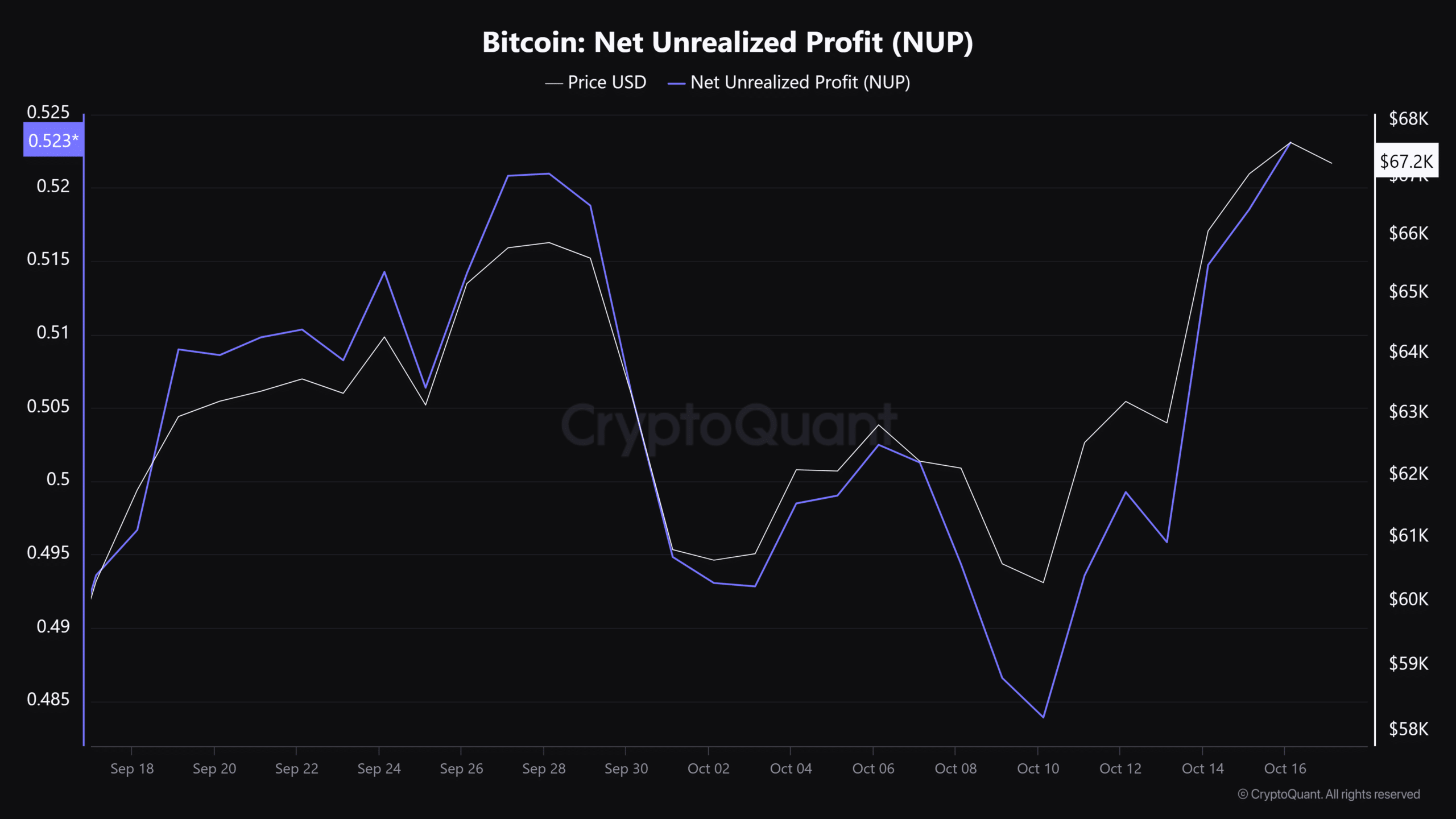

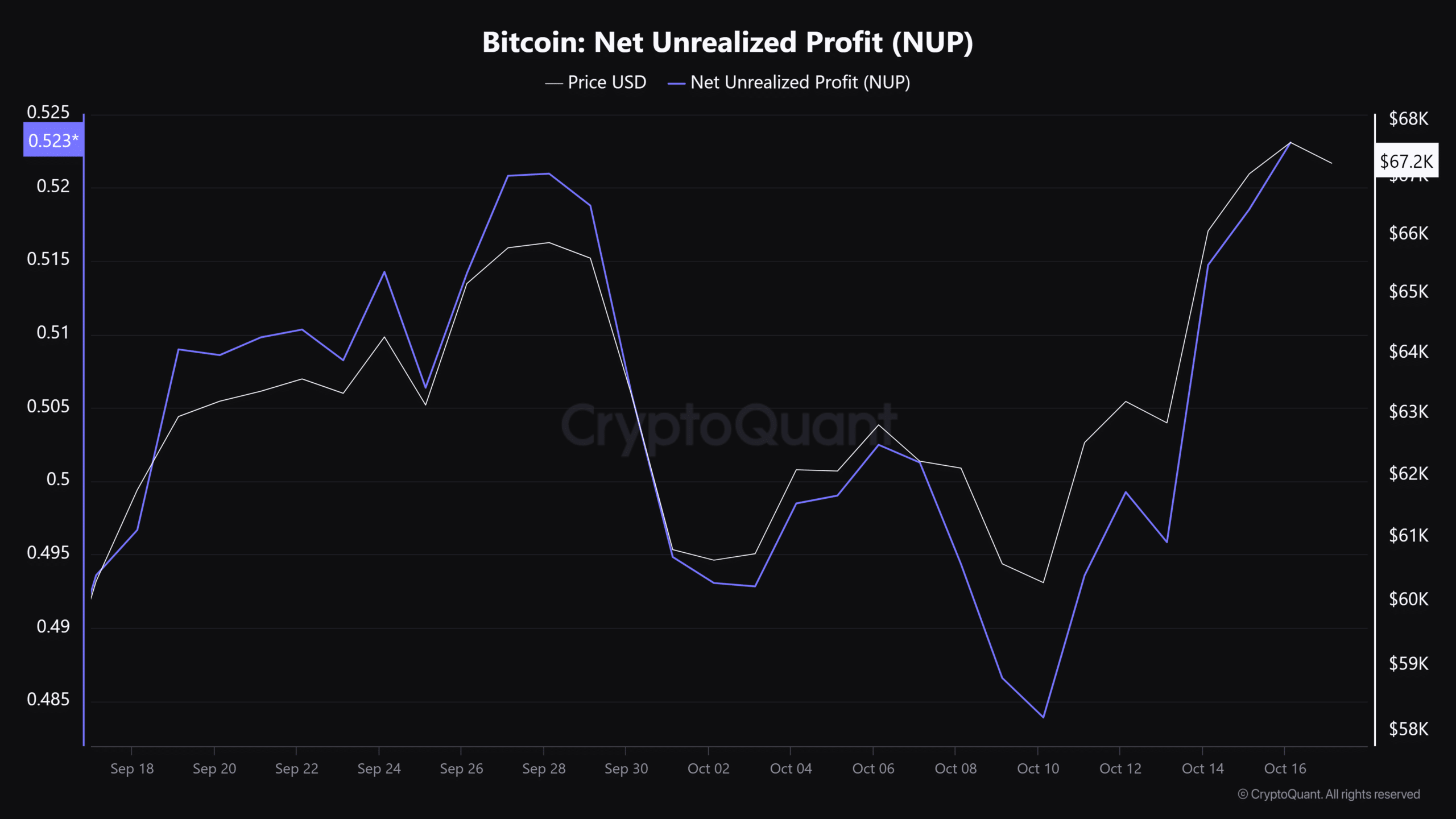

Over the past 24 hours, Bitcoin’s net unrealized gains have gone through the roof, indicating that a large portion of BTC holders are sitting on unrealized gains.

This reflected rising confidence in the market, with more holders holding on to their gains – a snowball effect of reduced selling pressure and growing bullish sentiment for Bitcoin.

Source: CryptoQuant

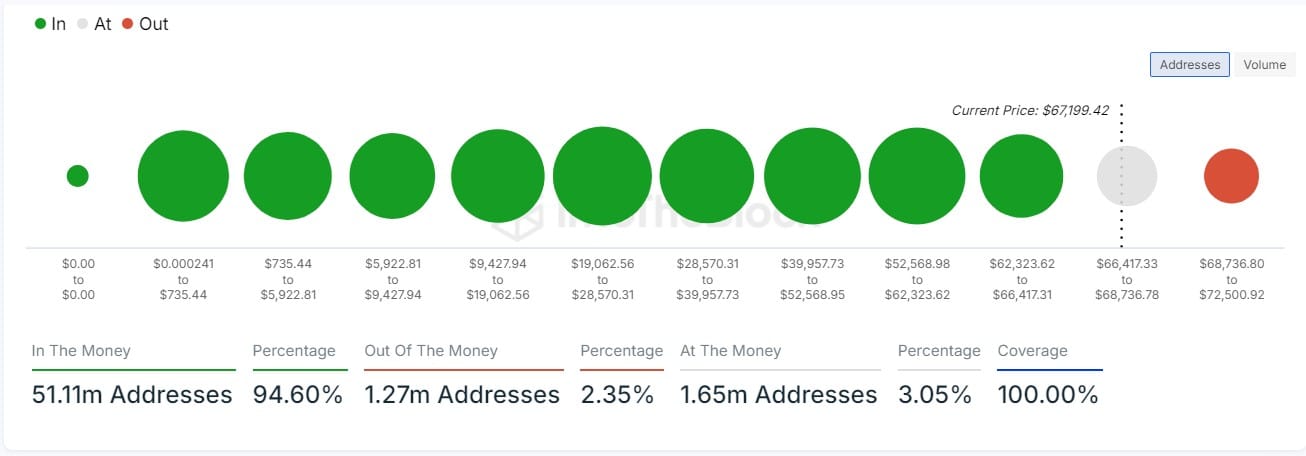

94% of Bitcoin holders win

AMBCrypto’s analysis of IntoTheBlock revealed that a whopping 94% of Bitcoin holders were making profits at the time of writing. This created a bullish undertone in the market.

When holders are already making profits, they refuse to sell during short-term fluctuations, further tightening Bitcoin’s supply.

With a spike in unrealized profit growth, supported by the larger share of profit holders at the current price, Bitcoin’s bullish rally is more likely to sustain in the long term.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

To top it all off, the king coin recently broke out of a bullish flag pattern. Historically, this technical signal indicates further price gains.

The fact that the FX reserve is still declining and unrealized gains remain strong, the breakout only strengthens the case for a sustained BTC rally.