- US Bitcoin ETF holdings are rapidly approaching those of Satoshi Nakamoto.

- With $3.4 Billion Inflows Post-Election, Bitcoin ETFs Also Collect 17,000 BTC Weekly

Bitcoins [BTC] The recent move towards the $90,000 mark has fueled excitement in the financial markets, significantly impacting spot Bitcoin ETFs in the US.

These ETFs are on track to potentially eclipse the holdings of Bitcoin creator Satoshi Nakamoto by becoming the largest collective Bitcoin holders.

Bitcoin ETFs Set to Surpass Satoshi Nakamoto’s Positions?

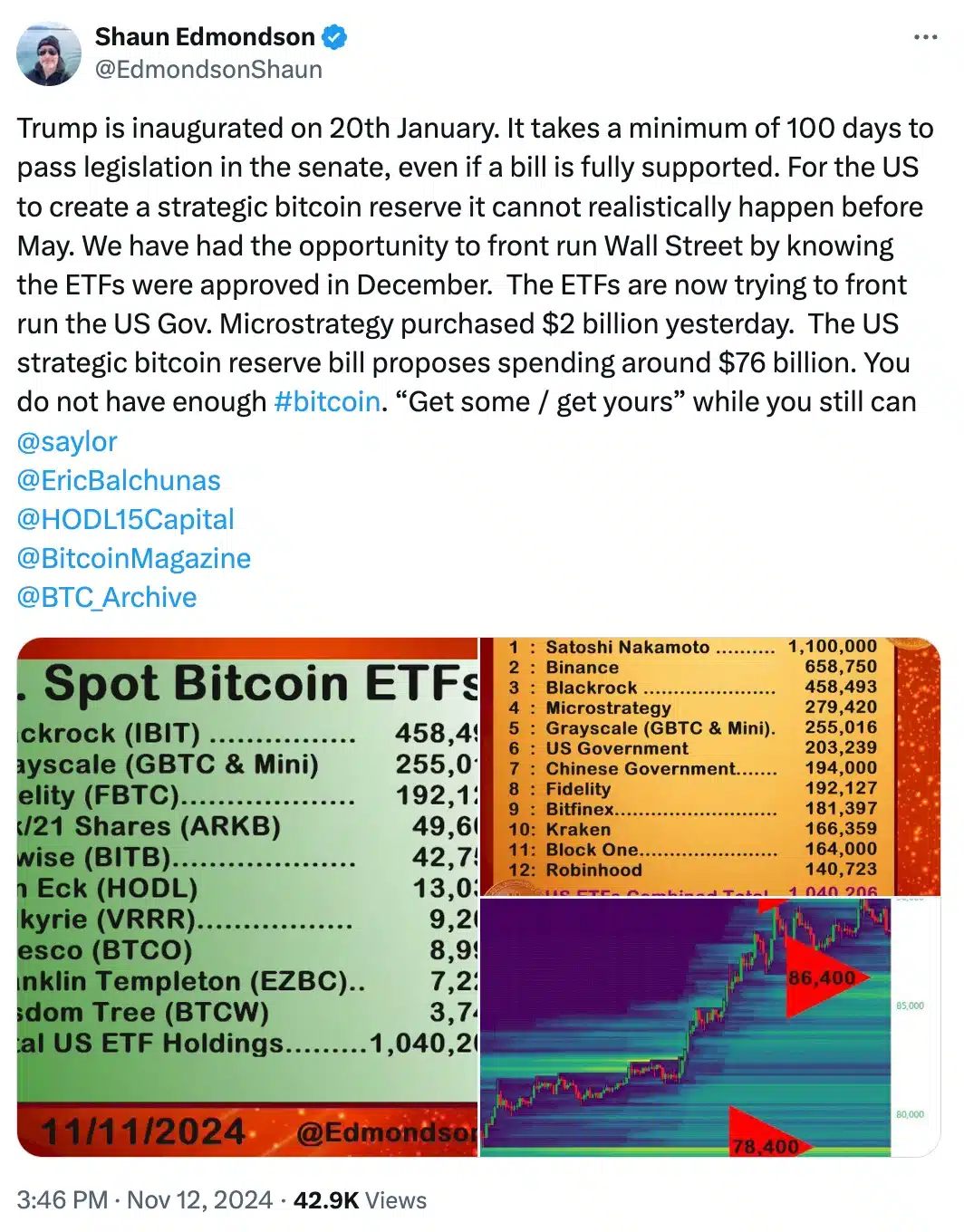

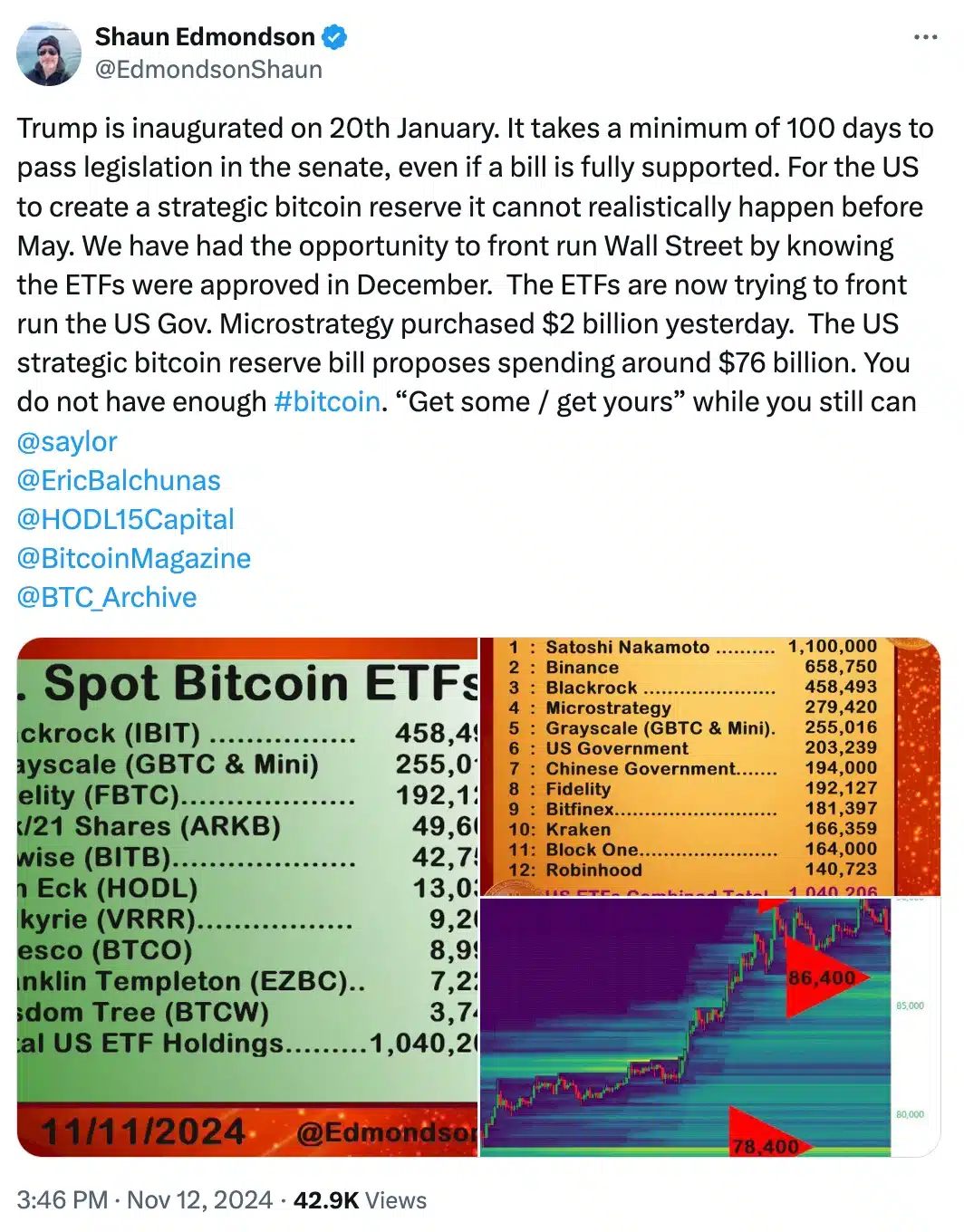

According to data from Bloomberg analyst Shaun Edmondson and Eric Balchunas, U.S. spot Bitcoin ETFs have accumulated about 1.04 million BTC — just shy of Satoshi’s estimated 1.1 million BTC.

This accumulation reflects growing institutional interest in Bitcoin as the asset gains traction within mainstream investment portfolios.

Edmondson noted the same about this:

Source: Shaun Edmondson/X

To which it is added, Balchunas said in his prediction:

“ETFs are now 95% of the way to overtaking Satoshi as the largest holder. Countdown clock in operation. Thanksgiving feels like a good over/under date.”

Bitcoin ETF update

On October 28, US Bitcoin funds reported a collective holding of 983,334 BTC, indicating a substantial accumulation of over 56,000 BTC over the past two weeks.

In addition, recent data from Farside Investors highlights the surge in interest, with US spot Bitcoin ETFs attracting an impressive $3.4 billion in just four days after Election Day.

That said, last Thursday marked a record performance for Bitcoin ETFs, as investors injected approximately $1.3 billion into these funds.

BlackRock’s IBIT alone saw a staggering $1.1 billion inflows, coupled with exceptionally high trading volumes.

According to the latest data from Farside Investors, US Bitcoin ETFs continued to see strong inflows on November 12, totaling $817.5 million, while IBIT accounted for the largest share at $778.3 million.

What’s behind this?

Analyst Eric Balchunas noted that these funds are accumulating Bitcoin at a rapid pace of around 17,000 BTC per week, putting them on track to surpass Satoshi Nakamoto’s estimated assets by December 2024.

In fact some credit from tits accelerated accumulation also goes to Donald Trump’s election victory.

However, some believe that the election is not the only factor at play. The fourth Bitcoin halving also has a significant impact, as highlighted by Jesse Myers, co-founder of OnrampBitcoin.