- Despite the billions of dollars inflows into Bitcoin ETFs, the BTC price is showing minimal movement. Experts weigh in

- Fundamental data shows interesting trends, including high circulating supply and balancing acts between buyers and sellers.

Despite significant inflows into spot Bitcoin [BTC] Exchange Traded Funds (ETFs), the expected corresponding increase in Bitcoin’s price has yet to materialize, confusing investors and analysts alike.

Reports indicate an unprecedented increase in interest rates and capital inflows into these financial products, highlighting a growing enthusiasm in the cryptocurrency space.

Over the past few weeks, these ETFs have experienced record inflows, marking the longest streak of positive flows since their inception, with BlackRock’s IBIT leading the way with significant net inflows.

On June 7 alone, the 11 spot Bitcoin ETFs tracked collective net inflows of over $200 million, led by $350 million inflows in IBIT.

This culminated in a staggering net inflow of $15.56 billion since January.

Despite the significant increase in spot ETFs over the past week, Bitcoin has only witnessed a modest 4.3% increase over the same period.

Over the past 24 hours, the cryptocurrency has struggled to gain further momentum, with the price hovering just above $71,000.

ETF impact on Bitcoin

The current stagnation in the price of Bitcoin, despite a significant influx of ETFs, raises questions about the actual impact of these financial instruments on the market value of the cryptocurrency.

Experts suggest that several factors are at play that weaken the ETFs’ influence on Bitcoin’s price.

According to Christopher Inks, a veteran crypto trader, Bitcoin’s market dynamics are complex, influenced by a convergence of spot trading, futures, options and now ETFs.

Ink emphasized the multi-faceted nature of the market and indicated that focusing solely on ETF activity provides an incomplete picture of price movements.

In response to an X user who asked why the spot ETFs aren’t moving the price of BTC, Ink said replied:

“You do realize that the market is made up of spot, futures, ETFs and options, right? Price at any time is a product of all these factors, not just one of them.”

Further discussions between financial experts, including a notable exchange between investor Frank Makrides and Bloomberg ETF analyst Eric Balchunas, sheds light on the nuanced interplay of market forces.

Source:

Balchunas pointed out that while ETFs buy aggressively, there is equivalent selling from other market participants, keeping the price in balance.

This phenomenon is often described as ‘buy the rumor, sell the news’, where the market’s anticipation of an event (such as the adoption of ETFs) temporarily drives prices up, only to stabilize or fall once the event occurs.

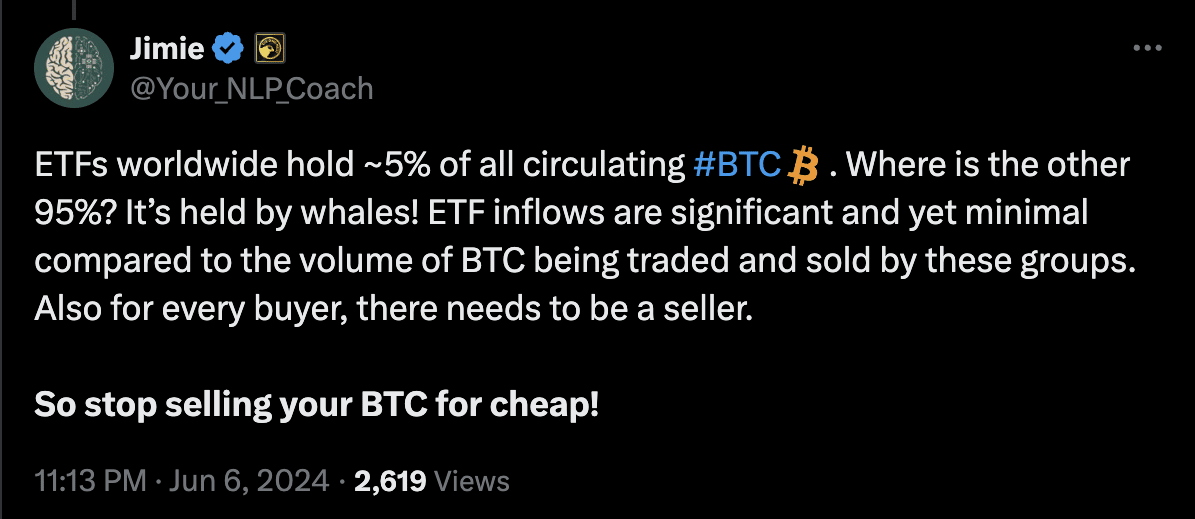

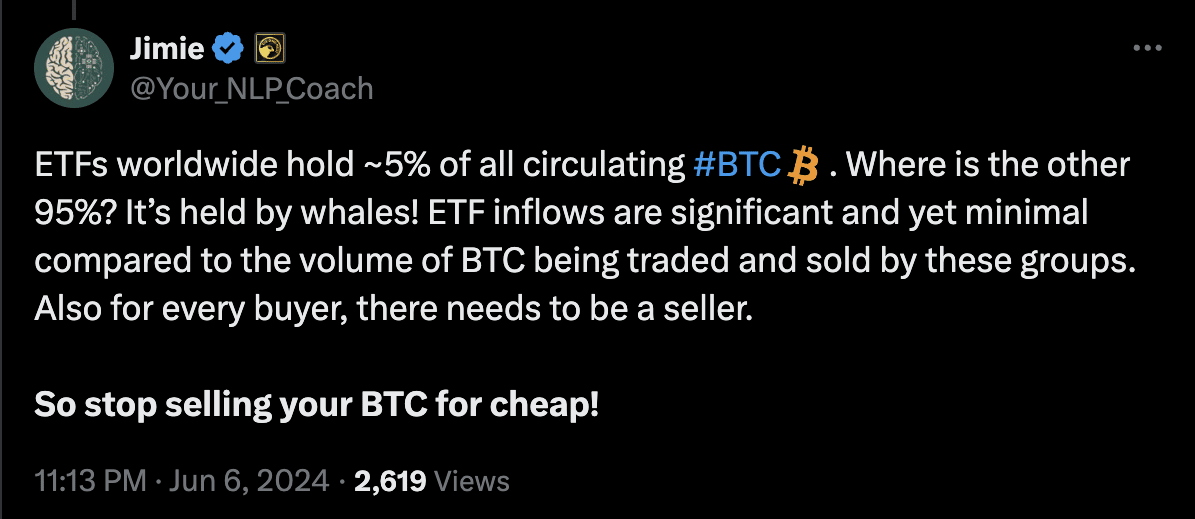

Jimie, another analyst, marked that while ETFs now control about 5% of the total circulating Bitcoin supply, the remaining 95% is controlled by a diverse group of investors, including whales, whose trading activities significantly influence the market.

Source:

This perspective was echoed in community comments under Frank Makrides’ X-post, which included users like Patrick Hubbard noted,

“When ETFs buy, it’s because someone is selling.”

Bitcoin stability analysis

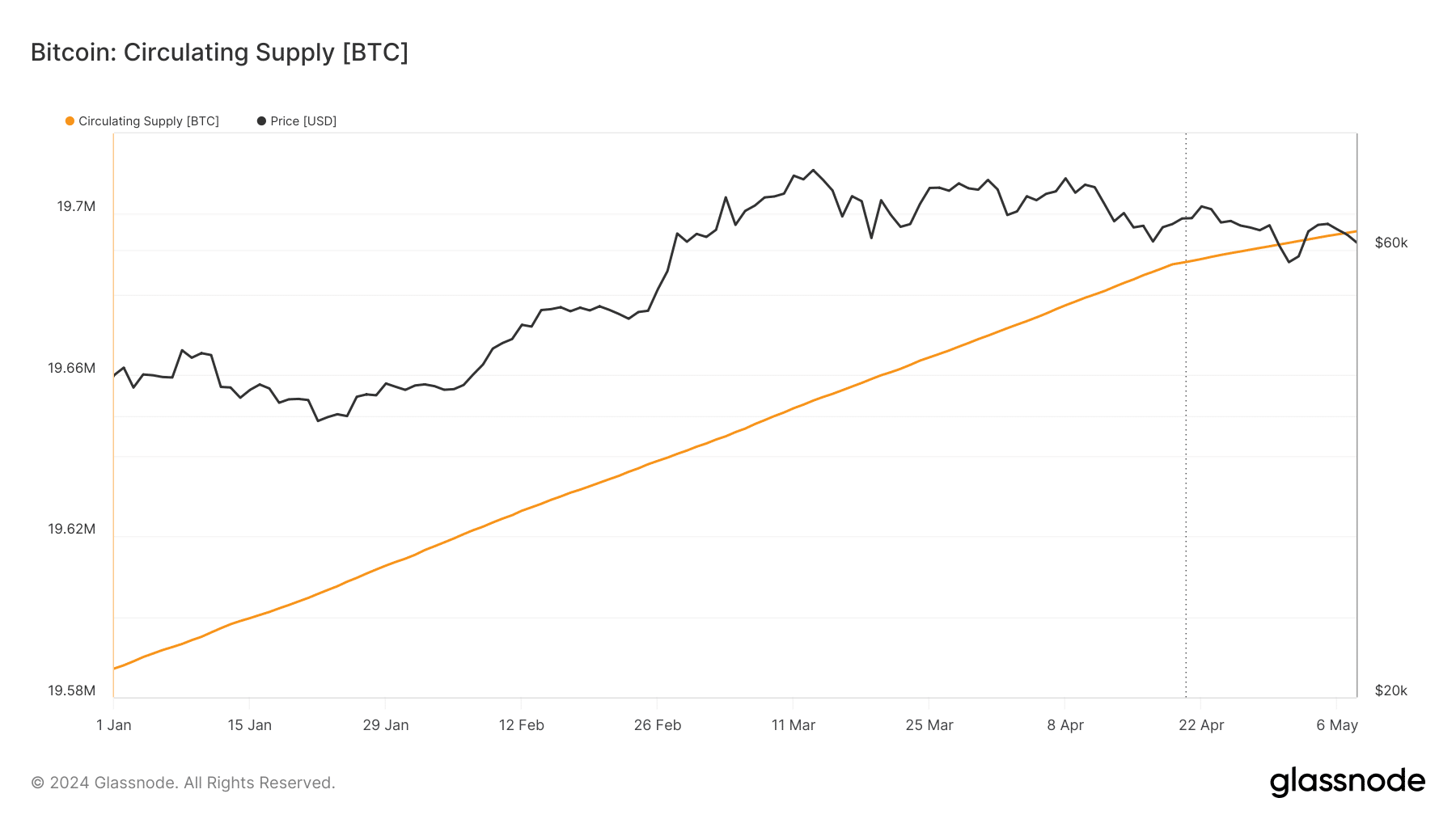

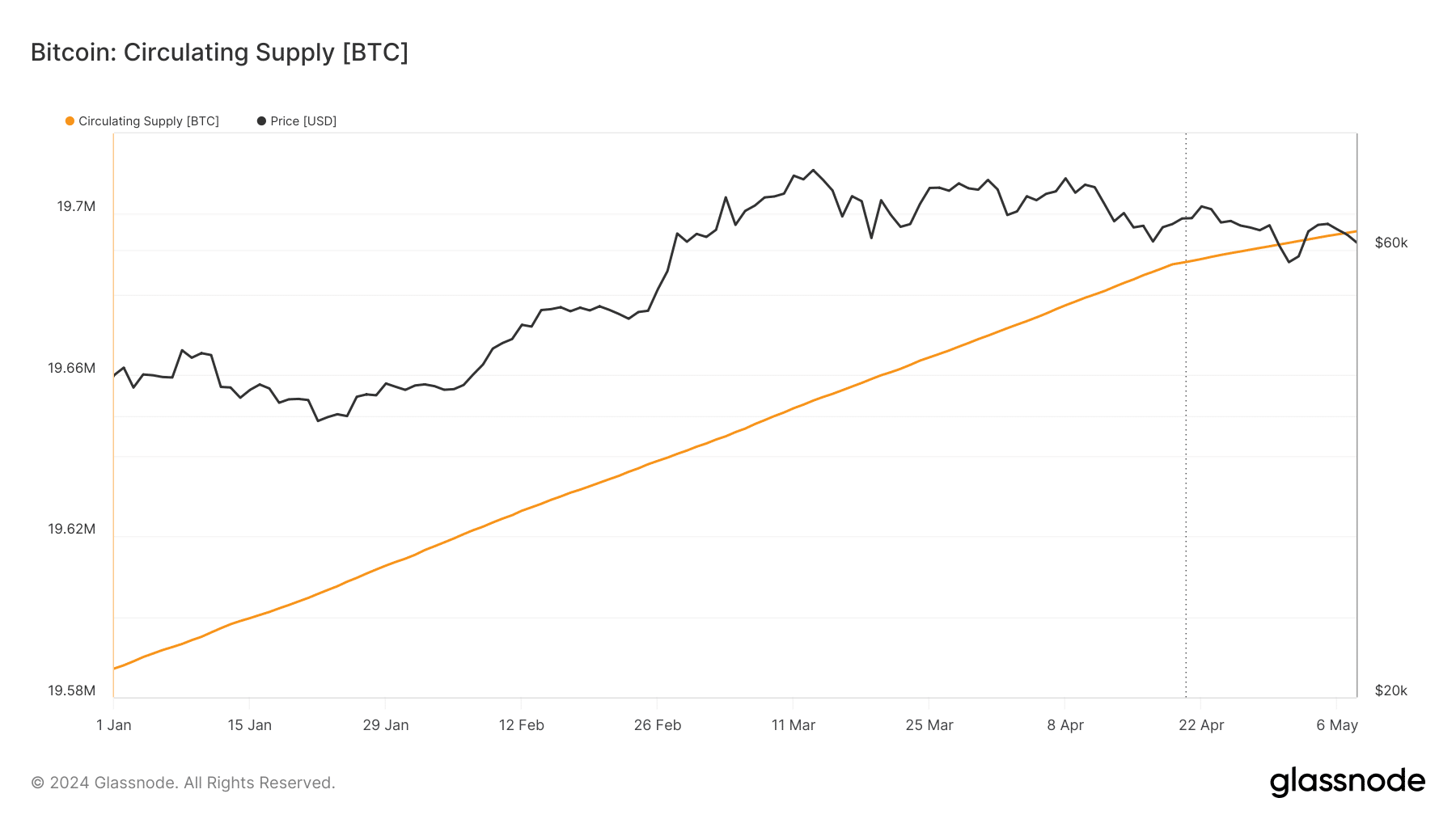

Examining Bitcoin’s fundamentals sheds light on why its price has not yet reflected rising inflows into spot Bitcoin ETFs. According to Glass junctionBitcoin’s circulating supply has been on an upward trend since the beginning of the year.

Source: Glassnode

Typically, an increase in circulating supply suggests that there are more BTC available for sale, which could lead to a price drop as demand decreases.

However, continued demand for spot Bitcoin ETFs appears to be absorbing enough supply to maintain current price levels, although not enough to drive prices significantly higher.

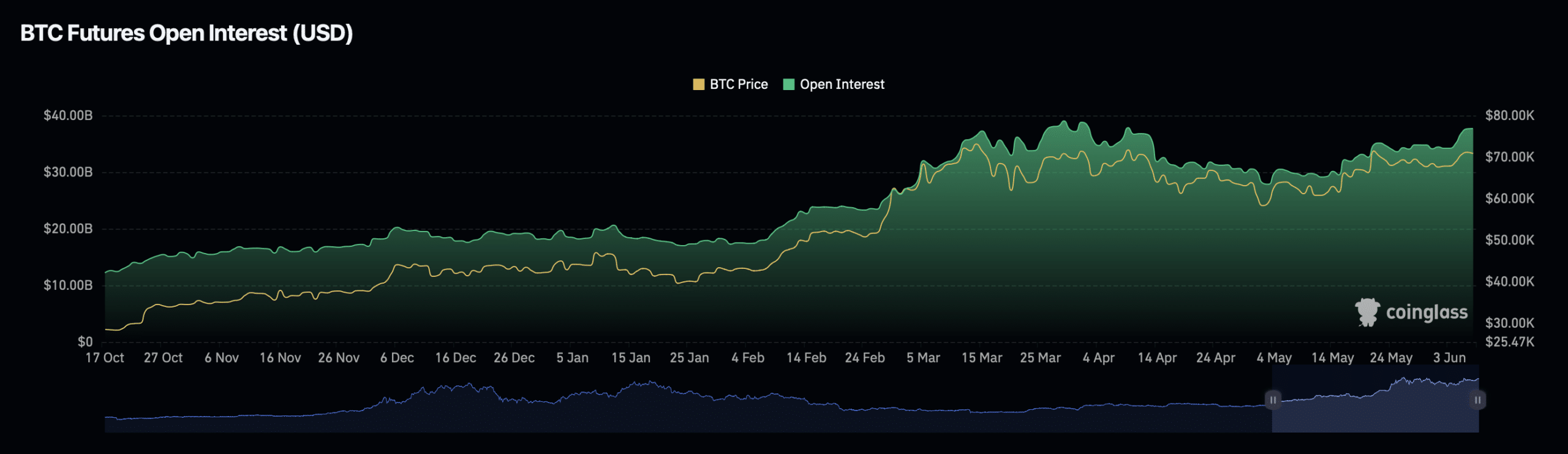

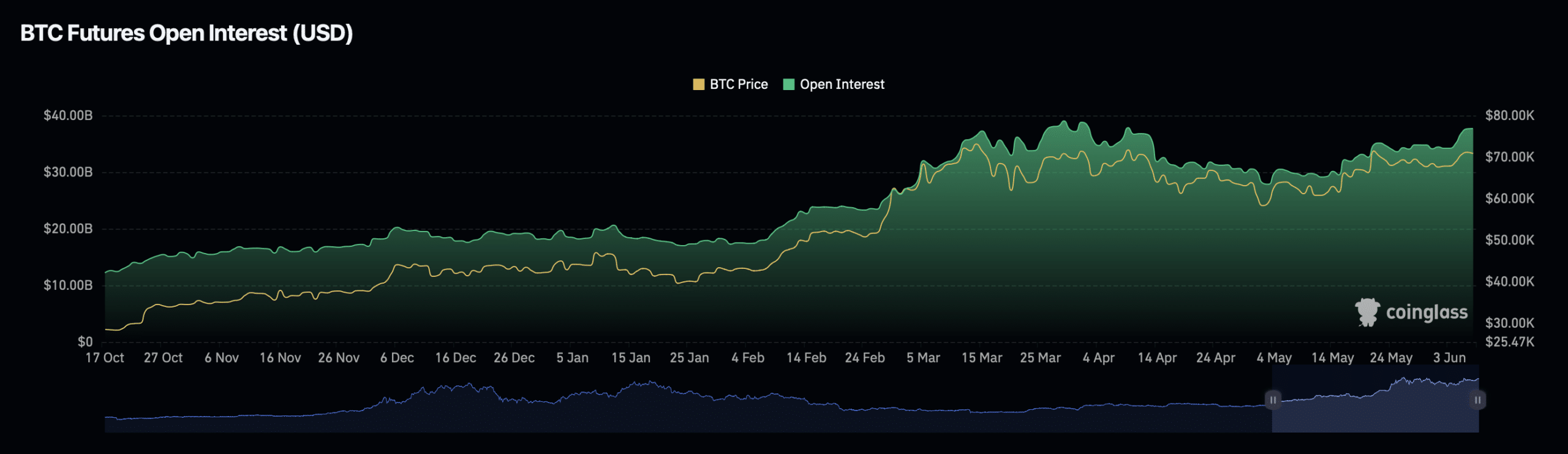

Furthermore, open interest dynamics also support Bitcoin’s current price trends.

Facts from Coinglass indicates that there has been no significant movement in Bitcoin’s overt interest; it recorded only a small increase of 0.8% over the past 24 hours, while options volume is down almost 40%.

This slight increase in open interest, coupled with a decline in options volume, signals cautious market sentiment.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

Despite these factors, there are signs of a possible upward movement. A recent AMBCrypto report highlighted a bullish crossover in Bitcoin’s MACD on the daily chart.

Moreover, Bitcoin’s Relative Strength Index (RSI) remains well above the neutral threshold, indicating that prices may rise in the near future.