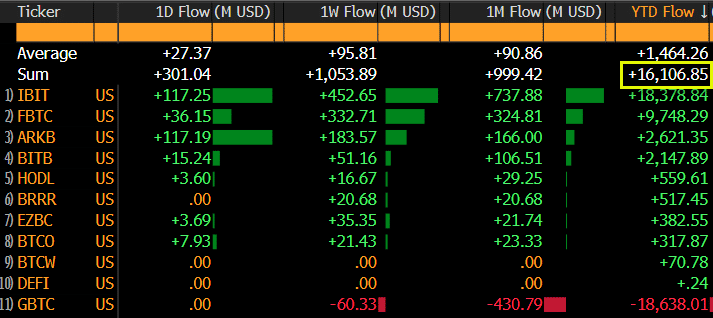

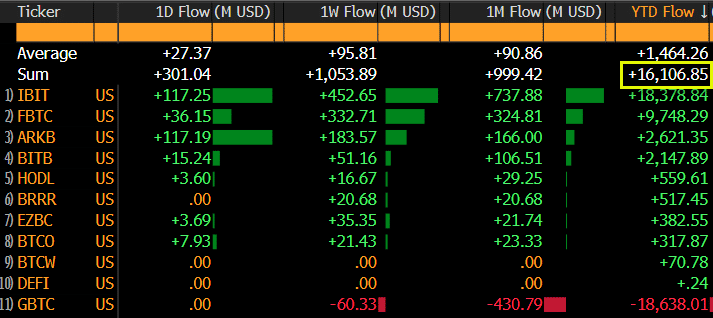

- US spot BTC ETFs saw net inflows of $16 billion, outperforming expectations in a record six months.

- BlackRock’s IBIT tops the charts with over $20 billion in net assets and $18.6 billion in net flows

Undoubtedly the American spot Bitcoin [BTC] ETFs (exchange traded funds) have been a runaway success in the history of the crypto market.

The BTC ETFs reached a new milestone: $16 billion in net flows in six months, outperforming estimates from Bloomberg analysts, who predicted $12-$15 billion in net flows in 12 months.

Commenting on the celebration, Bloomberg ETF analyst Eric Balchunas said recognized that their estimates had been approved.

“The YTD net total (the highest number in all of this) has exceeded +$16 billion for the first time. Our estimate for the first twelve months was $12-15 billion, so we have already achieved that with six months to go.”

Source: X/Eric Balchunas

Interestingly, the recent BTC recovery above $60,000 also saw renewed inflows into the ETFs.

Balchunas added that the products were in “two steps forward” mode after netting +$300 million on July 15 and around $1 billion on a weekly basis.

BlackRock is the leader in BTC ETFs

BlackRock has recorded remarkable growth among US spot BTC ETFs. On Tuesday, the company’s iShares Bitcoin Trust (IBIT) generated $260 million in net flows and reached $1 billion in daily trading volume value.

Soso value facts revealed that BlackRock was the best performing BTC ETF at the time of writing, with $20.9 billion in assets. Grayscale’s GBTC and Fidelity’s FBTC came in second and third in terms of net worth.

BlackRock still led in terms of net flowswhich was $18.6 billion, followed by Fidelity at $9.8 billion.

BlackRock’s explosive growth was a tip-off for ETF Store’s Nate Geraci claim that advisors and institutional investors joined the ‘party’.

“iShares Bitcoin ETF now has over $20 billion in assets and receives a quarter of a billion on any given Tuesday…*$20 billion*. *6mos* after the launch…Advisors and investors are clearly coming to this party.”

Will Mount Gox’s refund derail the party?

Meanwhile, Mount Gox has moved a significant amount of BTC to Kraken for reimbursement to victims, sparking new fears after last week’s German BTC dump.

However, most market analysts suggested that the distribution of Mt Gox “overrated”, especially given the likely launch of the US Ethereum ETFs next week.

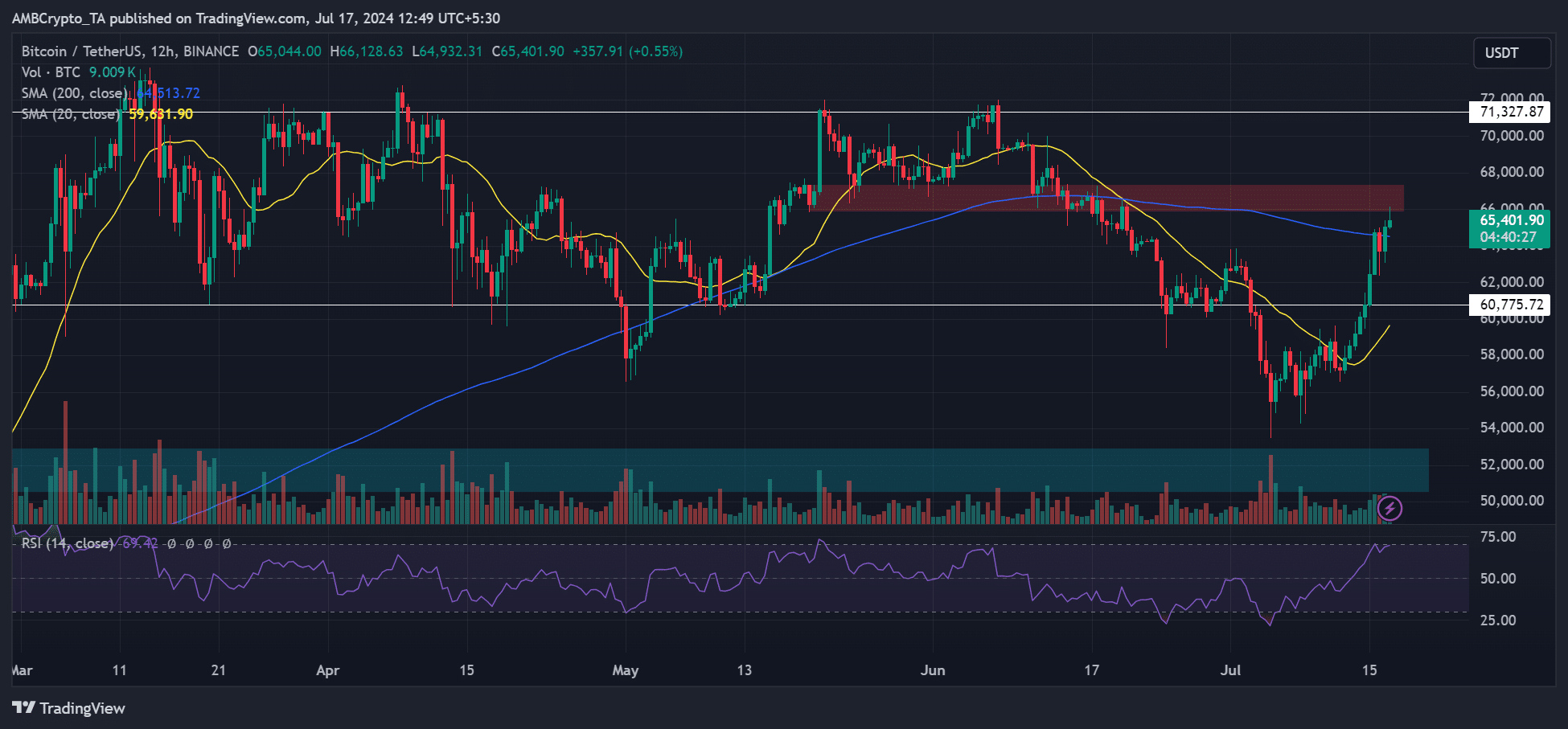

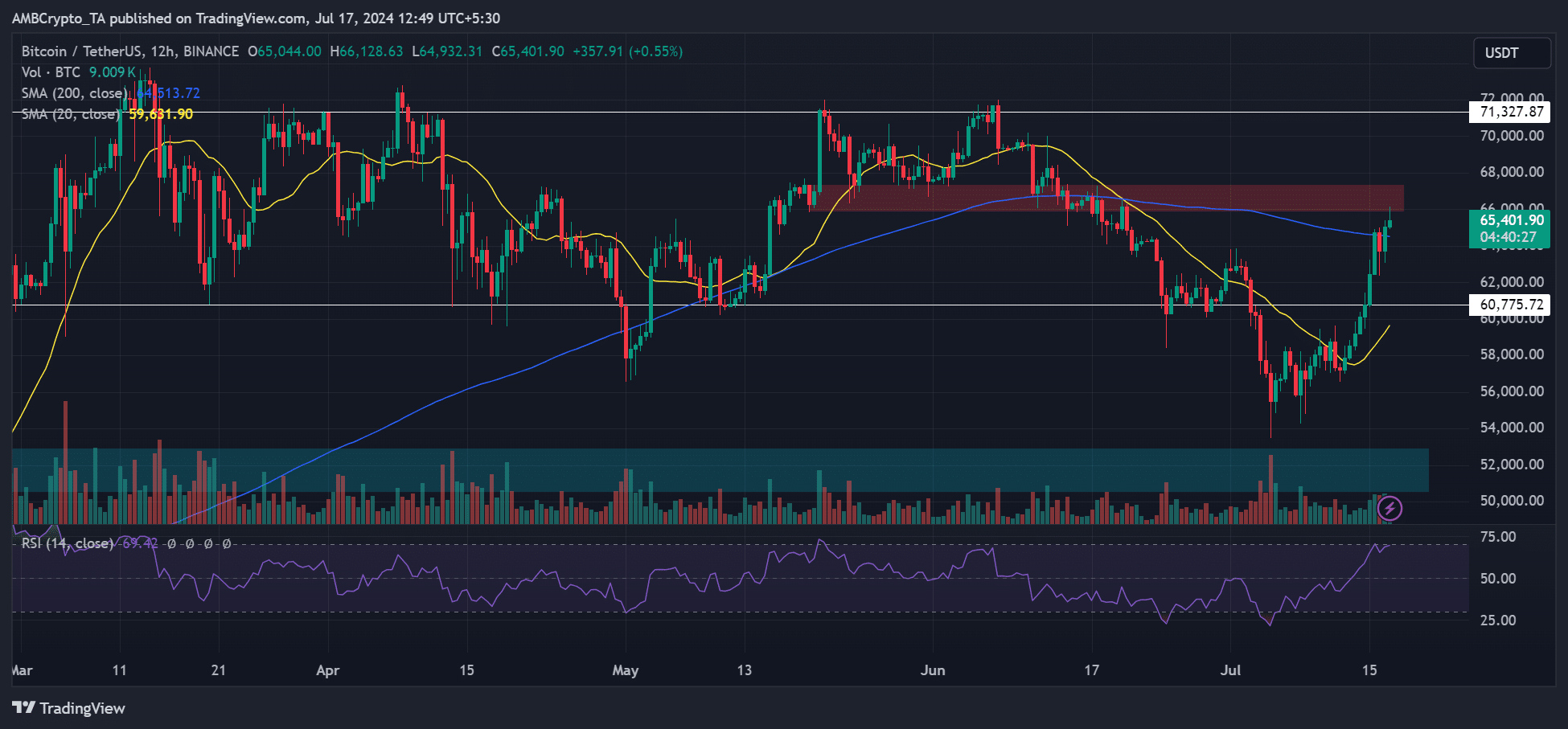

On the price charts, BTC was bullish and above the short- and long-term price trends, indicated by 20-day SMA (Simple Moving Average) and 200-day SMA.

It traded at $65.4K but hit key resistance and breaker block area (highlighted in red). A convincing move above the hurdle could accelerate a retest of the range high at $71K.

Source: BTC/USDT TradingView

The founders of Glassnode echoed same bullish outlook, albeit with caveats if negative news were to hit the market.

“Our key risk/reward chart shows recovery towards a bullish environment. The Bitcoin risk signal has recovered, but is still in a high-risk area.”