The launch of is undeniable Discover Bitcoin ETFs has done wonders for the price of Bitcoin and other cryptocurrencies in general. These ETFs now have unlocked institutional demand in the world’s largest crypto asset to change the dynamics ahead of the next halving. On the other hand, recent tensions between Iran and Israel have caused Bitcoin to fall to $61,000 in the past 24 hours, reversing weeks of price gains.

Bitcoin ETF Wallets Now Whale Addresses

Institutional demand for Bitcoin has been increasing since the beginning of the year from the issuers of the various Spot Bitcoin ETFs. These fund providers have been snapping up Bitcoin left and right and now own 4.27% of the total BTC supply, as noted by on-chain analytics platform IntoTheBlock.

These whale wallets have now been added to an extensive list of whales on the Bitcoin network that are jointly owned 11% of the total circulating supply.

Unlike previous BTC halvings, this time there is a new source of demand coming from the traditional institutional sector.

The newly introduced Bitcoin ETFs are driving institutional demand, resulting in ETF portfolios already amassing 4.27% of the Bitcoin supply! pic.twitter.com/volLU15Wgd

— IntoTheBlock (@intotheblock) April 13, 2024

It’s remarkable to mention that IBIT from BlackRock and Fidelity’s FBTC ETFs have positioned themselves as the frontrunners. According to data from BitMEX Researchthese two spot ETFs now hold 405,749 BTC at the end of the trading session on April 12.

This wave of institutional money has fueled the speed of Bitcoin rise to a new all-time high of $73,737 and underlined its potential as a mainstream asset class. However, a looming conflict between Iran and Israel appears to be undoing months of this price increase. Bitcoin in particular has seen a notable drop from $67,800 to $61,000 over the past 24 hours.

However, fundamentals indicate that this price drop is temporary and the crypto is already reversing most of this loss. At the time of writing, Bitcoin is trading below the $65,000 price.

Bitcoin is now trading at $64.330. Chart: TradingView

Changing halving dynamics

One of the point out such fundamental points to a stable Bitcoin price increases in the coming months is the impending Bitcoin halving. Investors are steadily approaching the outcome of this halving, with the Bitcoin blockchain now less than 1,000 blocks away from the next event.

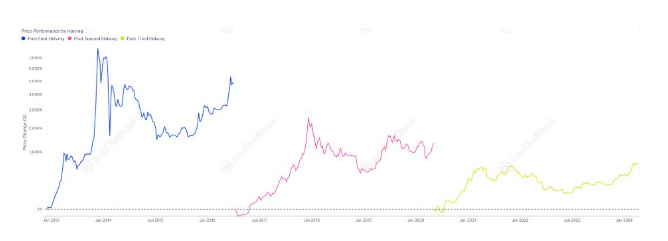

Previous halvings have themselves led to a price increase for Bitcoin in the days following the halving. Bitcoin rose by more than 7,000% in the months after the first halving in 2012. The halving in July 2016 led to a price increase of 3,000% in the following months. The most recent halving in May 2020 led to an increase of almost 1,000% in the following months.

As noted by IntoTheBlock, the impending halving is different from previous ones. Unlike the last three halvings, there is “a new source of demand from the institutional sector” through Spot Bitcoin ETFs. a repeat of previous halving The outcomes could allow Bitcoin to easily rise above the $100,000 price level.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.