- Bitcoin’s price soared after Donald Trump’s presidential victory, approaching the $90,000 mark.

- BlackRock’s Bitcoin ETF and crypto stocks hit record trading volumes during Bitcoin’s rally.

Bitcoin [BTC] has entered a bullish phase following the victory of Donald Trump as the 47th President of the United States.

Interestingly, market speculation was already buzzing with predictions that Trump’s victory could push BTC to the long-awaited $100,000 mark.

As Bitcoin approaches $90,000, that milestone appears within reach – although market analysts remain cautious, stressing that future price movements remain uncertain amid continued volatility.

In addition to BTC’s impressive price rise, the broader crypto market is also witnessing remarkable performance.

Impact of Bitcoin approaching $90,000

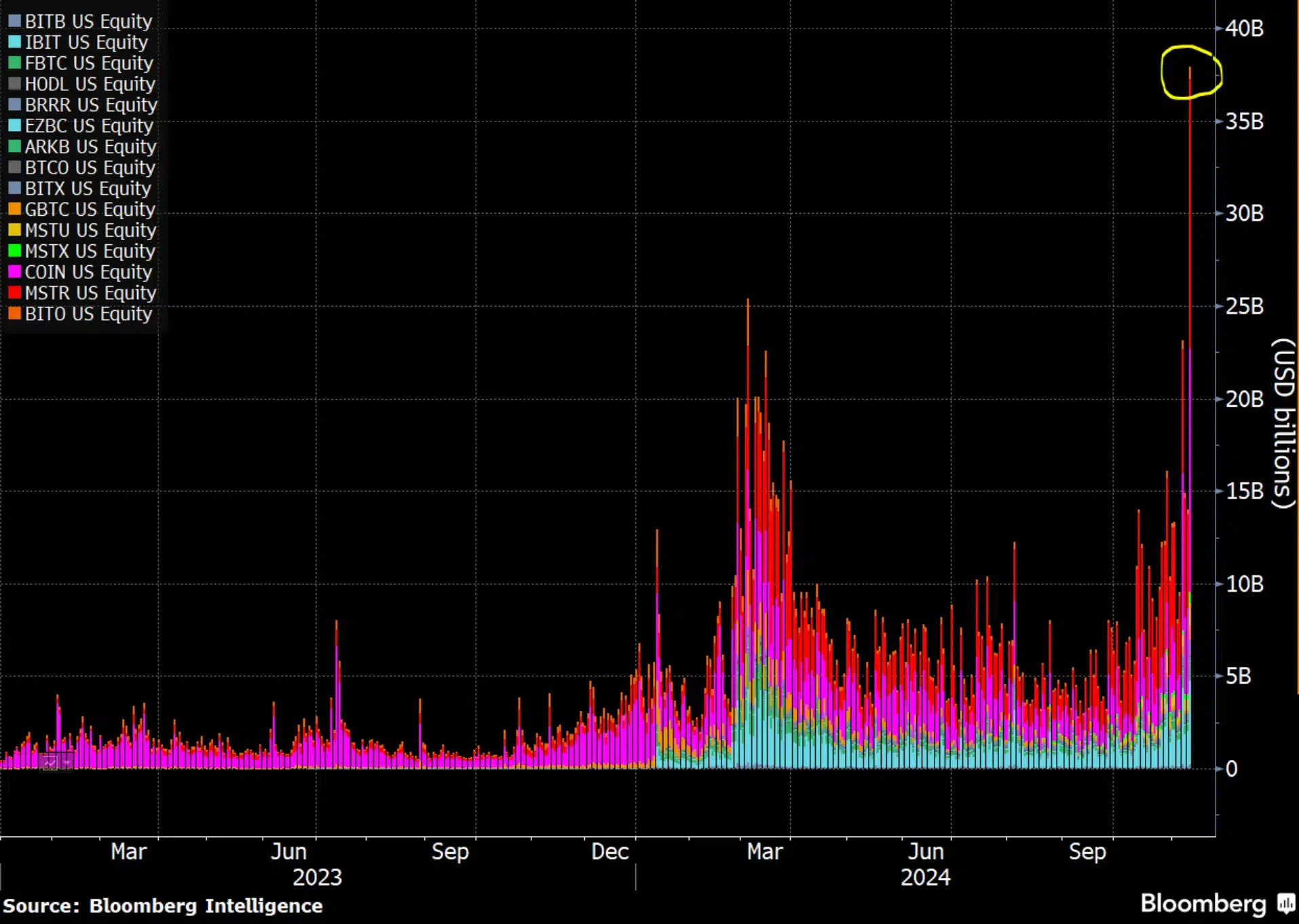

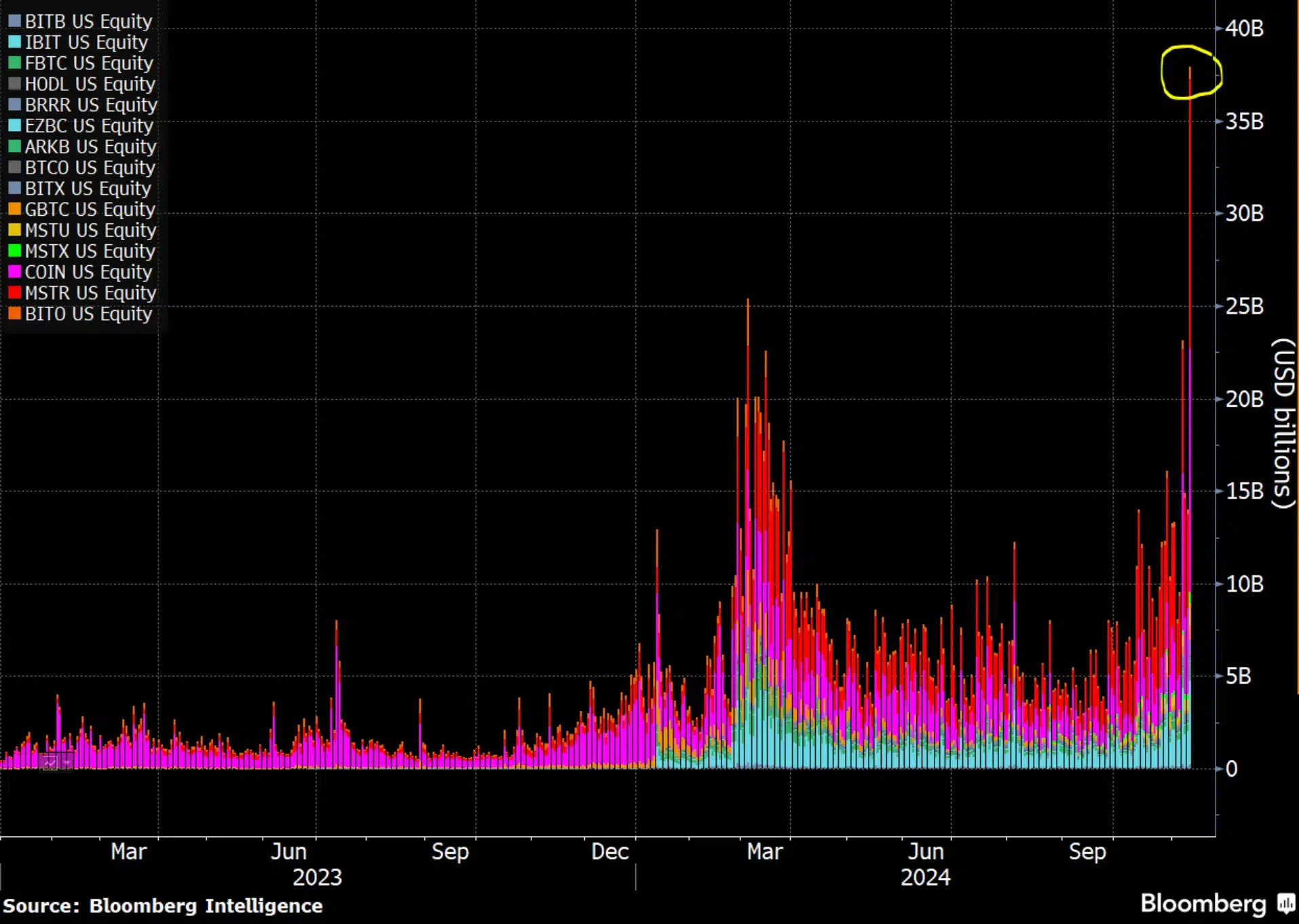

Bitcoins recent rally of 11% in 24 hours, taking it to $89,700 on November 12, has led to a surge in trading volumes for US Bitcoin Exchange-Traded Funds (ETFs), along with crypto firms like MicroStrategy Inc. (MSTR) and Coinbase Global Inc. MINT).

Combined daily trading volumes for these assets reached a record $38 billion, a significant increase from the previous record of around $25 million in March.

Bloomberg Intelligence and ETF analyst says about the same Eric Balchunas said,

“The Bitcoin Industrial Complex (ETFs + MSTR, COIN) saw $38 billion in trading volume today, setting lifetime records everywhere, including $IBIT bringing in $4.5 billion, indicating a robust week of inflows. Just an amazing day, it really deserves a name a la Volmageddon.

Source: Eric Balchunas/X

Bitcoin ETF is also experiencing a strong increase

Well, it wasn’t just the usual players like Bitcoin ETFs, MSTR and COIN that witnessed a surge; BlackRock’s spot BTC ETF also shattered previous trading volume records.

Days after Trump’s victory, BlackRock’s Bitcoin ETF recorded inflows of more than $1.1 billion in a single day, setting a new benchmark.

MicroStrategy emerged as one of the biggest gainers on November 11, with its stock rising more than 25% to $340. Coinbase also rose nearly 20% to reach $324.20 – its first time above $300 since 2021.

Notably, MSTR and COIN were among the top five most traded stocks in early trading, even surpassing giants like Apple and Microsoft, as noted by ETF analyst Eric Balchunas.

Community response and more

Considering the remarkable impact following Trump’s victory, Sam McDonald replied to Balchunas’ tweet saying:

“@EricBanchunas is just trying to gauge the mood on Wall Street. Are these figures that attract attention? It seems (from a distance) like the Trump effect is taking everything to the next level.”

So, while BTC’s recent price surge has created excitement, it is uncertain whether this rally is driven solely by Trump’s victory or if other factors are also at play.

Therefore, as the market adjusts in the coming days, it will be intriguing to see whether Bitcoin’s momentum will continue or if a pullback is in store.