- The Hong Kong Bitcoin ETF reserves reached 4,941 BTC, worth more than $310 million.

- BTC is up 4% in the last 24 hours, but some numbers have been bearish.

Bitcoin [BTC] ETFs have remained a hot topic of discussion in the crypto world since their approval in January 2024.

While the United States has dominated the ETF sector on a global level, new players have now entered. For example, Australian and Hong Kong ETFs recently set records.

Bitcoin ETF: Australia and Hong Kong lead the way

For starters, Hong Kong Bitcoin ETFs have witnessed a substantial increase in outflows in recent days. Precisely, Hong Kong’s BTC ETFs registered a 28.6% increase from the previous reserve.

The recent rebound pushed BTC reserves to 4,941 BTC. According to the AMBCrypto Converter, the total Hong Kong BTC ETF reserves were valued at over $310 million.

Like Hong Kong, the Australian Monochrome Bitcoin ETF (IBTC) also made headlines. Since its debut, it has received 83 BTC in inflows. This approached the 100 Bitcoin threshold in terms of total holdings.

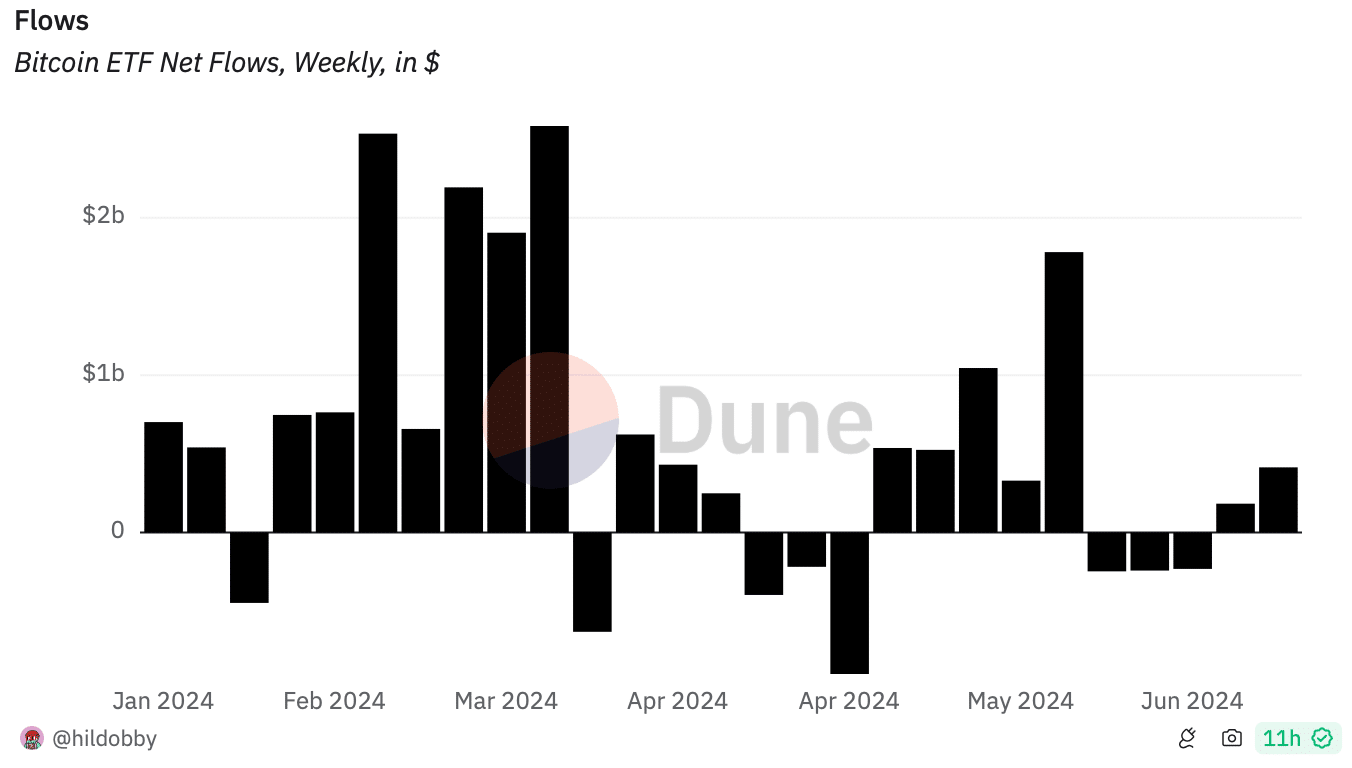

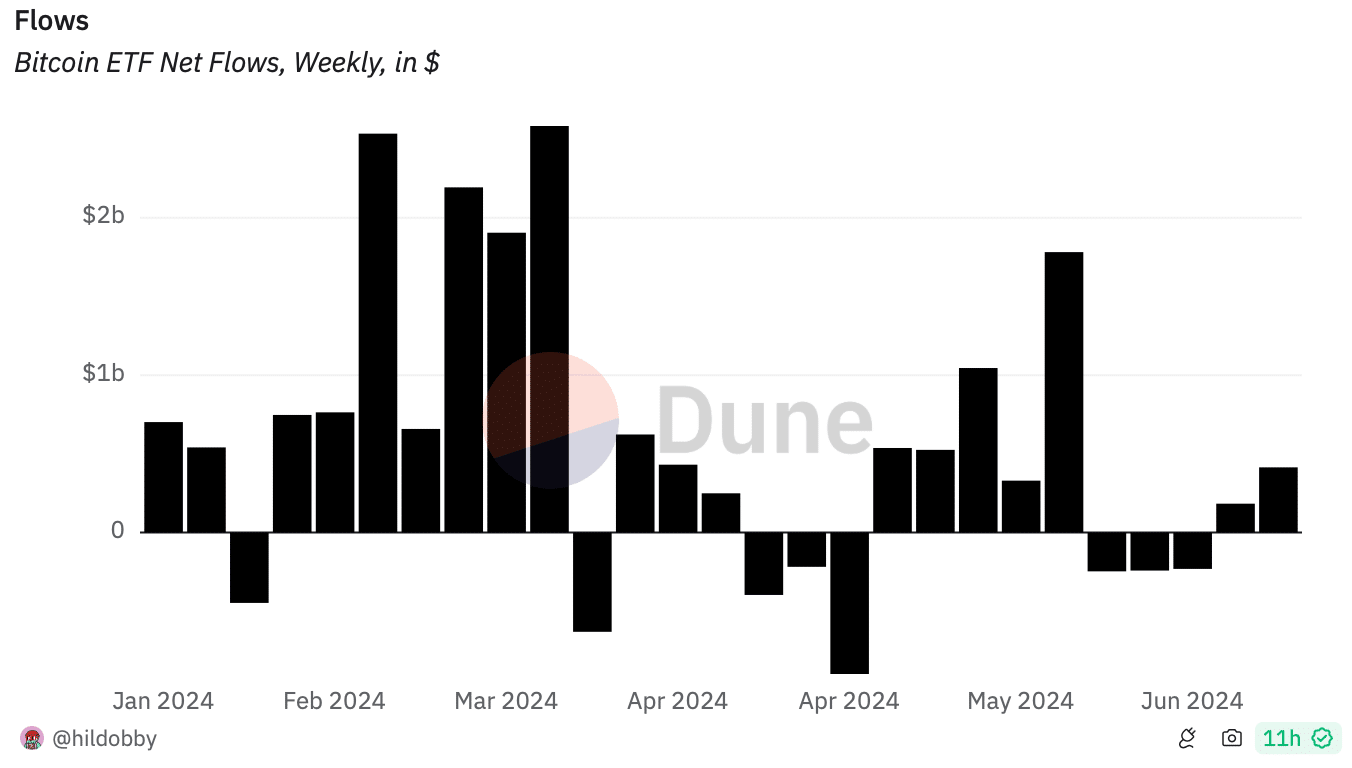

Since there has been a lot of attention on BTC ETFs, AMBCrypto planned to take a closer look at what is going on. Our analysis of Dune Analytics data found that BTC ETF net flows have declined in recent weeks.

However, it was interesting to note that net inflows remained higher, reflecting BTC demand and investor confidence in the king of cryptos.

Source: Dune

BTC turns bullish

While all this was happening, the Bitcoin bulls stepped up their game as the weekly and daily charts turned green. According to CoinMarketCapBTC has risen by more than 4% in the past 24 hours.

At the time of writing, BTC was trading at $62,810.22 with a market cap of over $1.23 trillion.

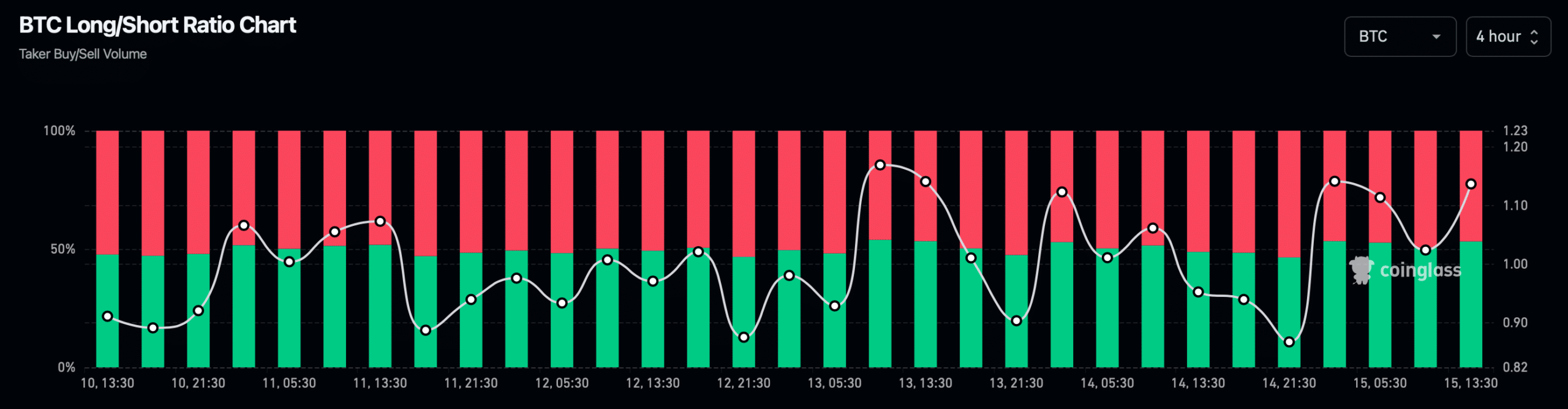

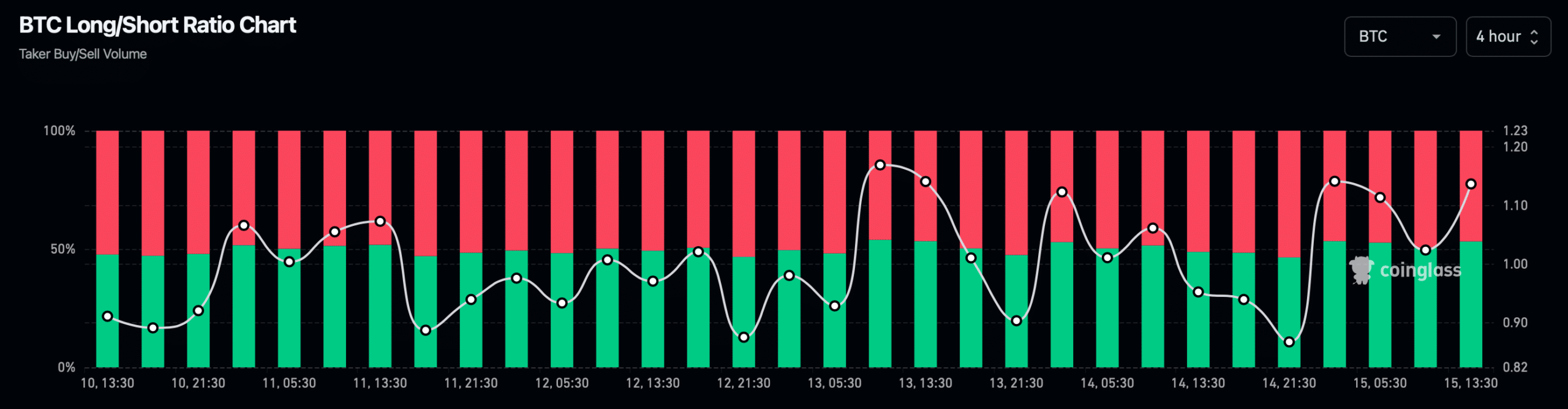

Our look at Coinglass’s data revealed a bullish signal. Bitcoin’s Long/Short ratio registered a huge increase at the time of writing, reflecting more long positions in the market than short positions.

This suggested that bullish sentiment around the coin was increasing in the market.

Source: Coinglass

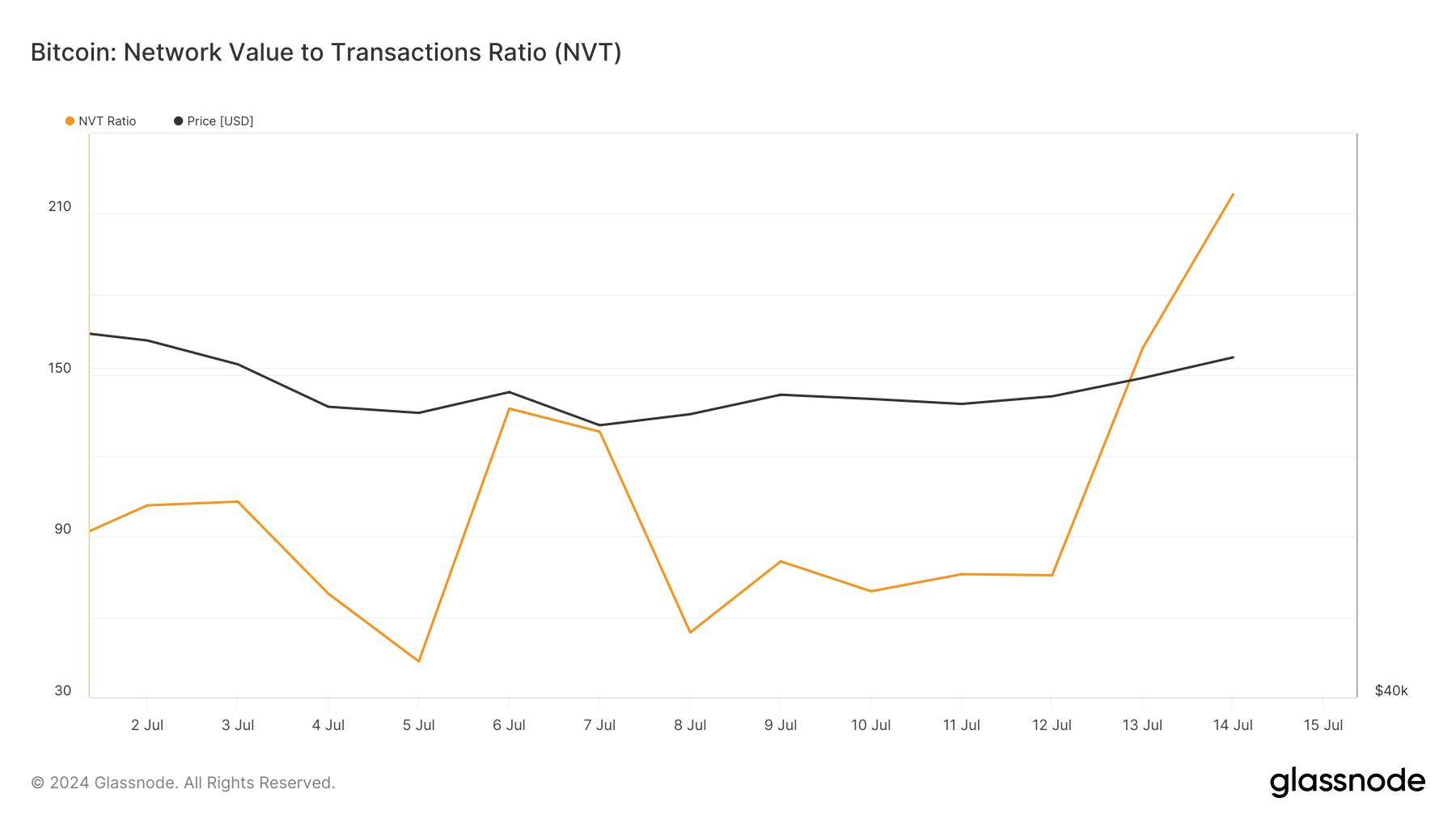

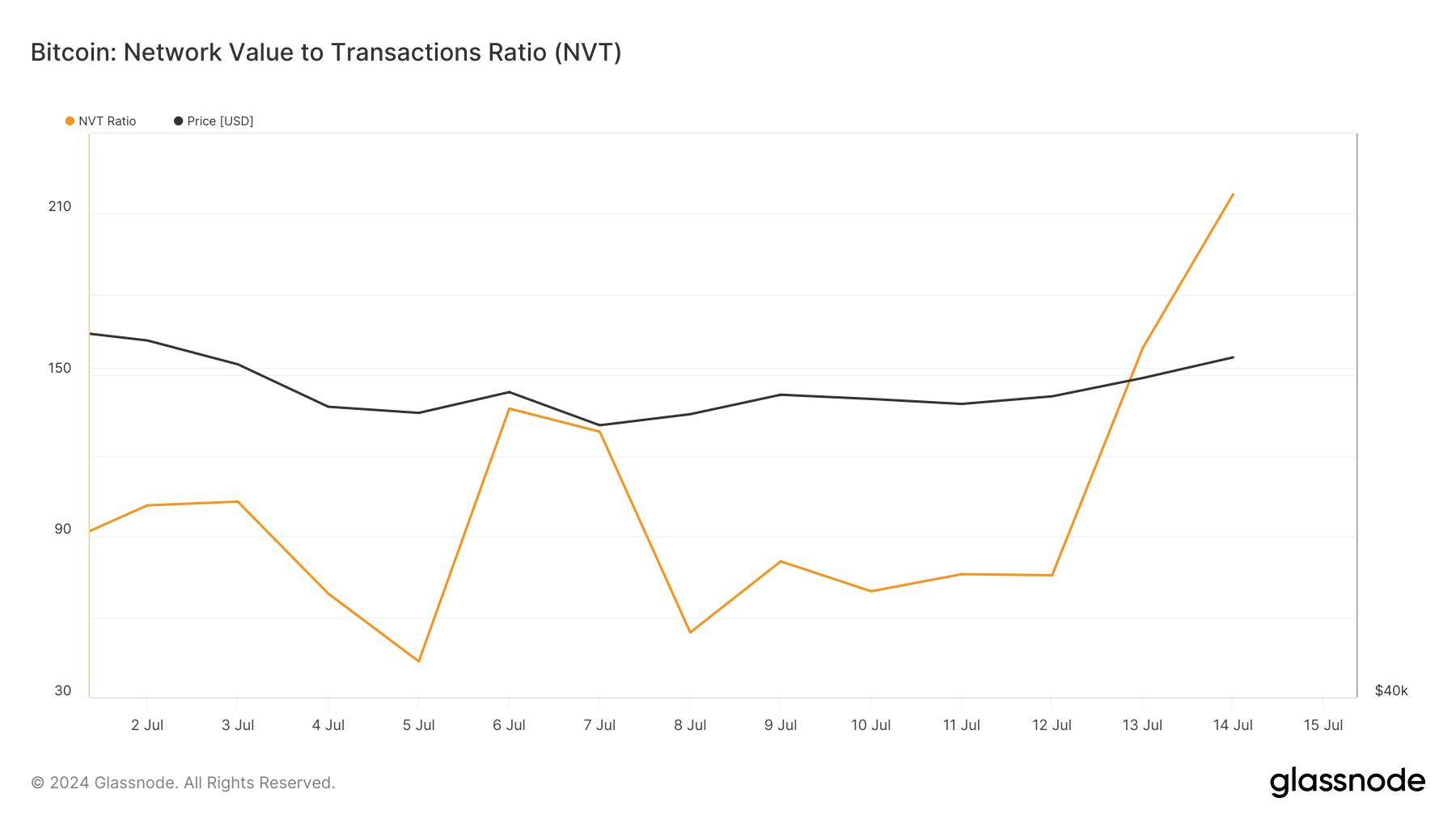

However, not everything worked in BTC’s favor. For example, BTC’s NVT ratio registered an increase. Whenever the measure rises, it indicates that an asset is overvalued, signaling a possible price correction.

Source: Glassnode

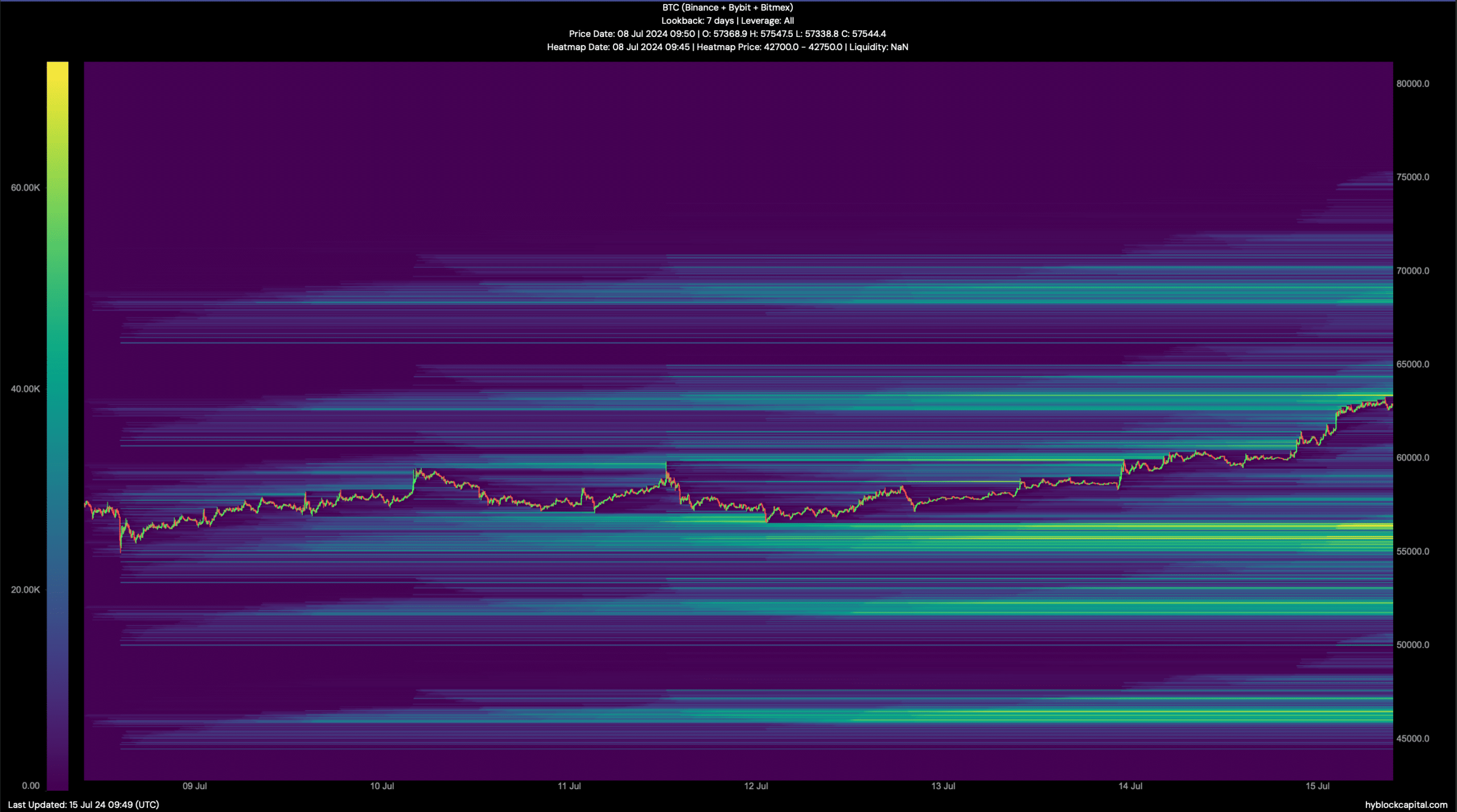

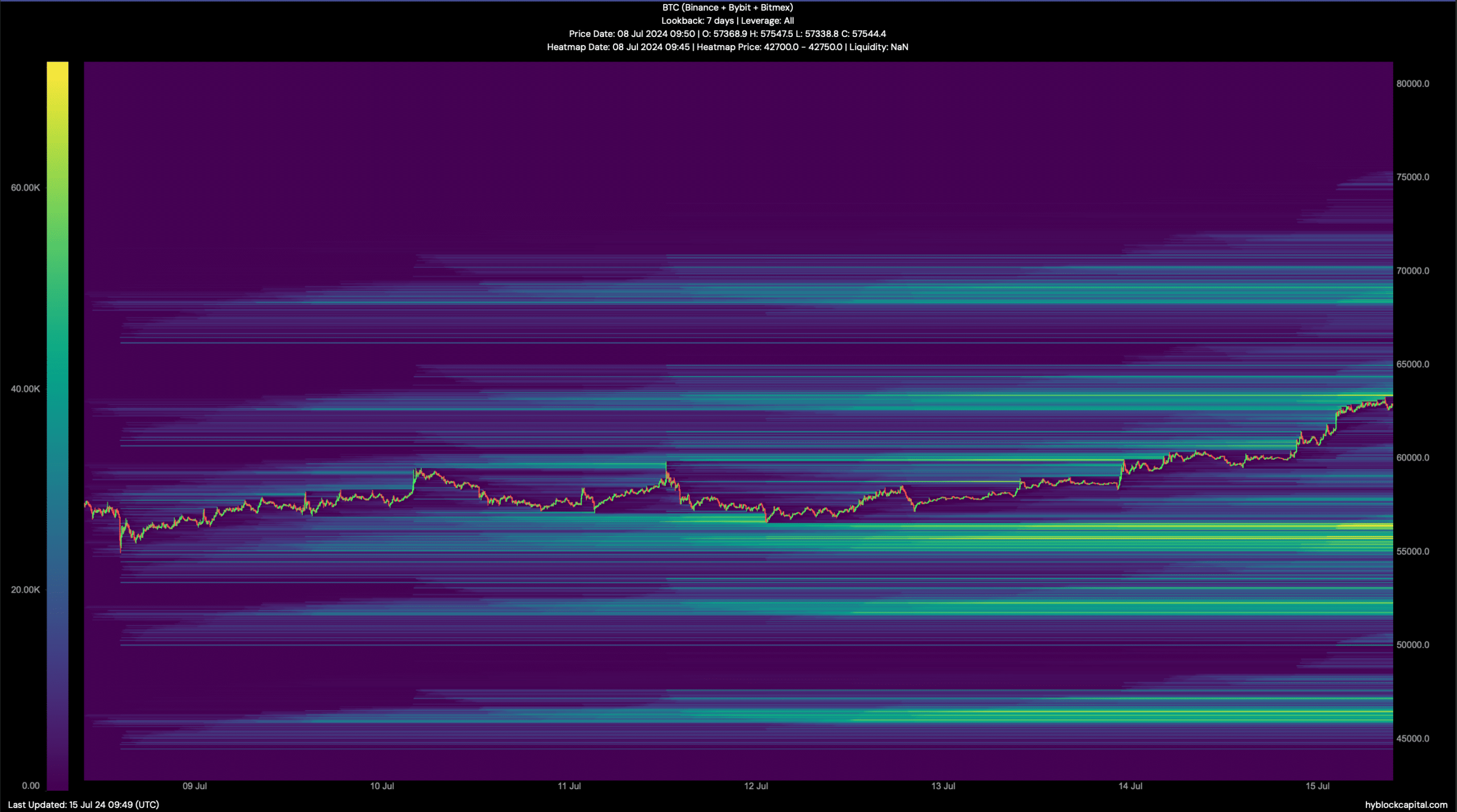

Therefore, AMBCrypto checked Hyblock Capital’s data to look for short-term support and resistance levels.

Read Bitcoins [BTC] Price prediction 2024-25

We found that if the bulls continue to control the market, it will not be surprising to see BTC reach $68,000 in the coming days.

However, if a trend reversal occurs, as suggested by the NVT ratio, it could fall again to $56,000.

Source: Hyblock Capital