- Bitcoin suffered a sharp decline, falling below $60,000, with analysts predicting a possible recovery due to a CME gap.

- Whale activity has increased despite the price drop, indicating strong market interest and potential bullish momentum.

Bitcoin [BTC] has experienced a sudden and significant drop in the past 24 hours, which has surprised many in the crypto community.

After briefly trading above $63,000 in the early hours of the previous day, Bitcoin saw a sharp decline, falling more than 6% to reach the $57,000 region.

Although the cryptocurrency has since recovered slightly and is now trading at $59,103, it continued to fall 5.7% over the past day.

This bearish price action has sparked widespread debate among analysts and traders, and it continues to do so now reevaluate their short-term prospects for digital assets.

A quick recovery in prospect?

The unexpected drop has led several prominent analysts to share their updated perspectives on Bitcoin’s future trajectory.

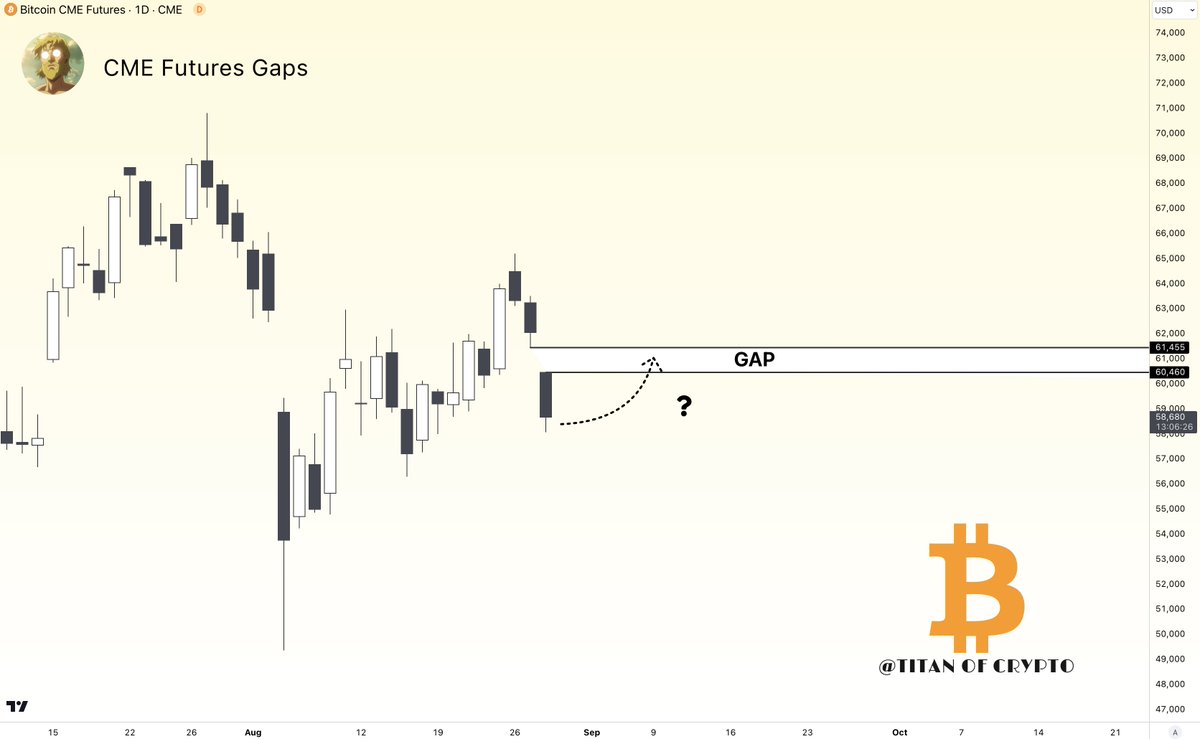

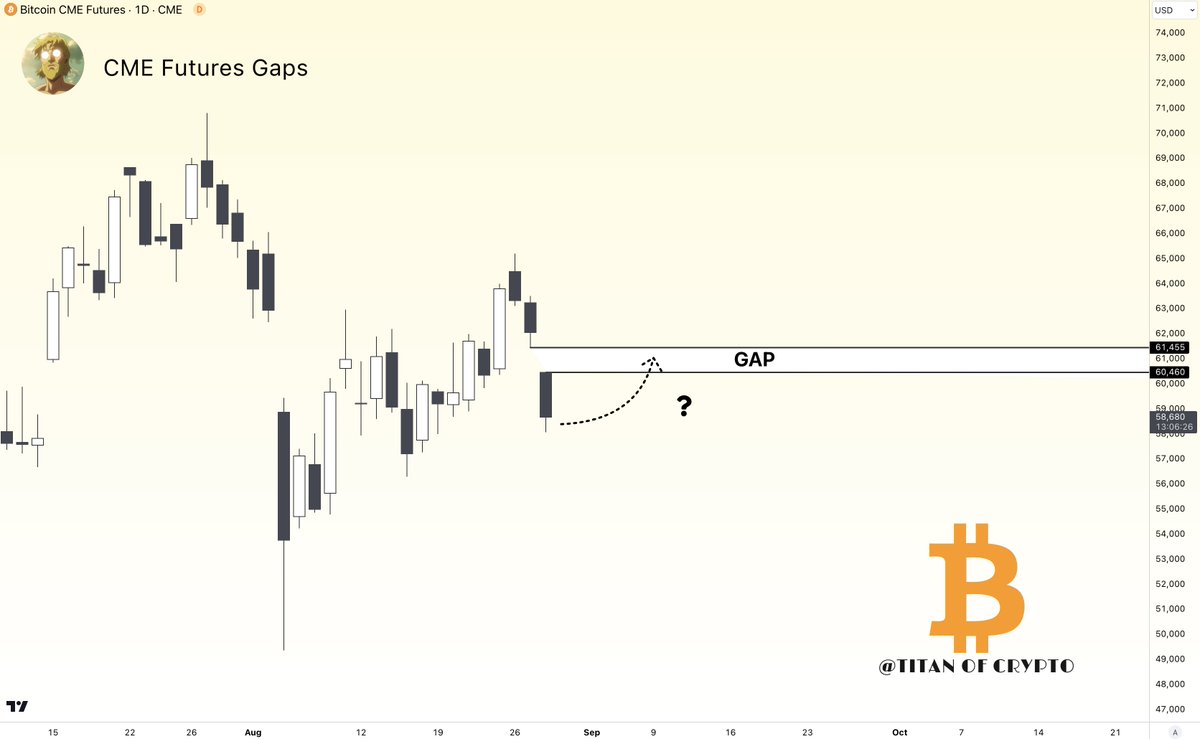

One such analyst, Crypto’s Titan, turned to X (formerly Twitter) to suggest that Bitcoin could quickly recover to the $61,000 region.

Source: Titan by Crypto on X

Crypto’s Titan Pointed Out the Emergence of a CME Futures Gap in the Daily Timeframe, to report,

“Bitcoin short-term update. A CME futures gap has appeared on the daily time frame. BTC could retreat to around $61,400 to fill it.”

A CME Futures gap occurs when the price of Bitcoin on the Chicago Mercantile Exchange (CME) opens at a significantly different level than where it closed during the previous trading session.

This gap is often seen as a key indicator by traders, who believe that Bitcoin tends to ‘fill’ these gaps by returning to the level where the gap emerged.

In this context, Titan of Crypto’s analysis suggested that Bitcoin could rise to around $61,400 to close this gap, providing a potential short-term recovery opportunity.

However, other analysts have taken a more cautious approach in response to the current price drop.

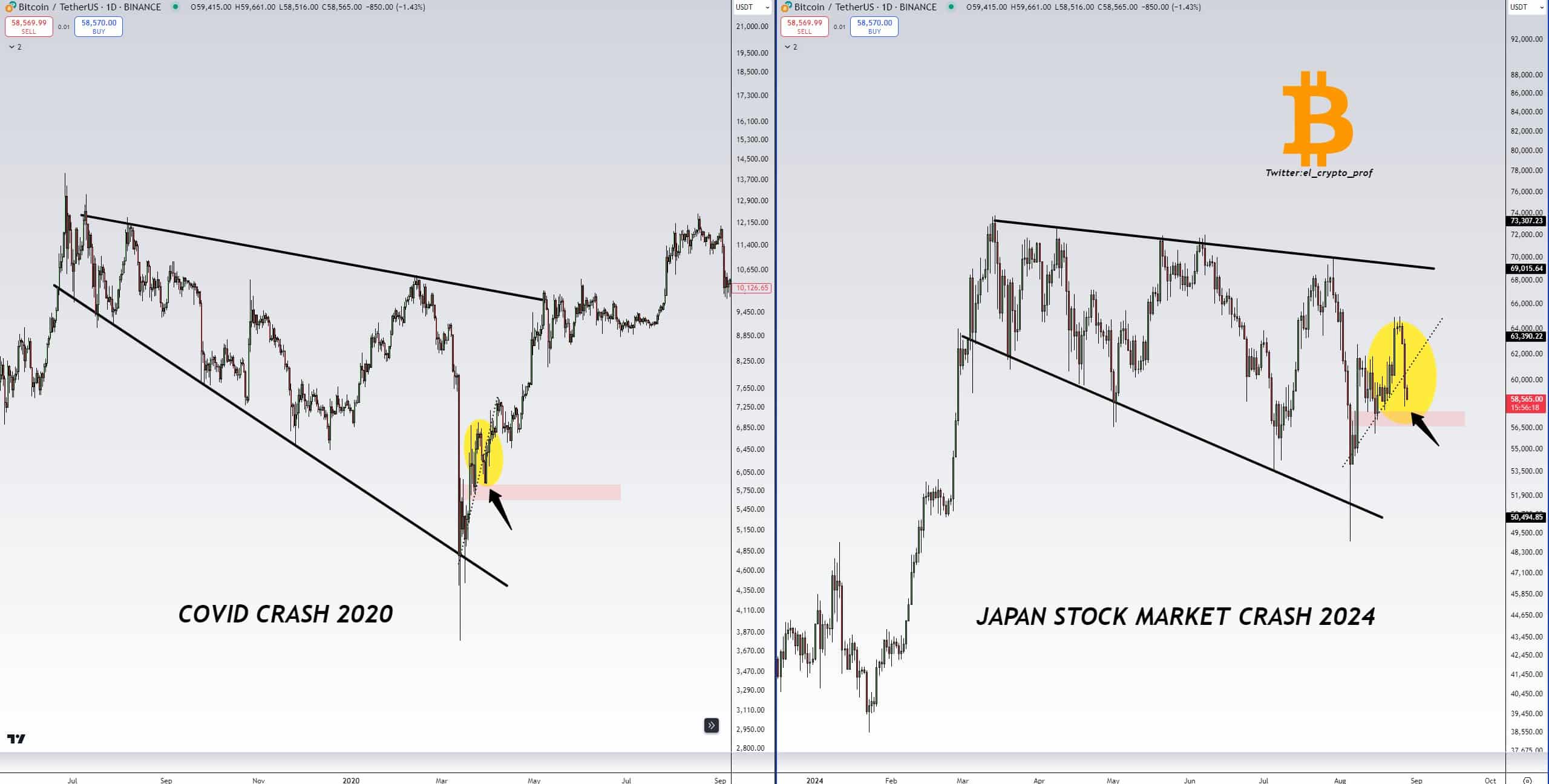

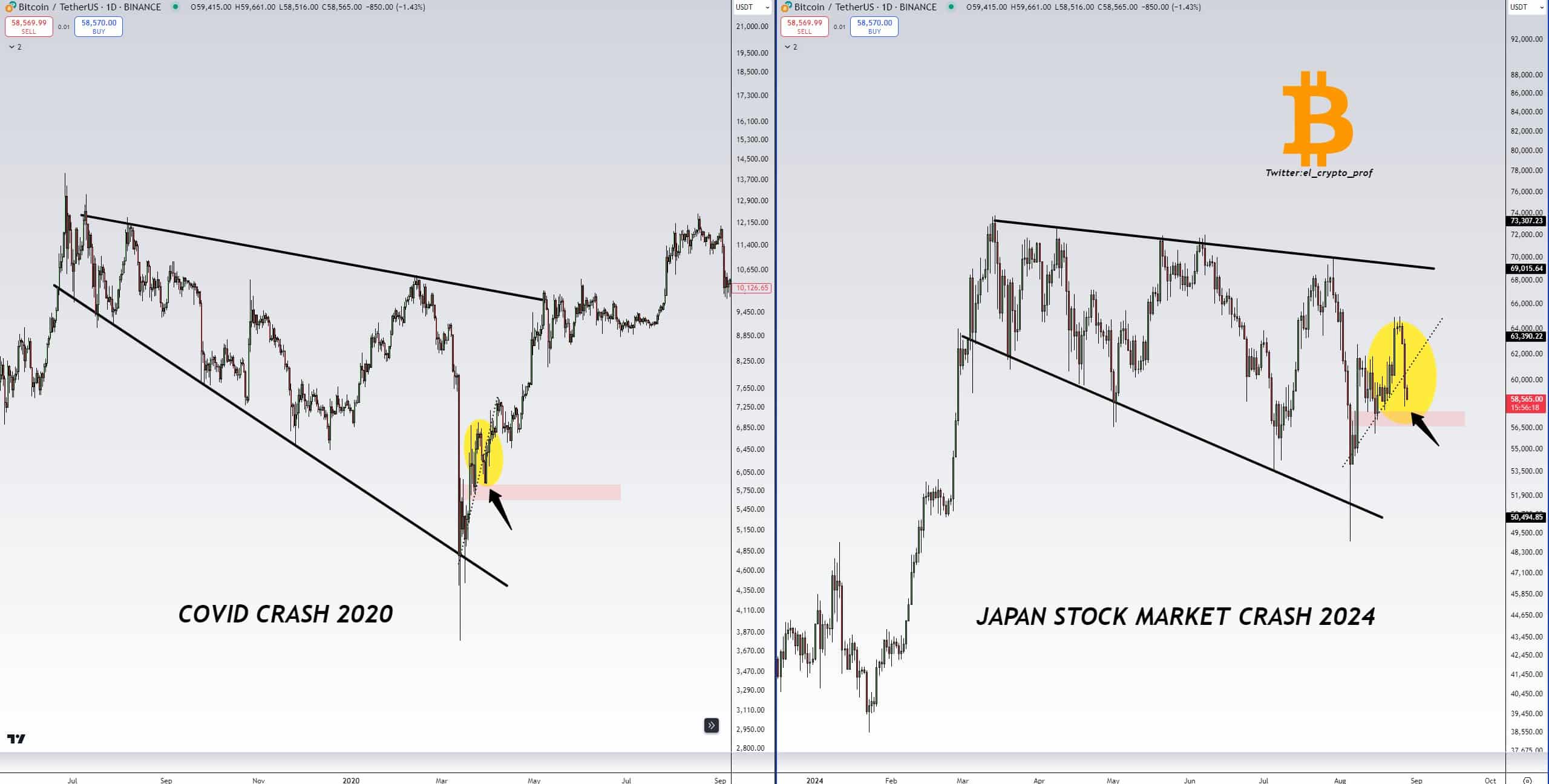

Mustache, another well-known figure in the crypto world, urged calm by drawing parallels between the current market situation and past events.

Mustache shared two images comparing Bitcoin’s price chart from 2020, when the cryptocurrency experienced a sharp decline before a significant rally, with the current price action following the 2024 Japanese stock market crash.

Source: Mustache/X

Mustache commented:

“Covid crash 2020 vs Japanese stock market crash 2024. No need to worry here, imo. BTC continues to copy the 2020 fractal almost 1:1.”

Bitcoin’s fundamentals are showing mixed signals

Despite continued volatility, Bitcoin’s fundamentals offered some insight into the asset’s potential direction.

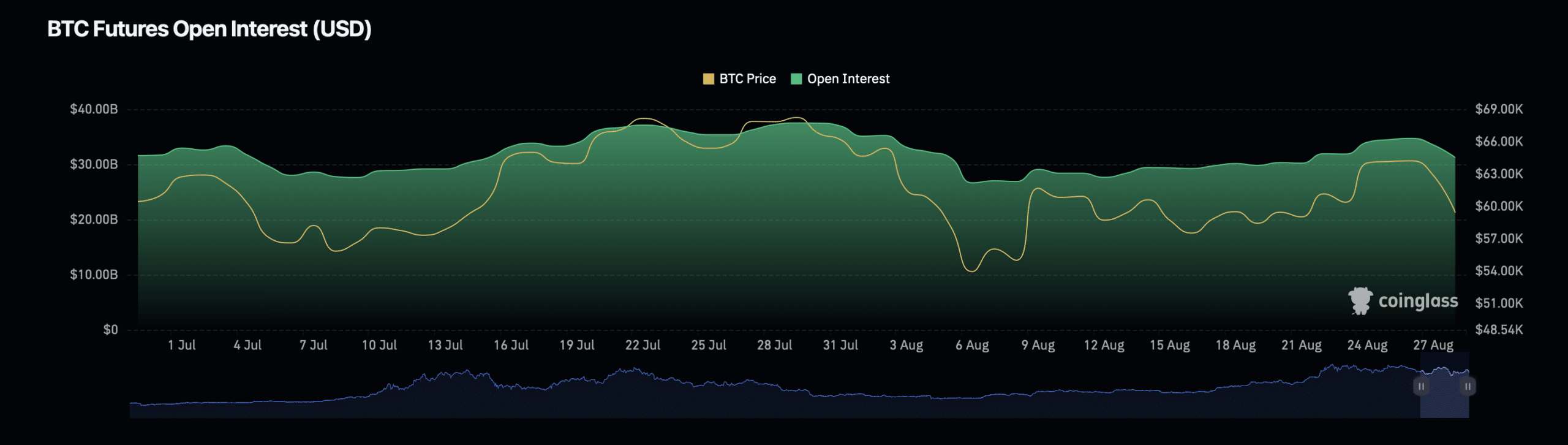

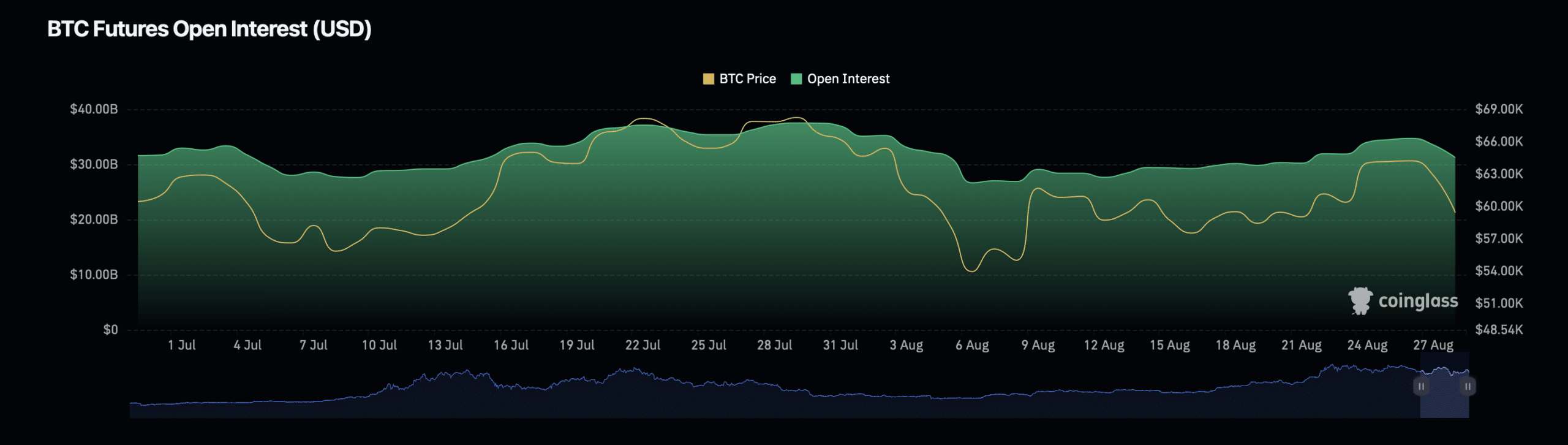

Facts from Coinglass revealed an interesting trend in Bitcoin’s Open Interest, which has fallen nearly 7% over the past day to reach a valuation of $31.02 billion.

Source: Coinglass

However, the asset’s Open Interest volume told a different story, with a substantial increase of 62.93% to a valuation at the time of writing of $83.73 billion over the same period.

This difference between Open Interest and volume suggested that although fewer traders held positions, the intensity and size of trades increased significantly.

This indicated increased market activity that could lead to further price fluctuations.

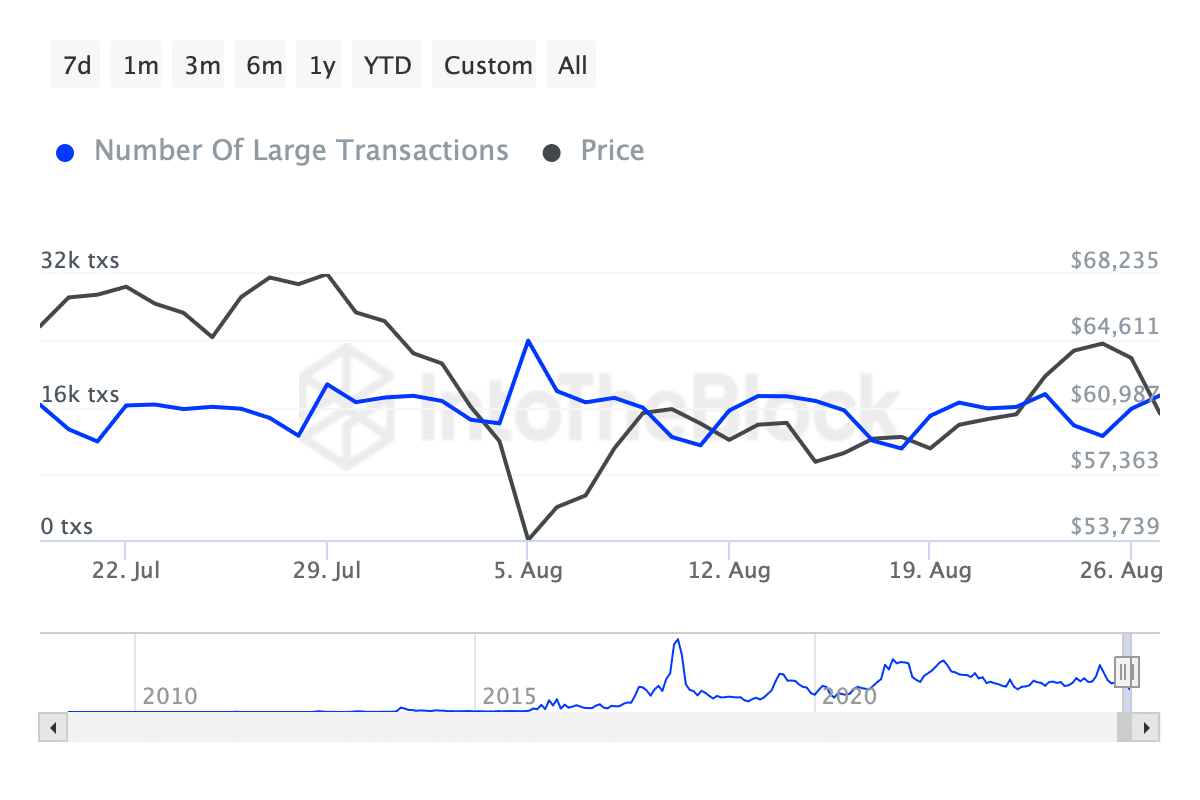

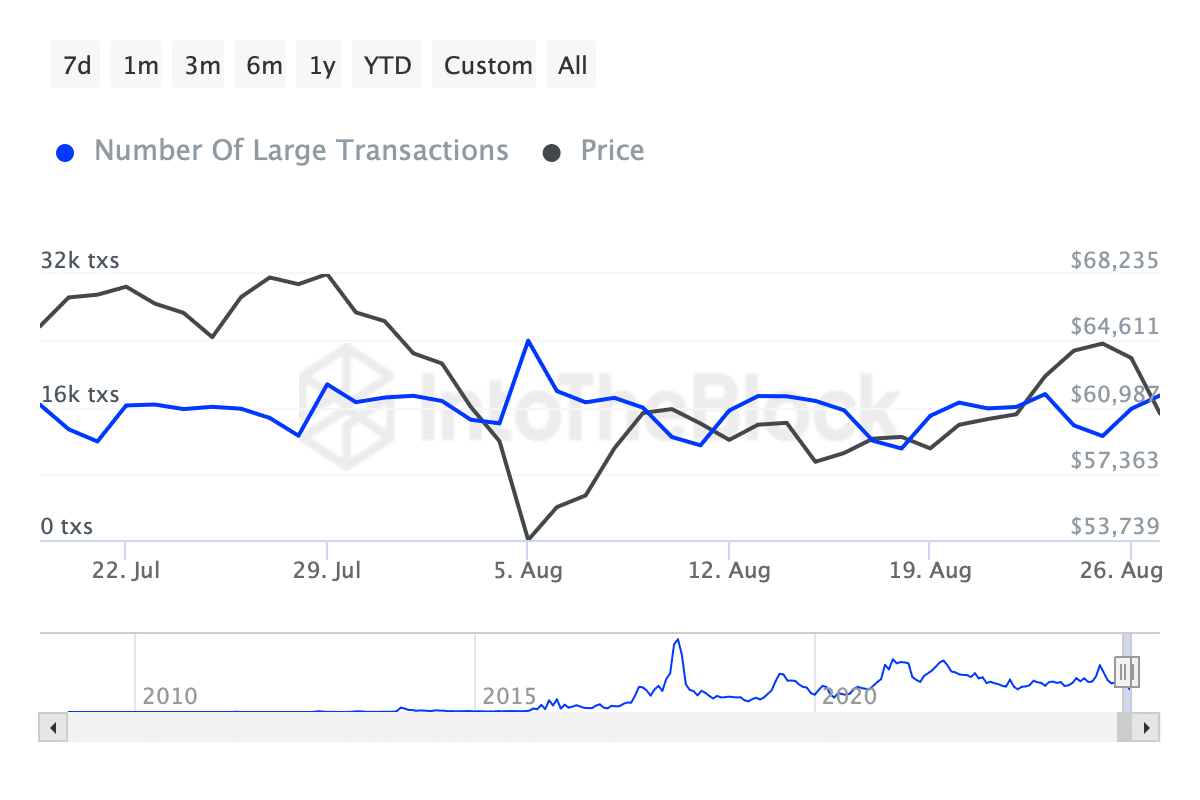

Moreover, facts from IntoTheBlock showed a notable increase in Bitcoin whale transactions over the past week, especially transactions larger than $100,000.

Despite the recent price drop, whales – major holders of Bitcoin – seemed to amass a larger share of the assets.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

The number of whale transactions has also increased from less than 13,000 over the weekend to over 17,000 at the time of writing.

This increase in whale activity suggested that key market players could be positioning themselves for a potential upside move even amid the current bearish trend.