- BTC broke its previous ATH as it rose to over $94,000.

- At the time of writing, the price is trading around $92,500.

Bitcoin [BTC] saw a dramatic reversal after hitting an all-time high of $94,000 in the last trading session.

This peak was followed by a sharp decline, caused by long-term holders liquidating positions worth $3 billion.

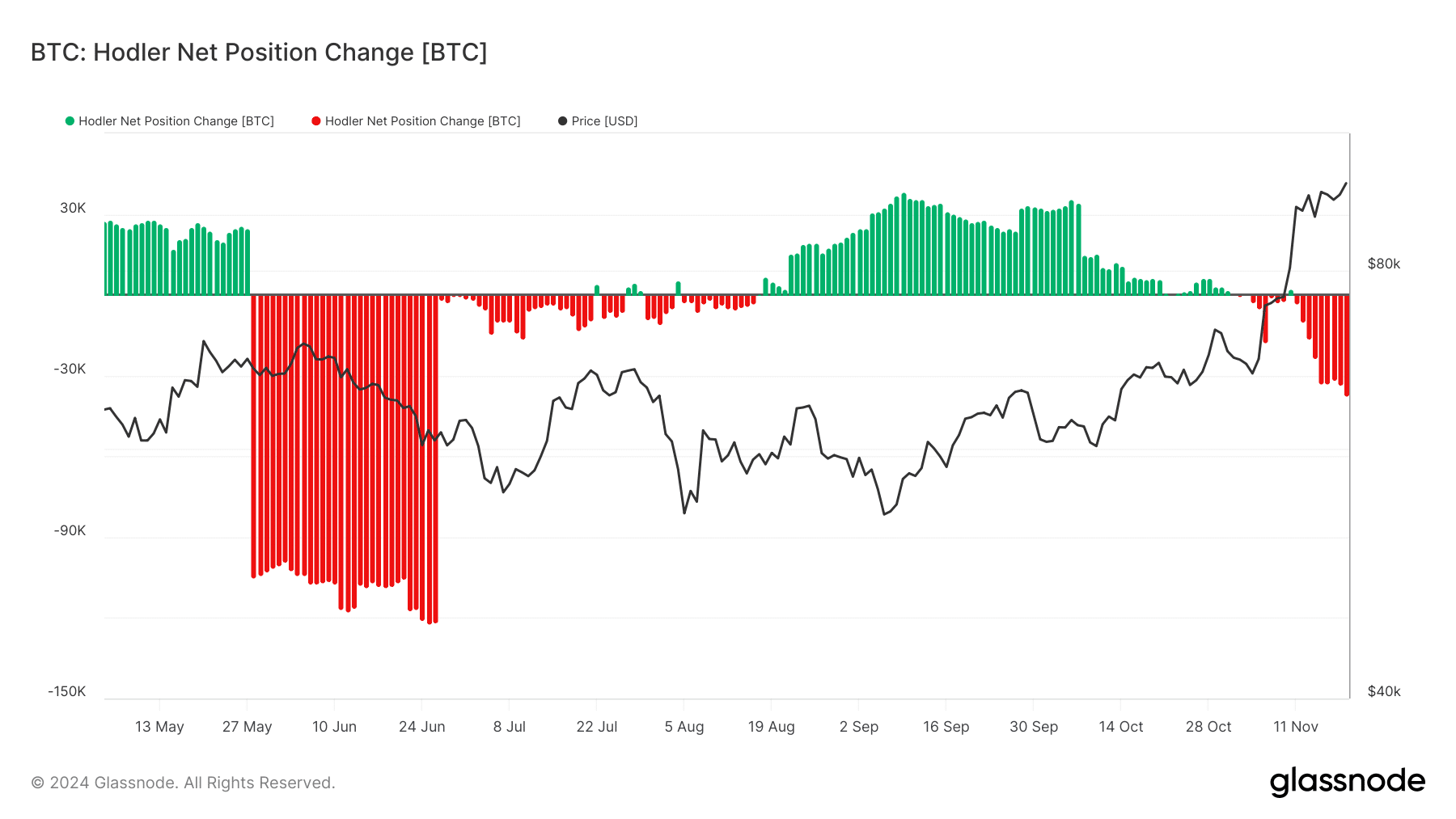

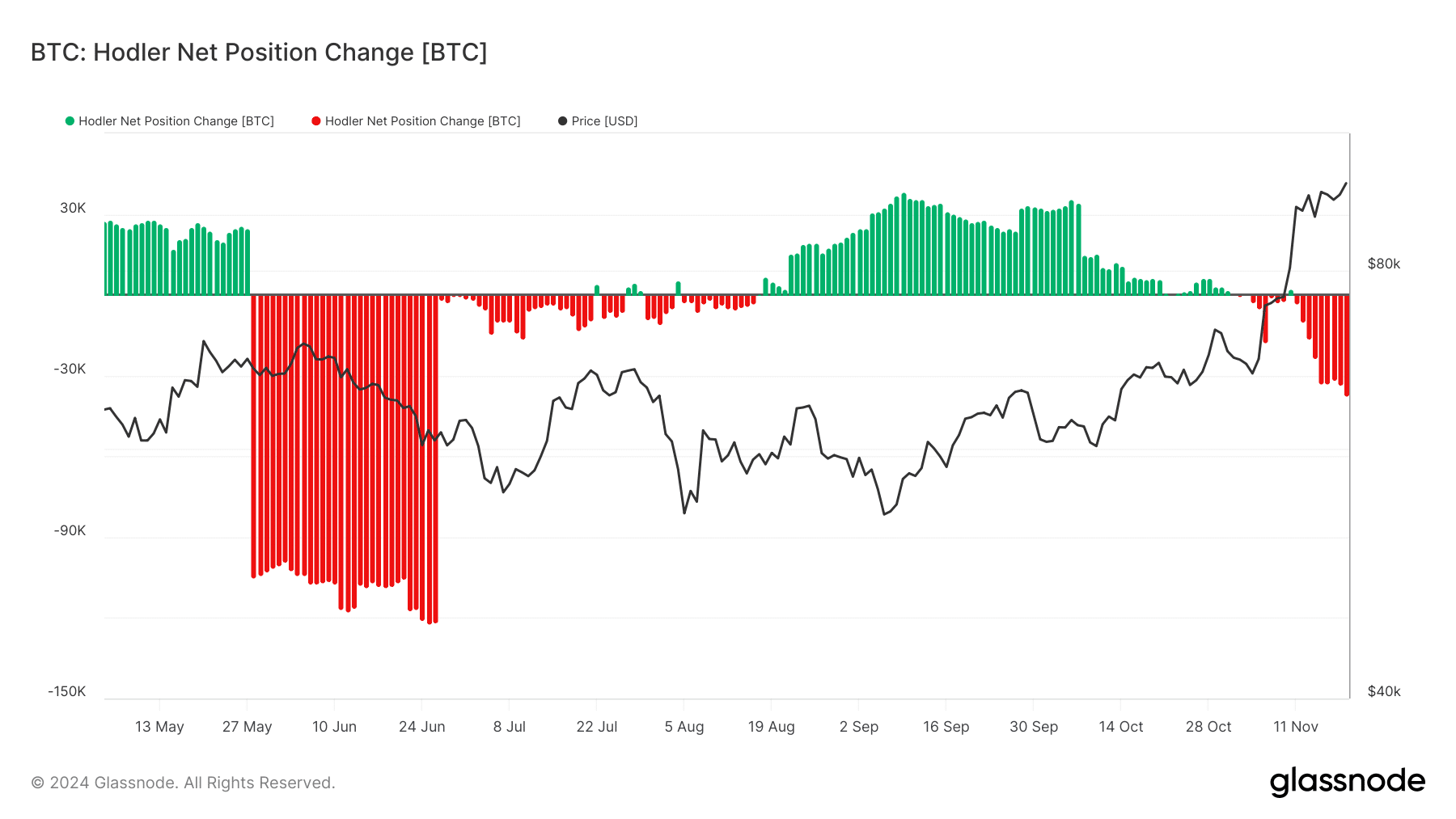

On-chain data indicated that the HODLer Net Position Change metric fell to its most negative level in months, while net exchange flows also indicated increased selling pressure.

This combination of factors has the market wondering: is this the start of a deeper correction or a consolidation before further gains follow?

Bitcoin Slumps: Price Action and Technical Analysis

Bitcoin’s price chart highlighted the rapid rise to $94,000 before retreating to $92,500.

Analysis by AMBCrypto showed that the price of BTC, which started around $90,000, rose to around $94,105 during the last trading session.

Trading volume showed a significant increase, reflecting increased activity during the sell-off.

The 50-day moving average remained above the 200-day moving average, indicating that the long-term upward trend was still intact.

Source: TradingView

However, the RSI stood at 76.62, indicating an overbought situation. This, coupled with the MACD’s weakening momentum, suggested that Bitcoin could enter a consolidation phase or even a short-term correction.

Support levels around $90,000 and $85,000 will be crucial to watch as a break of these levels could worsen the downturn.

HODLer behavior: profit taking at peak levels

AMBCrypto’s analysis of from Glassnode The graph showed that the HODLer Net Position Change revealed a significant shift in the long-term behavior of holders.

After months of accumulation (indicated by green bars), recent activity shows a sharp transition to distribution (red bars).

At the time of writing, the HODLer chart has recorded its most negative trend since June. More than 37,000 BTC, worth over $3.4 billion, have been sold.

So long-term investors opted to take profits when Bitcoin reached its all-time high.

Source: Glassnode

Such behavior is typical during extended rallies, where the lure of record profits motivates even the most steadfast holders to sell.

Historically, similar selloffs have led to temporary pullbacks before Bitcoin resumed its bullish trajectory.

The AC flows highlight the selling pressure

The CryptoQuant chart on Bitcoin exchange netflows further underlined the ongoing sell-off. A spike in inflows on exchanges indicates that holders are moving their BTC to exchanges, likely with liquidation in mind.

AMBCrypto’s analysis showed that the negative flow peaked during the last trading session, when more than 8,600 BTC were registered. At the time of writing this has remained negative.

Negative net flows during previous accumulation periods had supported Bitcoin’s price rise, but the recent reversal signals a shift in market sentiment.

Source: CryptoQuant

If foreign exchange inflows continue to exceed outflows, it could create persistent selling pressure, making it difficult for Bitcoin to recover its all-time high in the near term.

However, a decline in premium income could indicate that most profit-taking has already taken place.

What’s next after the Bitcoin crisis?

After a prolonged rally, Bitcoin’s pullback from $94,000 reflects a natural profit-taking phase, with long-term holders enjoying gains.

The technical and on-chain indicators suggest that while the broader trend remains bullish, the market could be poised for consolidation or a short-term correction.

Read Bitcoin’s [BTC] Price forecast 2024-25

Critical levels to keep an eye on include the $90,000 and $85,000 support zones and on-chain metrics such as HODLer activity and exchange net flows.

A reversal of selling pressure or renewed buying interest could pave the way for Bitcoin to challenge new highs, but for now, caution remains necessary as the market digests these major moves.