- Bitcoin Dominance showed signs of cooling after violating a key resistance zone.

- Are alternative assets ready for a revival of investment portfolios?

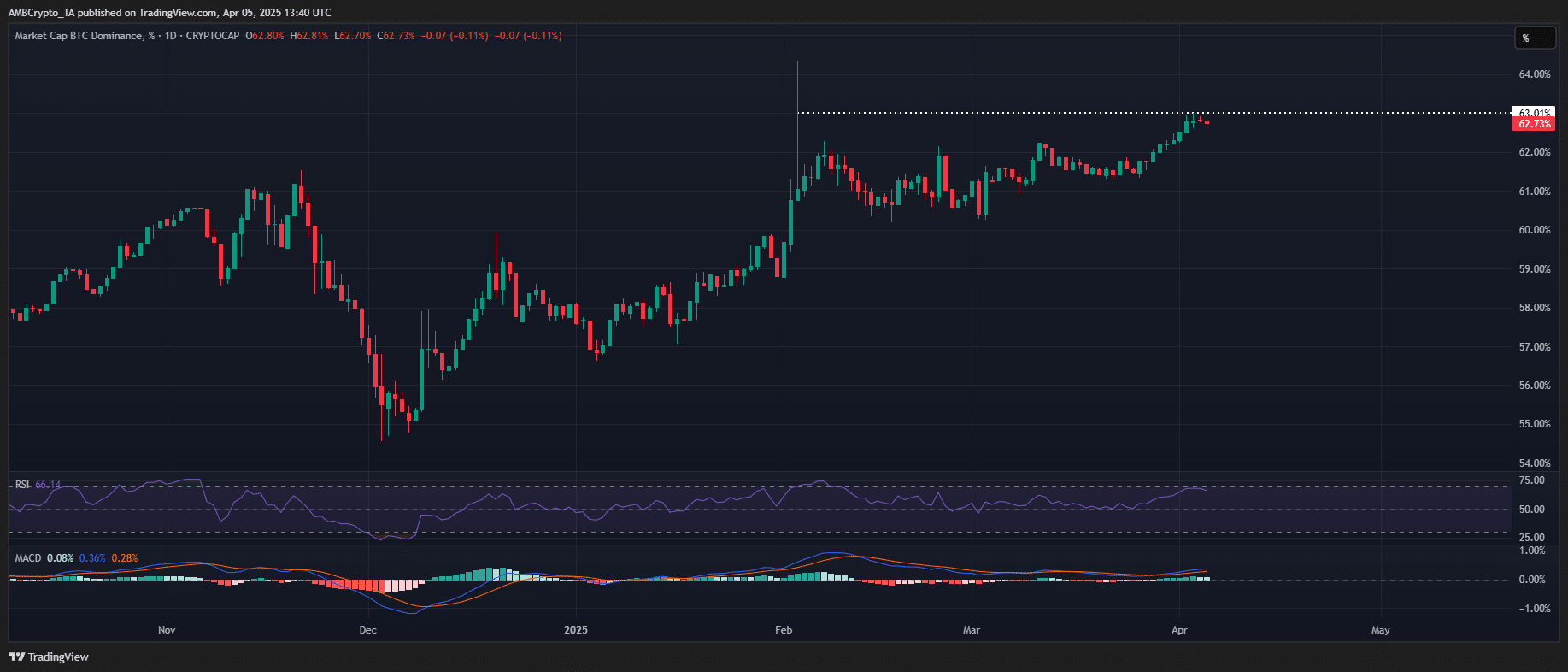

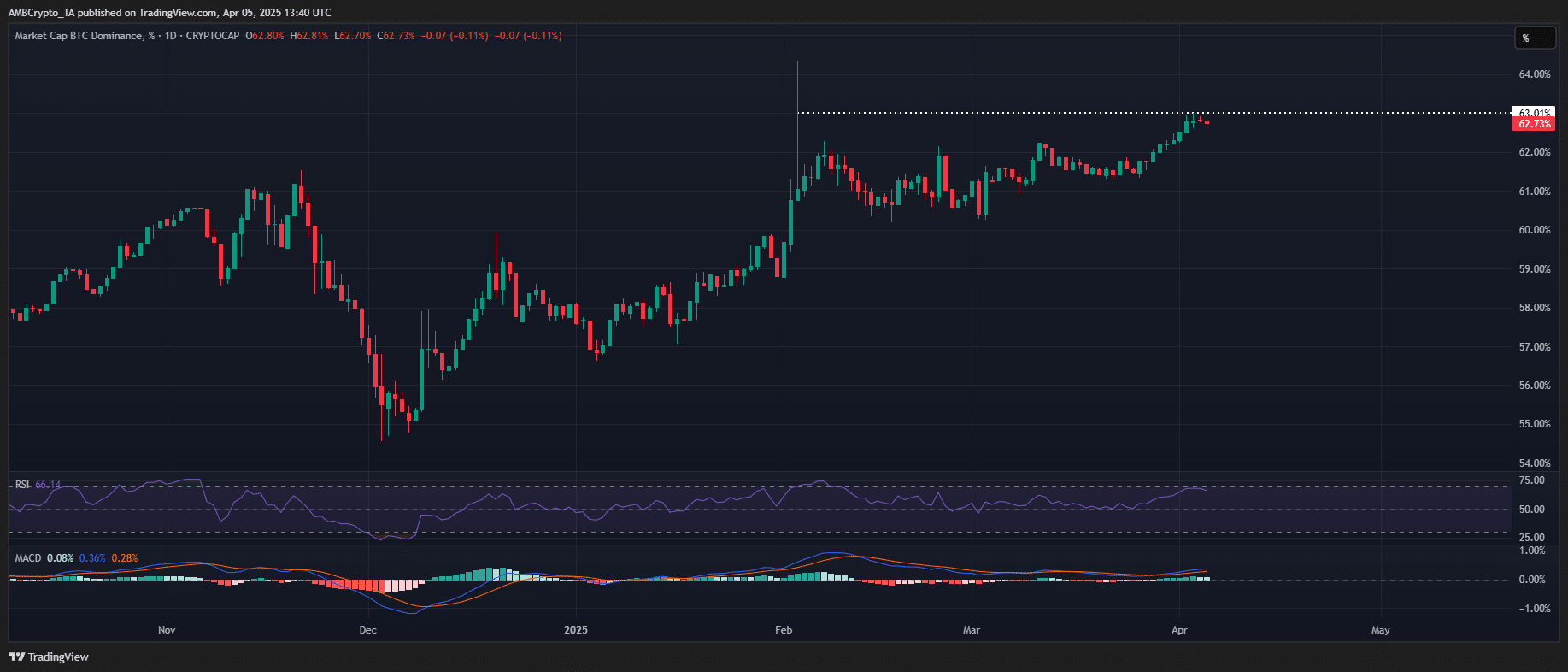

After a strong rally, Bitcoin -Dathinance [BTC.D] has begun to show signs of exhaustion.

At the time of the press, the relative strength index (RSI) was deep overbought, which increases the chance of a corrective retracement, while the MACD Bearish -Crossover signaled a momentum shift while BTC.D tests the most important resistance level of 63%.

Historically, such technical circumstances preceded capital rotations in risk-on assets, which suggests a possible revival of Altcoin when BTC.D starts to relax.

Source: TradingView (BTC.D)

However, confirmation of a local top remains elusive. Although Bitcoin has demonstrated structural resilience in the midst of macro-offs, altcoins with high caps remain very volatile with failed support tests.

Solana [SOL] Serves as a good example-in-house, it actively recovered $ 115 in March. Yet it has not succeeded in establishing a solid support basis, making it structurally weak and susceptible to further distribution cascades.

The same pattern extends to most altcoins, which strengthens a fragile market structure. Consequently, reducing the risk of continuing capital rotation is reduced despite the overheated technical technical BTC.D.

Altcoins ready to disconnect from Bitcoin Dominance

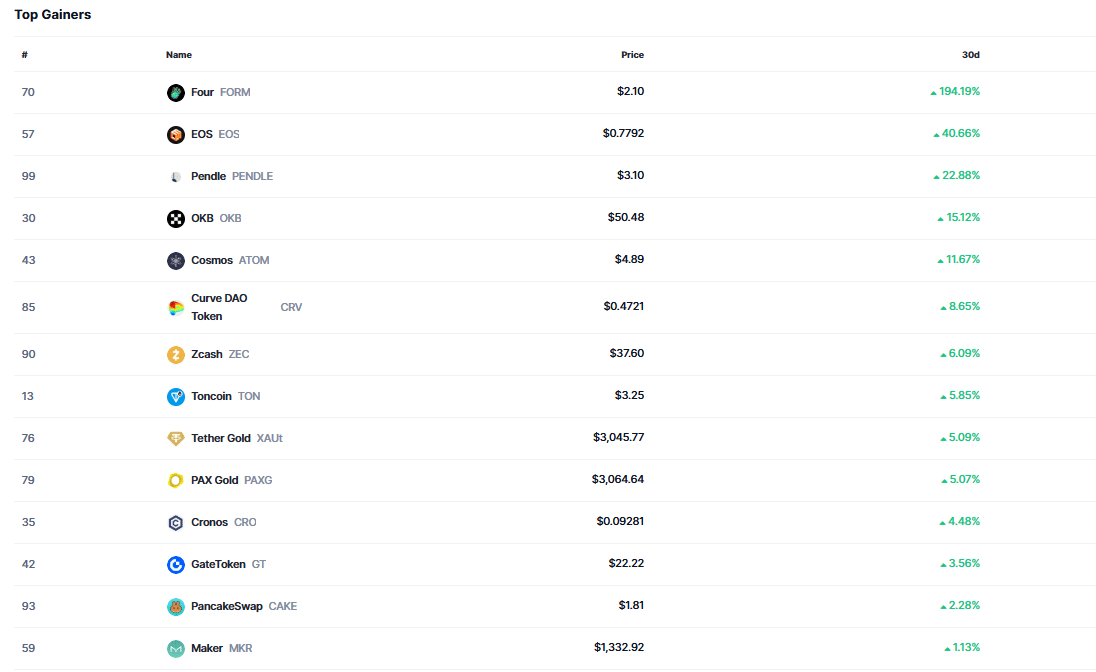

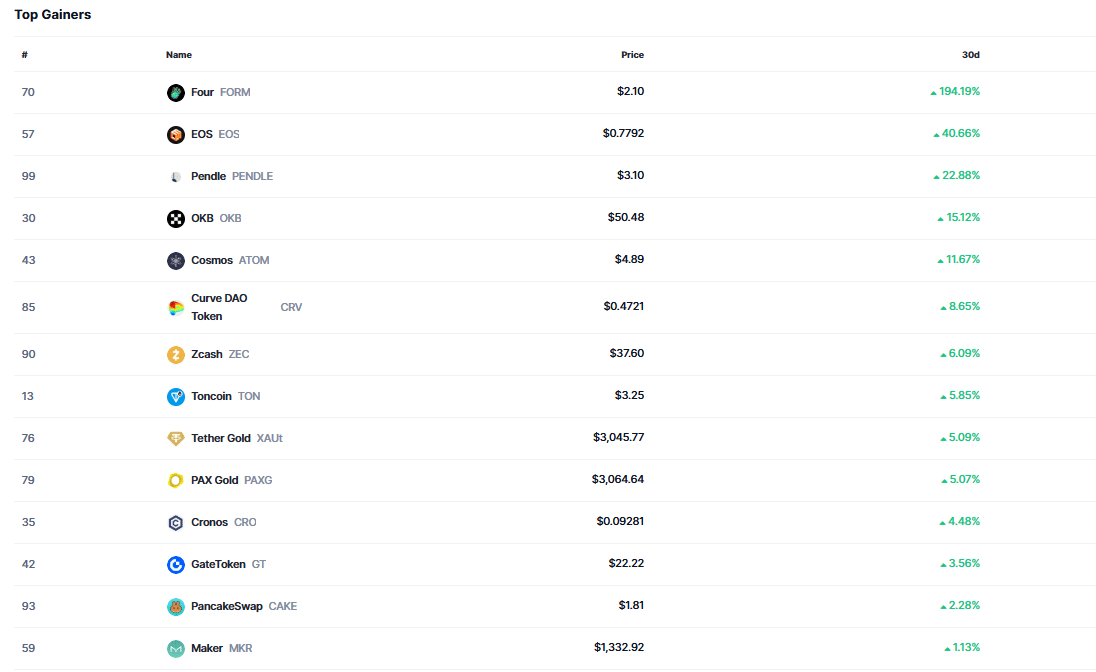

Coinmarketcaps Monthly profit graph Underlines a decisive capital rotation in low and mid-cap altcoins.

Topping of the Leaderboard is four [FORM]An active with a low cap that has posted a rally of 194.19% at $ 2.10, indicating an increased speculative interest and liquidity inflow.

Mid-Cap Activa such as EOS [EOS]OKB [OKB]and Cosmos [ATOM] have also made remarkable profits, each retaining market capitalization above $ 1 billion, which signals a broader market participation above Bitcoin’s dominance.

Source: Coinmarketcap

High Cap-Altcoins, on the other hand, continue to be confronted with distribution pressure. Despite some trade at Subs $ 1 levels, their demand has decreased as BTC Dominance Peaks.

In particular, there is no power of a high cap-cap [ADA] The disadvantage leads and registers a steep monthly marking of 30%.

As leaders within the Altcoin market, their failure disrupts Bullish Momentum, the capital rotation dynamics.

This structural divergence underlines why, despite Bitcoin -Dominance that flashes overbought conditions, a long -term Altcoin season Remains unlikely.