- Bitcoin’s dominance has reached a local high, warning investors of a potential market overheating.

- THIS highlights the next best “dip” opportunity.

Two days ago, Bitcoin [BTC] Its dominance rose to an impressive 57%, following a daily gain of more than 5% that pushed BTC above the $66,000 mark – a level it had not exceeded in more than 150 days.

Bitcoin is now trading at $67,350 and has risen more than 10% in just one week. This rapid rise has led analysts at AMBCrypto to speculate whether the market is approaching an overextension.

If this is the case, a pullback to a local low could occur before BTC attempts to retest its all-time high.

High bitcoin dominance indicates overheating

Over the past week, daily gains of over 2% have helped Bitcoin recover from the $60,000 slump, confirming that this level is new support.

Furthermore, the rise was reinforced by a rising RSI, indicating strong momentum. Trading volume also spiked to a new local high, signaling increased support from retail investors.

As a result, Bitcoin dominance also climbed to a new high. However, this bullish momentum has pushed BTC into “greed” territory, indicating possible signs of market overheating.

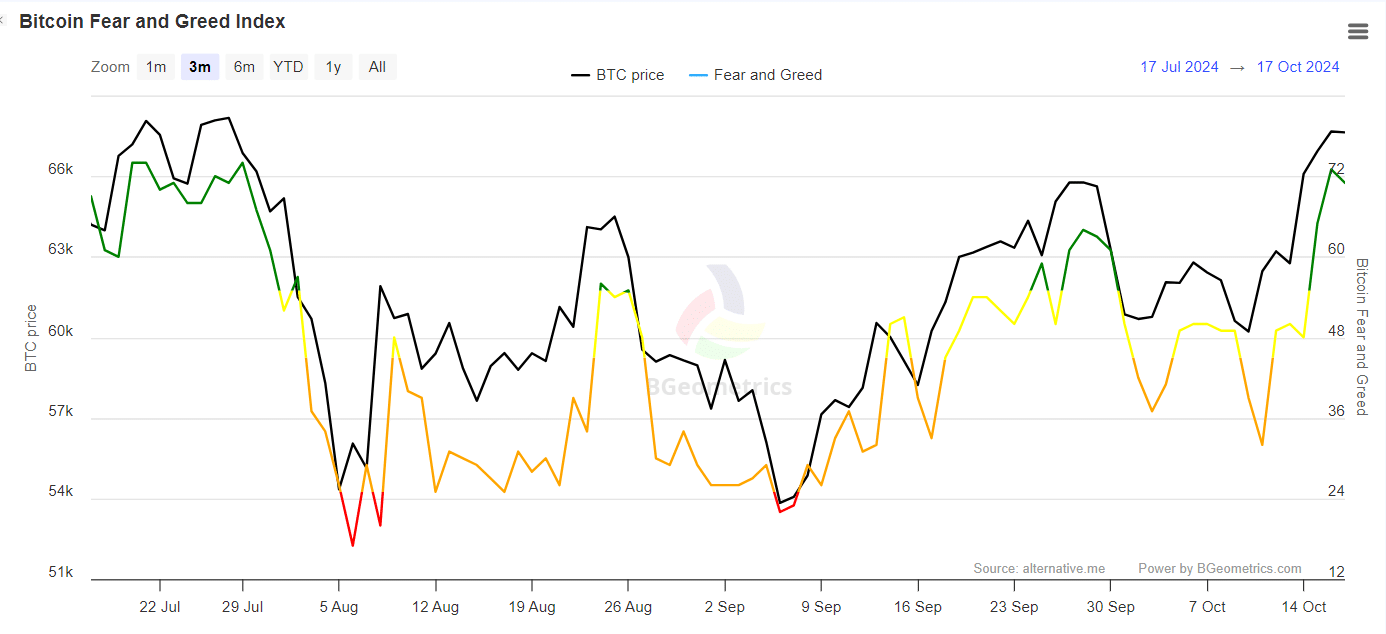

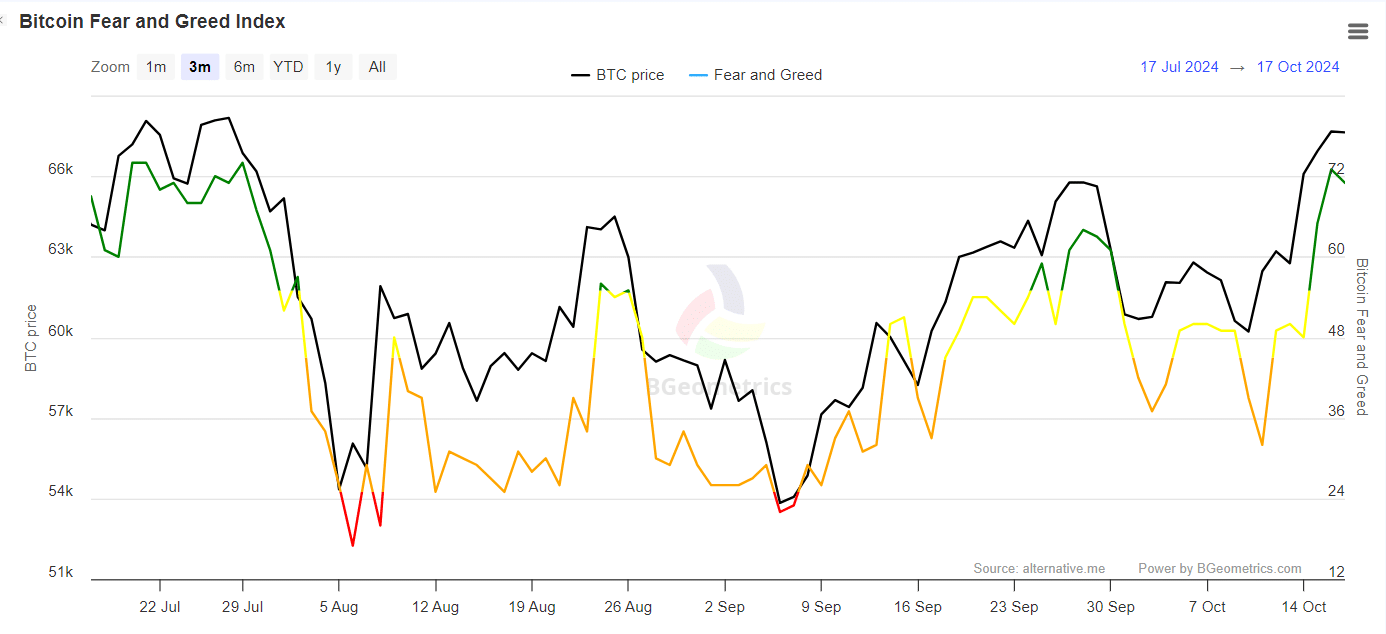

Source: BGeometrics

Historically, a shift toward greed often coincides with the stage in a cycle where Bitcoin reaches a market top, often leading to a subsequent price crash.

At this stage, many traders drop out and double their profits, while new buyers hesitate, fearing the inevitable correction.

Therefore, these traders usually wait for a downside buying opportunity, taking advantage of the market bottom when Bitcoin dominance reemerges.

Currently, with Bitcoin dominance reaching a new high and other signals pointing to a market top, Bitcoin could be primed for a correction.

This correction could shake weaker hands, allowing new buyers to take advantage of a potential dip.

Bitcoin could retreat to a local low

Bitcoin was previously rejected at $64,000, which should convert to support to signal the potential dip. This scenario unfolds as new interest sees this price range as an attractive entry point.

Moreover, BTC becomes more vulnerable to speculation swingsincreases the likelihood of larger short positions in futures trading, with traders targeting $64K as the next dip.

This situation further reinforces the idea that BTC may be waiting for a correction before attempting to test its ATH.

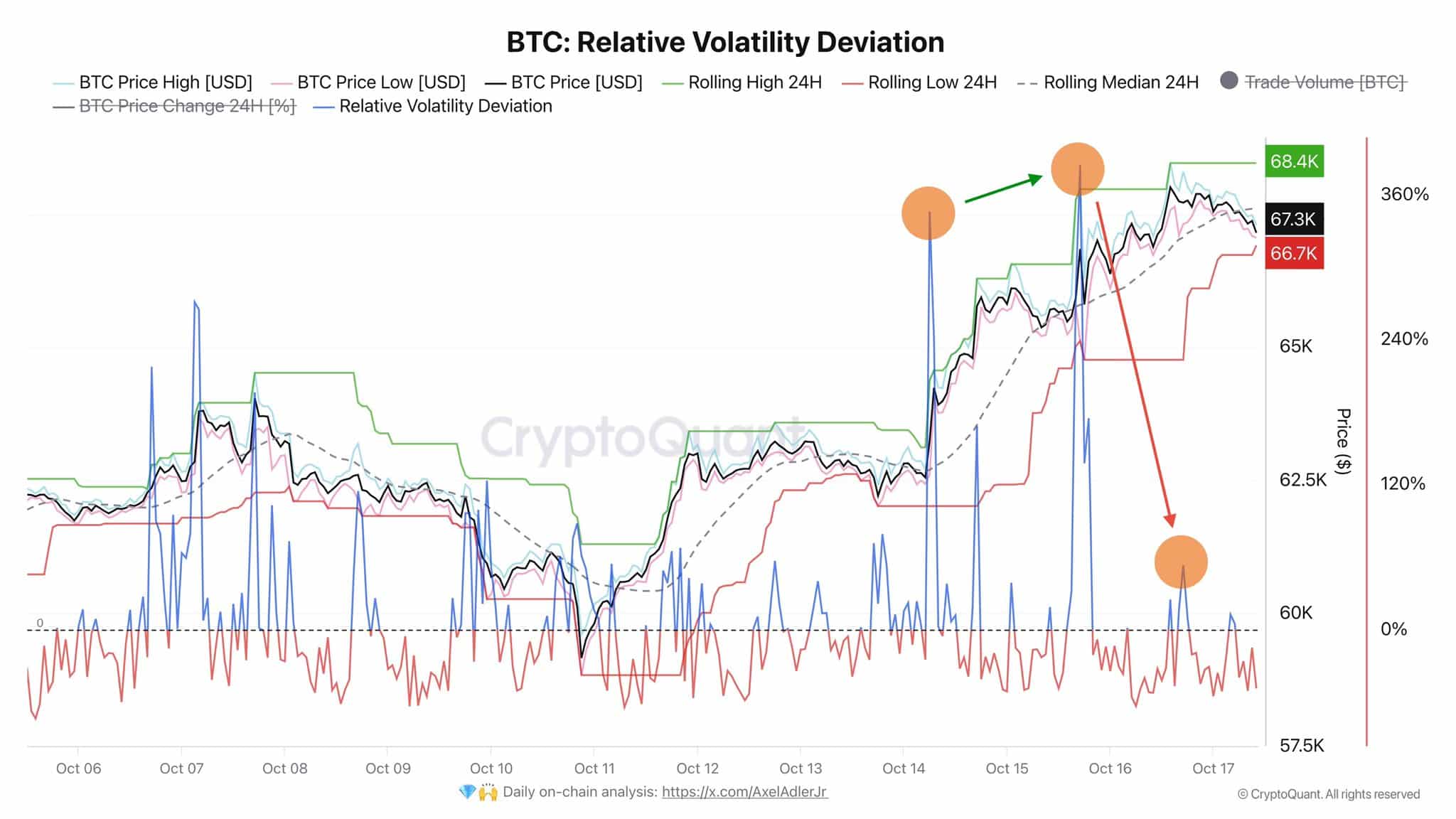

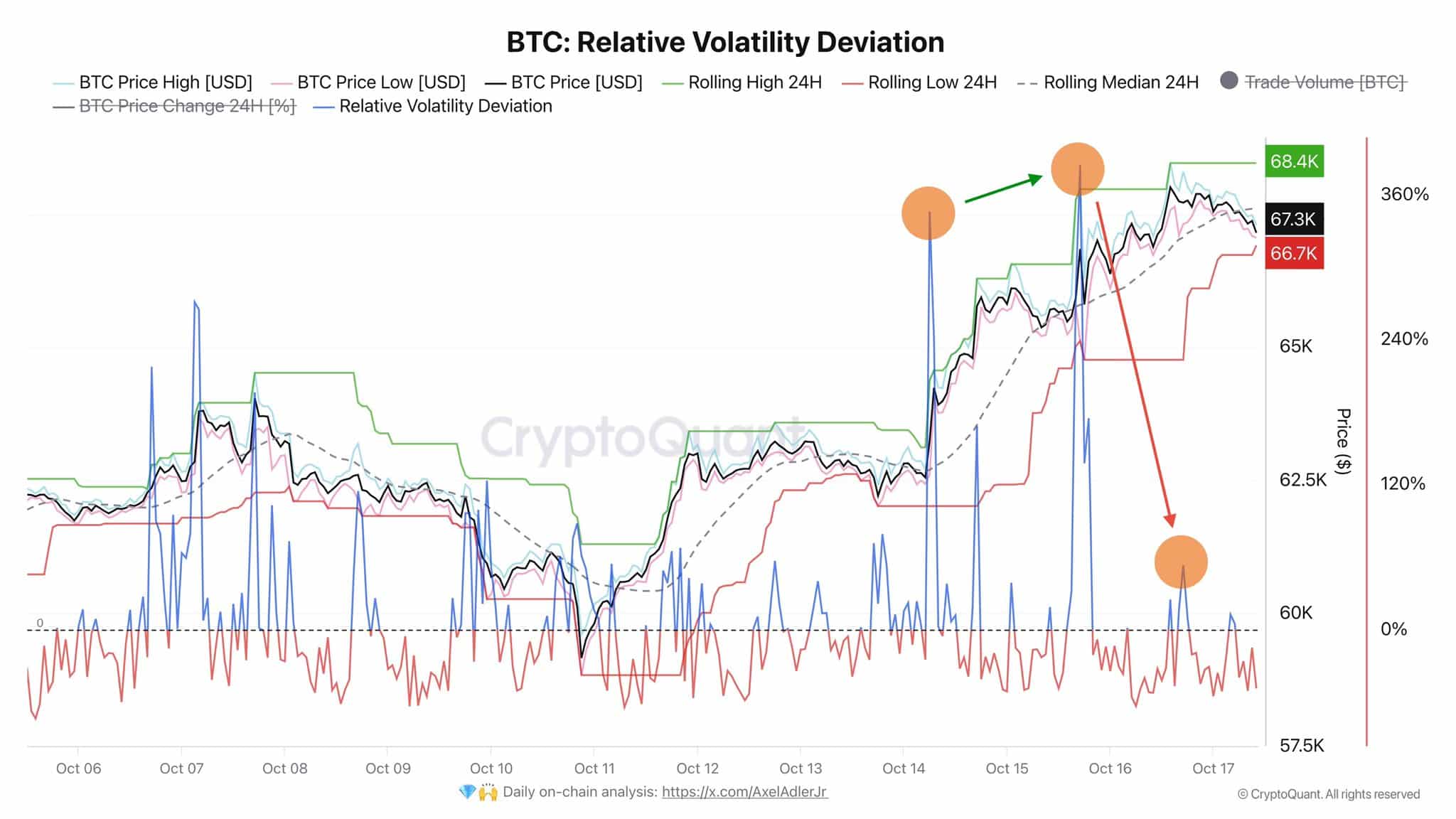

Source: CryptoQuant

Furthermore, a prominent one analyst has also warned investors as volatility has turned negative, driven by the surge in Bitcoin dominance.

Currently, the price is fluctuating between $68.4K and $66.7K, while the Open Interest on top exchanges has risen to $20.3B, making BTC even more vulnerable to sudden price fluctuations.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Overall, the high Bitcoin dominance indicates an overextension of the market, supported by other variables. The rapid rise to $67,000 has driven the market to greed, indicating that the current price represents a market top.

While the AMBCrypto analysis suggests $64K is the next target for a potential local low, it offers the best dip buying opportunity.