- Analysts claimed that the Alt season could lag amid a possible rise in BTC dominance.

- But other observers expected the alt season to be triggered by the launch of the US ETH ETF.

The altcoin market could reach a turning point this week as US spot Ethereum [ETH] ETF starts trading. As the largest altcoin, ETH’s performance could set the pace for the altcoin sector.

However, according to renowned crypto analyst Benjamin Cowsaltcoin season could lag amid a potential price surge Bitcoin [BTC] dominance ahead of a likely Fed rate cut in September.

According to Cowen, the current BTC dominance reflected the pattern of 2019, two months before the Fed cut rates and Alts failed to catch up.

“BTC also had an explosive movement at the time, and ALTs just couldn’t keep up. Similar candle today, possibly two months before the first rate cut.”

Source: X/Benjamin Cowen

Will Ethereum ETF Trigger Alt Season?

This could be bad news for crypto investors who were expecting relief from the altcoin market, which saw massive declines in June.

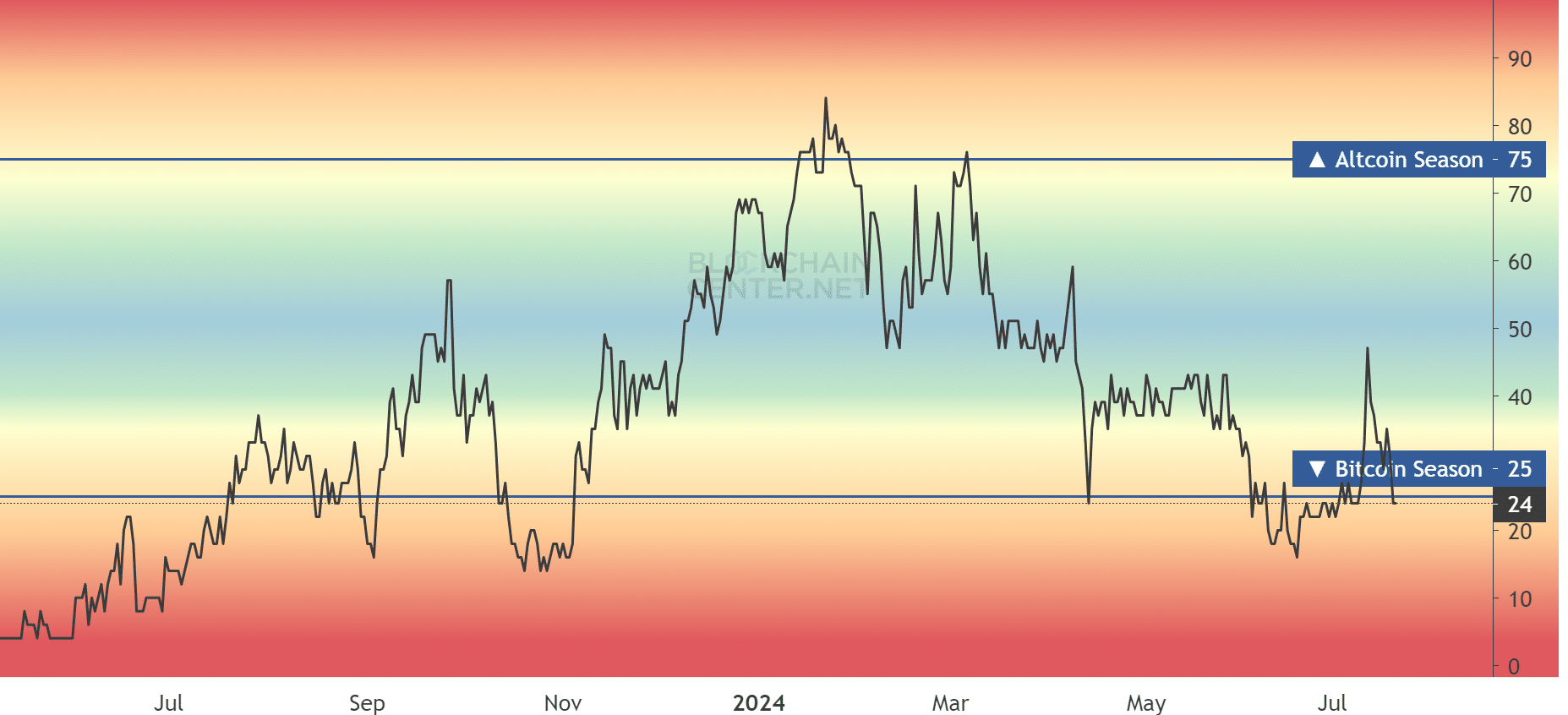

In addition, the Altcoin Season Index indicator revealed that the alt season had not yet started, at the time of writing.

Source: Blockchain Center

According to the indicator, the first half of 2024 was a Bitcoin season. And if Cowen’s predictions are correct, this pattern could continue.

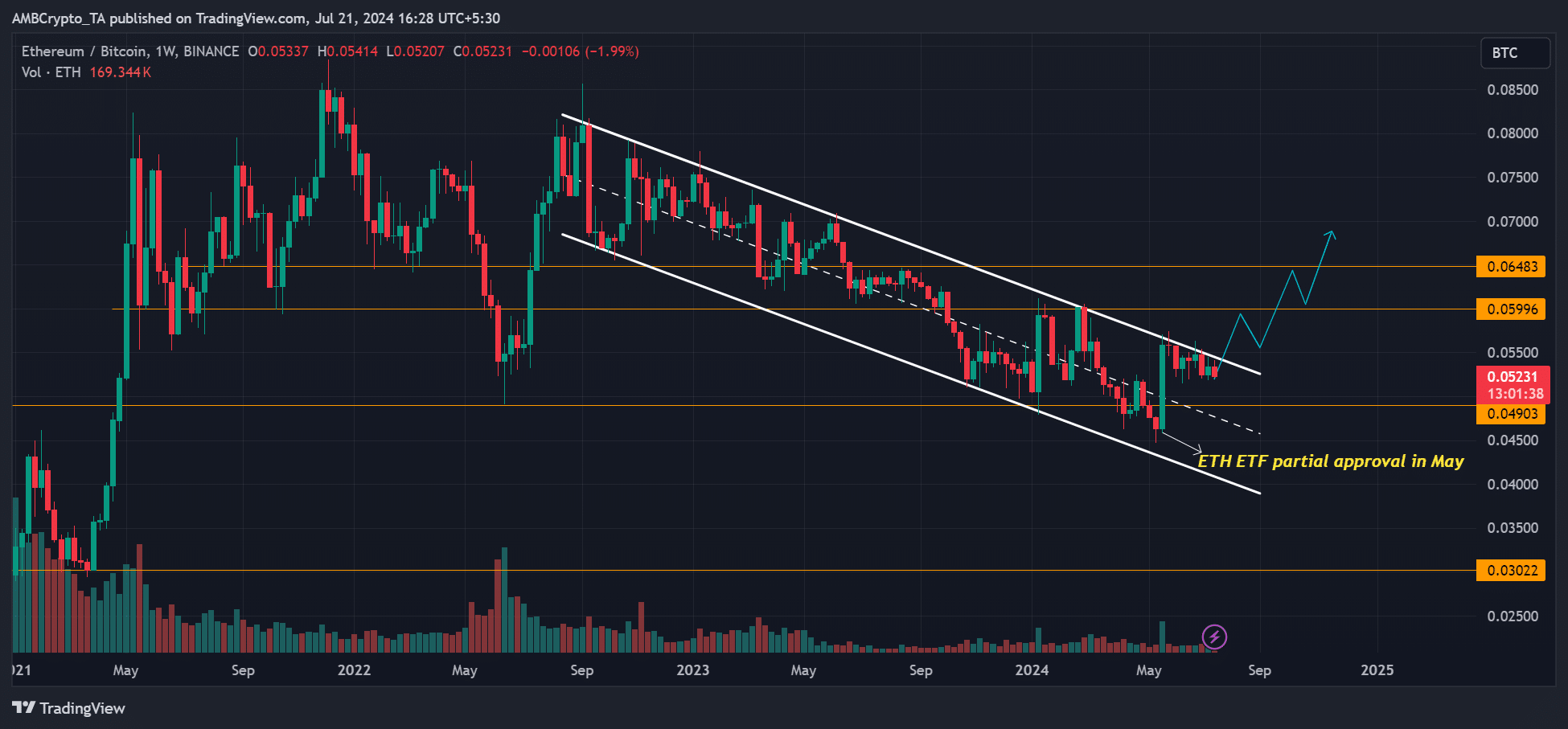

However, BTC Dominance is just one way to measure Altcoin season. According to some analysts, including the founders of Glassnode, the other is the ETH/BTC ratio.

ETH/BTC tracks ETH performance against BTC. According to the founders of Glassnode, who use the username Negentropical at

The products will be launched and marketed this week.

AMBCrypto’s evaluation of the ETH/BTC ratio found that it increased following the partial approval of ETH ETF in May. However, the ratio had yet to break the downward trend, as indicated by the descending channel (white).

Source: ETH/BTC, TradingView

It remains to be seen how ETH/BTC will react and whether this could trigger altcoin season. The BTC dominance and the ETH/BTC ratio were therefore important fronts to monitor and measure the possible impact on altcoins.