- At the time of writing, Bitcoin’s dominance is said to exceed 60%.

- Bitcoin wallet business saw a resurgence despite negative funding rates.

Bitcoins [BTC] Its dominance has been steadily increasing, with 60% reach at press time.

The death cross, where the short-term average falls below the long-term average, has been crossed on the daily chart, but remains on the weekly chart.

In 2023, Bitcoin started to rise immediately after this event, moving above the 50-day moving average and holding it as support.

However, in 2022, Bitcoin had a small rally before the death cross, but it faded afterwards, similar to 2021.

Source: TradingView

In 2020, Bitcoin also rose to the death cross, had a brief pullback and continued to rise, similar to 2023.

The strength of the current move depends on Bitcoin staying above $60,000 and holding that level as support. If this fails, there could be a slow decline until the Fed takes action.

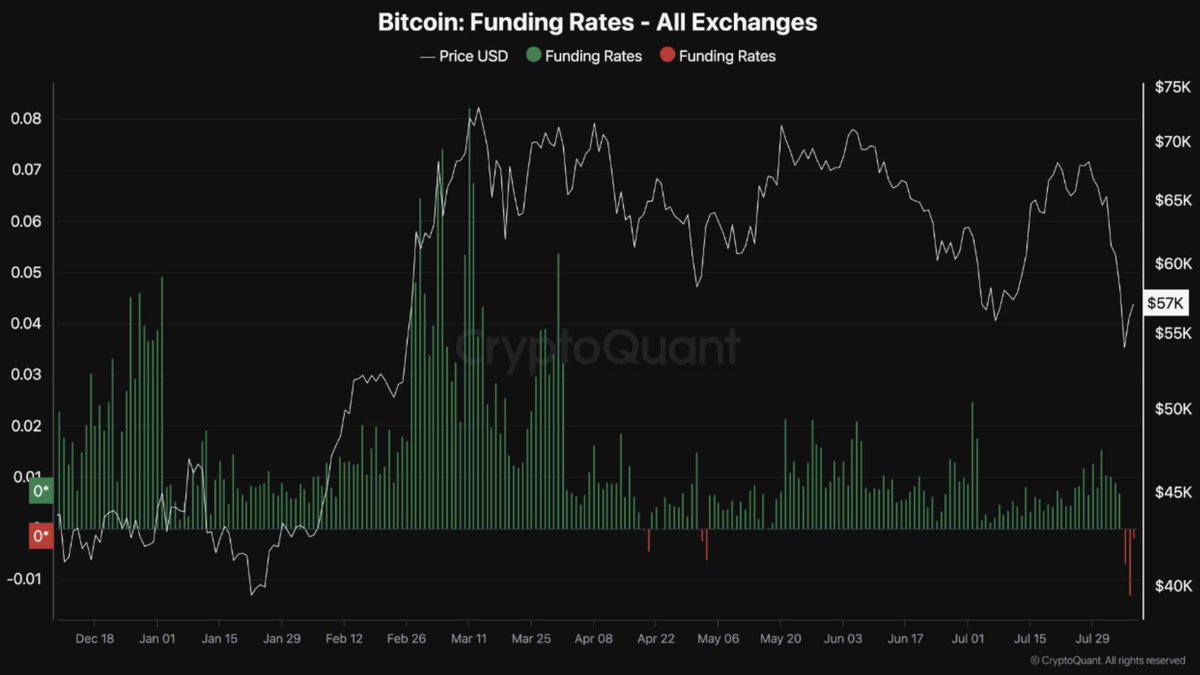

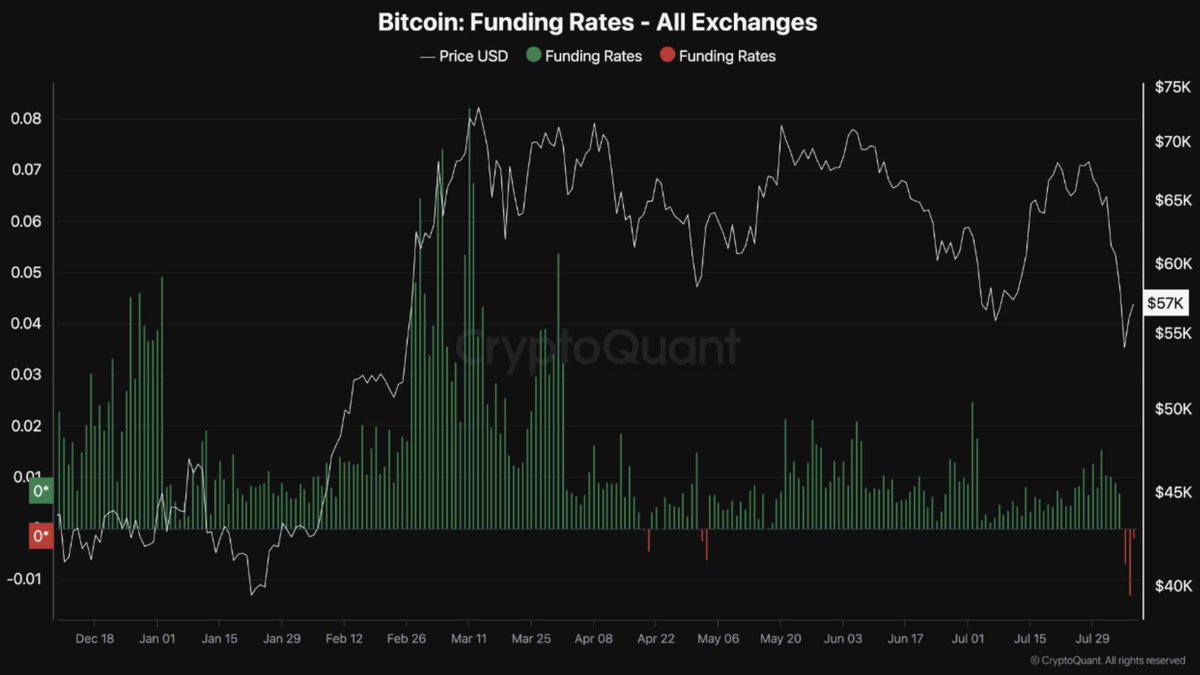

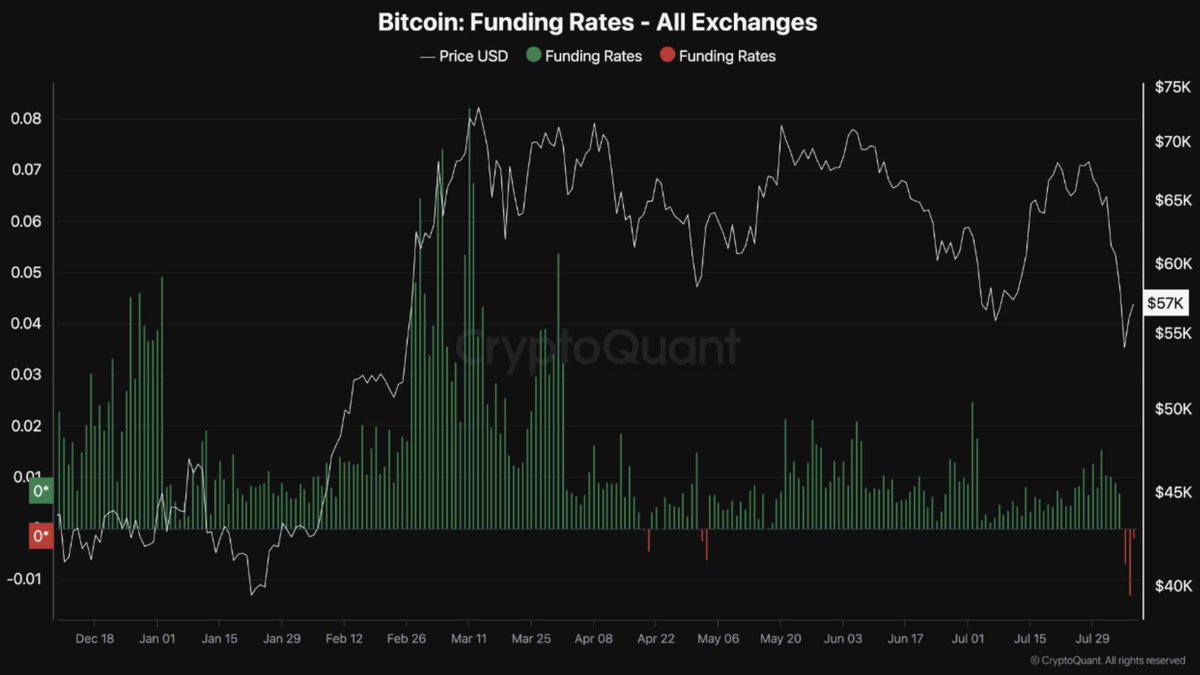

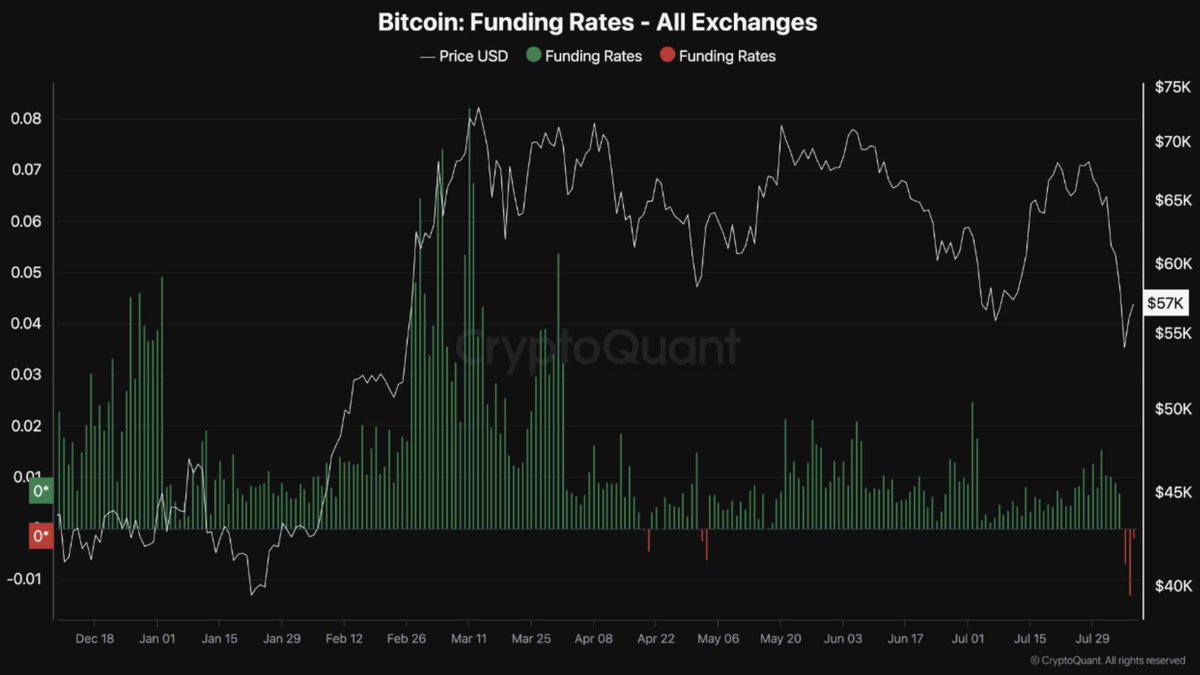

What does the negative BTC financing rate mean?

Bitcoin recently experienced its first major decline of 33% in this bull market. BTC funding rates have turned negative again, signaling a potential buying opportunity for long-term investors.

Major buyers like Blackrock and MicroStrategy are increasing their Bitcoin holdings.

With the business cycle bottoming out and the ISM index below 50, Bitcoin’s market dominance is expected to increase.

Source: CryptoQuant

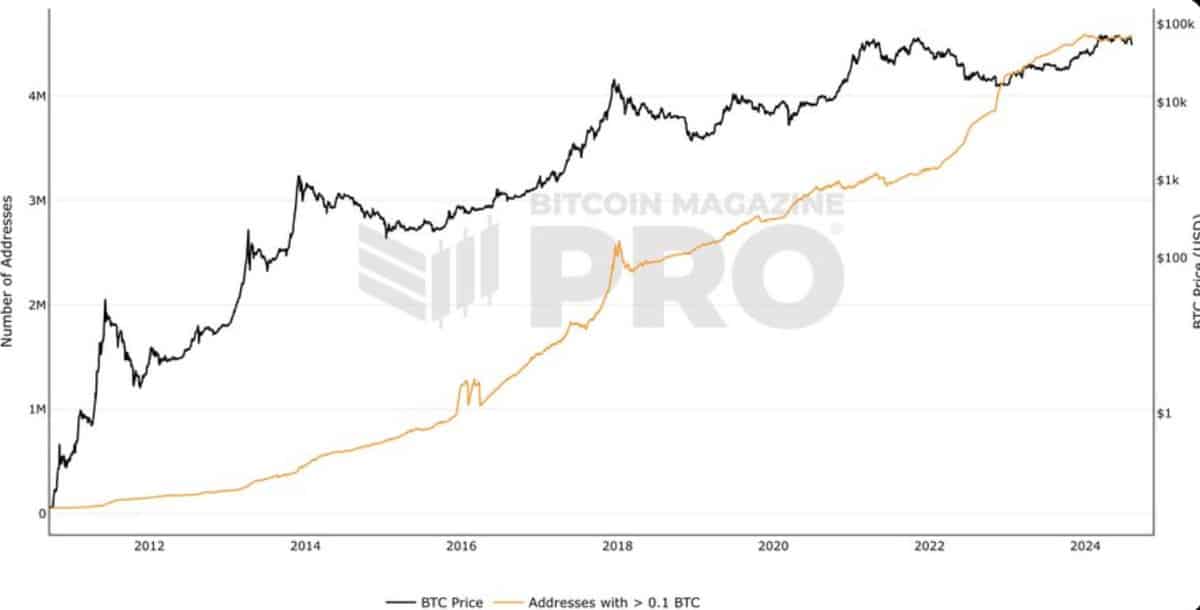

Bitcoin addresses with more than 0.1 BTC hit ATH

The number of Bitcoin addresses holding more than 0.1 BTC is growing steadily, indicating dominance is increasing, as is whale buying activity.

Over the past month, they have amassed $23 billion worth of Bitcoin. Long-term holders, those who plan to hold their BTC for the foreseeable future, also moved 404,448 BTC, worth $22.8 billion, to their addresses.

This significant accumulation indicates a strong belief in Bitcoin’s future potential.

Source: Bitcoin Magazine PRO

Is your portfolio green? Check out the BTC profit calculator

ETH/BTC turns higher again

Ethereum initially rebounded strongly after this week’s market crash, but quickly lost those gains as Jump Trading continued to sell.

The declining ETH/BTC chart indicates that Bitcoin’s dominance will likely continue to grow, especially considering that Ethereum is the largest cryptocurrency after Bitcoin.

Source: TradingView