- Bitcoin will likely continue to trend downward in the coming weeks.

- Short-term holders’ average cost basis marked a potential local top for Bitcoin.

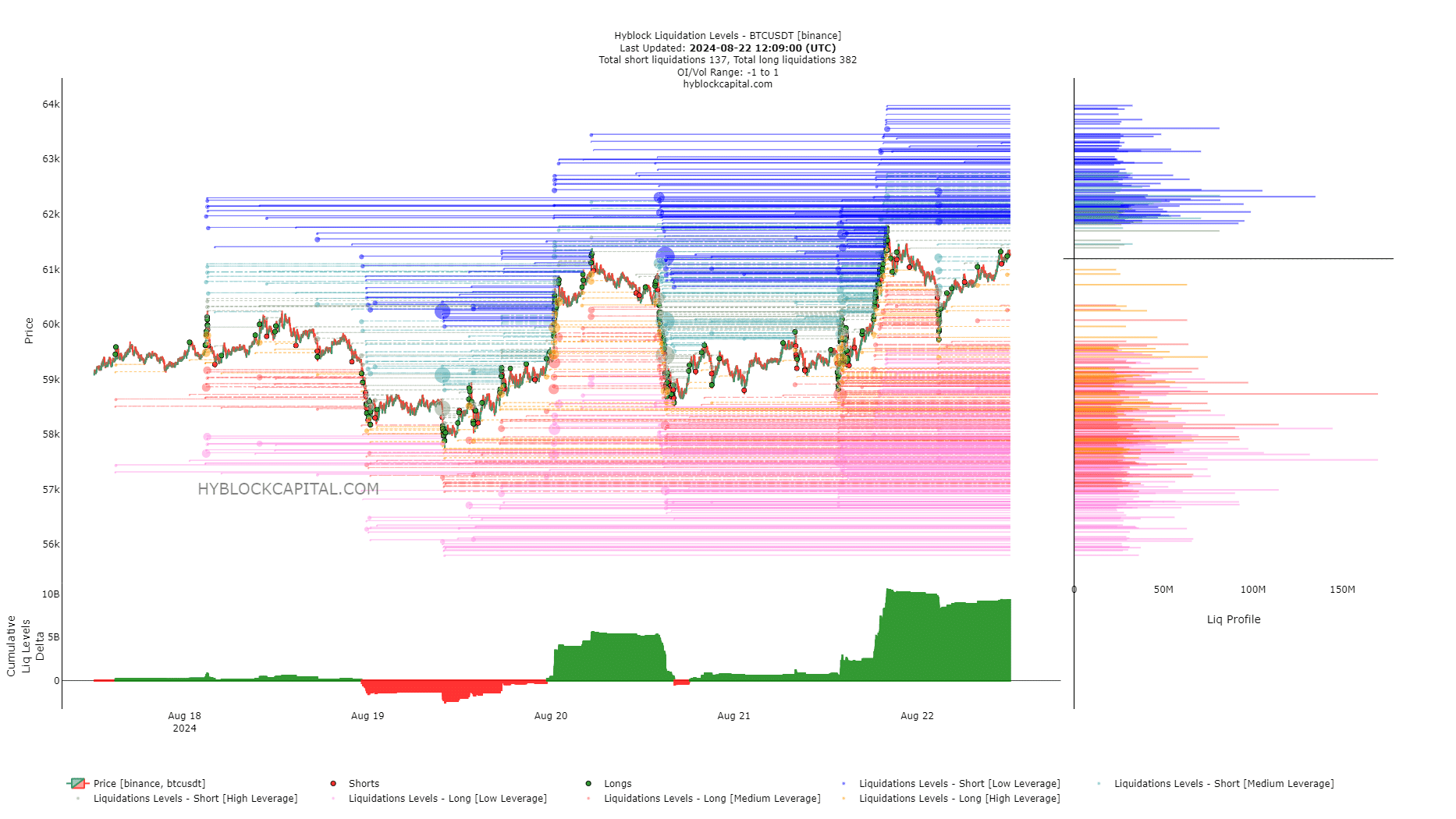

Bitcoin [BTC] experienced increased volatility in recent days. On August 21, the price reached $61.8k, but a few hours later it dropped to $59.7k.

Source: Hyblock Capital

These price movements may be caused by the liquidity pools that have built up around BTC over the past week.

The cumulative delta of liq levels was hugely positive, promising a near-term price drop to flush out overzealous bulls.

To understand whether Bitcoin can resume its uptrend after a price drop, AMBCrypto took a closer look at other whale accumulation statistics and trends.

The near-term holder cost basis would be a strong barrier

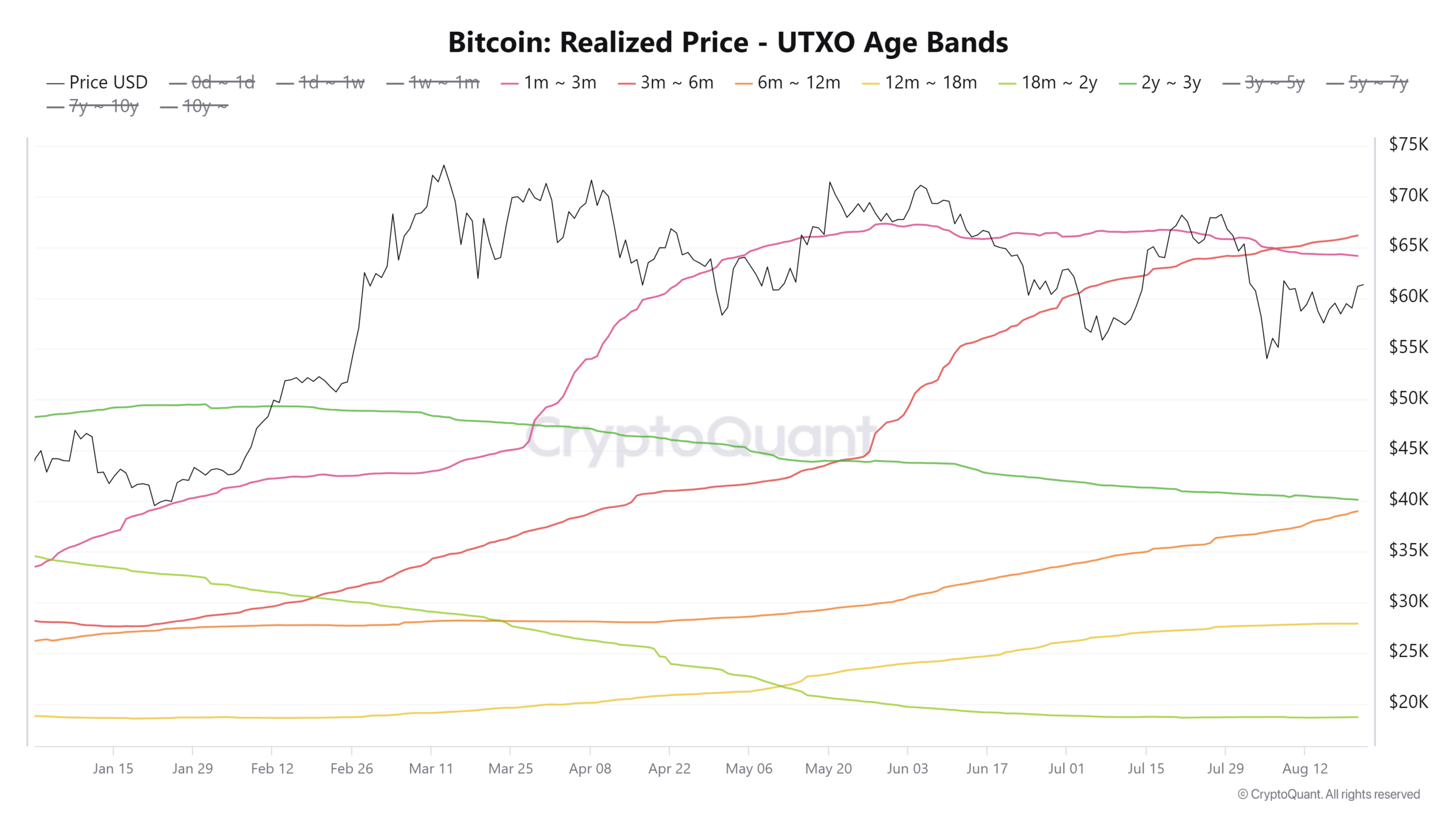

CryptoQuant Analyst Burak Kesmeci noted that Bitcoin holders’ realized prices could be used to delineate resistance zones in the short term. Short-term holders are those who have kept BTC in their wallets less than 155 days.

Using the UTXO age ranges, he noted that the 1-3 month BTC holding cohort had an average cost basis of $64,000. Similarly, the 3 to 6 month course had an average cost basis of $66,000.

Since market prices were below this zone, most of these holders were likely at a loss.

Therefore, a price increase in this area would likely cause underwater holders to exit the market near break-even, which could fuel selling pressure.

BTC’s price action in recent months means that a move towards $66,000 would likely also be a good opportunity for profit.

Assessing whale accumulation/distribution trends

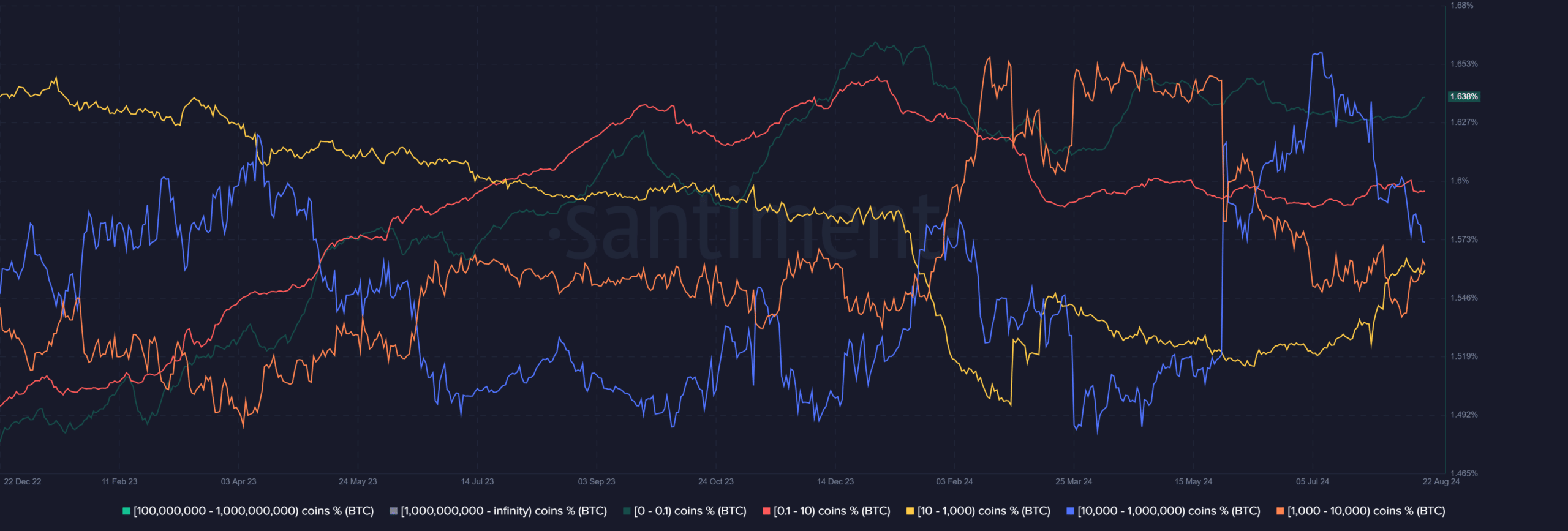

The portfolios holding 10,000 to 1 million BTC experienced a sustained accumulation phase from early December 2023 to late January 2024. During this period, the price of the king of crypto increased by 16%.

Fast forward to March, BTC rose another 70%, but this was in addition to the BTC whale cohort (over 10,000 coins) trading and taking profits during the rally.

Similarly, this whale cohort experienced a distribution phase over the past six weeks, even though Bitcoin’s price performance has not been strongly bullish.

The implication was the expectation of a price drop and a continued downward trend.

Read Bitcoin’s [BTC] Price forecast 2024-25

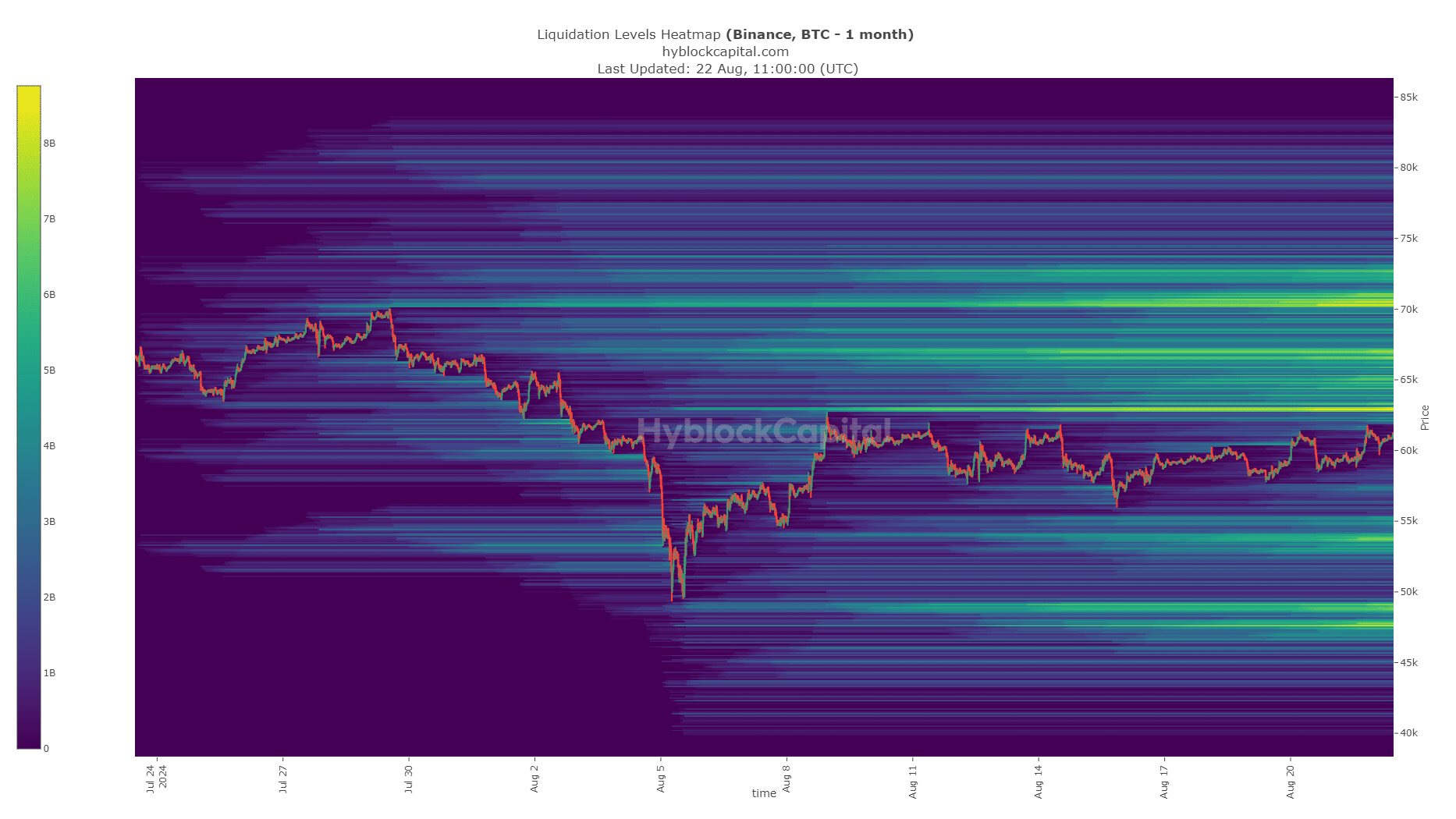

The one-month liquidation heatmap highlighted the bandwidth’s potential more clearly. The deep liquidity pockets of $63,000, $67,000 and $70,000 are likely to pull prices in the coming weeks.

Yet the liquidity built up in the south at $54,000 and $49,000 were also important magnetic zones. As things stand, the price movements and whale accumulation trends do not favor a breakout past $66,000.