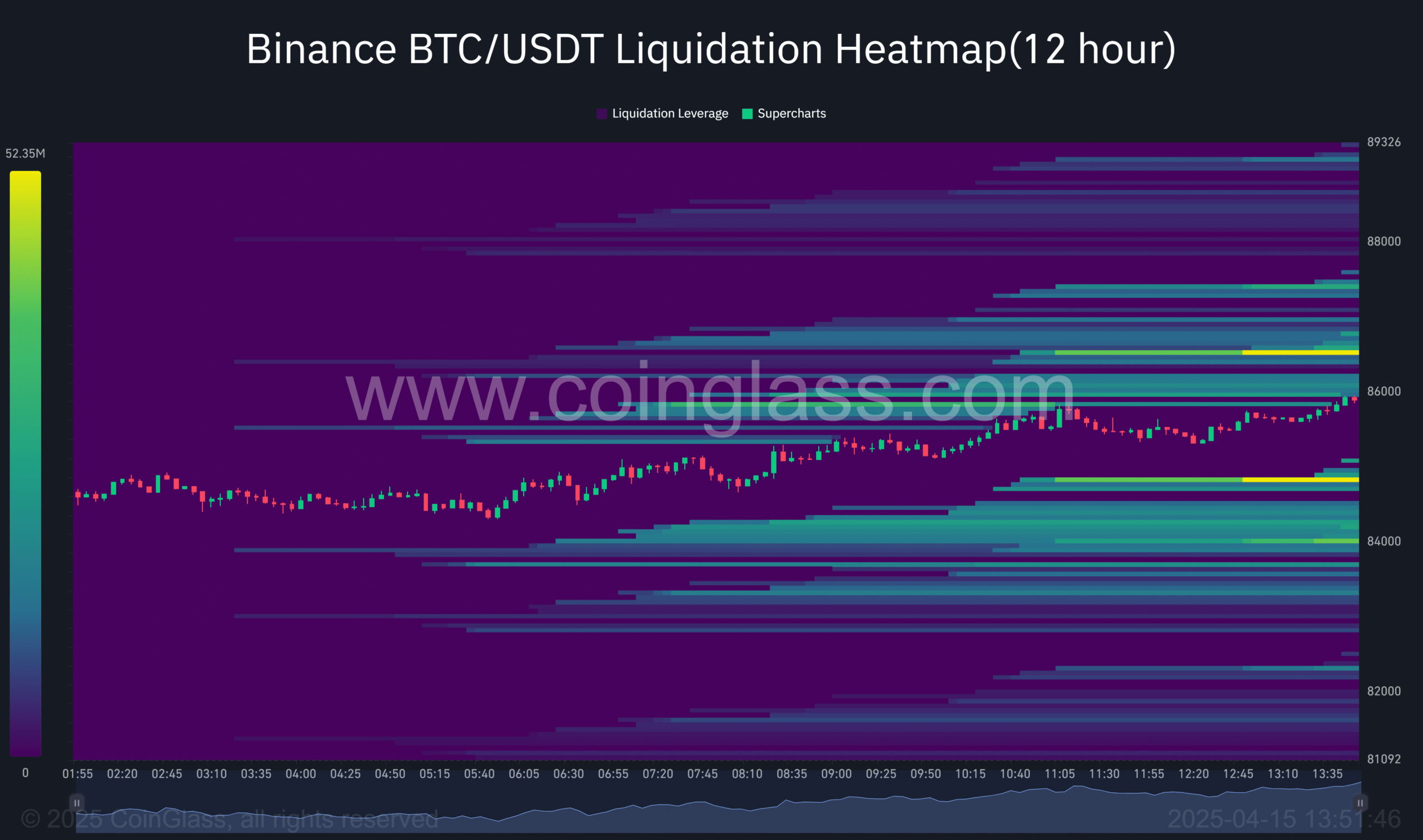

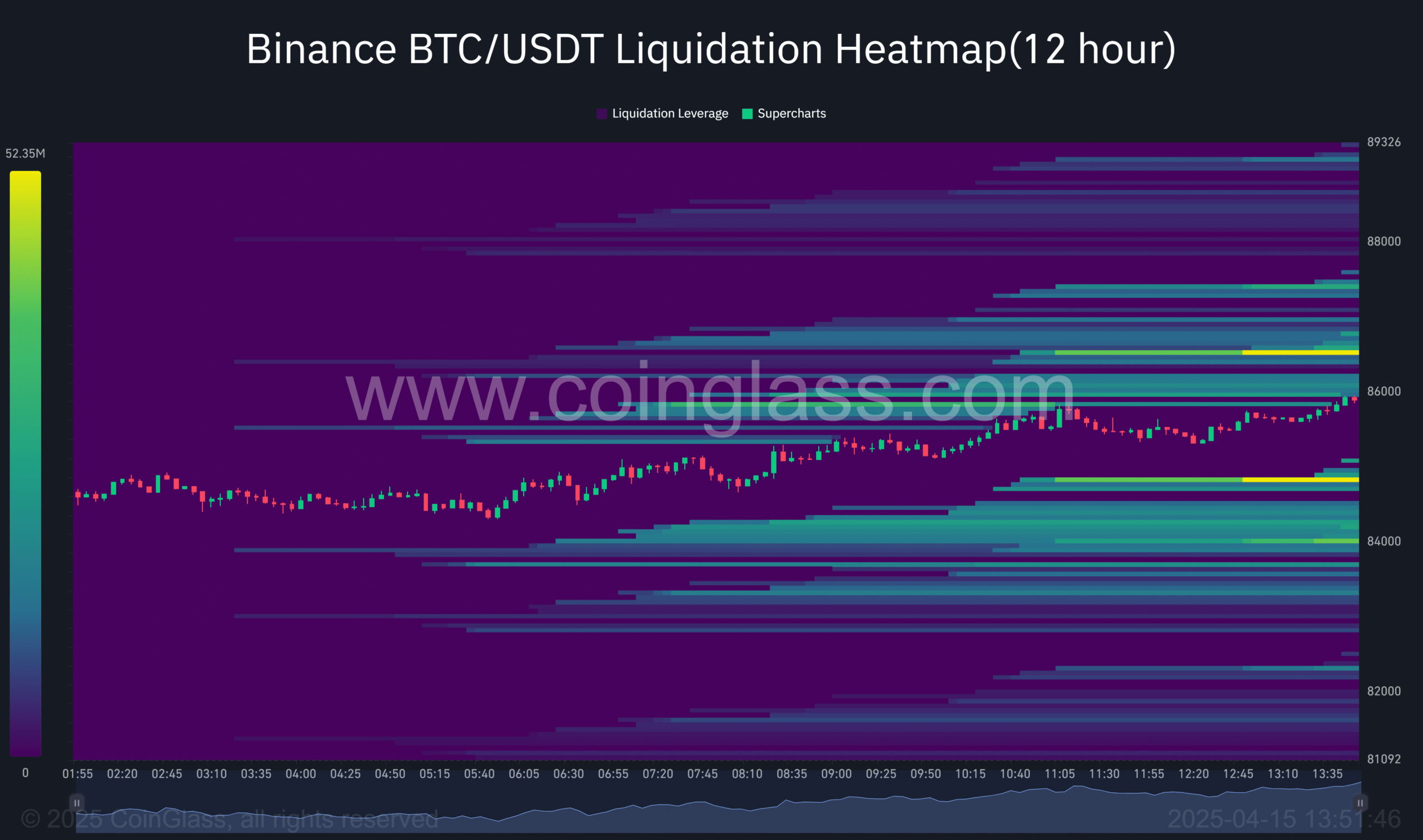

- Bitcoin may be approaching an important liquidity zone around $ 86k, where 77% of the liquidation levels are long

- A classic setup could arise where overcrowded positions are used before a potential reversal

Let’s take a step back to investigate Bitcoin’s weekly structure. The high-quality sentiment that weighed on his recent price action could relax, whereby BTC consistent daily candles is closed with an average of $ 82.60k-one sign of underlying bidding strength.

In particular, the relative strength index (RSI) seemed to be covered with overheated levels, which suggests that the momentum still has room to expand without making immediate profit.

Support for this bullish undercurrent, all included exchanges Net outflows from 35,758 BTC on April 11, for a price of $ 83,403 per BTC – A textbook signal of strategic accumulation.

Together these signals refer to the rise of potential soil formation. One where an increasingly solid demand wall can absorb the pressure on the sales side and the downward risk of the cap. At least theoretical.

However, from a liquidity position, the image can be less reassuring. A considerable liquidity cluster forms above the time rate levels. According to Ambcrypto analysis, this could create a risky attitude for a narrow liquidity swing.

In short, is this setting the stage for a bullfall?

Market makers who want to operate overflowing long positions

At the time of pressure, Bitcoin came near $ 86.50k after an important liquidity zone. However, there seemed to be Signs of weakness below.

Source: Coinglass

The long positioning of the retail trade has been relatively low, with bid-axle ratios in the context of the negative to signal blur. Moreover, the Flat Open Interest (OI) caused a lack of incoming fresh capital to support the move.

It is crucial that 77% of the liquidation levels were clustered around this liquidity zone long positions. Consequently, this liquidity cluster can act as a magnet, which may cause a downward sweep while market makers benefit from forced liquidations.

In fact, this level also represents the Alfa -price zoneAn important area that has succeeded historically as support and resistance. There is a risk that Bitcoin can go briefly above this level, just to fall back – set up a bullfall.

Bitcoin needs real conviction, hard data

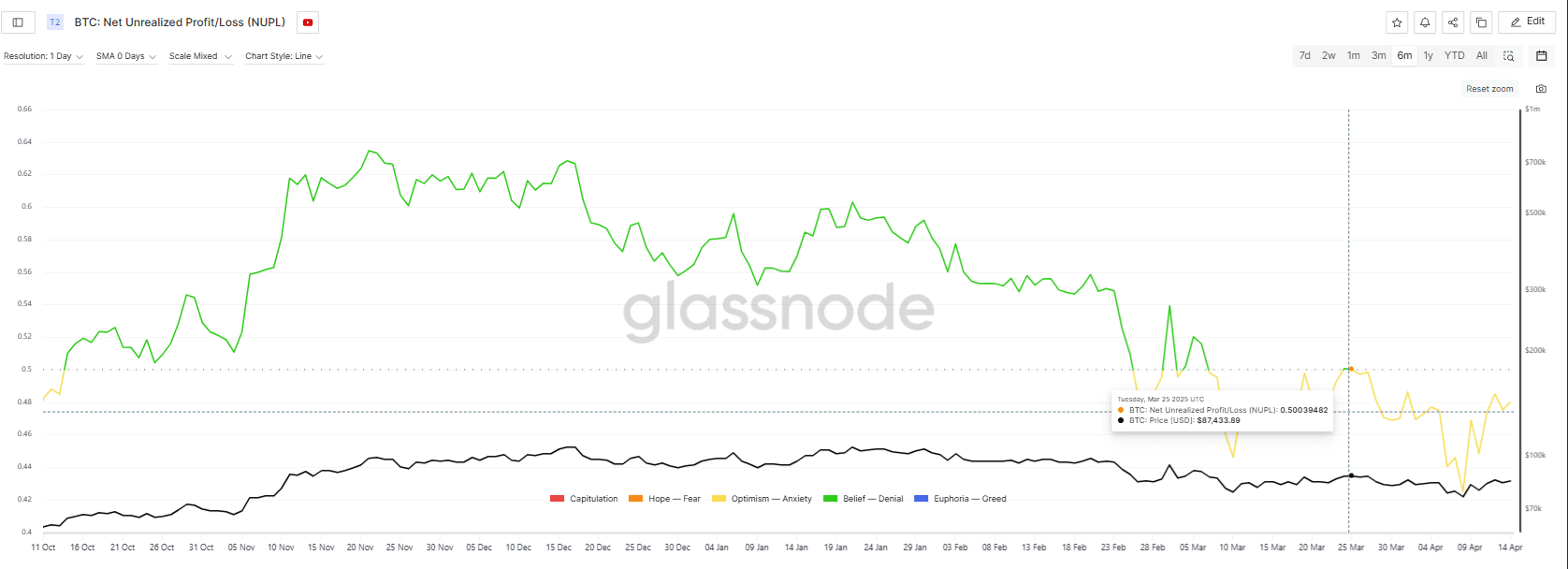

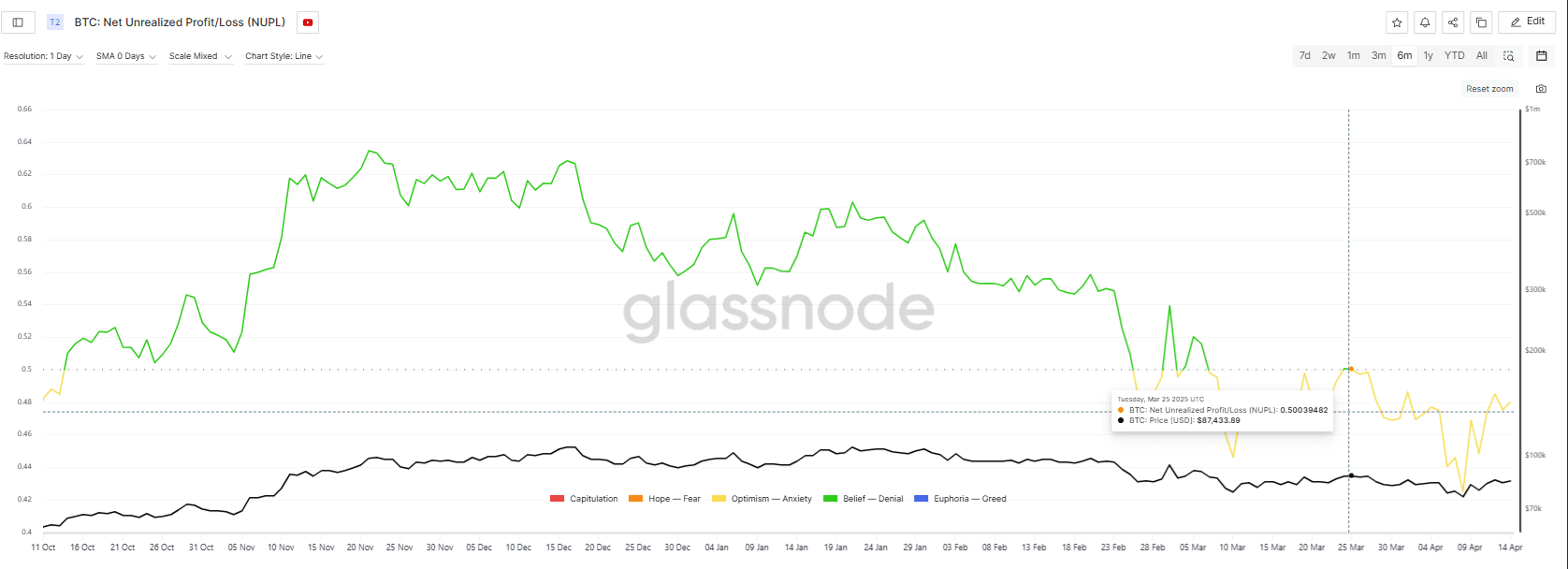

The NUPL (Net non -realized profit/loss) Metriek reveals the state of the current whimsical price action of BTC.

Since March 7, it has remained in the ‘optimism’ phase. This hinted that a significant part of the market is in non -realized profit, with large holders probably accumulating.

Every time BTC is approaching the $ 86k -$ 87k zone, however, the NUPL shifts to ‘fear’, which shows that a growing number of market participants are starting to feel uncomfortable about their non -realized profit.

This shift suggests that the profit, although not yet realized, will be put under pressure and can be taken off the table soon.

Source: Glassnode

For example, on March 25, Bitcoin recently recovered $ 87.5K. However, before the NUPL could enter the faith phase, it turned into fear. This pointed to market participants who are increasingly realizing or covering against non -realized profit.

While Bitcoin visits this zone again, a similar pattern can control the NUPL, which indicates a shift in market sentiment.

As a result, with 77% of the liquidations concentrated in long positions around this critical liquidity cluster, a narrow sweeping could be activated. This would lead to forced liquidations, which may run lower BTC.

Unless Bitcoin breaks decisively from this accessible structure, the risk of further volatility and liquidation cascades remains increased. This makes the market vulnerable to a bearish leg.