- Bitcoin will go through a Deleveraging process and prices can fall in the short term.

- However, the depletion of the seller could occur, the longer BTC consolidates around $ 100k.

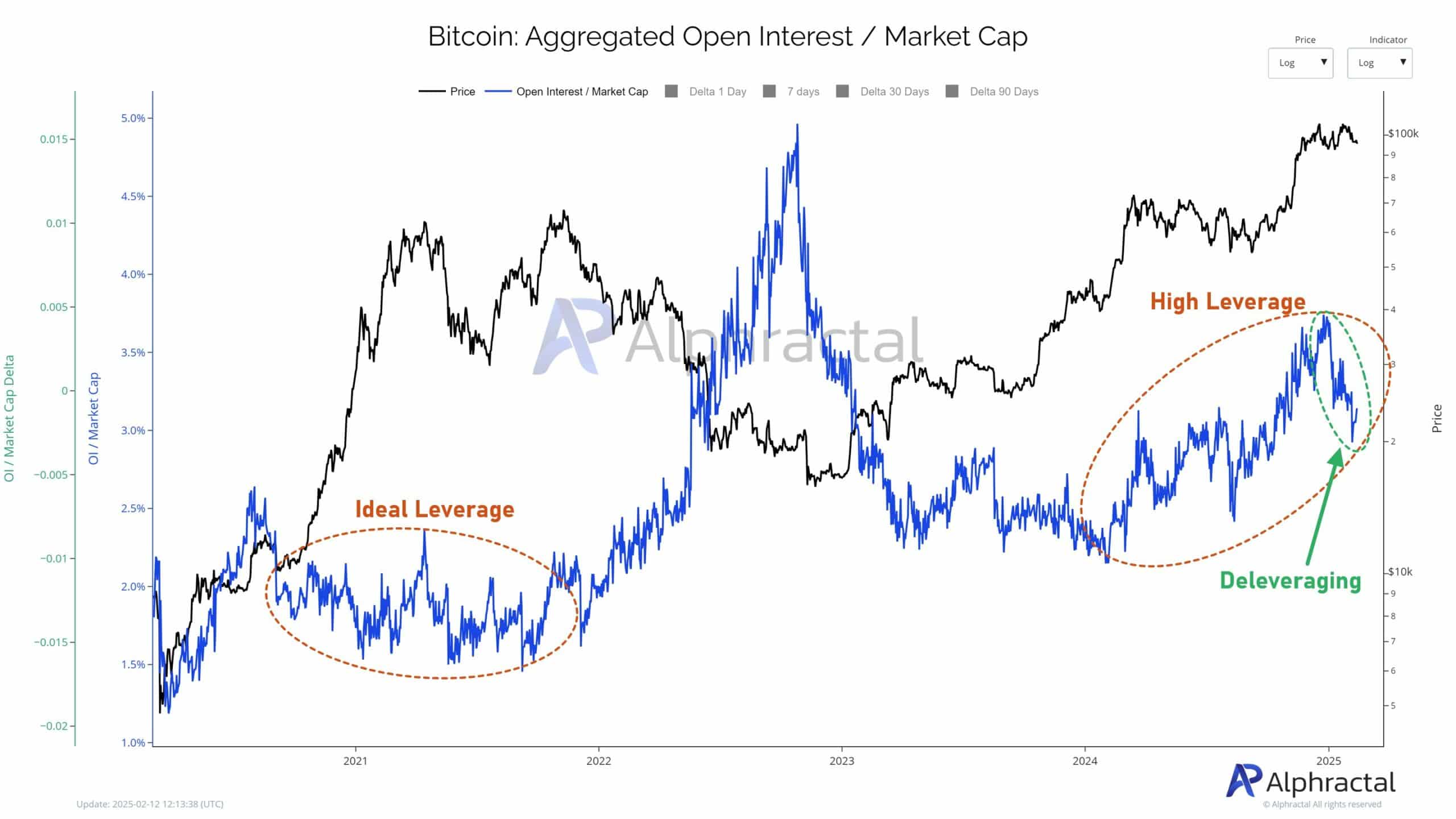

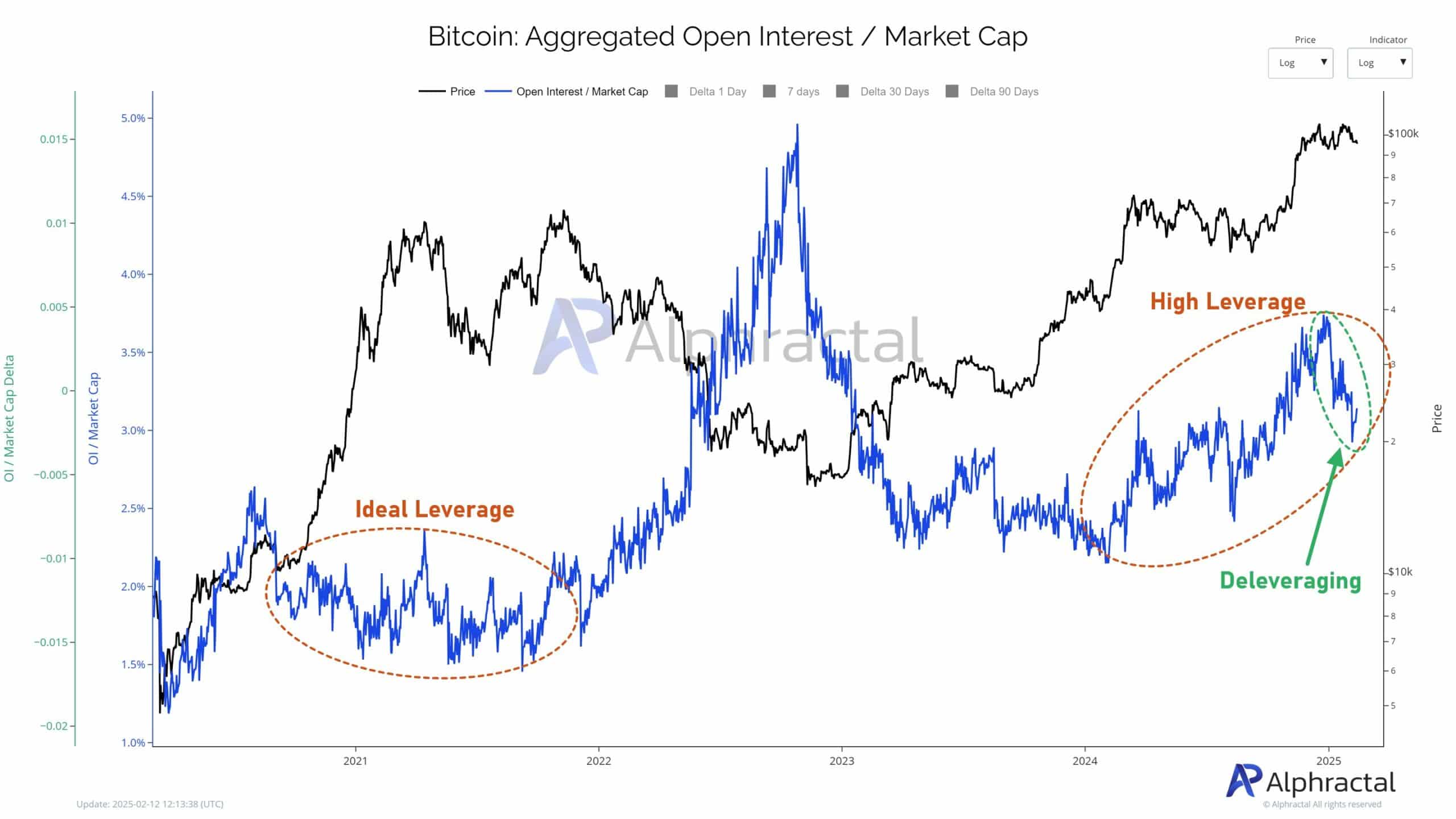

Bitcoin [BTC] is currently in a Deleveraaging process, as indicated by the aggregated open interest in 90 days in 17 large stock exchanges.

This trend is often followed by price falls or extended lateral movement in response to closing or liquidating positions.

In particular, the open interest in the market capital ratio, which has risen considerably since the beginning of 2024, suggests that an elevated Bitcoin market risk compared to the more balanced circumstances during the Bull Run 2021.

Source: Alfractaal

Recent activities show significant delevering, signaling a BTC golf of liquidations and the closure of institutional positions – AKIN to a liquidity reset.

This higher ratio can increase the risk of further price decreases, which influences that in long positions.

Assessing liquidity zones and trader Sentiment Kloof

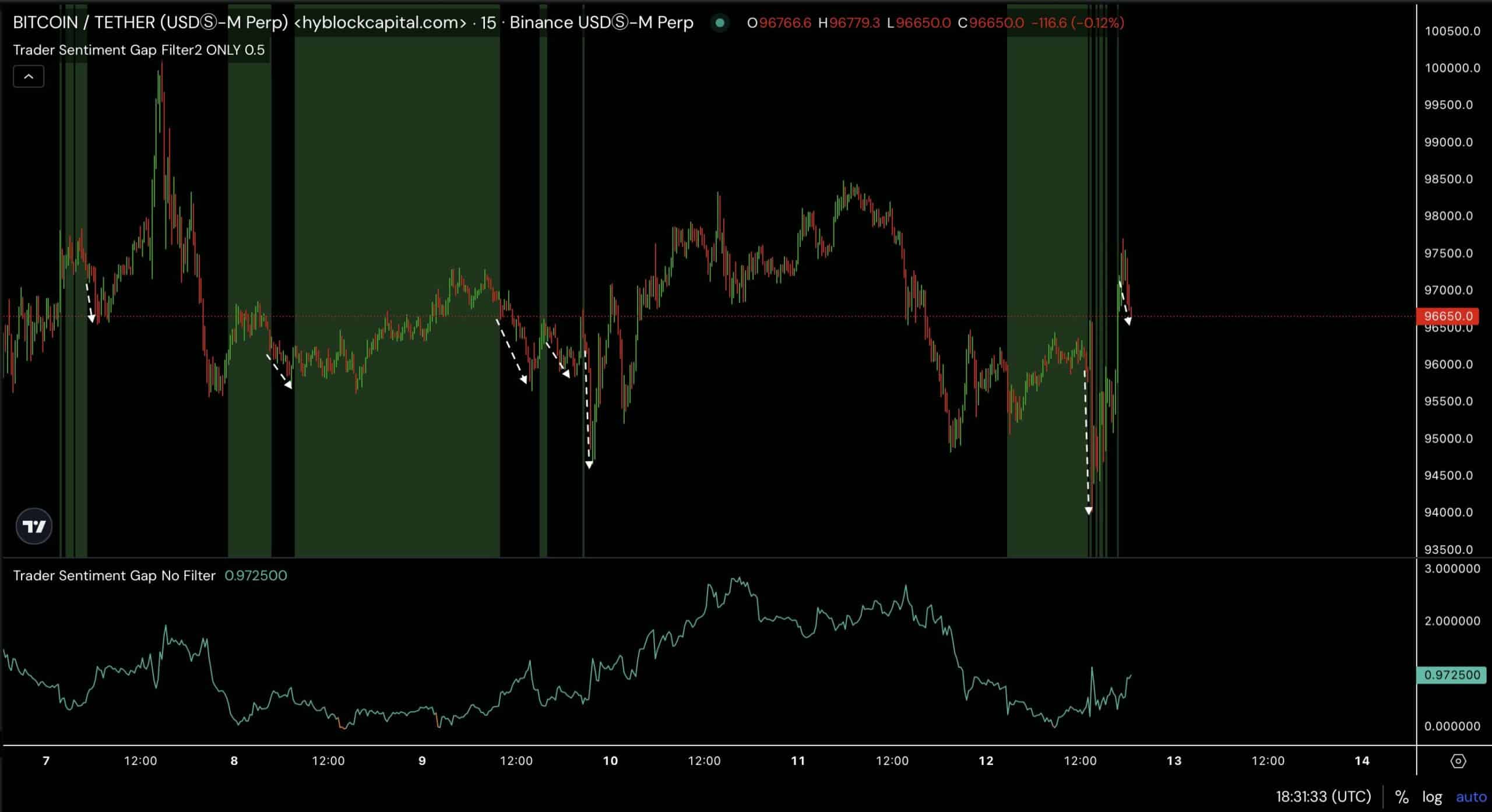

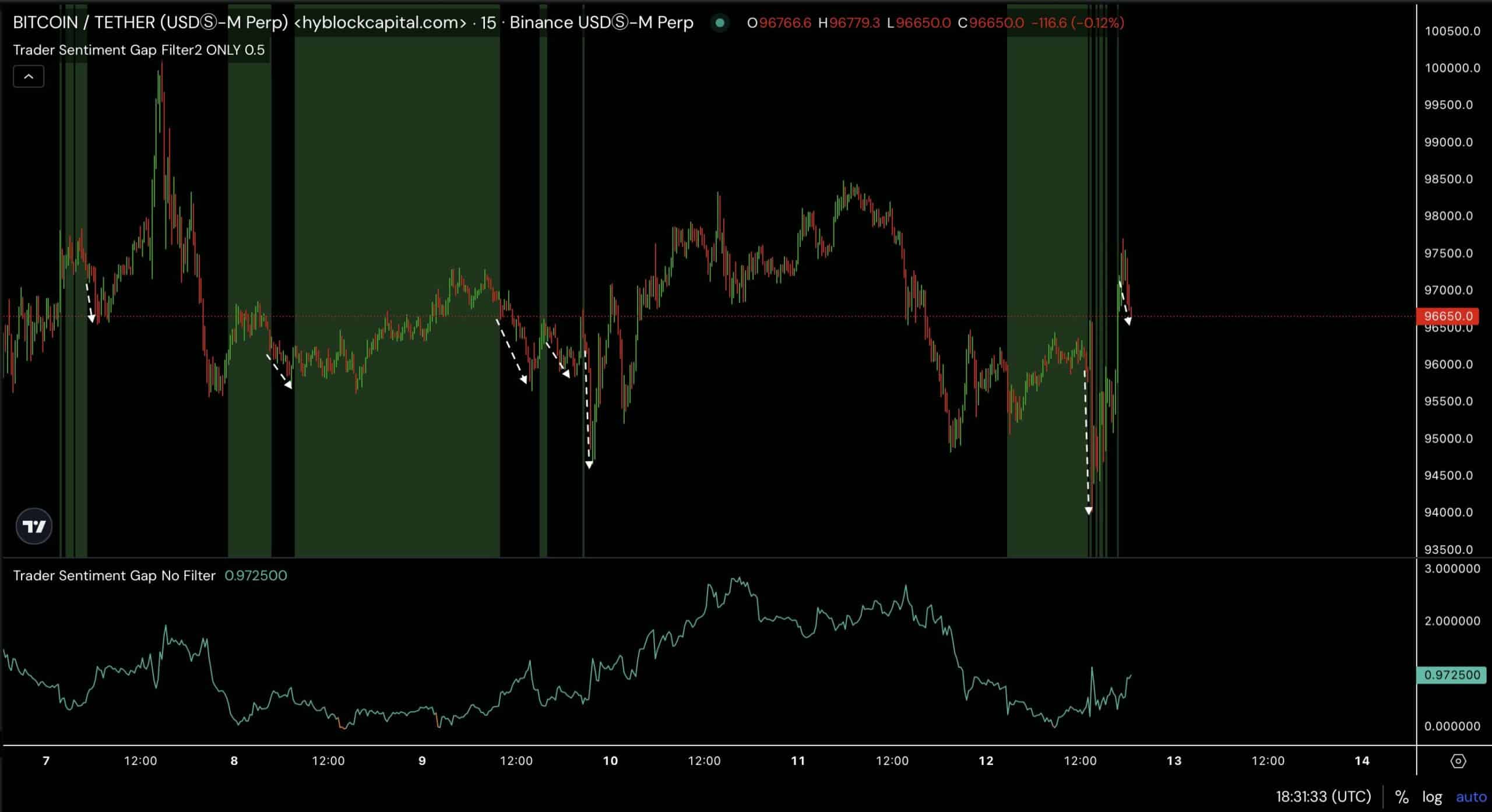

More analysis noted that significant liquidity was merged at $ 93,700 and $ 98,800. After yesterday’s news, a short -term recovery for BTC was followed by a decline.

This first drop can be focused at the level of $ 93,700 to absorb this “liquid liquidity”, where buying orders wait.

If BTC does not fall to $ 93.7K, this can indicate a strong underlying support or bullish sentiment, where buyers intervene at higher levels, preventing a deeper fall. This scenario can lead to a faster recovery or even a price die.

The sentiment gap on the BTC also showed a remarkable shrinking to a lower level, especially when filtered at 0.5, indicative for a minimal sentiment gap between top traders and retail traders.

Historically, such a contraction often precedes a considerable price movement. On February 12, the price of Bitcoin fell after a reduction of a gorge, the price of Bitcoin fell sharply from $ 96,650 to a low of $ 94,000 before he returned.

Source: Hyblock Capital

This pattern suggested that a narrow sentiment gap can lead to the initial price fall, followed by a recovery, which reflects shifts in trading behavior and market dynamics.

This also supports the expected decrease according to the Deleveraging signal.

Given the current low sentiment gap, BTC can see a similar short -term volatility with potential disadvantage followed by an upward correction.

Why accumulation is about $ 100k crucial for BTC

However, there is an important trend in which holders of short term (STHs) now have 4 million bitcoin. This represents 46% of the peak of 2017 and 86% of the peak of 2021, after he has collected 1.6 million BTC since September.

The increasing number of short-term holders (STHs) contrasts with the falling distribution of long-term holders as shown in their decreasing share of the total BTC offer.

This shows that BTC continues to gather around $ 90k – $ 100k price range.

Source: Glassnode

This consolidation could indicate exhaustion of the seller, offering a stable basis for a possible continuation of the rally.

As BTC stabilizes, the market can get confidence, reducing the chance of sudden sale. This would be the scene for a persistent uprising after the delevering is over.