- Bitcoin enters Wyckoff Phase E with a ‘Golden Cross’, insights into $ 125k in the short term.

- Analyst eyes $ 260k by August – September, with reference to shrinking withdrawal activity as an important engine.

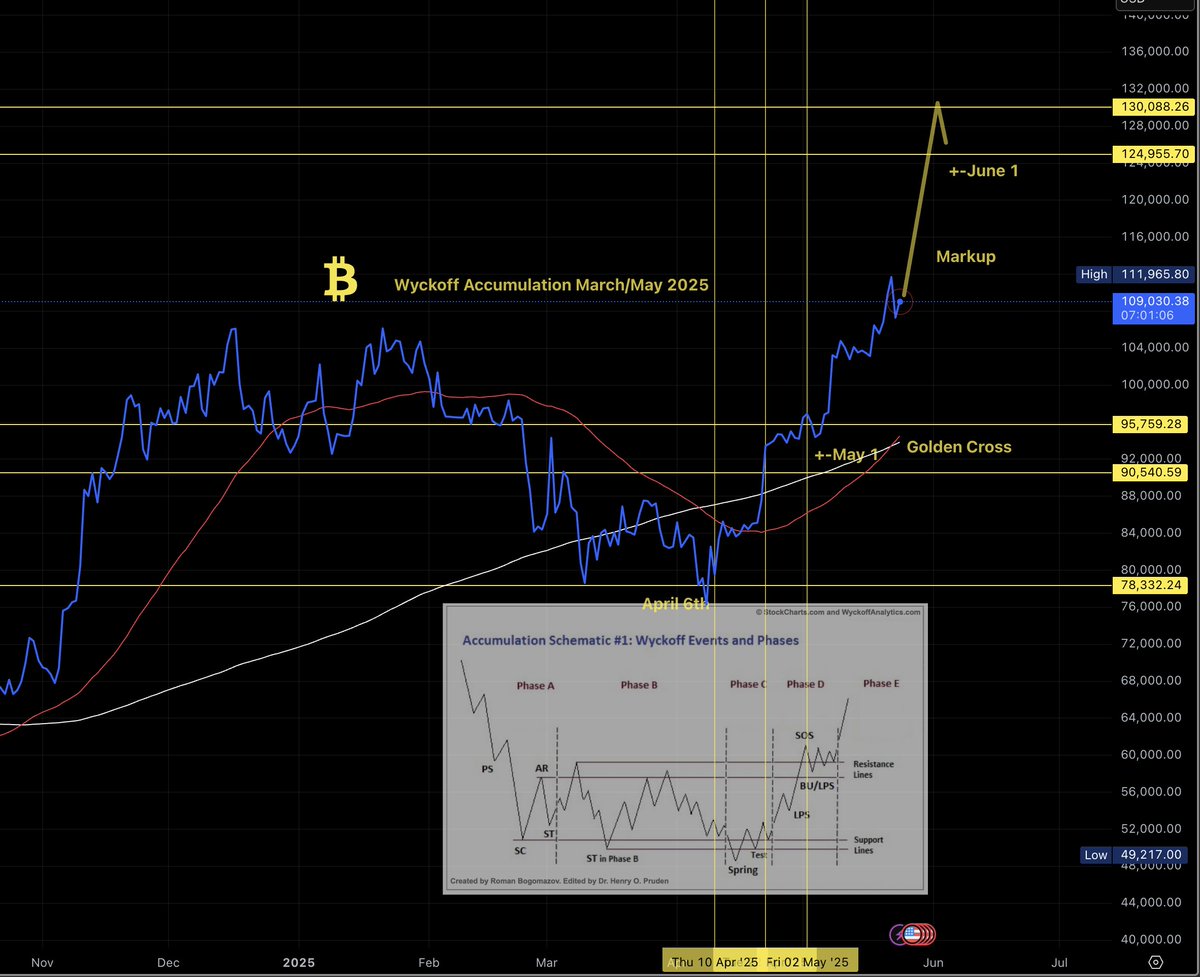

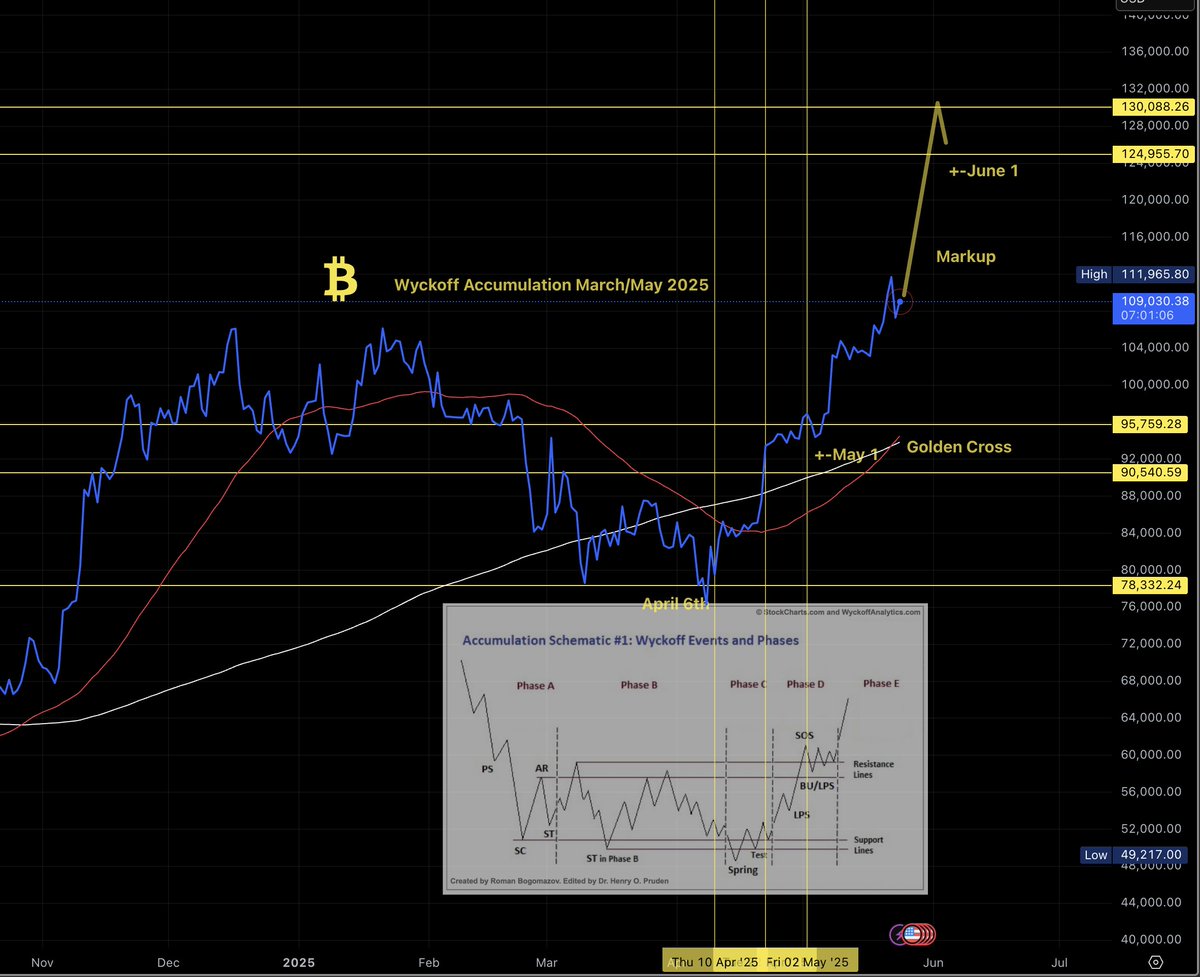

Bitcoin [BTC] Officially introduced phase E of the Wyckoff – accumulation model – typically characterized by a breakout and a strong upward continuation.

An important technical confirmation was witness On 24 May, when the 50-day advancing average (MA) crossed the 200-day MA and was the favorite ‘Golden Cross’ on the daily map.

The graph pattern is traditionally considered a bullish long -term signal. It usually indicates a shift in sentiment.

Of course, many traders have now set their sights on the $ 125m marking -the first major resistance in this Markup phase.

Source: X

The real question remains – what else happens?

US Senate Crypto accounts can initiate the next market phase

Of a highly regarded market analyst tweetThe next cycle for Bitcoin can be a distribution phase or a reacumulation phase.

In his opinion, the most likely is renewed, especially with the US Senate who will soon vote on the most important crypto legislation.

Natural injecting regulatory events volatility. But they can also support institutional trust, especially if the legal clarity arises around classifications of digital assets.

Address Withdraw Bitcoin to refuse

On-chain statistics add fuel to the current rally.

The falling number of exchange transactions – an important indicator follow -up how often BTC is moved to private portfolios, suggested that the sales pressure could decrease.

By tackling the decline, the resulting sales pressure can act as a secret bullish driver, which reduces the resistance of the overhead and the flow momentum.

This pattern is in line with the projection by the analyst of a distribution movement near $ 260k in August or September, assuming that the market stock is limited.

Source: Cryptuquant

Policy and price promotion to look

With Bitcoin firm in Wyckoff phase E and supported by a ‘Golden Cross’, the momentum is firm in the short term.

However, macro circumstances such as regulations and trends on the chain will determine what happens next.

If the market continues, herncumulation or distribution depends on the sentiment of investors and the fate of legislation on the hanging bitcoin accounts.