- Moderate losses rise, but no signs of mass panic among holders.

- The price fell by 17%, but the peace and accumulation continue.

Bitcoin [BTC] has introduced a consolidation phase that shows signs of cooling without activating widespread sales.

Data on chains reveal a market characterized by moderate losses, the fading of high-profit holdings and growing mid-range positioning.

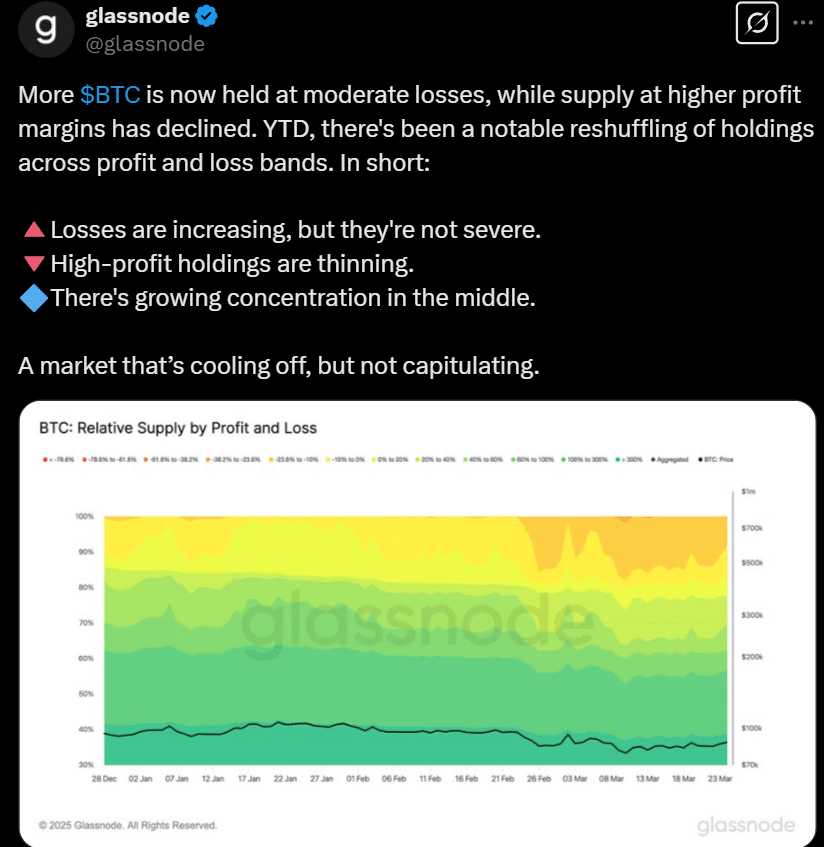

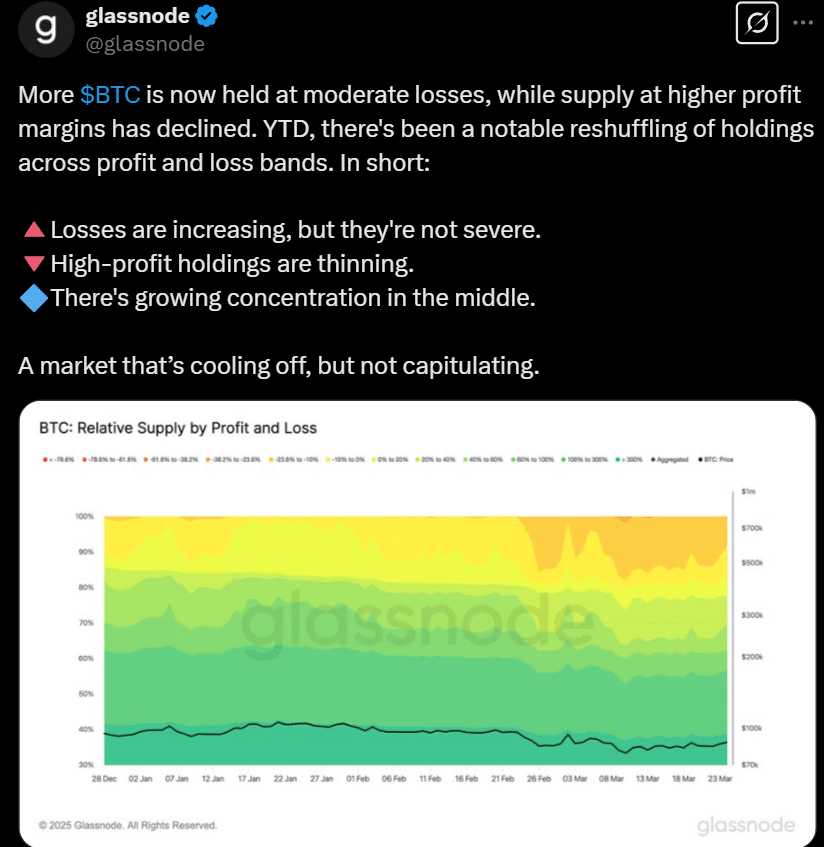

Glass node shared That the share of Bitcoin was held in moderate non -realized losses in 2025 grew considerably.

Swimming in red – but floating

Holdings in the loss range of -23.6% to -10% increased this year by 7.75%, which indicates more underwater holders. At the same time, the high-profit has fallen (40-60%) by 3.57%, while the mid-profit positions (20-40%) rose 3.45%.

This shift suggests that coins migrate from ties with sprofit to mid-range levels, consistent with a market in Cooldown mode, but no panic behavior.

Source: Glassnode

But there is more pressure structure elsewhere.

The pressure is on

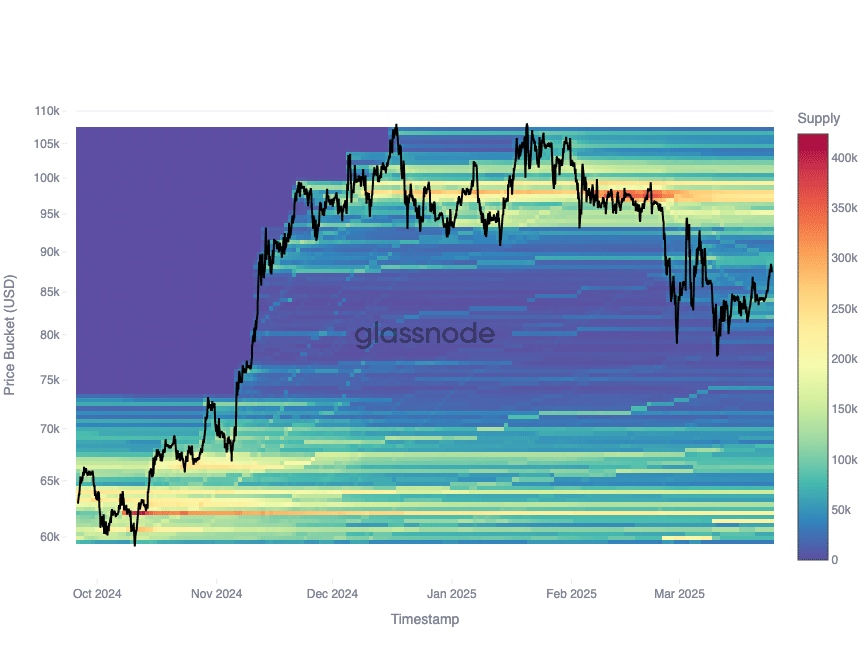

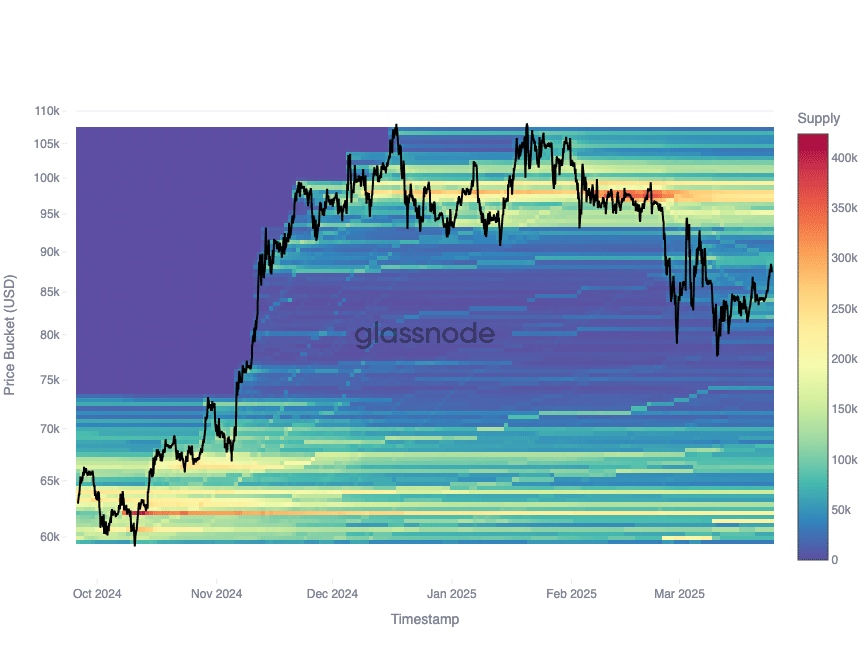

There is increasing pressure on holders in the short term, who have acquired Bitcoin for the past 155 days. More than 2.8 million BTC of this group is under water and forms considerable non -realized losses.

However, it should be noted that most investors instead of selling a loss.

The average acquisition price for holders in the short term is almost $ 92,500. Bitcoin stays just below this level, making it a critical resistance threshold.

Cryptovizart, a senior analyst at Glassnode, identified The range of $ 90k – $ 93k as the supply zone.

Source: X

This area is an offer zone, because investors who have bought here can sell if the prices reach $ 90k – $ 93k. Above that range is the path to a new of all time, while it indicates the constant consolidation below.

But some are just … waiting

Yet not all holders respond in the same way.

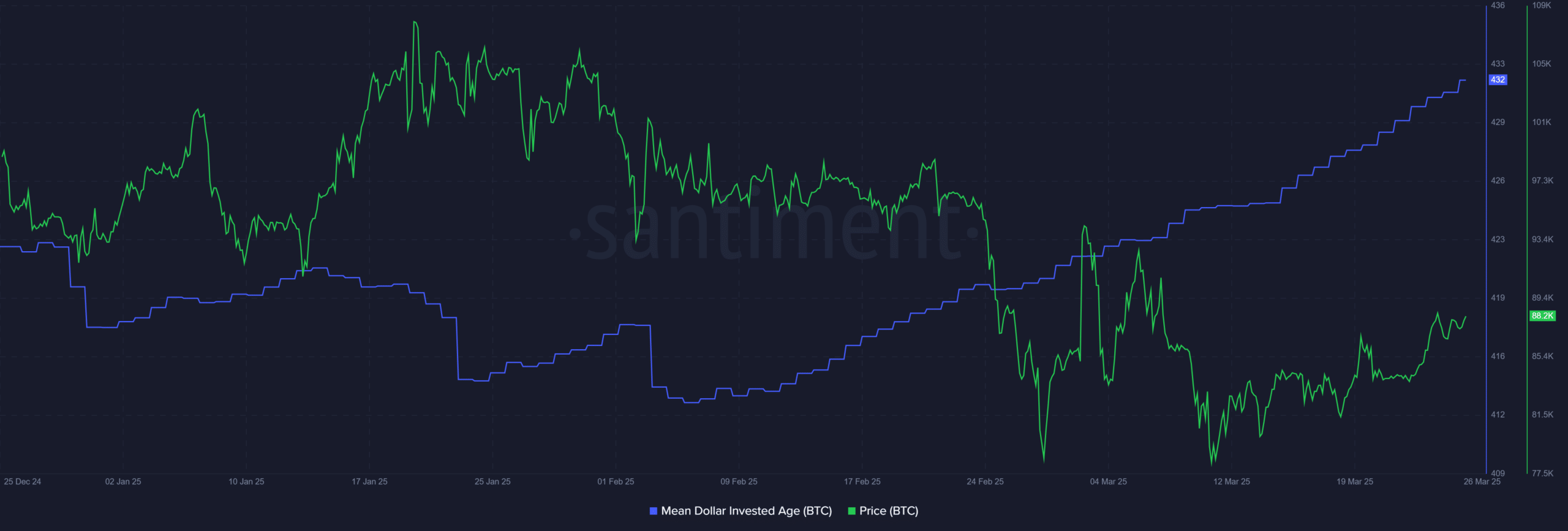

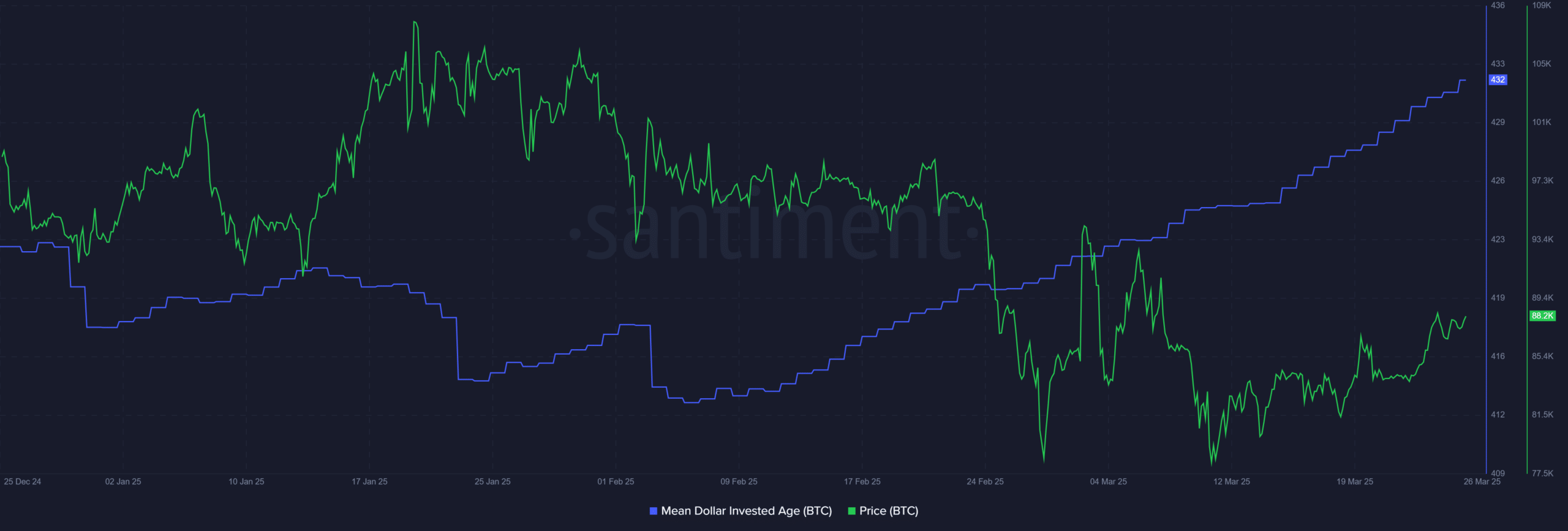

The average dollar -invested age of Bitcoin climbed from 418 to 432 days between 4 February and 26 March. This indicates that old coins sleep, which suggests that accumulation about distribution.

Source: Santiment

The price is falling, but Bitcoin Hodling remains strong

The price of Bitcoin dropped from $ 101,403 to $ 84,330 in that period, but MDIA continued to rise.

This divergence reflects trust in the long term. Investors seem to be willing to maintain volatility and to point out in a silent accumulation phase.

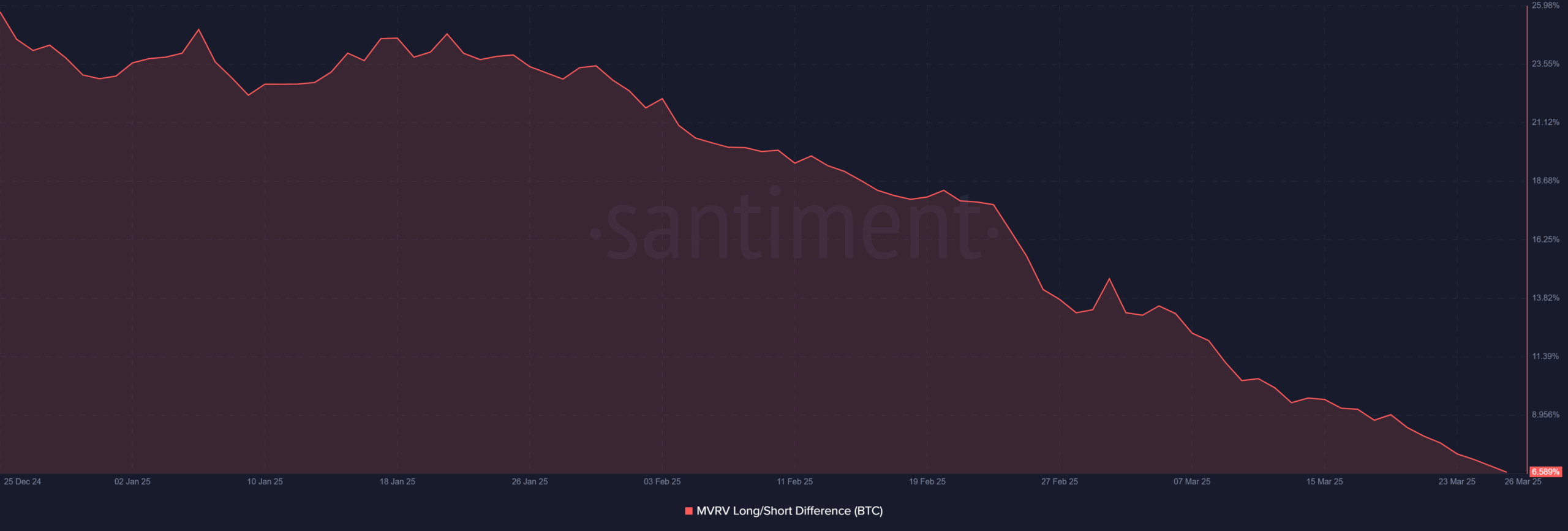

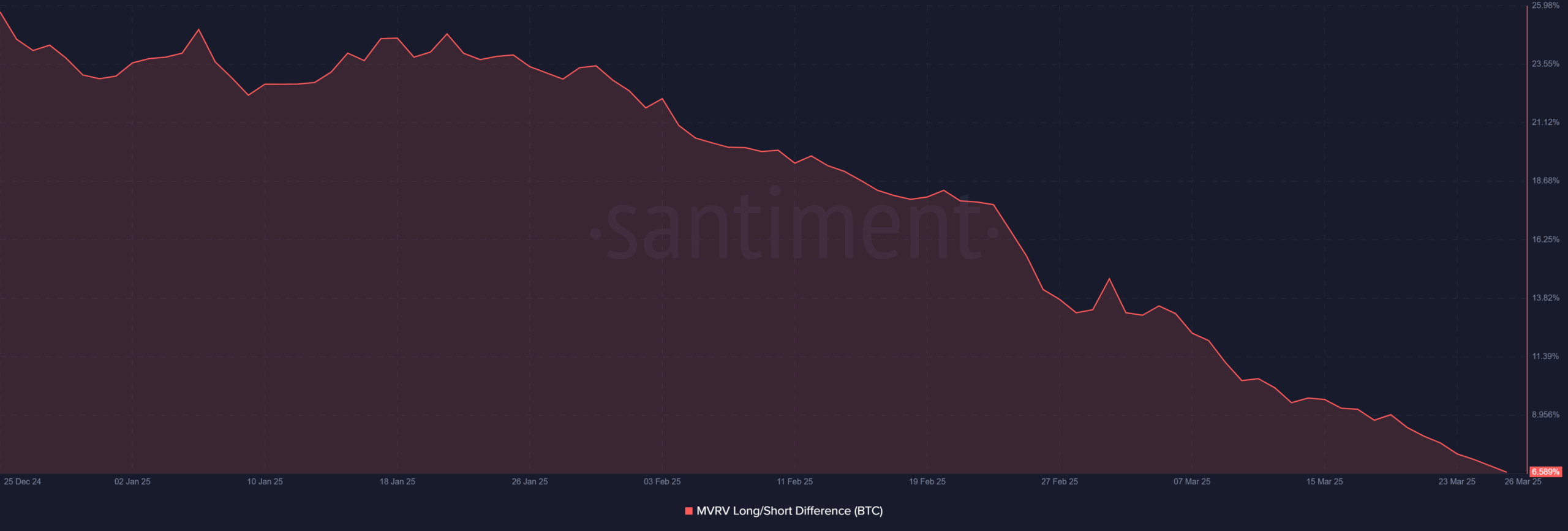

Now let’s zoom in on another important statistics. The MVRV -long/short difference, which follows the profitability of holders, fell from 22.12% on 3 February to 6.59% on March 26.

Source: Santiment

This 70% decrease shows that the long -term holders lose their profitability, although the sentiment remains stable. And that is not the only signal of calmness.

Watch whales, don’t dump

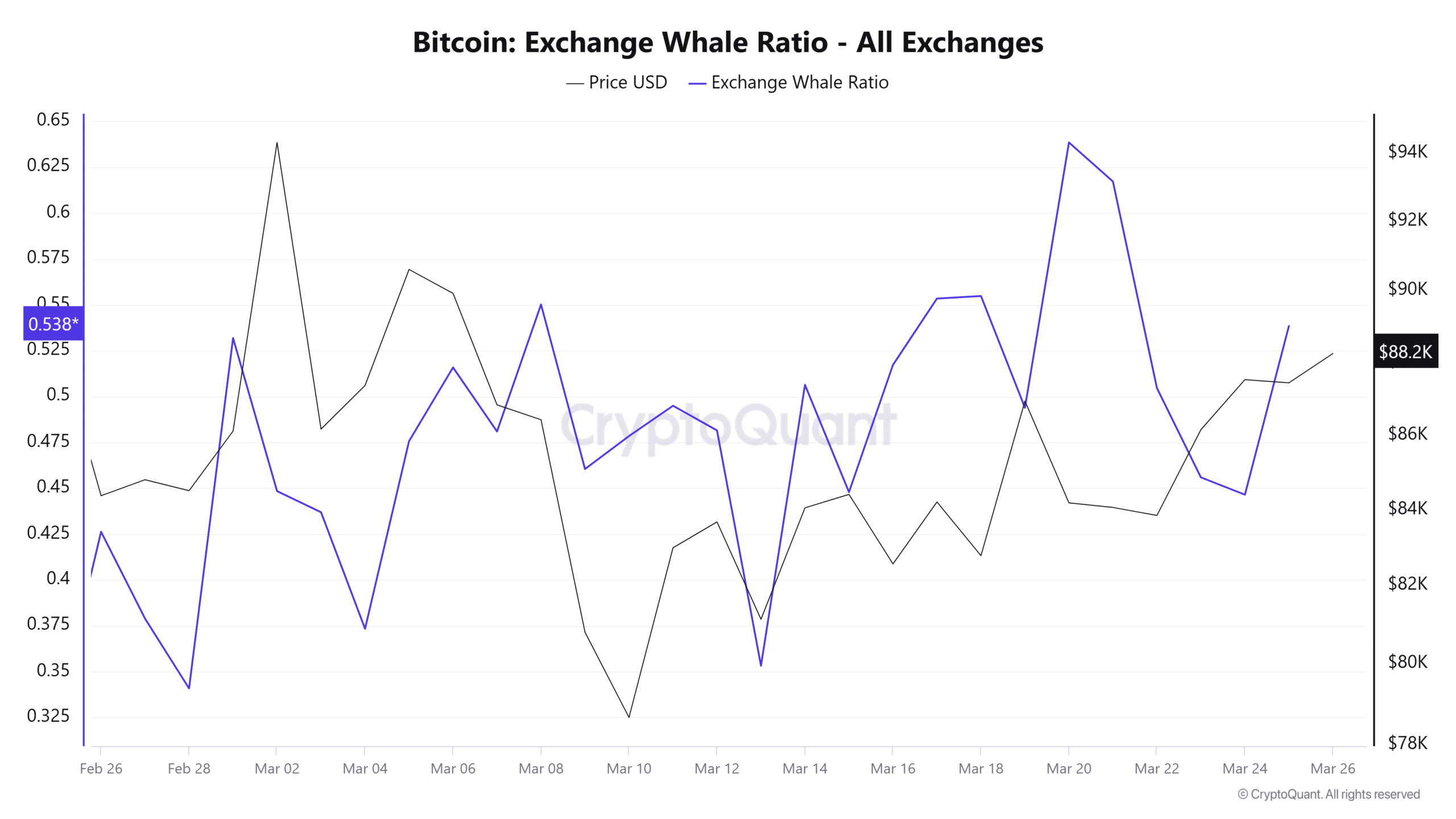

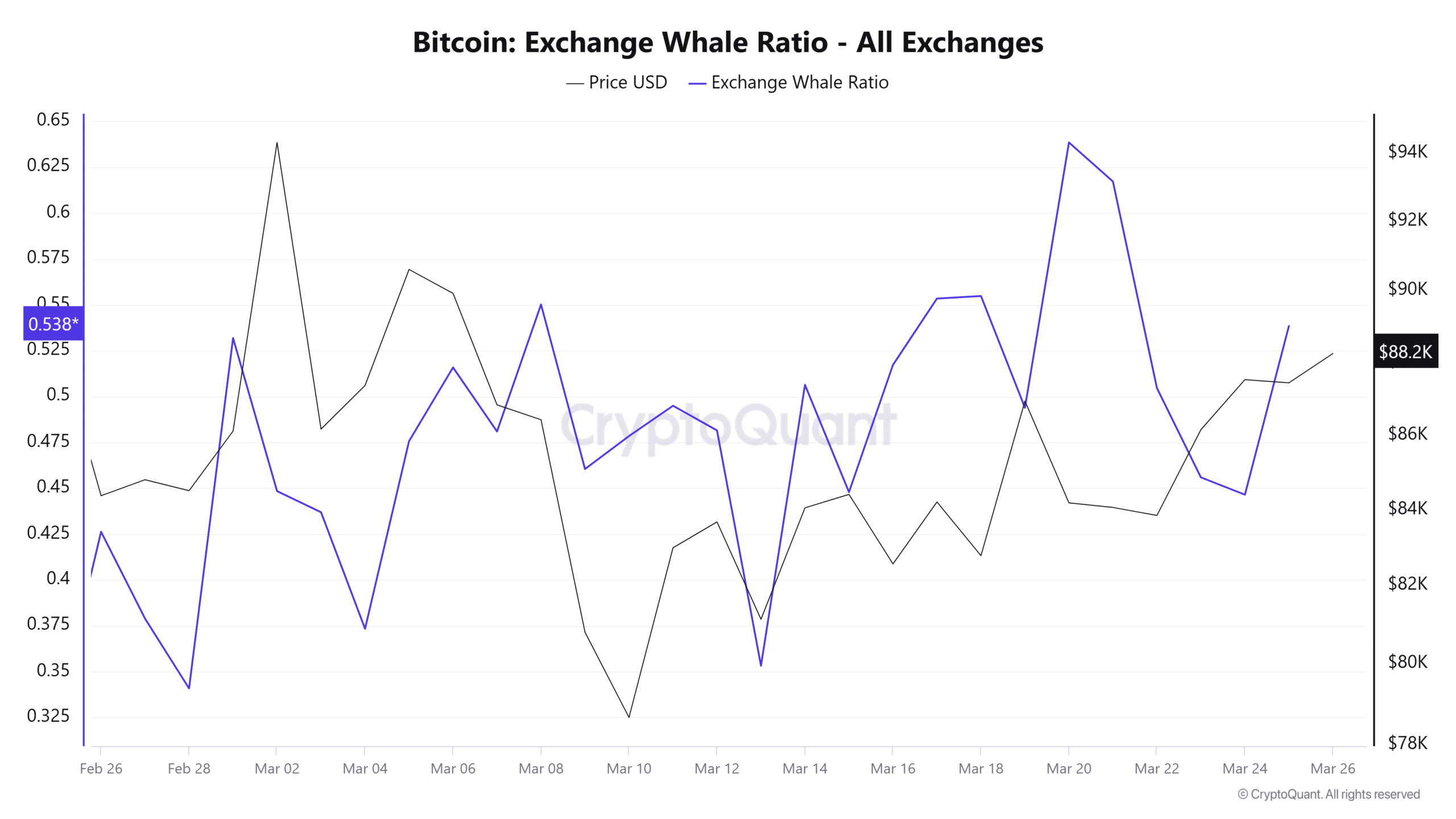

Cryptoquant data reveal a quiet market, supported by the exchange rate ratio that stays above 0.50 in March.

Source: Cryptuquant

Peaks on March 14 and March 20 are geared to stabilization near $ 84,000 and a recovery of up to $ 88,200. This pattern suggests whale activity during low volatility, without causing major sale.

Bitcoin is in a cooling phase, no breakdown.

Statistics on platforms show steady accumulation, lower profitability in the short term and sleeping long -term companies. Resistance is almost $ 90k- $ 93k; Support is $ 87k $ 89k.