- Bitcoin Cash has risen 15.38% in the past 24 hours, reaching a seven-month high.

- Market indicators suggested that BCH was about to make a bullish crossover, signaling a further uptrend.

Bitcoin Cash last month [BCH] has seen a strong revival. Since hitting a local low of $321, the altcoin has seen continued upward momentum.

As such, Bitcoin Cash has risen to a seven-month high of $536 over the past 24 hours.

This bullish trend also held on the monthly and weekly charts. In fact, at the time of writing, BCH was trading at $512.

This marked an increase of 15.38% on the daily charts, with the altcoin gaining 15.86% on the weekly charts and 42.65% on the monthly charts.

Despite the recent price increase, BCH still remained approximately 88.18% below its ATH of $4355.

As BTC continues to make new ATH, BCH will also continue to enjoy the momentum. Therefore, our analysis indicates that BCH is well positioned for more gains on its price charts.

What BCH Charts Say

According to AMBCrypto’s analysis, BCH is experiencing increased buying activity and strengthening upward momentum.

source: TradingView

Over the past 24 hours, the RSI has risen from 57 to 68, indicating that buyers are dominating the market.

This increased buying pressure was reflected in trading volume, which rose 314% to $1.75 billion last day, according to CoinMarketCap.

Moreover, BCH’s Stoch RSI was on the verge of a bullish crossover, marking the beginning of a new bullish wave, while maintaining existing bullish momentum.

When this happens, it indicates that an asset is experiencing higher inflows, with investors continuing to buy for fear of missing out, especially after a short uptrend.

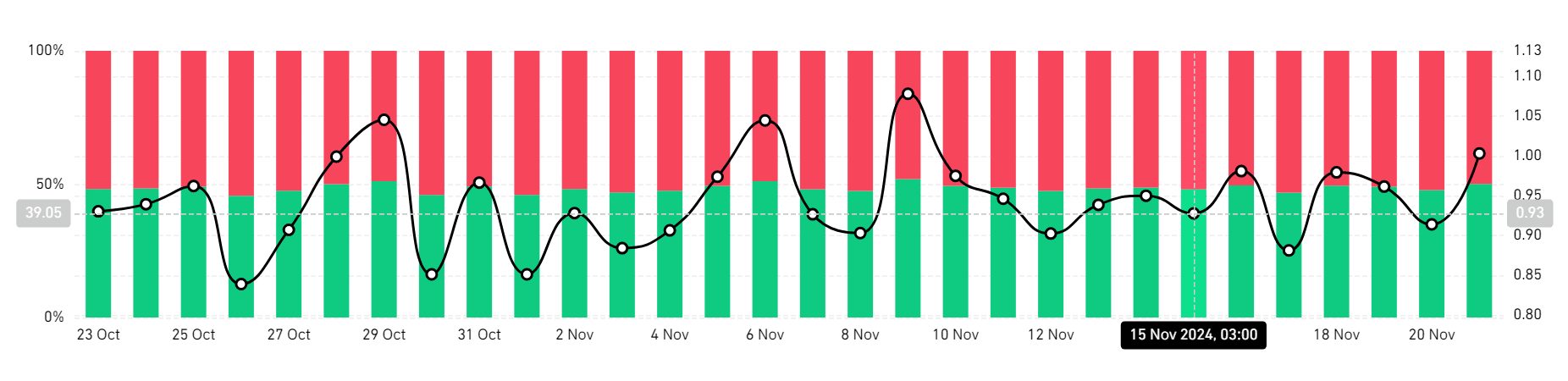

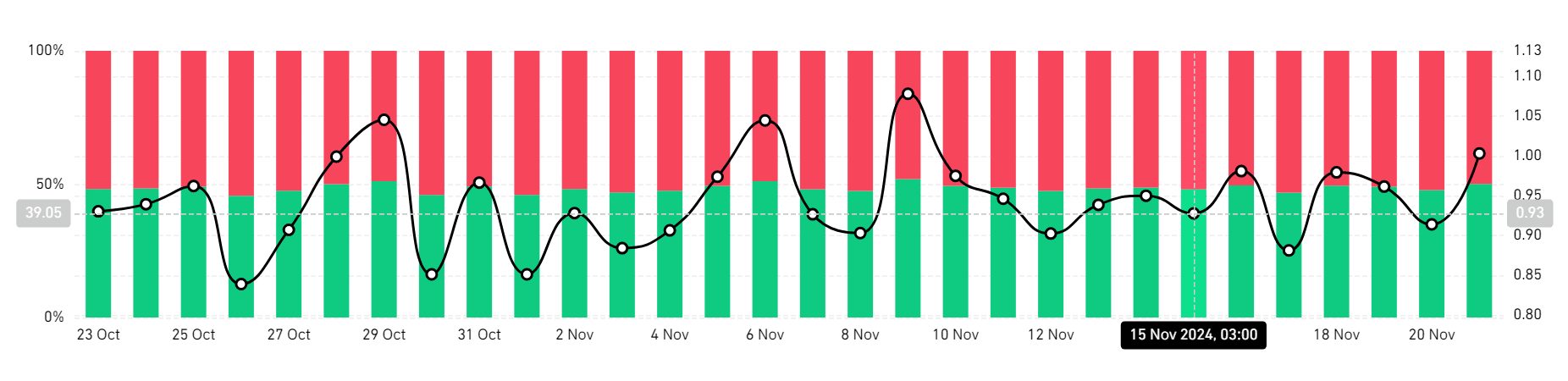

Source: Coinglass

Looking further, Coinglass’ data showed that most investors were optimistic and expected prices to rise. So the Long/Short ratio of 50% suggested that longs dominated the market.

Source: Santiment

This bullishness is clearly visible among long position holders. According to Santiment, the MVRV Long/Short difference has increased from -7.56 to -4.13 over the past week.

When this rises, it shows that longs are not only making profits, but also confident in the altcoin’s future prospects.

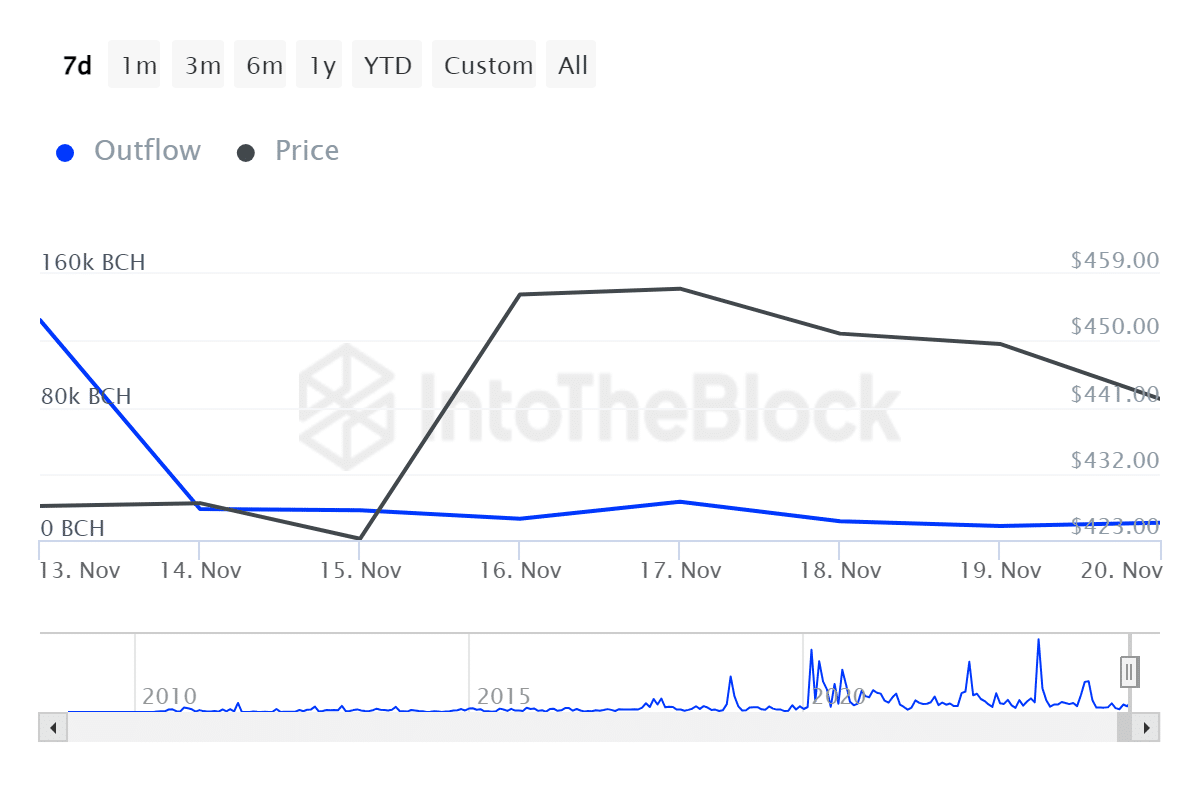

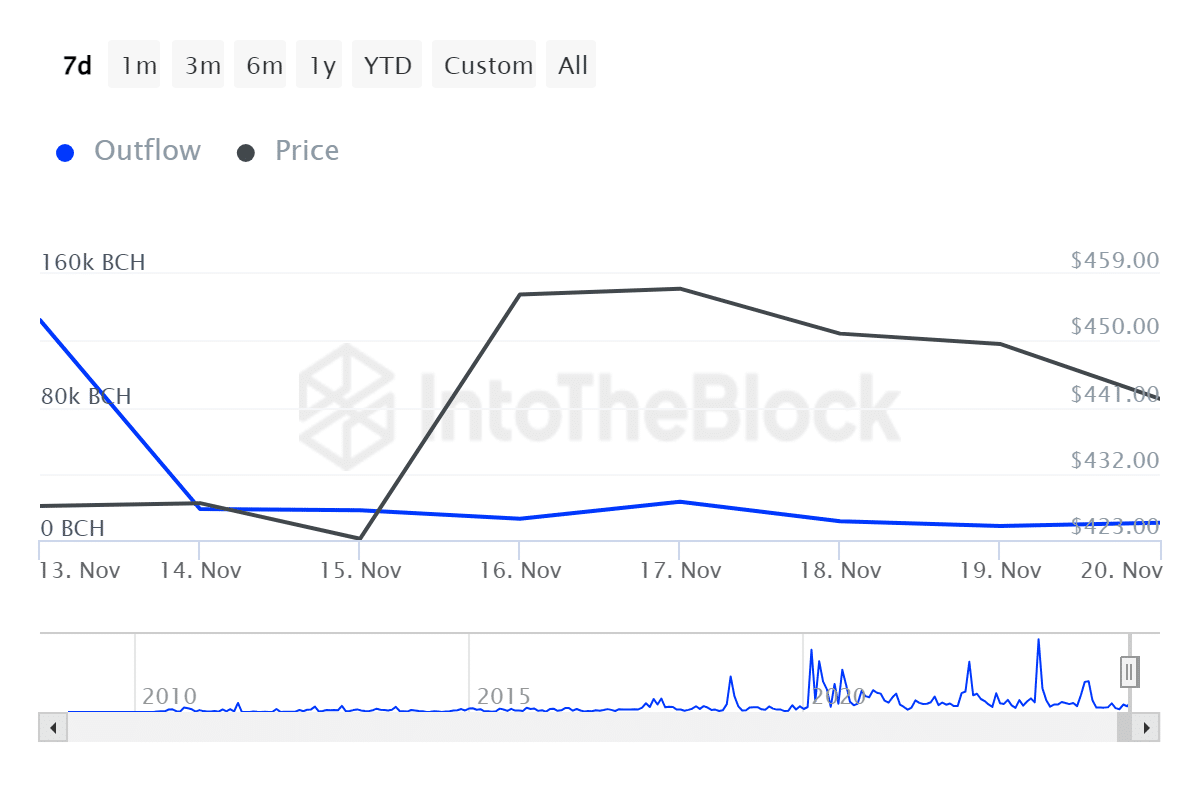

Source: IntoTheBlock

Finally, BCH’s large bondholder outflows have fallen to a monthly low of 10.42k. Such a decline here suggests that fewer large investors are withdrawing their money.

The large holders were therefore bullish and seemed to anticipate further price gains.

Read the one from Bitcoin Cash [BCH] Price forecast 2024–2025

What now?

If positive sentiment holds, BCH could make a bullish crossover and start a new wave. As such, after hitting the seven-month mark, BCH will find the next significant resistance around $620 if current sentiment holds.

Therefore, if the altcoin is rejected, it will find support around $407.