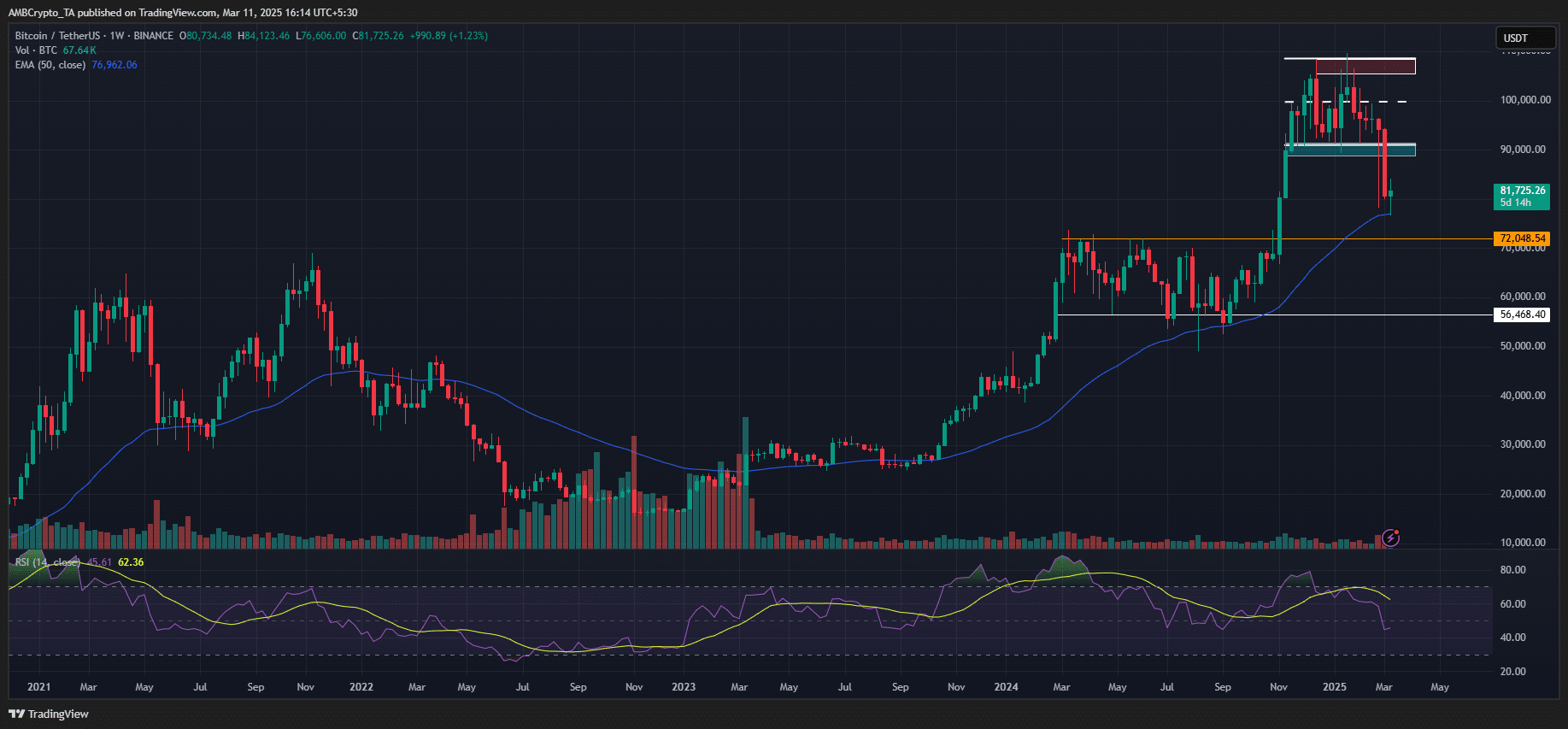

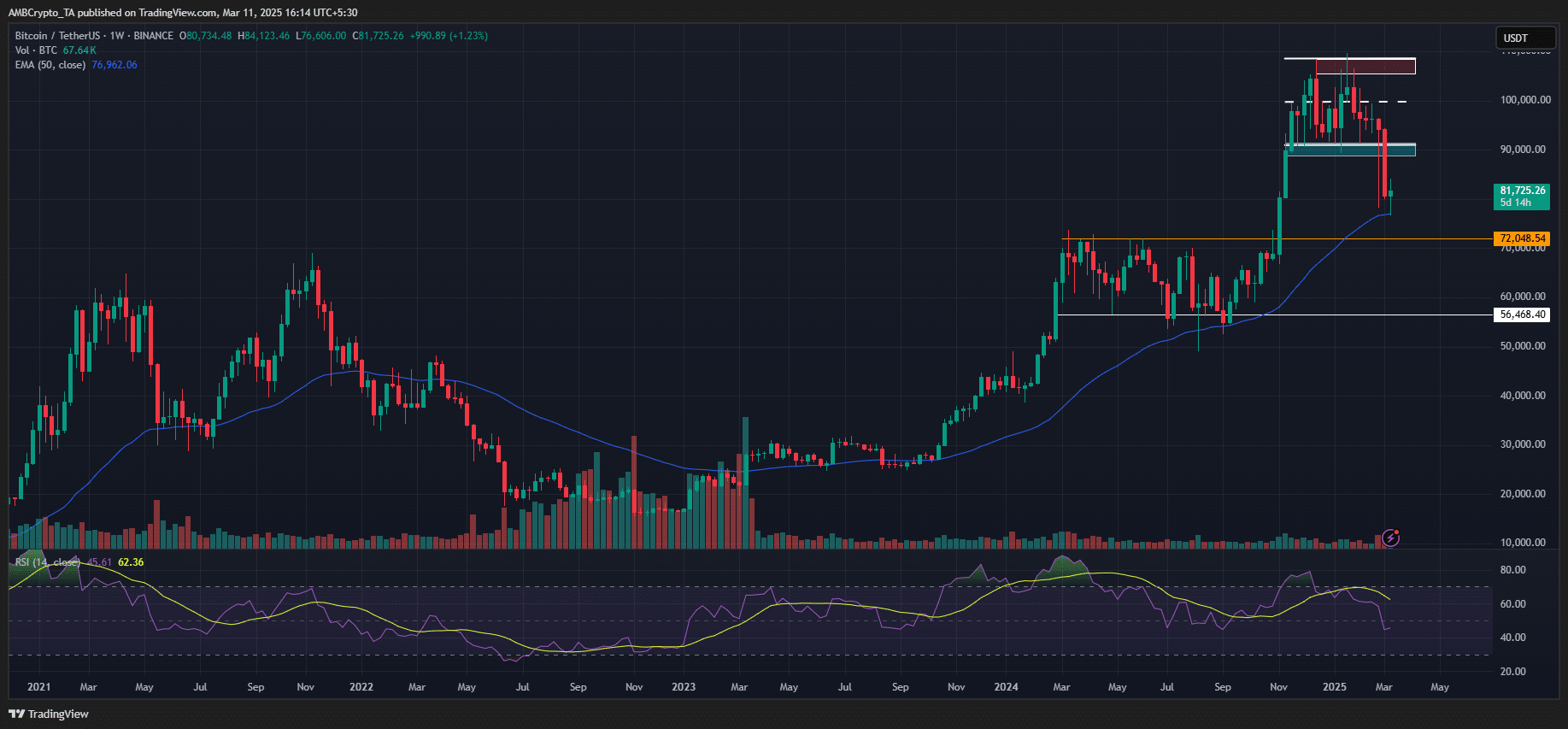

- BTC could extend losses to last November of $ 72k’s American election levels.

- Cathie Wood projected better macro conditions in the second half of 2025.

Bitcoin’s [BTC] Could slide below $ 75k in the short term in the midst of renewed American recession fears. Greg Madagini, director of Crypto Options Analytics Platform Amberdata, even projected that BTC could fall to $ 72k in the short term.

Bitcoin’s potential dip up to $ 72k

In its weekly market report, Magadini stated”

“BTC prices seem to deliver a Bart Simpson pattern that would focus on the prices at $ 72k, the level of November 5.”

Source: Ambdata

The Bart Simpson pattern refers to the formation of a sharp rise, marched through consolidation and then a sharp retrace.

If the pattern is validated, BTC could tap the American election level of November, such as Retracement seen between US shares, Magadini added.

“Given that the SPX (S&P 500 Index) has now been withdrawn in election prices, I think this pattern for Spot BTC could be in the cards.”

A similar Bearish -by -view was shared by the renowned technical analyst Peter Brandt, row That BTC has been structurally supplemented and has to reclaim $ 95k to make the market sentiment positive again.

In the midst of the American recession fearsArk Invest’s Cathie Wood ensured that the US economy would experience a ‘deflational tree’ in the second half of 2025. said”

“In our opinion, the market is the last part of a rolling recession, which will give the Trump administration and the Powell has fed much more degrees of freedom than investors, setting up the US economy for a deflation in the second half of this year!”

Another positive update was the strong correlation between BTC and global money supply (M2). Most analysts have noticed that BTC is left with Global M2, and the recent drawdown reflected the decrease in M2 last quarter.

Since the indicator was risen in Q1 2025, BTC can bounce back if the correlation applies.

Source: X

Jon Consorti, head of growth at side Bitcoin, noted that with the BTC fear and greed index on typical ‘soil’ levels, the cryptocurrency can be prepared for a recovery.

“Anxiety and greed index on 20, achieved a value in bull markets when Bitcoin is on its way to make a local soil.”

At the time of the press, BTC was appreciated at $ 81.6k after a short dip up to $ 76k. The level was also a 50 exponentially advancing average (EMA) on a weekly graph and crucial support for earlier bull markets. It is still to be seen whether it will hold in the short term.

Source: BTC/USDT, TradingView