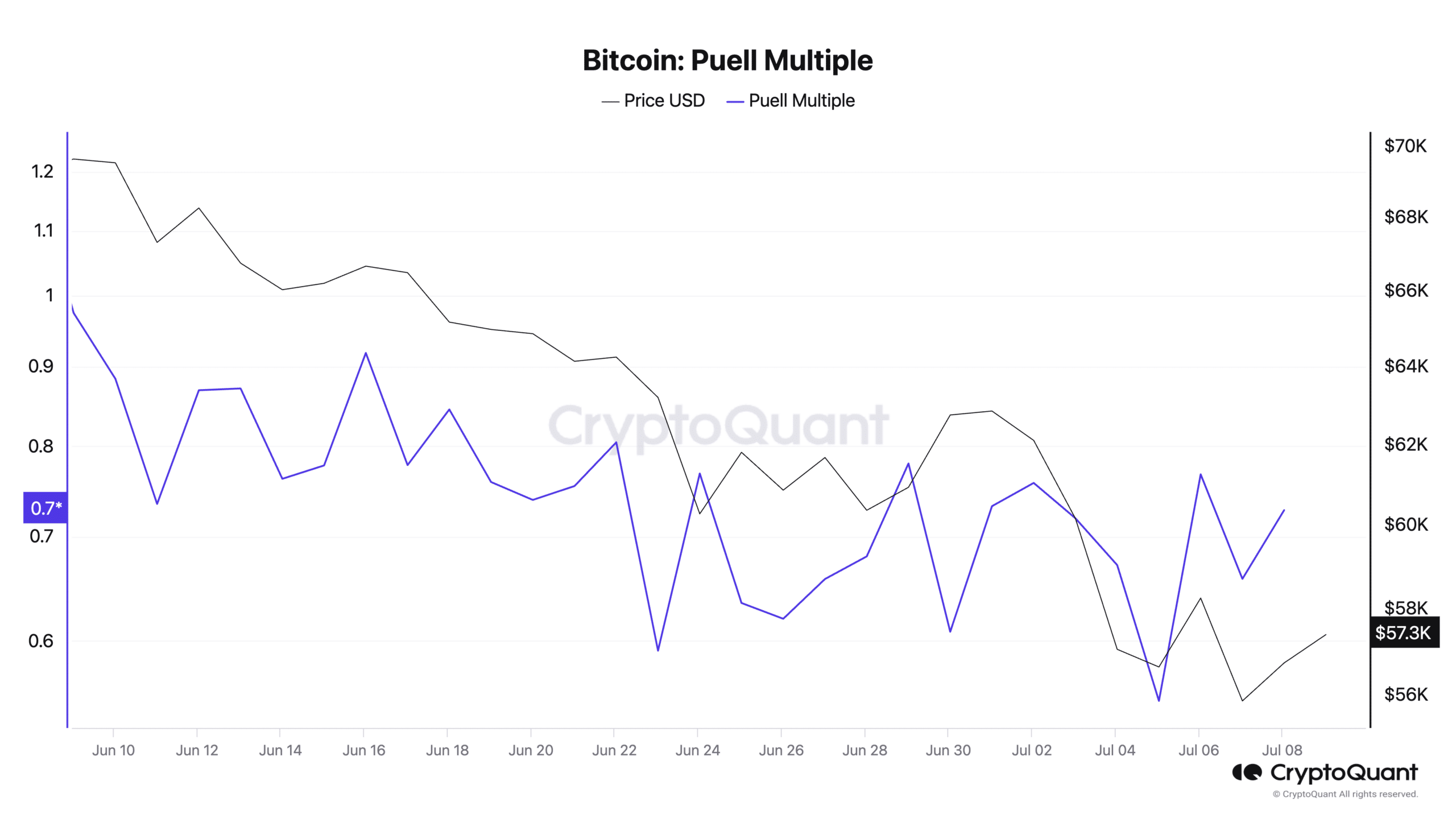

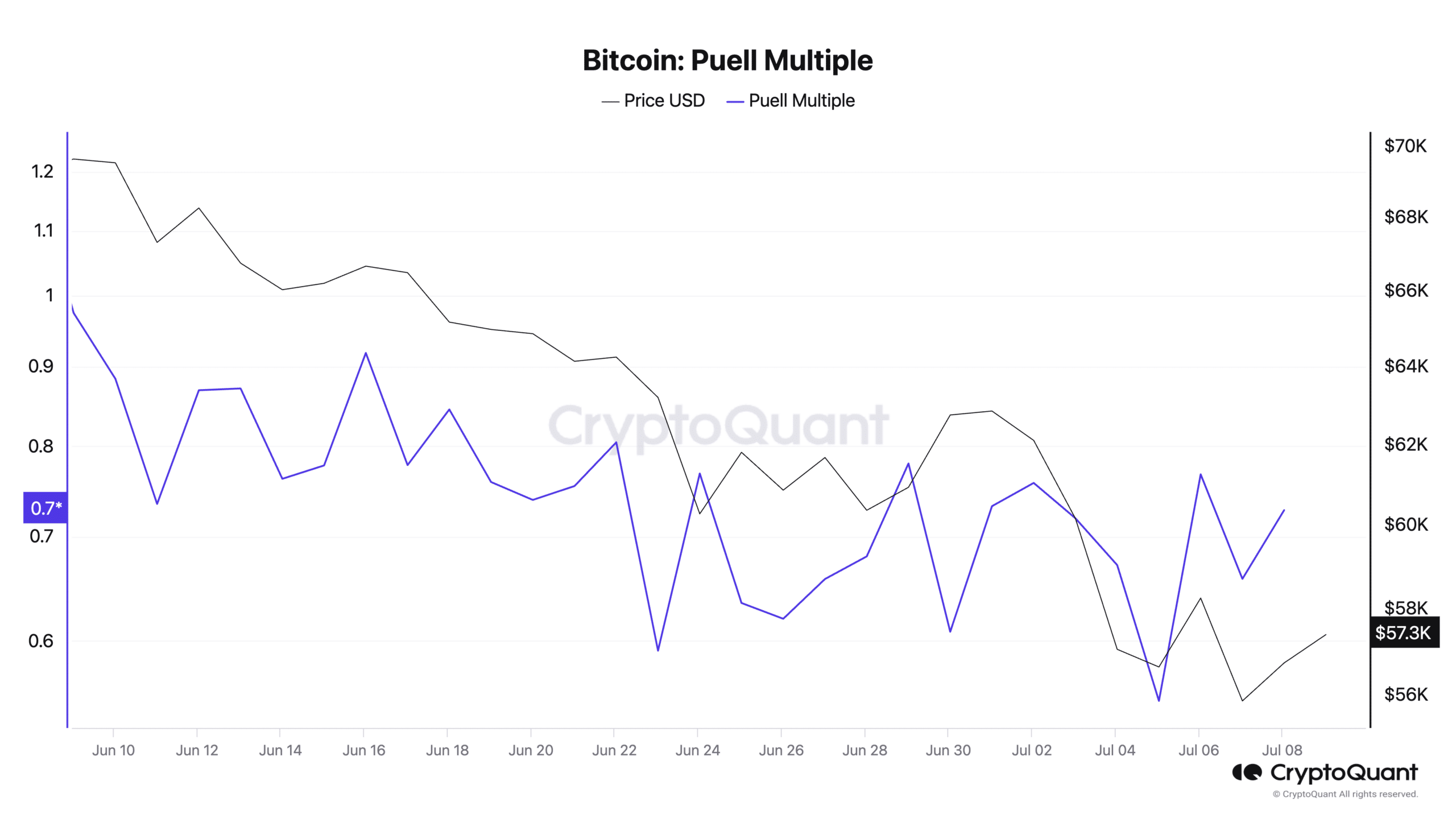

- Bitcoin’s Puell Multiple has fallen over the past month.

- This presented a buying opportunity for market participants.

Bitcoin’s recent decline [BTC] Puell Multiple hinted at the possibility of a new bull cycle, pseudonymous CryptoQuant analyst Crypto Dan discovered in a new report.

BTC’s Puell Multiple tracks the profits miners make on the network by comparing BTC’s daily issuance value to its 365-day moving average.

When BTC’s Puell Multiple rises, it indicates that the coin’s daily issuance is significantly above the annual average. This often corresponds to market spikes and signals that BTC is overvalued and falling.

Conversely, when this measure falls, it suggests that the daily issuance value is below the annual average, indicating a possible undervaluation of BTC.

It is often followed by a BTC price spike as market participants “buy the dip.”

At the time of writing, BTC’s Puell Multiple was 0.80. It started its current cycle of decline on June 6 and has fallen 54% since then.

Source: CryptoQuant

Dan reviewed BTC’s historical performance and found that when the Puell Multiple plummeted during the bull cycle in 2016 and 2020, it was “followed by the beginning of Bitcoin’s strong rise.”

According to Dan, this can happen in the current market cycle.

“In 2024 Currently, similar movements have been detected. Although it is difficult to determine the exact end of the adjustment period, it can be expected that it will not be far away. It is likely that we will see the beginning of a bull rally in the third quarter of 2024,” Dan said.

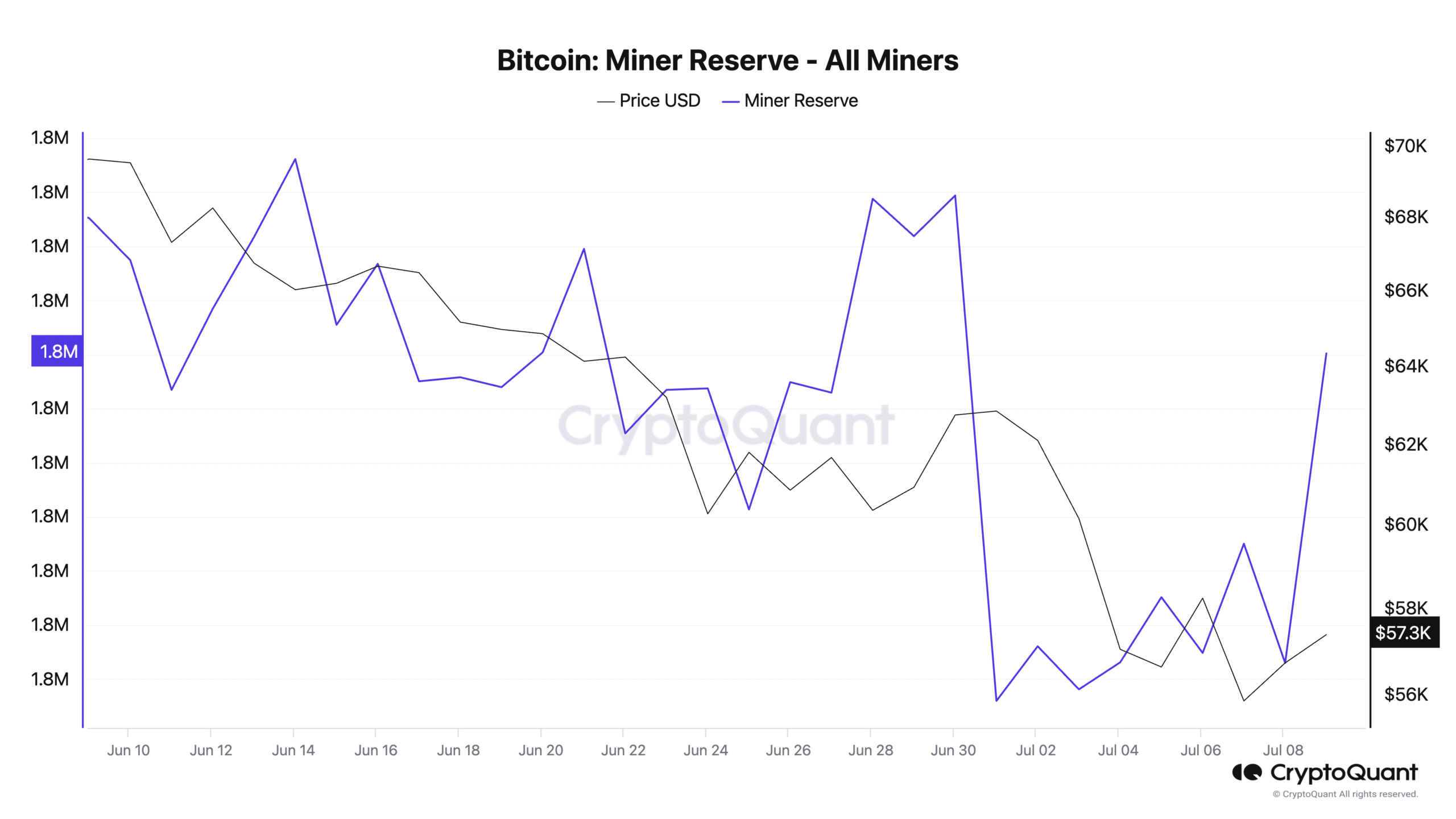

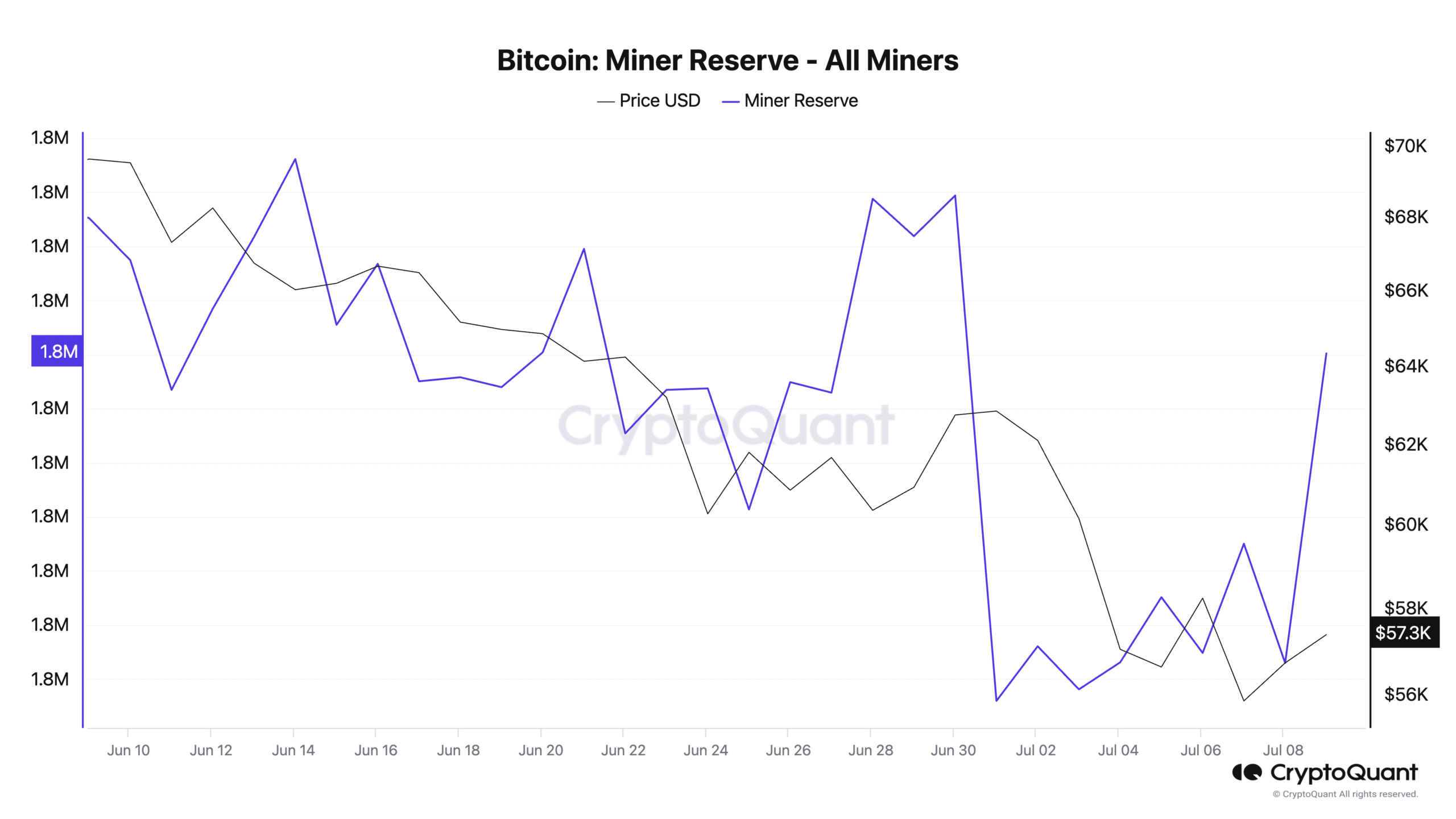

What are BTC miners up to?

The past 24 hours have been marked by a surge in BTC miner reserves. This metric measures the number of coins held in the wallets of affiliated miners. His value indicates the reserve that miners have yet to sell.

At the time of writing, 1.82 million BTC, valued at $104 billion at market prices at the time of writing, were held by miner wallets.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Over the past 24 hours, BTC’s miner reserve has increased by 1%. When this increases, it means miners are holding on to their coins rather than selling them on the market.

Source: CryptoQuant

It may be due to the expectation that the price of the coin will rise in the short/medium term.