- A review of BTCs On-Chain Losses Ribbon revealed that there was still an uptrend in the market.

- A drop in BTC foreign exchange reserves indicates a decrease in the coin’s sell-off.

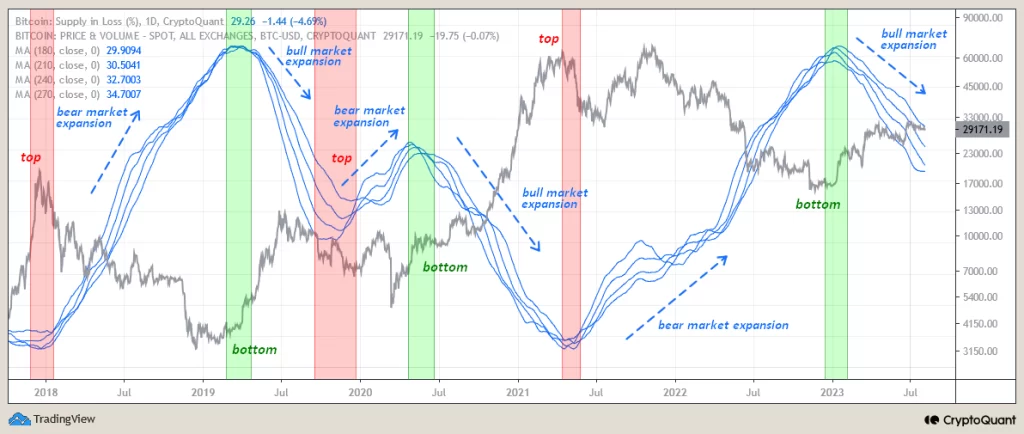

Like Bitcoin’s [BTC] price traded below the $30,000 psychological price, positive sentiment in the market waned. However, pseudonymous CryptoQuant analyst BaroVirtual has found that the bullish trend has remained in the market.

Read Bitcoin [BTC] Price forecast 2023-2024

The analyst assessed the leading coin’s On-Chain Losses Ribbon and found that the price of BTC reached a local bottom between December 2022 and January 2023 and has started a bullish trend since February.

Source: CryptoQuant

BTC’s On-Chain Losses Ribbon is a technical indicator that uses moving averages to measure the amount of BTC in loss. The four moving averages used are the 180-day moving average, the 210-day moving average, the 240-day moving average, and the 270-day moving average.

When the ribbon is narrow, it indicates that a small amount of BTC has been lost. This is a bullish signal as it suggests that the market is not oversold and there is still room for price increases.

Conversely, when the ribbon is wide, it indicates that a large amount of BTC has been lost and the market is in an oversold state.

Furthermore, a bullish signal presents itself when the ribbon turns from top to bottom as it indicates that the price of the asset in question has bottomed out. Also, when the ribbon starts spinning from bottom to top, it usually means that the coin is approaching a price top and a drop is imminent.

BaroVirtual commented:

“In February 2023, a rapid decline of the Ribbon began, indicating a steady development of the bullish trend. The danger to bulls from the point of view of this indicator can occur only when the ribbon reaches its conditional low point, then begins to fix its position and turn from bottom to top. I reiterate that nothing threatens the bullish trend at this point.”

Market provides unwavering support to the number one coin

Although the price of BTC has remained within a narrow price range since April, exchange reserves continue to fall. BTC’s Exchange Reserves statistic tracks the king coin number held on cryptocurrency exchanges.

Source: CryptoQuant

The increase in BTC exchange reserves indicates a wider distribution, which often puts downward pressure on the price. However, a decline means that few sell-offs are recorded, leaving room for an increase in the price of the coin.

At the time of writing, BTC foreign exchange reserves amount to 2.08 million BTC. On a 30-day rolling average, this is down 1.4%, data from CryptoQuant revealed.

Despite the significant resistance facing BTC at $30,000, the number of open trading positions on derivatives trading pairs has also increased. Also assessed against a 30-day moving average, BTC’s outstanding interest is up 6%.

Is your wallet green? Check out the Bitcoin Profit Calculator

According to CryptoQuant, this was $9.51 billion at the time of writing.

Source: CryptoQuant

With the reporting period largely characterized by positive funding rates, investors continued to bet on price increases.

Source: CryptoQuant