- Bitcoin faced significant resistance between $98,000 and $100,000.

- Shrinking foreign exchange reserves and inflows indicated reduced selling pressure, tilting towards bullish sentiment in the long term.

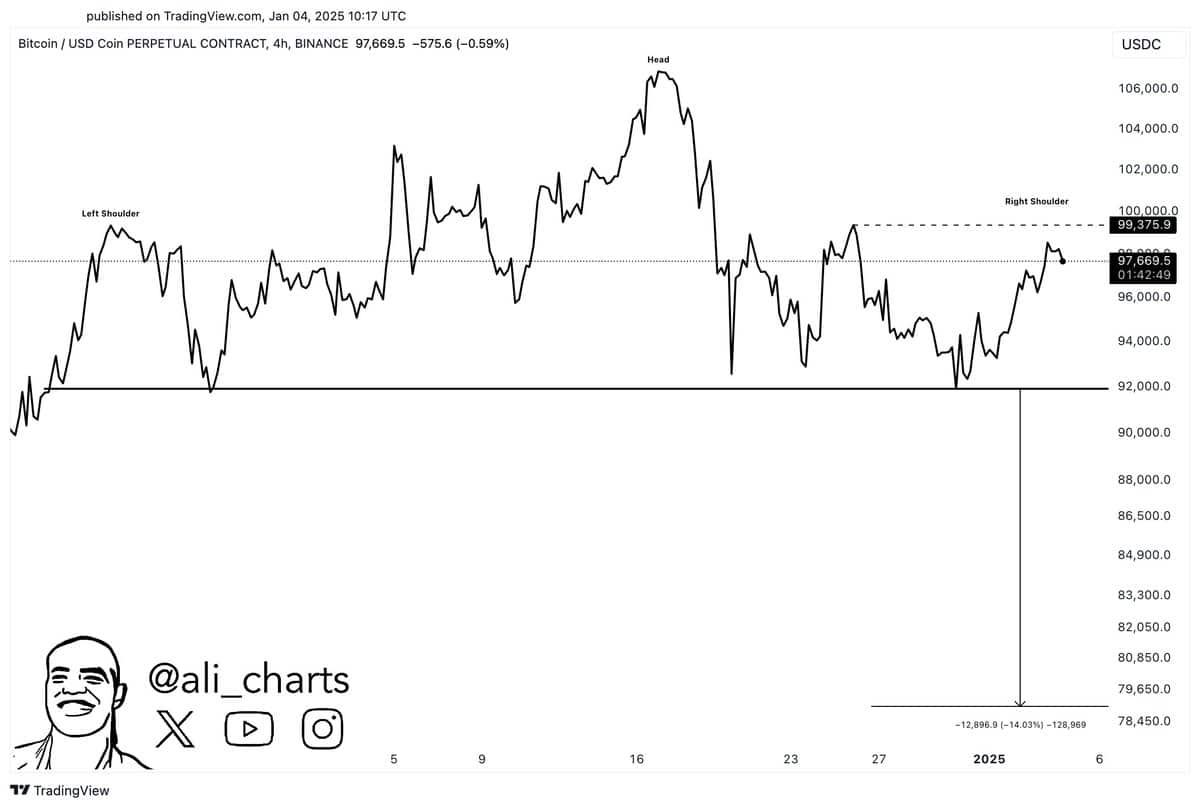

Bitcoins [BTC] The journey to regain the psychological price level of $100,000 was met with heavy resistance. At the time of writing, the price near a key pennant supply area was hovering between $98,000 and $100,000.

This key resistance zone has proven to be a challenge for bulls as short position takers defended it vigorously.

Breaking this resistance level is crucial for Bitcoin to continue its upward trajectory and avoid a potential bearish reversal.

Source: TradingView

The head and shoulders pattern looms

According to a renowned analyst on XBitcoin’s price chart suggested a possible head-and-shoulders pattern. If confirmed, this bearish setup could push the price towards the $78,000 region.

Such a correction would be in line with technical expectations, given the historical accuracy of the pattern.

However, the pattern remains invalid until a decisive break below the neckline.

For bulls, a strong daily or weekly close above $100,000 is crucial. This would negate the bearish outlook and pave the way for Bitcoin to explore new highs.

Source:

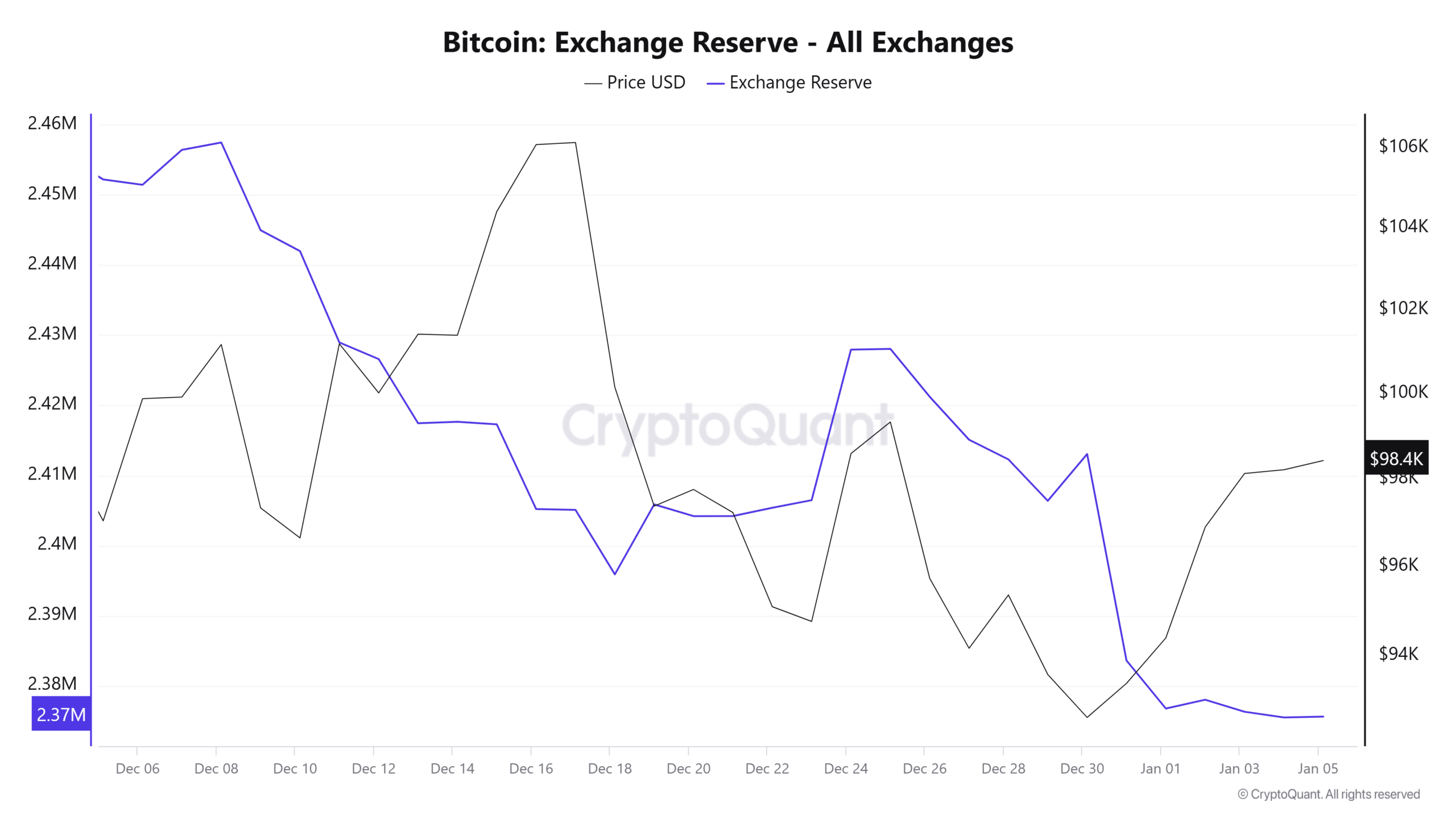

Declining foreign exchange reserves indicate bullish potential

Statistics about the chain offered a more optimistic perspective. Bitcoin exchange reserves have consistently fallen, indicating that there are fewer tokens available for sale.

This suggests that market participants are increasingly choosing to hold on to their Bitcoin, easing selling pressure on the king coin.

Source: CryptoQuant

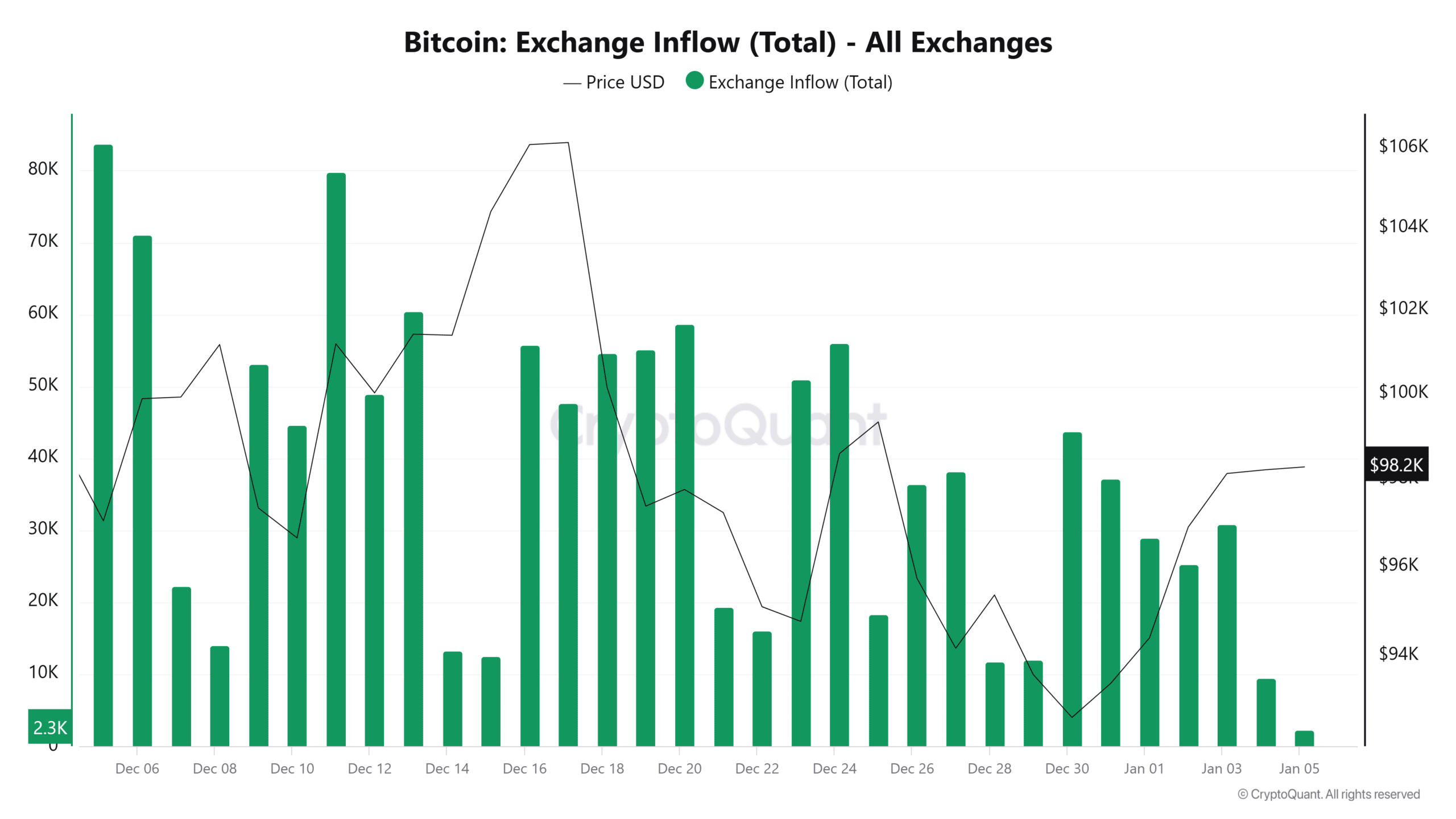

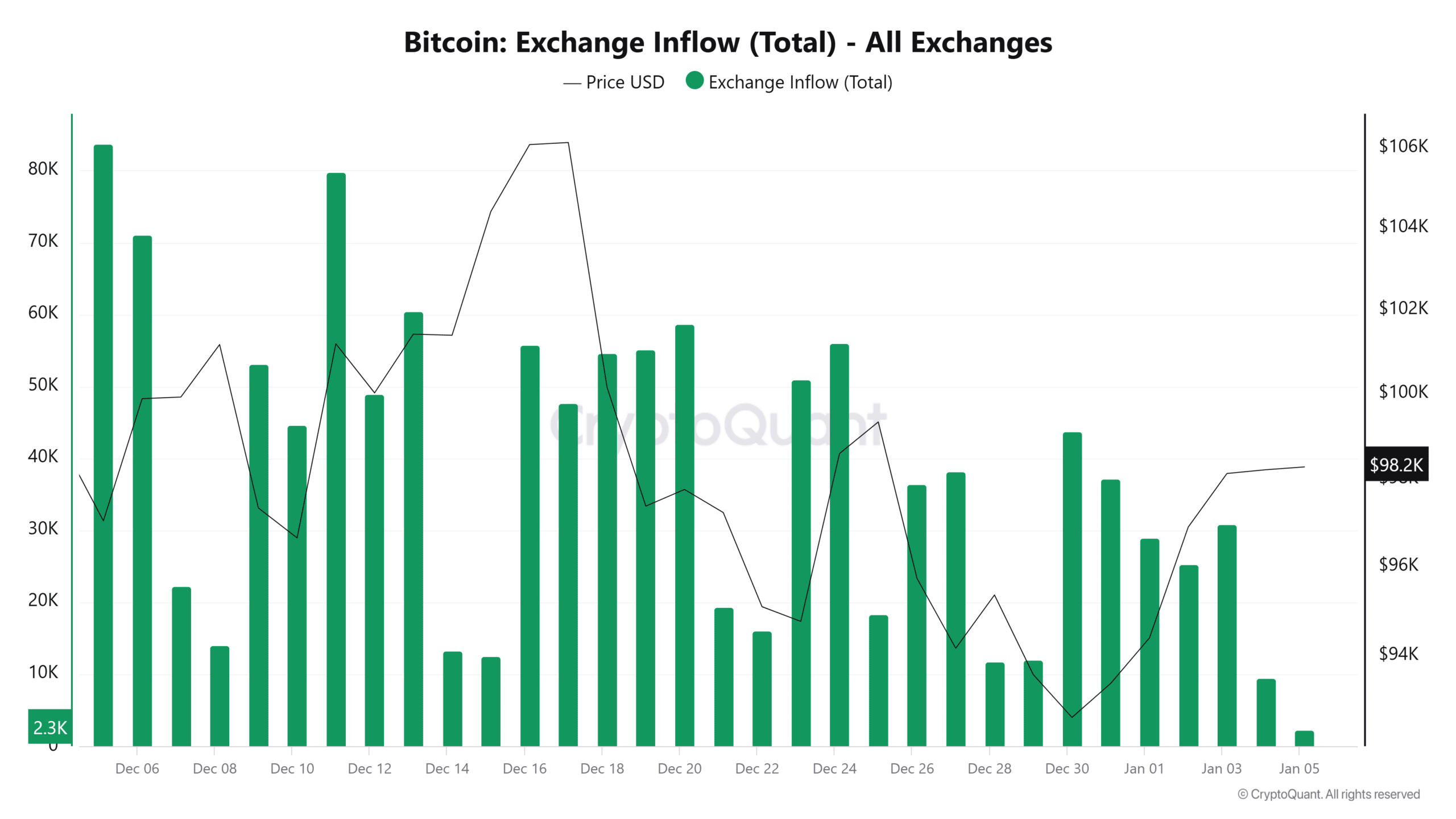

In addition, foreign exchange inflows – a key measure for assessing potential sales activity – have declined steadily since December 30.

The reduced inflows reported by CryptoQuant suggest less Bitcoin is being transferred to exchanges, further supporting the bullish outlook.

Source: CryptoQuant

What lies ahead for Bitcoin?

The battle between Bitcoin’s bulls and bears is intensifying, with the king crypto remaining trapped below the $100,000 resistance level.

A breakout above this key resistance level could pave the way for further gains. However, if this does not happen, the bearish head and shoulders pattern can be validated.

Despite this technical uncertainty, the on-chain data paints a bullish picture.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Reduced foreign exchange reserves and inflows indicate a shift in sentiment, with holders appearing more confident in Bitcoin’s long-term prospects rather than shorting their existing positions.

Bitcoin’s next move will largely depend on its ability to overcome the $100,000 resistance.