Este Artículo También Está Disponible and Español.

Bitcoin is now testing the psychological price level of $ 100,000 again after a decrease of 2.22% in the last 24 hours. In particular, Bitcoin recently returned around an order block for $ 99,200 in the last 24 hours because it continues to act with intense volatility.

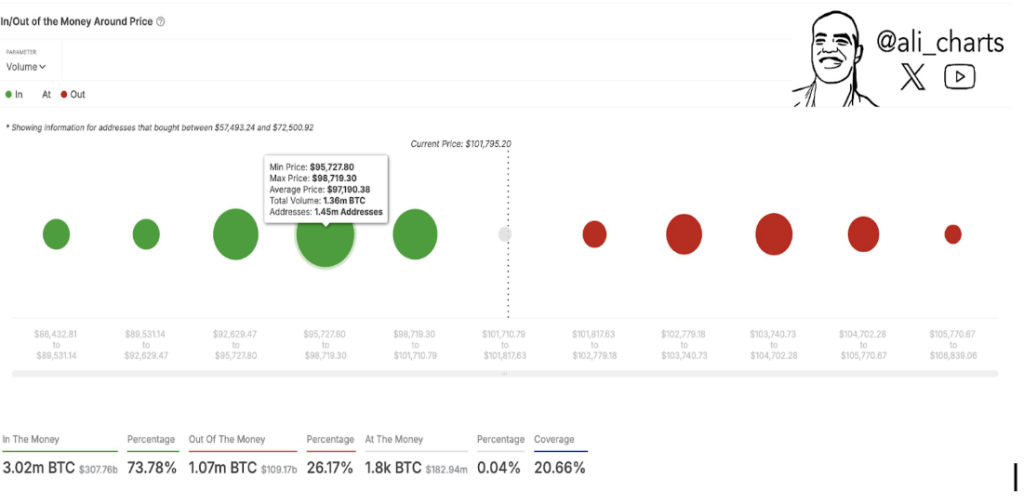

In the meantime, Crypto analyst Ali Martinez has pointed to $ 97,190 as an important level of support, and emphasizes that Bitcoin must remain above to maintain his bullish process. This insight comes in the midst of competitive price fluctuations who tested the sentiment of investorsBut optimism remains strong because data indicates that many traders continue to bet on Bitcoin’s upward process.

Bitcoin’s most important support level identified at $ 97,190

When Martinez noticed, $ 97,190 is one of the most critical support levels for Bitcoin, and above it is above that crucial for maintained The Bullmarkt. This insight is supported by data from On-Chain Analytics Platform Intotheblock. In particular, the data is unveiled by the in/out of money around Price Statistics from Intotheblock, which follows the number of addresses or earns money at the current price of a crypto activum.

Related lecture

In the case of Bitcoin, approximately 73% of the addresses that Bitcoin bought at the current trading range is in profit. A significant part of this, around 1.45 million addresses, bought Bitcoin between $ 95,727 and $ 98,719 at an average price of $ 97,190. These addresses jointly contain around 1.36 million BTC around this level, making it one of the most densely concentrated areas of interests in the current cycle.

Given this concentration of interests, Bitcoin Must retain its position Above $ 97,190 to keep his bullish momentum and keep sentiment positive with traders. A break below this level can push many of these holders to break-even, so that the probability of panic sales. This can in turn bring further to the pressure and cause a step -by -step effect on the Bitcoin price.

Image X: Ali_charts

Binance Futures -Data show a strong bullish sentiment

Despite worrying about Bitcoin’s ability to maintain its support, market sentiment among traders remains largely optimistic. Remarkable, Open position On Binance, the world’s largest crypto exchange, it shows that a considerable majority of traders continue to bet on the top.

According to data from Coinglass, 60.94% of traders on Binance, the largest crypto exchange, with open bitcoin -Futures positions are at the front.

Martinez further pointed the bullish prospects and also pointed to a purchase signal of The TD sequential indicator, It appeared on the four -hour graph of Bitcoin. This technical tool has been contributed to identifying trend covers during this cycle, often prior to remarkable price repair.

Related lecture

As the Pattern keeps true againBitcoin could experience renewed buy busy in the coming daysPossibly set the stage for a retest of the level of $ 106,000.

At the time of writing, Bitcoin acts at $ 99,403, with 2.35% in the last 24 hours.

Featured image of Neon Dreams, Chart From TradingView