- Although the price of BTC has recently regained the $28,000 price level, short-term holders have refused to sell.

- Accumulation remains stable despite the coin’s yield below $27,500.

Bitcoins [BTC] The price briefly regained the $28,000 price point during the intraday trading session on October 5, but it remains to be seen whether or not the coin can move past this new resistance level.

At the time of writing, the leading coin was exchanging hands at $27,491, according to data from CoinMarketCap.

How much are 1,10,100 BTCs worth today?

It’s the short-term holders that need to be watched

BTC short-term holders (STH) are investor cohorts who have held their coins for less than 155 days. They tend to be more price sensitive than long-term holders (LTHs) because their coins are easily accessible and ready to be distributed once the price of BTC falls below their cost basis.

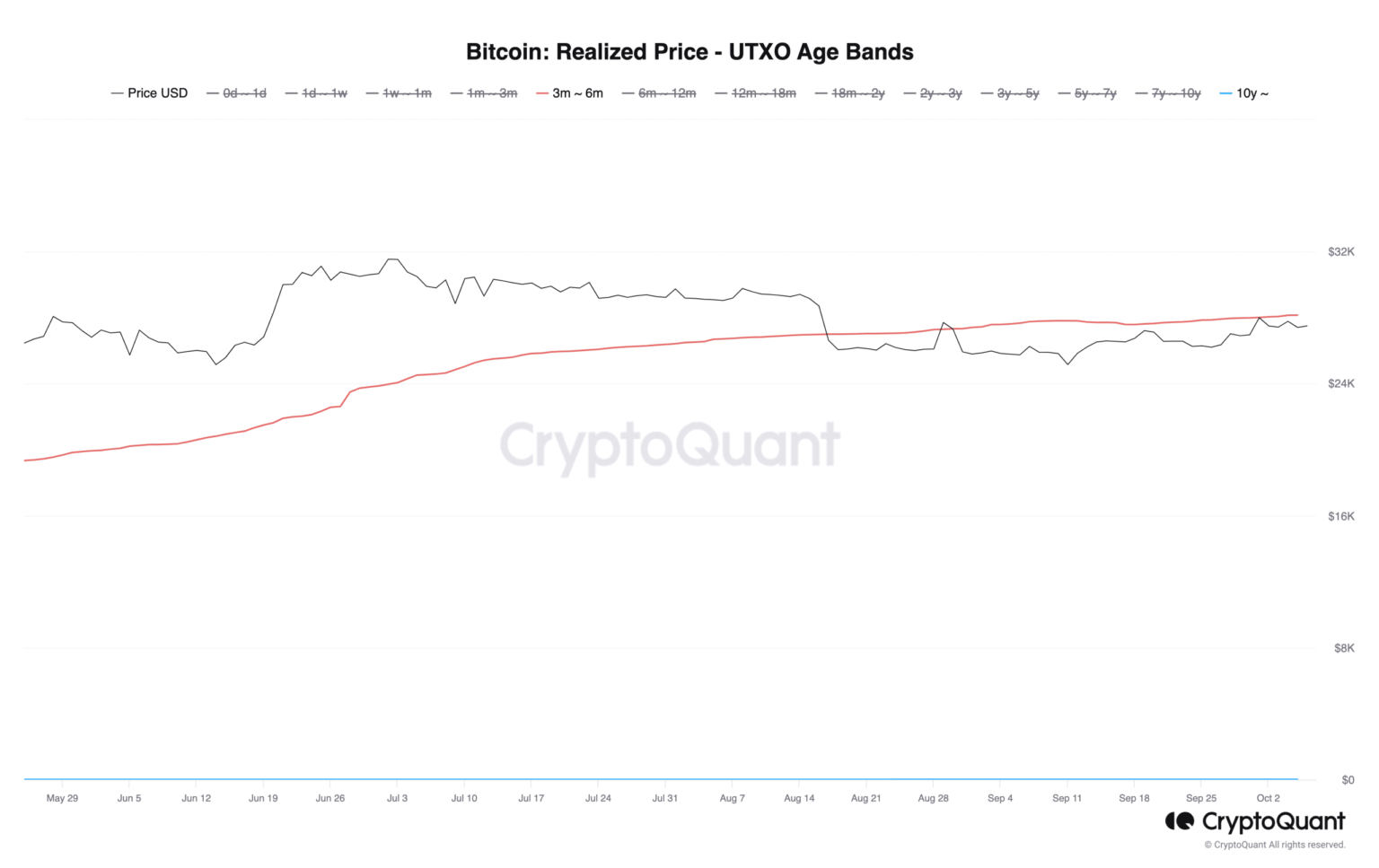

In a new after, pseudonymous CryptoQuant analyst Tarekonchain assessed the realized price of BTC – UTXO age groups. The metric proves useful in this regard because it shows a pattern of coin distribution among STHs as the price of BTC rises to the level at which they purchased their coins.

According to data from CryptoQuantThe realized price for BTC’s STH was above the coin’s current price at the time of writing, indicating that these investors were making a profit.

Source: CryptoQuant

As noted by Tarekonchain:

“There has been no significant influx of Bitcoin from these groups into the market to date. This lack of activity suggests that these investors are holding their positions and refraining from massive sell-offs.”

The analyst further added that if these investors “maintain their Bitcoin holdings without switching to exchanges, there is a high chance of prices rising. Conversely, if transfers increase, a price drop may be imminent.”

BTC on the daily chart

Following BTC’s price drop below $27,500, the Chaikin Money Flow (CMF), which attempted to move above the zero line during the trading session on October 5, resumed its downtrend.

At the time of writing, the indicator returned a negative value of -0.05, indicating some weakness in the BTC market. This showed that significant liquidity has disappeared from the market over the past 24 hours.

Nevertheless, coin accumulation remained stable. The Relative Strength Index (RSI) and Money Flow Index (MFI), with respective values of 57.13 and 67.65, reflected this.

Realistic or not, here is the market cap of ETH in BTC terms

Furthermore, as evidenced by the Directional Movement Index (DMI), BTC buyers continued to control the currency’s spot markets.

At the time of writing, the positive indicator (green) at 29:12 was above the negative indicator (red) at 10:22. This indicated that the power of the buyers was greater than that of the sellers.

Source: BTC/USDT on TradingView