- The FOMC minutes for the July 30-31 meeting showed that a large majority of Fed officials agreed to a rate cut in September.

- Bitcoin briefly regained $61,000 after the news, while Open Interest rose by almost $2 billion.

The Federal Open Market Committee (FOMC) has released its long-awaited minutes for its July 30-31 meeting.

The minutes dispelled any doubts about September rate cuts, with a large majority of Federal Reserve officials agreeing that inflation has eased.

Such macroeconomic data tends to cause price movements in the crypto market. Most of the top ten coins by market capitalization experienced small periods of volatility, with Bitcoin [BTC] breaking the psychological level of $60,000.

First Fed rate cut since 2020

According to the minutes of the July 30-31 meeting, most Fed officials support a September rate cut. Some members were also prepared to support a 25 basis point cut at the July meeting.

Read the minutes,

“The vast majority noted that, if data continued to come in as expected, it would likely be appropriate to relax the policy at the next meeting.”

The officials further noted that while inflation remained high, it had fallen significantly and was on track to reach the 2% target. Other economic indicators, such as the labor market, were also strong.

The cut will be the first time the Federal Reserve has refrained from tightening measures since 2020.

69% of investors on the CME FedWatch tool also expects the same decline. However, 30% of investors expect a steeper cut of 50 basis points.

Bitcoin jumps on “dovish” minutes

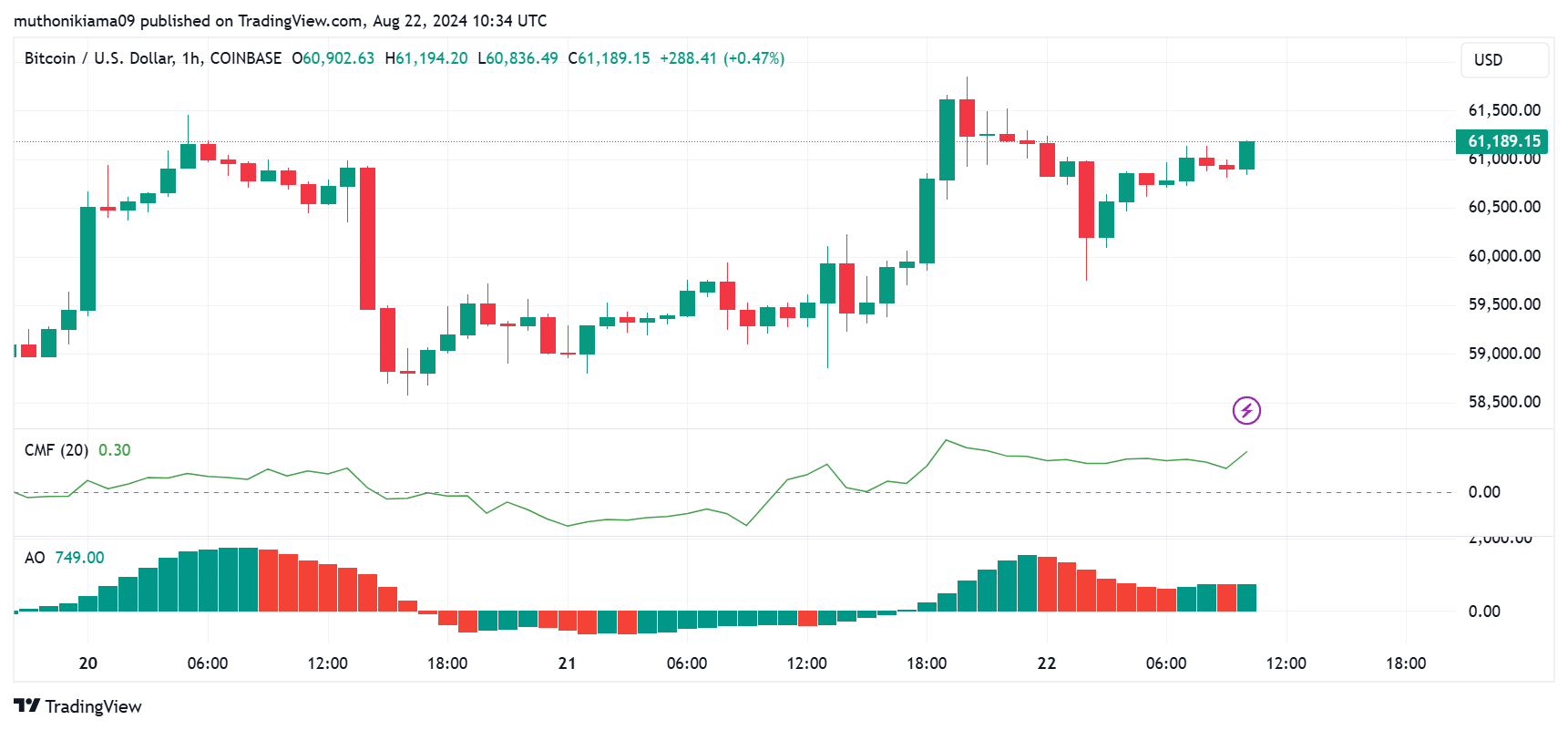

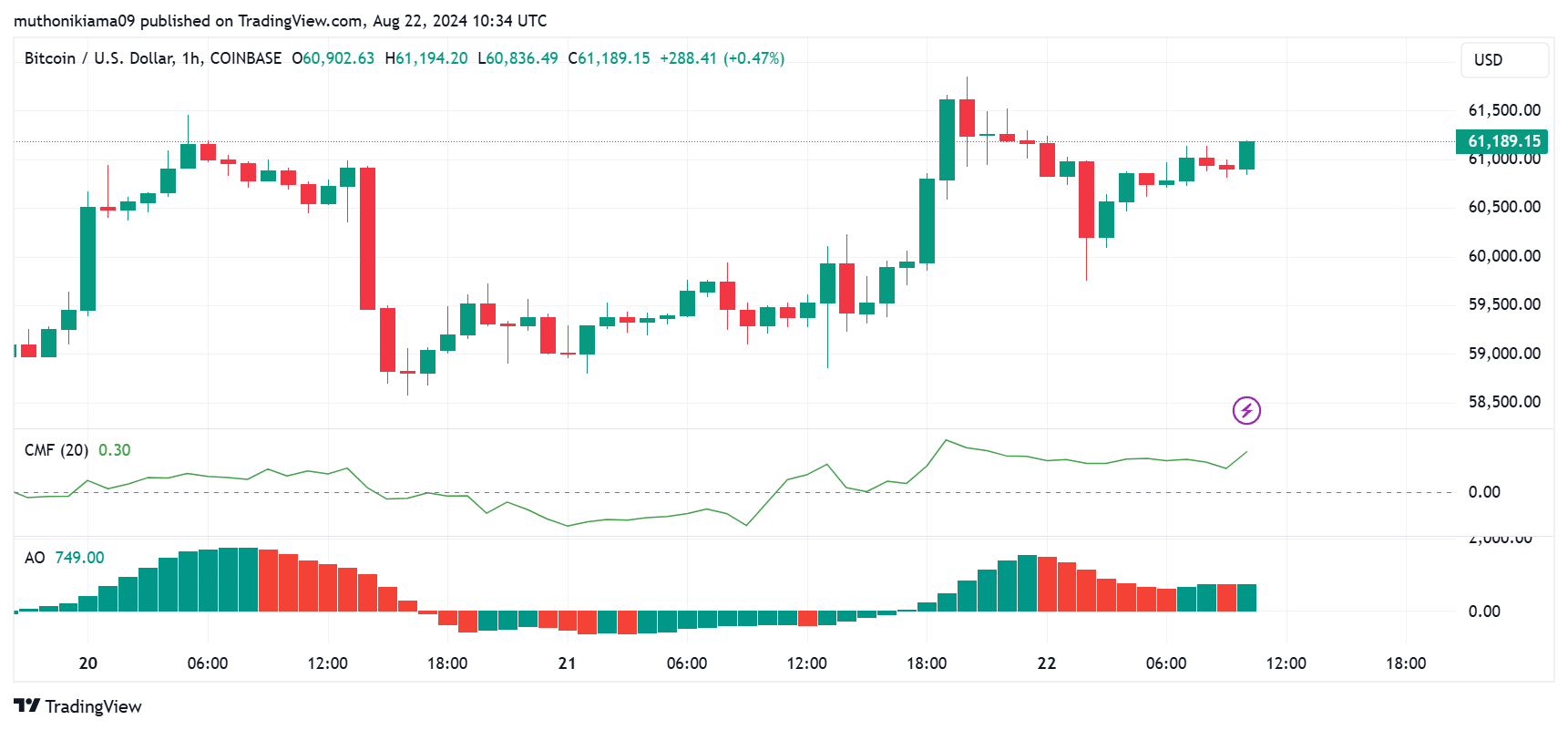

Bitcoin rose 2.6% to trade at $61,189 before falling to $61,189 $60,890.81 at the time of writing. BTC trading volumes have also increased by 26% per year CoinMarketCap data, as market interest in the coin grew.

The spike comes amid a rise in purchasing pressure, as reflected in the Chaikin Money Flow (CMF) index.

The CMF was in the positive region at the time of writing, peaking significantly on August 22, coinciding with the release of the FOMC minutes.

Source: TradingView

Nevertheless, the uptrend remained weak, as evidenced by the Awesome Oscillator (AO). The AO was positive on the hourly chart and also shifted green at press time.

While this indicates an upward trend, more confirmation is needed to confirm its strength.

Read Bitcoin’s [BTC] Price forecast 2024-25

Data from Mint glass also showed an increase of almost $2 billion in Open Interest, from approximately $30 billion on August 21 to $32 billion at the time of writing.

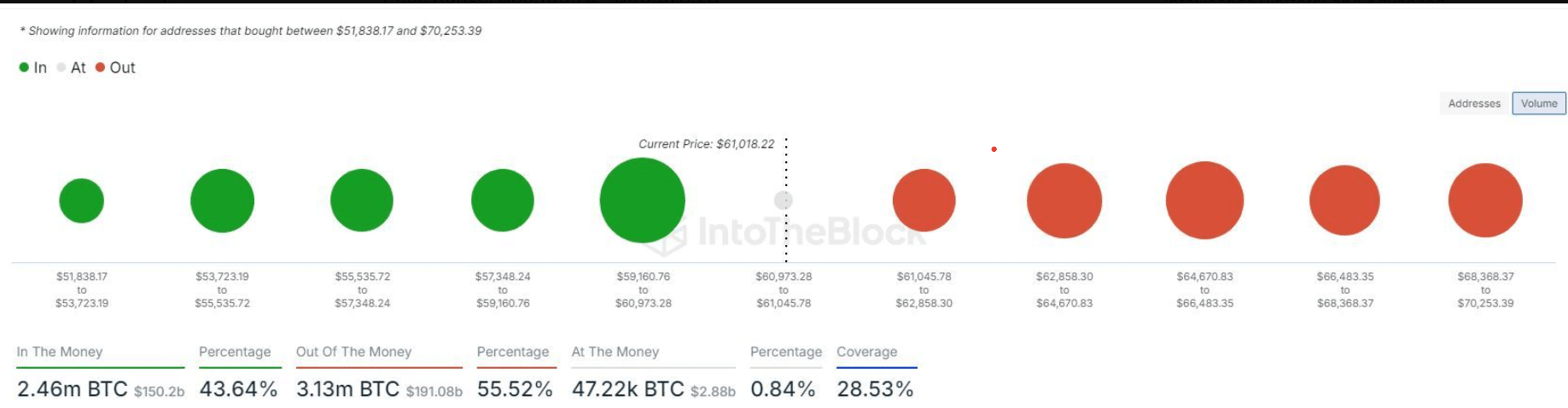

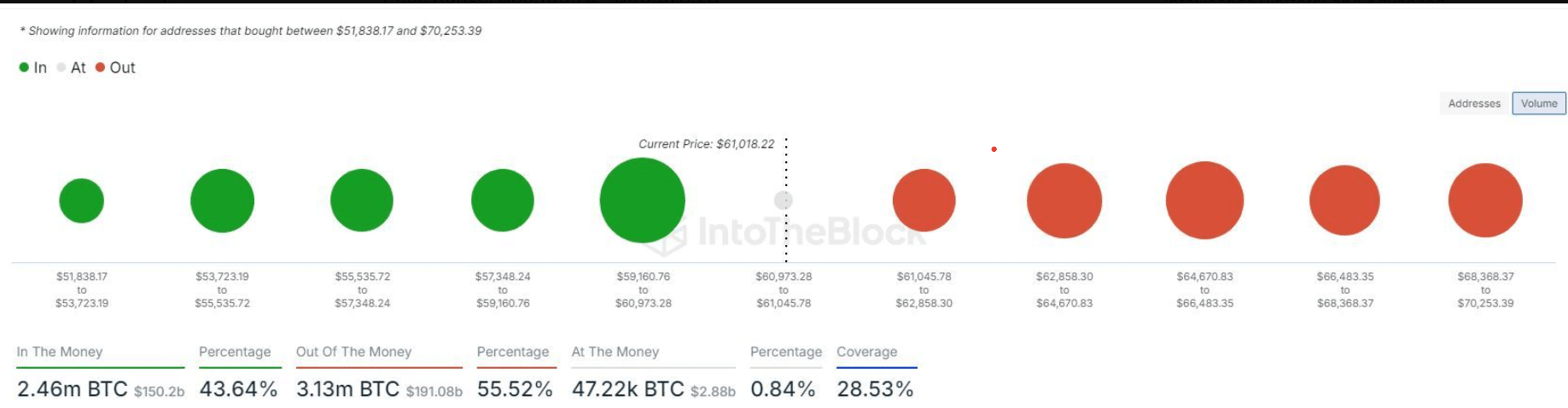

Bitcoin’s main resistance remained between $64,000 and $66,000 as the majority of coins were purchased at this level, according to IntoTheBlock data. Therefore, sellers may emerge once BTC approaches this price range.

Source: IntoTheBlock