David Puell, an on-chain researcher at Ark Invest, shared his insights in a detailed report today, offering a nuanced perspective on Bitcoin’s current state and future prospects. The reporttitled “The Bitcoin Monthly: July 2023,” covers several key topics central to understanding the current state of Bitcoin.

These topics include a comprehensive market overview, an analysis of Bitcoin’s low volatility and whether it indicates a potential collapse or breakout, as well as a discussion of the impact of the Federal Reserve’s tightening policy as a leading indicator of price deflation.

Ark Invest’s Short Term Bitcoin Price Prediction

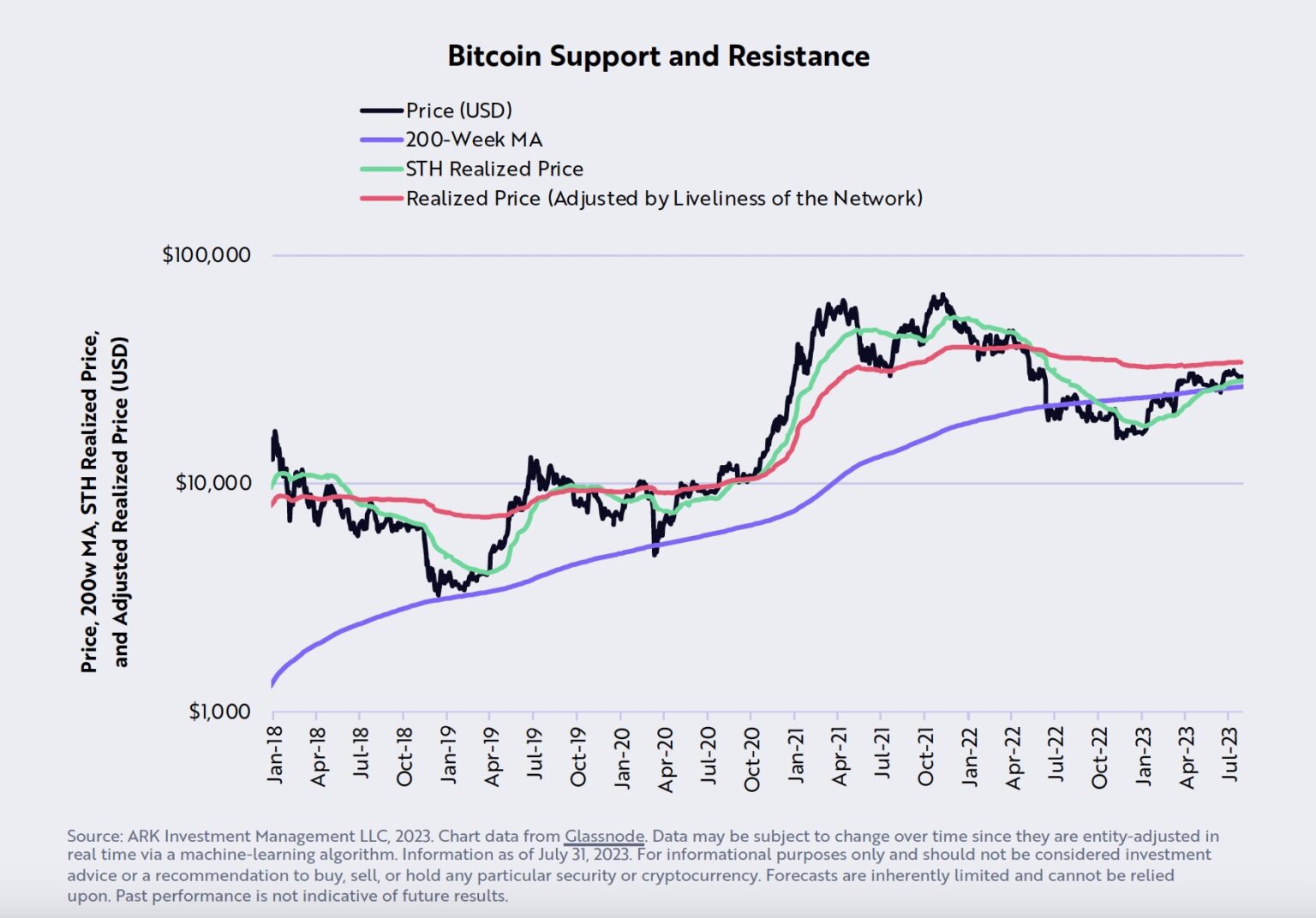

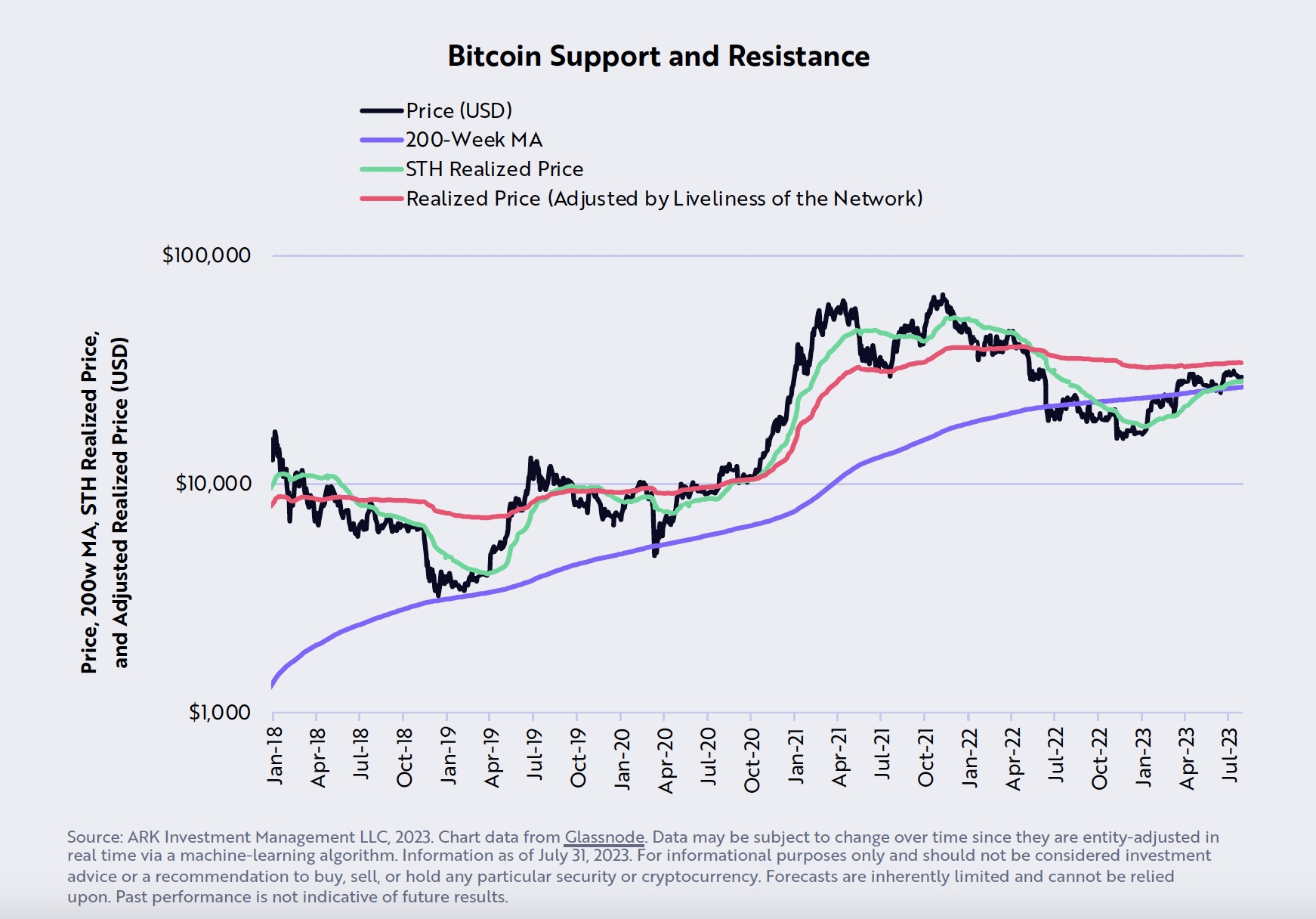

Puell’s analysis reveals a mixed but mostly bullish outlook for Bitcoin, with the cryptocurrency ending July at $29,230, above its 200-week moving average and short-term holder cost base (STH) of $28,328. This suggests a strong support level for Bitcoin, pointing to a potential upside, Puell notes.

However, Bitcoin’s 90-day volatility, which fell to 36% in July, a level not seen since January 2017, offers a neutral outlook. Puell explains, “Based on the low level of volatility, we think Bitcoin price could move dramatically in one direction or the other over the coming months.” This could mean a significant price move, but the direction – up or down – is uncertain.

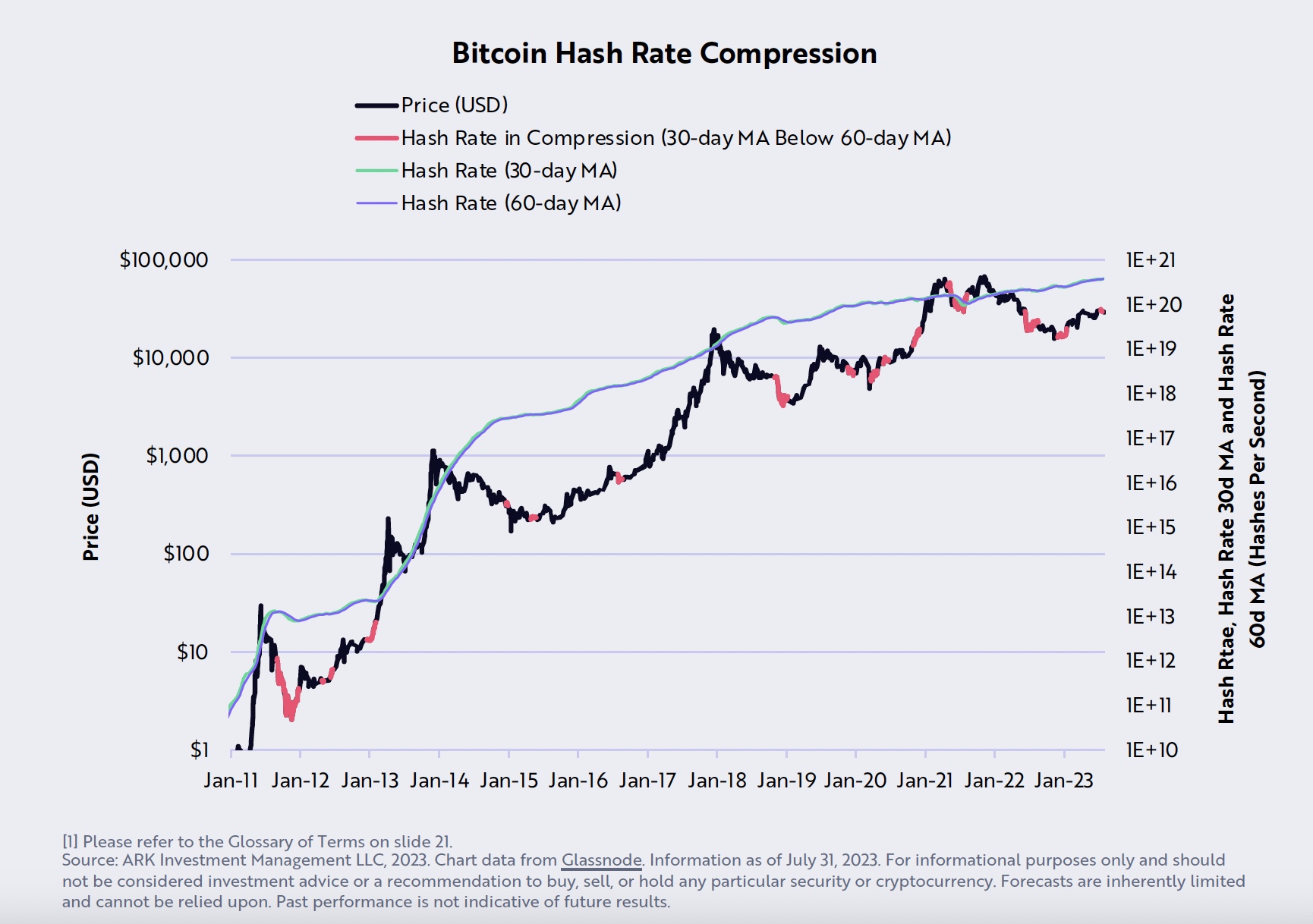

Puell also points to signs of miner capitulation as a bullish indicator. “In July, Bitcoin’s 30-day moving average hash rate fell below its 60-day moving average, suggesting that miner activity had capitulated,” he says. Miner capitulation is typically associated with oversold conditions in BTC price, indicating a possible bullish reversal.

The “liveliness” metric, which measures potential selling pressure relative to current holding behavior, also suggests an upward trend. The analyst notes, “In July, vibrance fell below 60%, indicating the strongest long-term holding behavior since the last quarter of 2020.” This indicates that more holders are keeping their coins rather than selling them, which could push the price up.

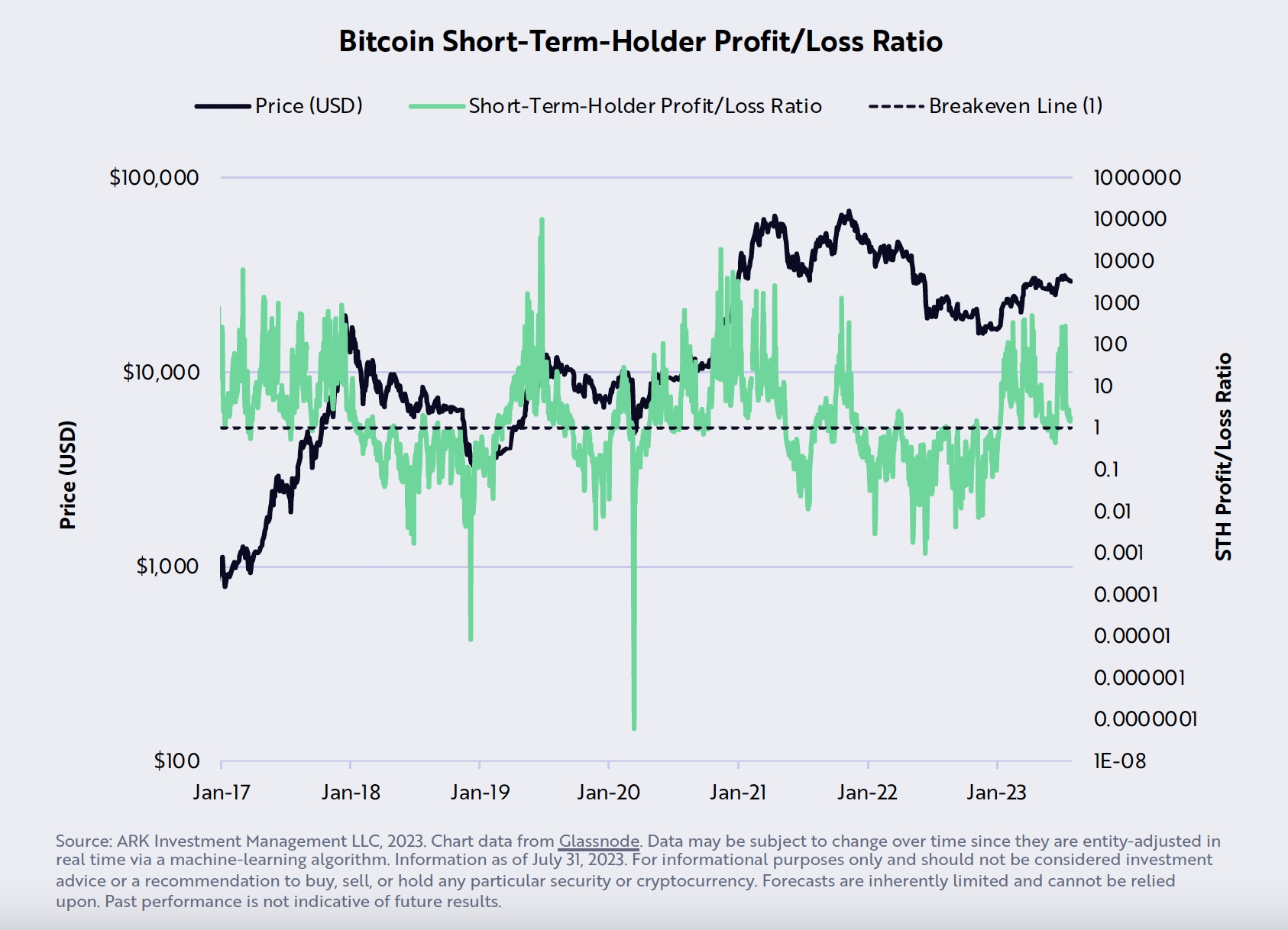

ARK’s short-term own profit/loss ratio, which ended at ~1 in July, is also seen as a positive sign. Puell explains, “This break-even level correlates both with local bottoms during primary bull markets and local highs during bear market environments.”

However, the future of Binance’s BNB token, which is under increasing regulatory pressure, looks bearish according to Puell. He warns, “As regulatory pressure mounts on crypto exchange Binance, its native token, BNB, could be on the brink of significant turbulence.” If BNB goes down, it could potentially affect the overall stability of the crypto market, including BTC.

Macro outlook

On a macroeconomic level, Puell discusses the potential impact of the Fed’s 22-fold hike in interest rates, which he sees as bearish for Bitcoin and the wider economy. He states, “According to noted economist Milton Friedman, monetary policy operates with ‘long and variable lags’ lasting 12-18 months, suggesting that the full impact of the Fed’s 22-fold rate hike is yet to come.”

The Zillow Rent Index, which is about nine months ahead of the Owners’ Equivalent Rent (OER), suggests that consumer price index (CPI) inflation could fall significantly below 2% by the end of the year. Puell sees this as a bullish sign for Bitcoin, as it could potentially increase the attractiveness of non-inflationary assets like Bitcoin.

Finally, Ark Invest takes a neutral stance on declining US import prices from China despite the ~12% depreciation of the yuan since February 2022. He notes: “All else being equal, Chinese exporters should have raised prices to to compensate for the depreciation of the yuan. . Instead, they have lowered prices, hurting their profitability.”

In conclusion, Puell’s report paints a complex picture for Bitcoin. While there are many signs of a potential bullish trend, there are also significant risks and uncertainties that could lead to bearish outcomes.

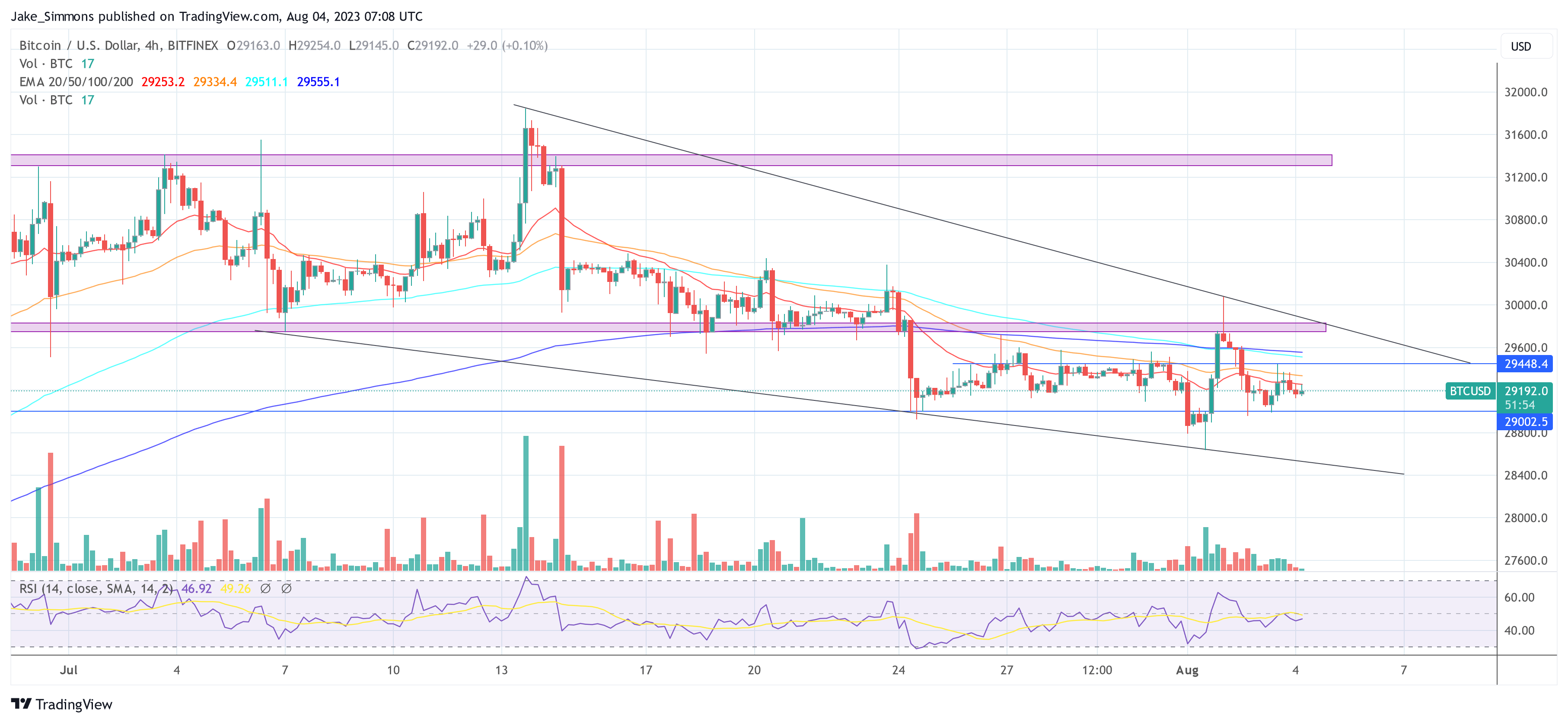

At the time of writing, the BTC price was at $29,152. The most crucial resistance right now is at USD 29,450. If BTC can overcome this resistance, a breakout of the multi-week downtrend is possible.

Featured image of Kanchanara / Unsplash, chart from TradingView.com