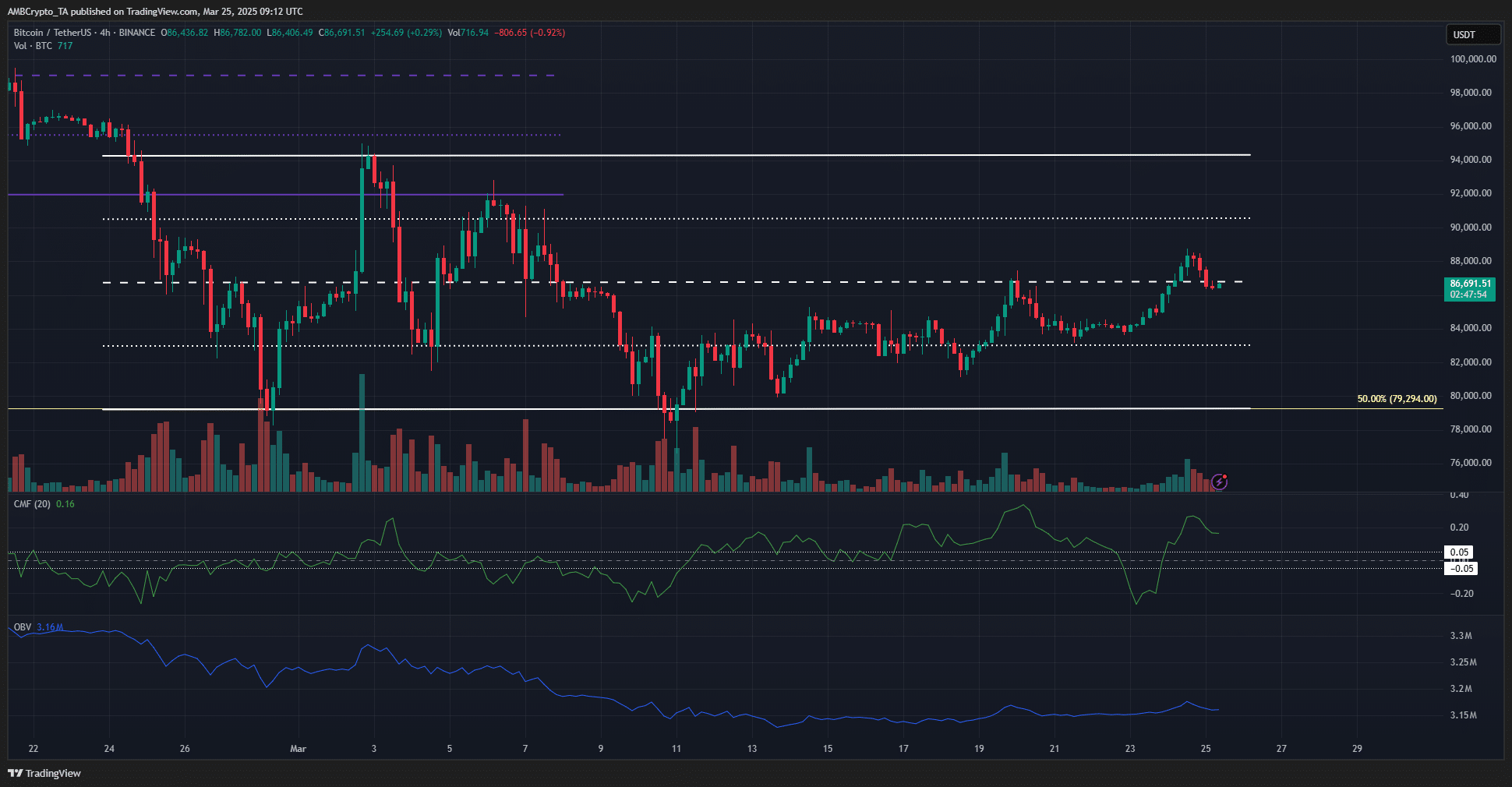

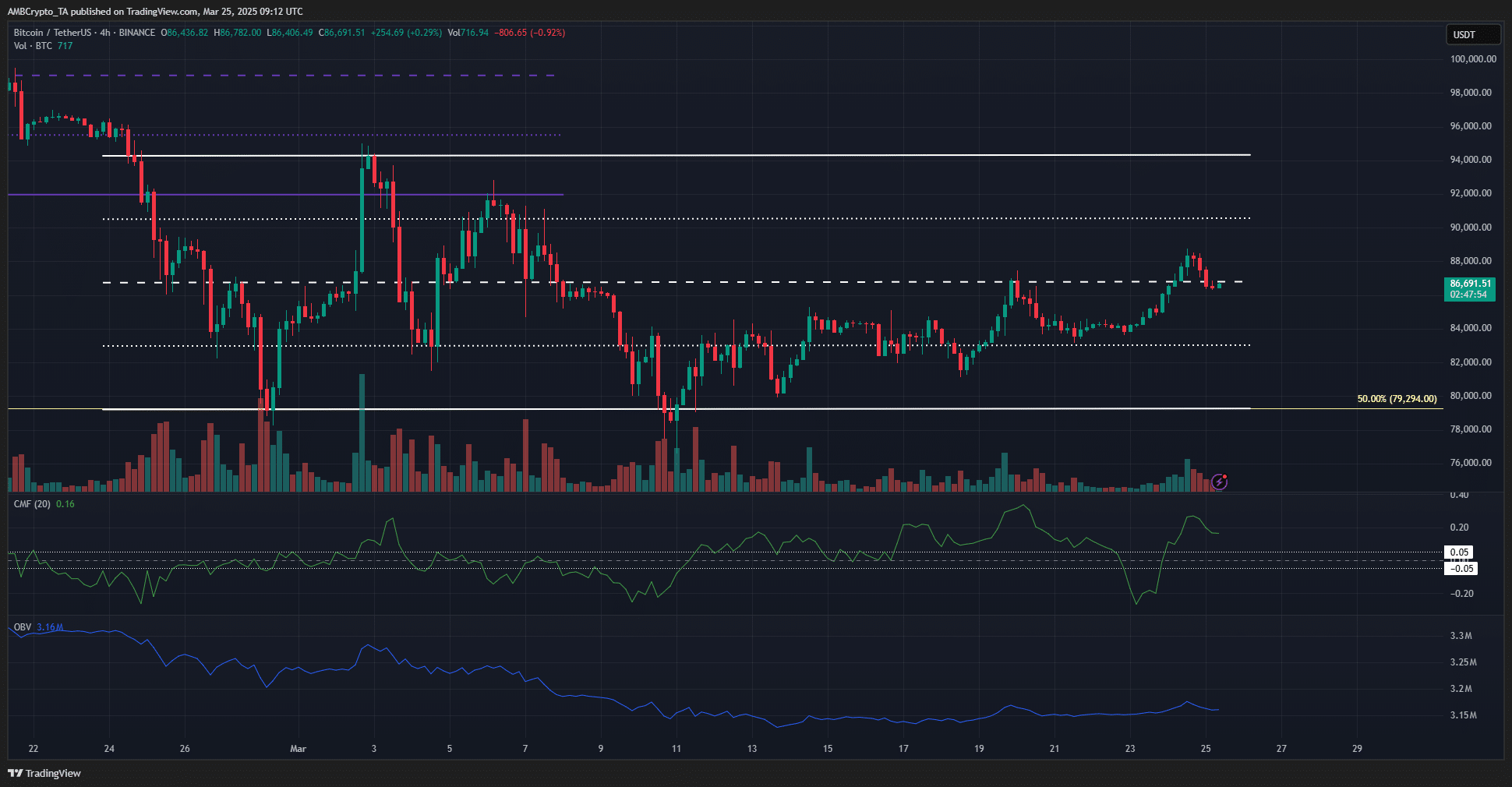

- BTC has a Bullish H4 structure and considerable capital inflow according to the CMF.

- This steady purchasing pressure can stimulate prices to the resistance level of $ 90.5k.

The Bitcoin [BTC] Praise process was Bullish last week. Compared to last Tuesday’s low point at $ 81.1k, BTC rose by 6.88%on the press. For long -term investors, the news meant that the realized price rose that Hodlers were still largely profitable.

If the realized price continued to rise, it could come to $ 150k $ 180k next to a BTC price. Regarding the next few days of trade, the price movement beyond the resistance of the middle range was a positive sign.

BTC breaks the local resistance of $ 86.8k

Source: BTC/USDT on TradingView

Since the end of February, the price of Bitcoin has been traded within a range of $ 79.2k to $ 94.3k, with a center of $ 86.8k. The price exceeded this local resistance on 24 March.

After the move there was a small pullback of 2%, but Bitcoin still showed potential for further profit. The Bullish price action remains on the 4 -hour graph, supported by higher highlights and higher lows in the past week.

The CMF indicated Bullish Momentum with a lecture of +0.16, which reflects a strong capital inflow. In the meantime, the OBV has gradually risen in the last ten days, but the local highlights must still be observed on March 3.

The most important resistance levels to check are $ 90.5k and $ 94.3k, which represents the immediate bullish goals from Bitcoin.

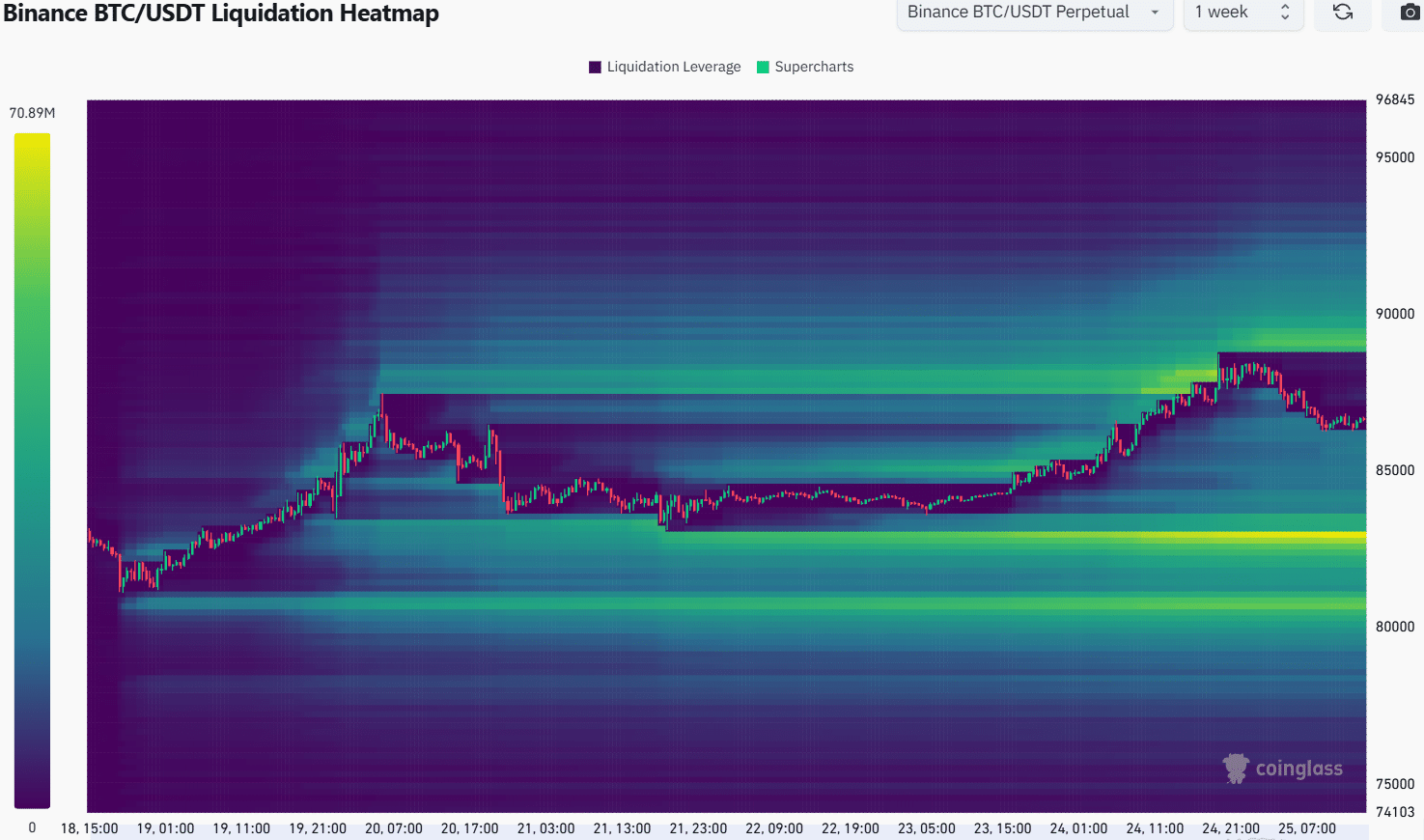

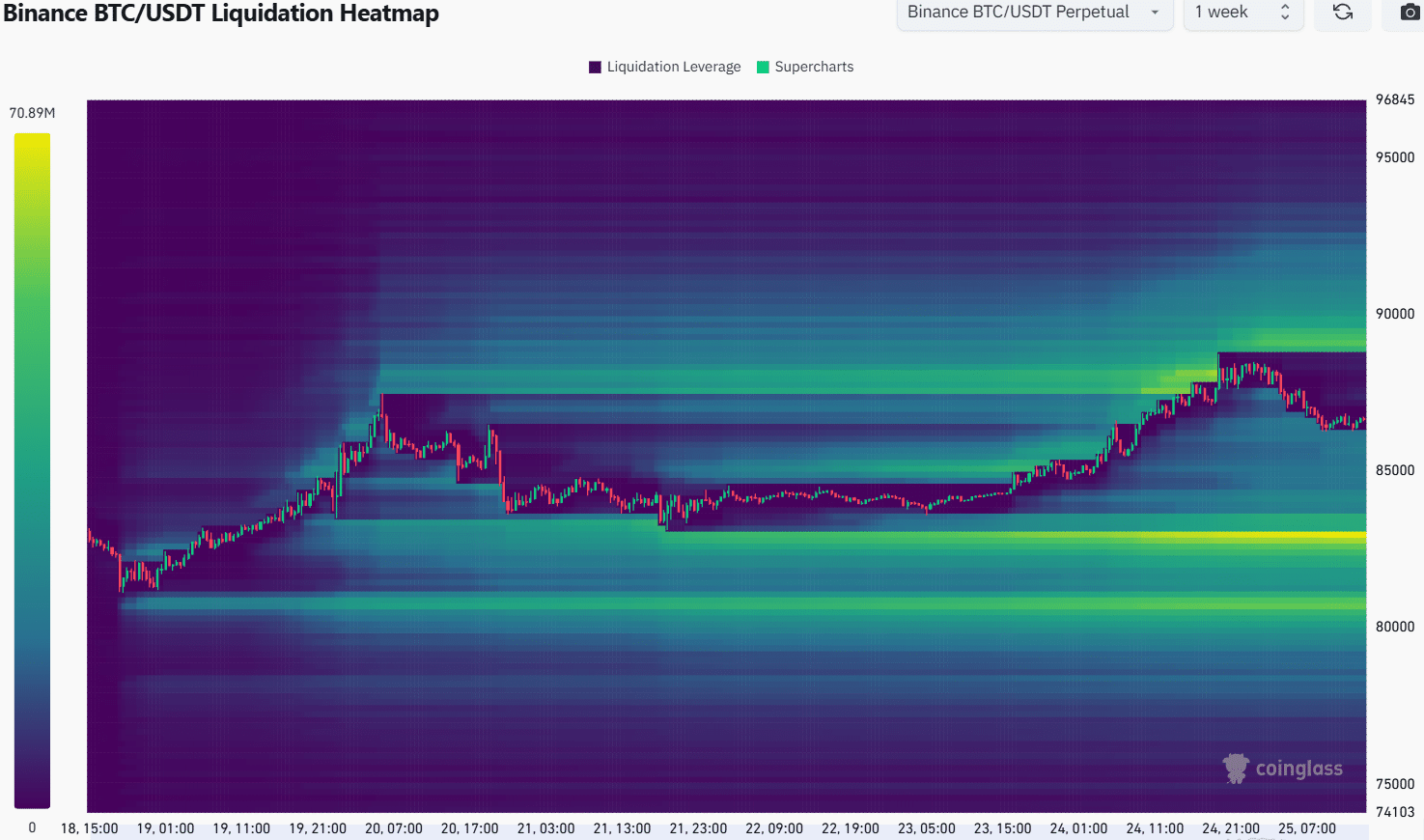

Source: Coinglass

The 1 -week liquidation heating showed rejection of the $ 88.2k liquidity cluster on 24 March. Another important liquidity pocket has formed between $ 88.9k and $ 89.7k, just below the psychological level of $ 90k.

A strong magnetic zone was identified at $ 83k, but the distance to the current BTC price of $ 86.6k suggests that an upward movement is more likely. These deliberately bullish outputs are further supported by technical analysis of the 4-hour graph.

However, a bearish reversal could occur in the range of $ 89k $ 89.7k. Swing traders must consider taking a profit in this region. The next resistance for $ 90.5K can present a challenging obstacle for the bulls.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer