- The phase of low volatility and muted trading activity suddenly gave way to intense buying and selling.

- Bitcoin funding rates turned positive, indicating a bullish narrative.

The false alarm, also seen by many analysts as the ‘dress rehearsal’, launched Bitcoin [BTC] to the highest level since May 2022. The dormant crypto market became a hive of activity as King Coin soared above $35,000 on high prospects for approval of a spot ETF.

How much are 1,10,100 BTCs worth today?

Upturn in trading volumes

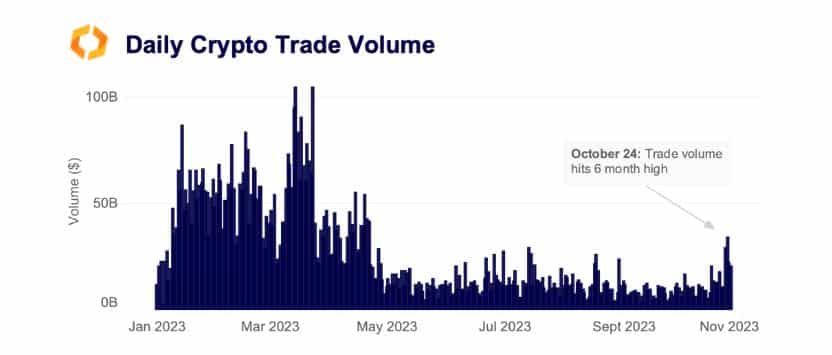

As a result of the price increase, a decisive shift in market sentiment was observed. The phase of low volatility and muted trading activity suddenly gave way to intense buying and selling.

According to crypto market data provider Kaikodaily volumes on centralized crypto exchanges reached a high not seen in the past two quarters. While the turnaround was led by developments directly related to Bitcoin, the spark ignited other altcoins as well.

The combined volume of all altcoins even rose above $15 billion last week, higher than that of Bitcoin.

Source: Kaiko

Additionally, BTC supply on exchanges saw a noticeable spike, according to data from Santiment. The higher prices tempted owners to give up their hoarding mentality and tie up their profits.

Source: Santiment

That said, there was no meaningful spike in liquidity on the exchanges. Kaiko’s data showed that Bitcoin’s market depth has hovered around $100 million over the past two weeks.

As is known, market depth refers to the number of buy and sell orders at different price levels on each side of the mid-price. The higher the market depth, the less likely Bitcoin’s price will be affected by large orders.

Source: Kaiko

A look into the derivatives market

Speculative interest in Bitcoin increased after its biggest jump in 2023. Funding rates, which represent the cost of holding bullish long or bearish short positions, perpetual futures turned positive on the exchanges. This indicated a bullish market trend.

Source: Kaiko

On the other hand, Open Interest (OI) started slowly. As shown in Hyblock Capital’s chart, the value of active futures and perpetual futures contracts grew at a much weaker pace compared to the spot price.

OI’s initial growth was based on strong buying pressure, as evidenced by the positive value of the Volume Delta indicator. Numerous long positions were opened during this period, as shown by the Net Longs indicator.

Source: Hyblock Capital

However, when the uptrend was halted and BTC consolidated around the $34,000 level, the strength of the buy orders began to wane. The volume delta tended towards zero and even fell into the negative zone on some trading days.

Bearish leveraged traders became dominant in the market as shorts outpaced longs in the market.

More volatility is expected

The rally roiled the market and provided some much-needed volatility. According to Kaiko’s analysis, a steady increase in implied volatility has been observed over the past ten days.

For the uninitiated, implied volatility is a measure of future expectations of price movements. Based on these observations, one can expect continued volatility in the short term, despite the fact that there were no substantial volatility-inducing triggers until January.

Bitcoin is decoupling from the traditional market

Bitcoin’s bullish rally also resulted in a further disconnect with technology stocks. The 30-day correlation coefficient between King Coin and NASDAQ 100 fell into the negative zone for the first time since July.

Source: Kaiko

Is your portfolio green? Check out the BTC profit calculator

It is striking that Bitcoin will move less with traditional market factors in 2023. The prospects for spot ETFs have promoted decoupling, with the crypto market increasingly reacting to crypto-specific catalysts.

Clear evidence of this trend was the way the stock and crypto markets responded to the ongoing war between Israel and Hamas. As stock markets felt the pressure, Bitcoin posted rapid gains.