- MicroStrategy is intended to pick up $ 2B to finance BTC purchases.

- The Bitcoin Holdings from MicroSstratey will soon be able to hit 500K BTC; Will the MSTy stimulate again?

Strategy, formerly micro strategy, is planning to salary $ 2 billion in capital through convertible banknotes to facilitate its Bitcoin acquisition.

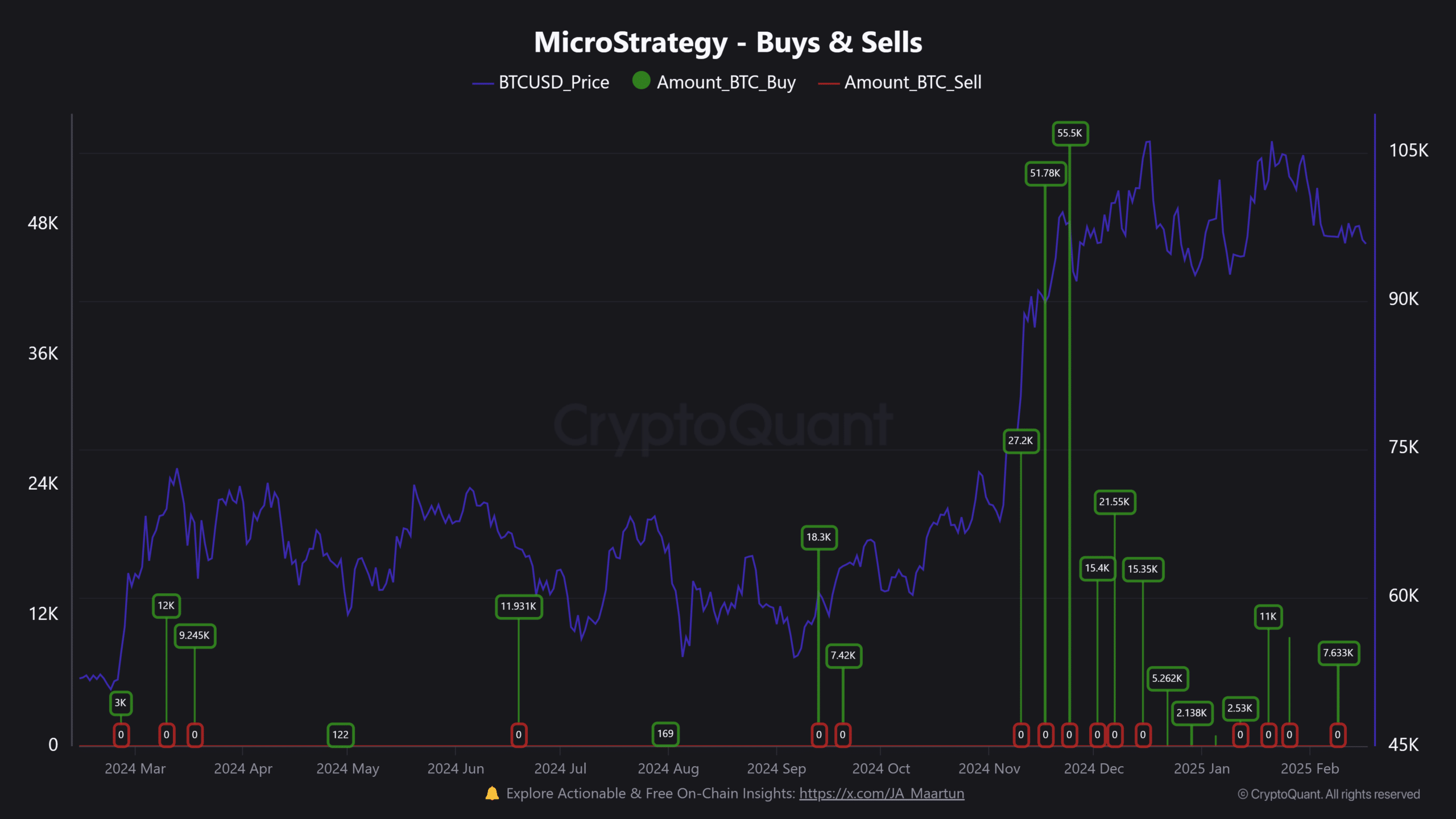

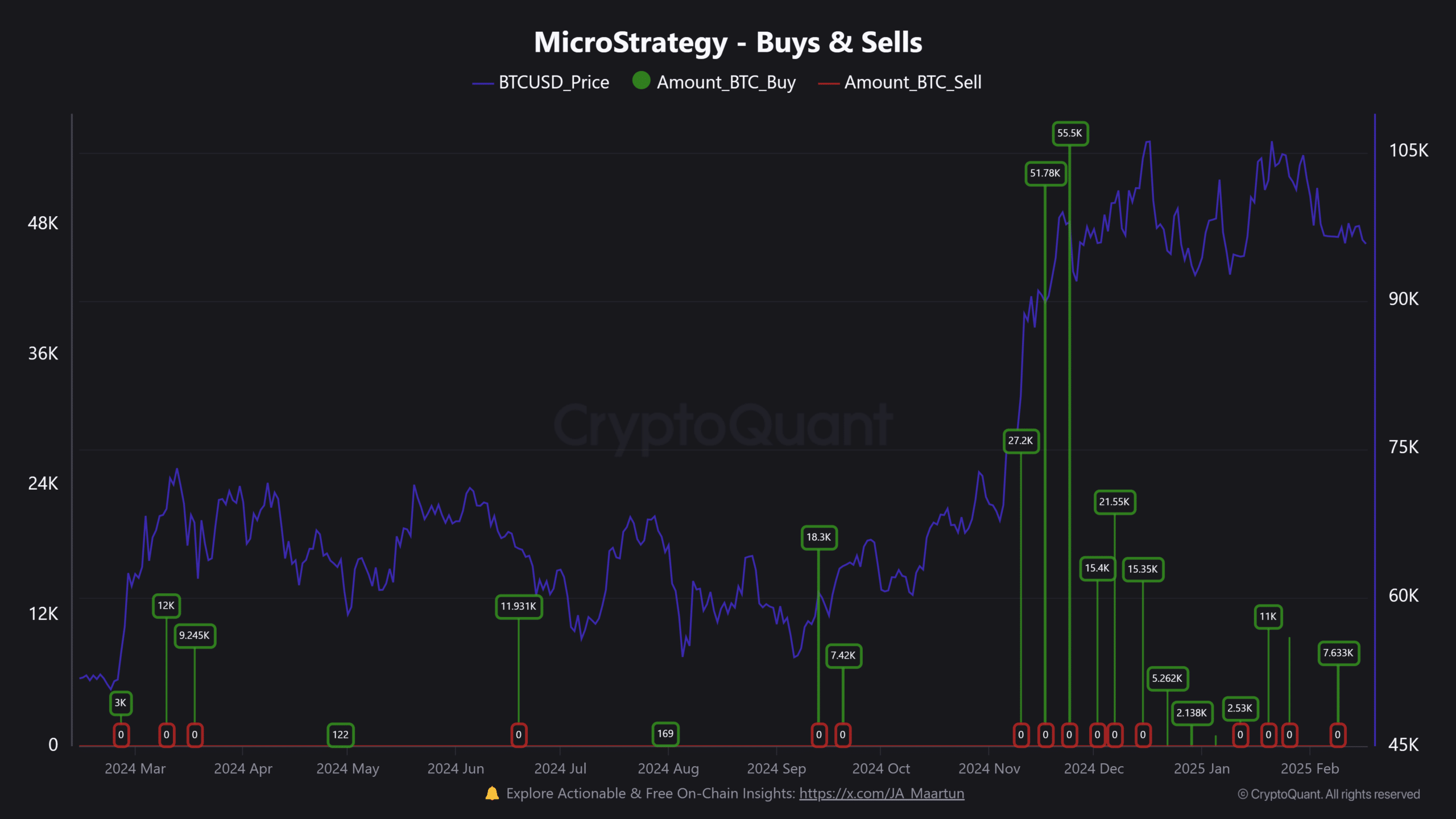

In 2025, the pioneer made five bids in BTC Corporate Treasury strategy (more than 30k BTC), so that the total interest was brought to 478740 BTC. That is $ 46.15 billion in BTC stock based on current market prices.

Source: Cryptuquant

MicroStrategy Eyes 500K BTC Holdings

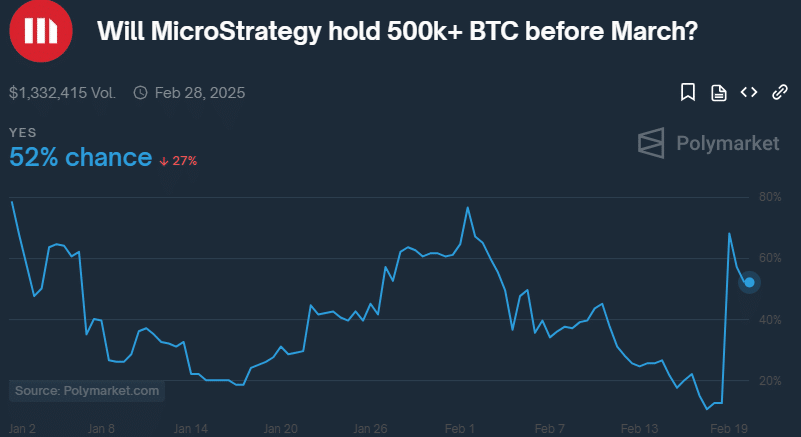

The last plan to attract capital for extra BTC purchases would expand the company preserves to 500K BTC before March. At the moment, however, the market seemed undecided to such an outcome.

Prediction site Polymarket has priced a 53% chance that the company reached the $ 500K BTC -Zoelwit at the end of February.

This was after a peak to 80% when the $ 2B increase was announced, suggesting that speculators were up to 500k BTC within a week 50/50 on strategy.

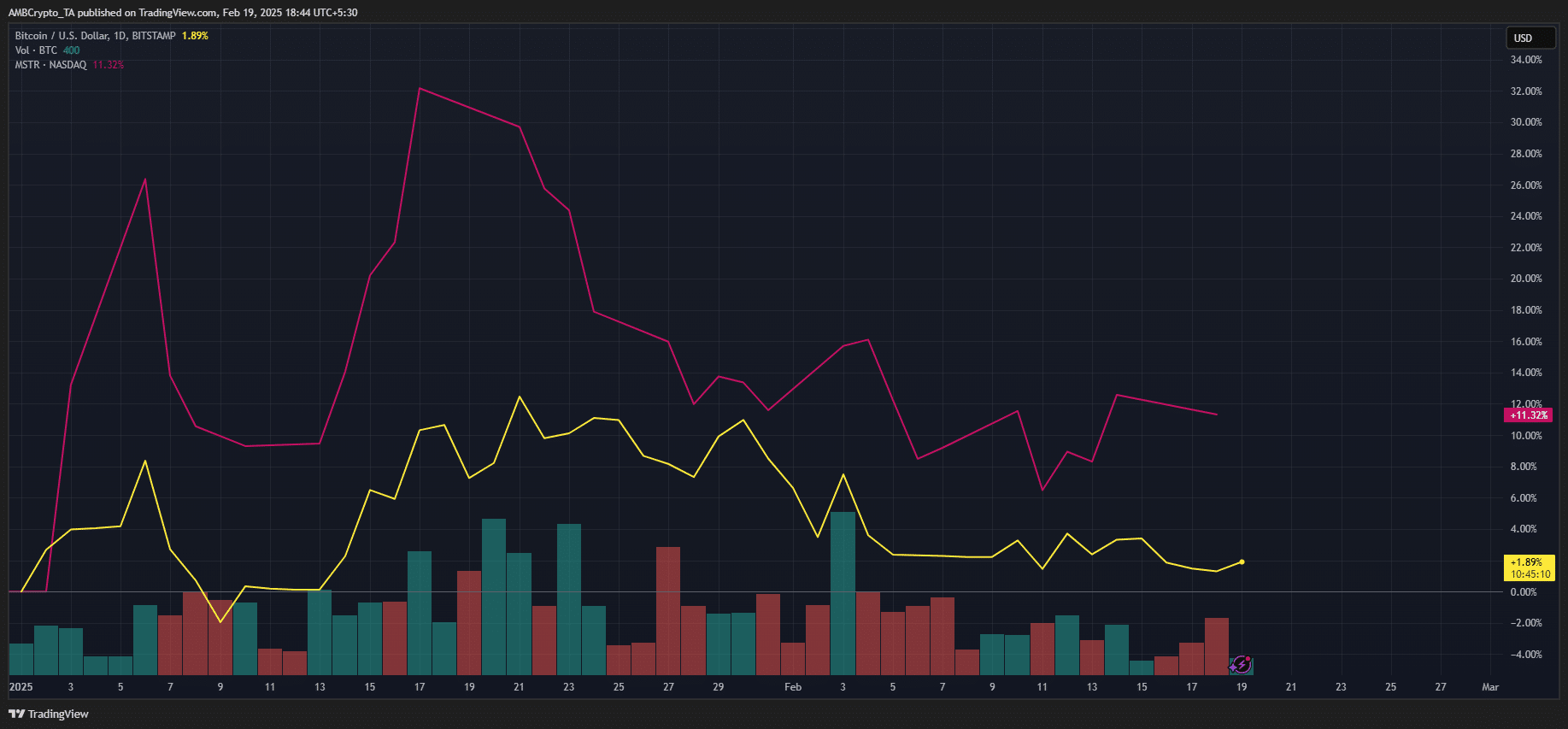

That said, MSTR fell by 16% from the end of January and was appreciated on the $ 333 press. But macro analyst Felix Jauvin projected The $ 2B Capital Rais from MicroSstratey could mark the local bottom of BTC.

In the same period, BTC paid 12% of recent highlights and traded at $ 96k. This underlined that BTC performed moderately well under the current market sentiment.

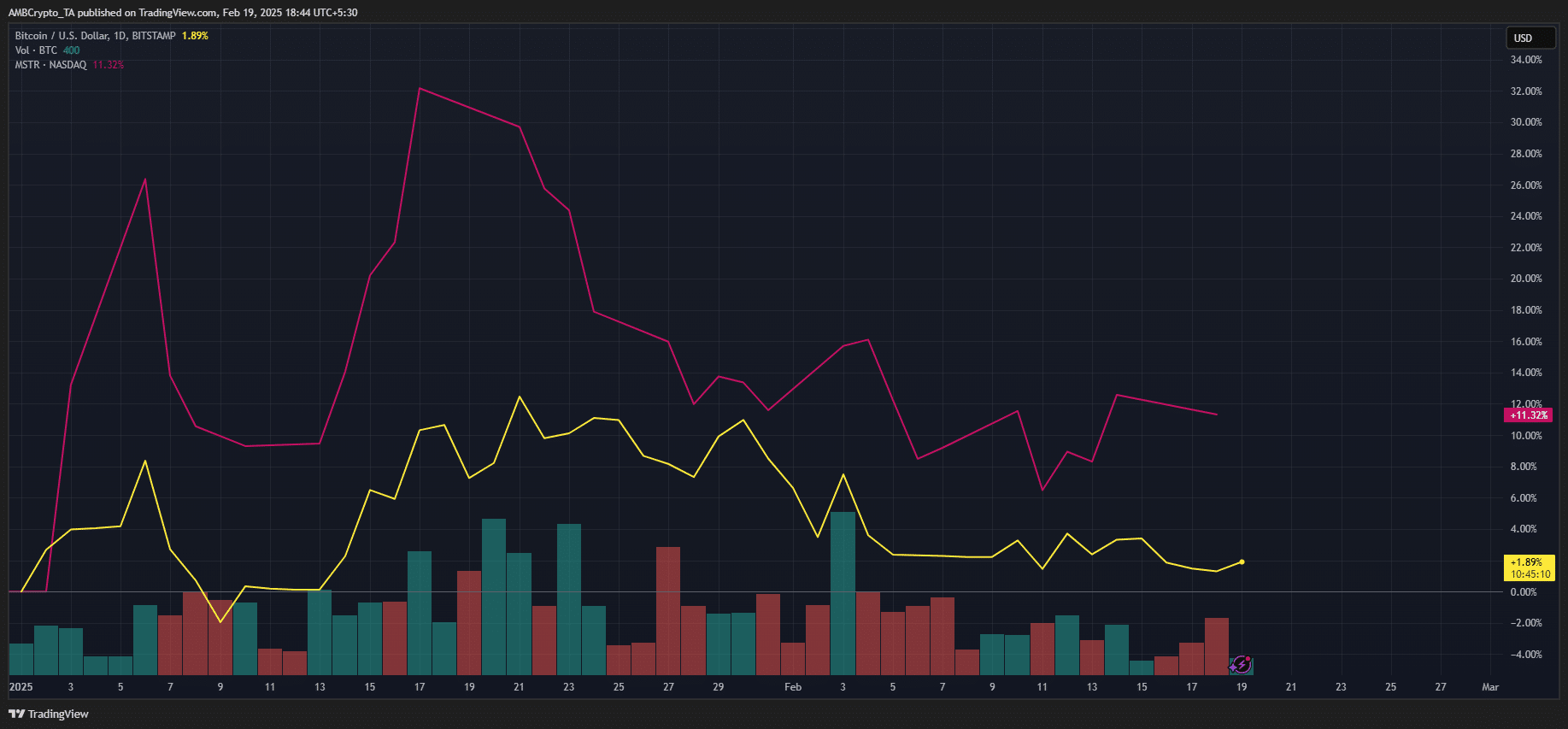

On a YTD (year-to-date) base, however, MSTREN registered a profit of 11% in 2025 compared to BTCs 1.9%.

Source: BTC vs. MSTR Performance, TradingView

When he was zoomed in on a yo-yo-year, MSTR rose with 373% compared to the 85% of BTC. Simply put, the stock was still a BTC -Bèta, thanks to the enormous attitude of micro strategy in the cryptocurrency.

MSTR was even one of the best performing US shares, given the BTC strategy. Whether the stellar performance in Q4 2025 will be repeated is still to be seen.