- BTC has been crossed in a historic ‘shopping area’, indicating that a bounce back is imminent.

- American investors have started buying BTC in this region, while derivaten traders sell instead.

Bitcoin [BTC] has not yet fully recovered after the market -wide sale.

The event saw its price fall from $ 90,000, which it had held since November 15, which was traded underneath on 24 February, making it a loss of 17.47% in the past month.

According to Ambcrypto’s analysis, BTC saw a large bouncer higher, because a certain sentiment fits in with a bullish story.

However, with the current sales pressure of the derivative market, the rally cannot come true. This is why.

American investors accumulate Bitcoin as prices touch new level

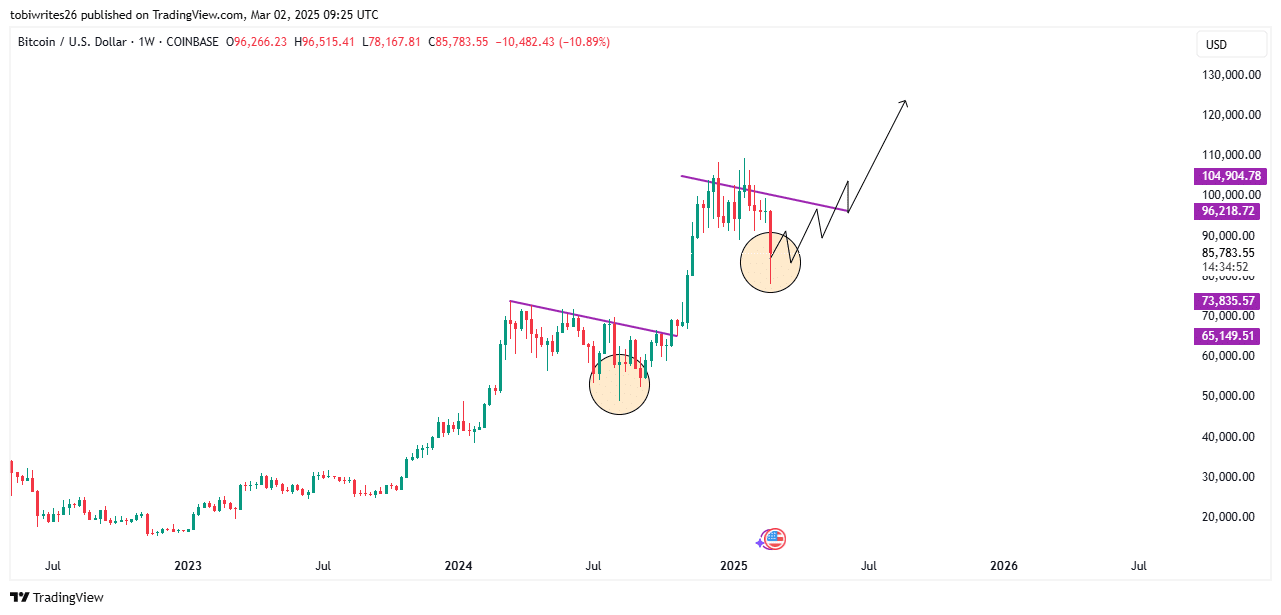

Recent analysis of cryptoquant shows that Bitcoin has arrived a zone that has mentioned a historic shopping area 1 and 2 on the map.

To exchange this area, Bitcoin must see a price fall of 15 to 20% – a decrease that it recently registered.

Source: Cryptuquant

These levels, as seen on the graph, are characterized as shopping areas because two important activities occur: the historical accumulation of BTC by market participants and investors who capitalize on the overreaction that led to a price decrease.

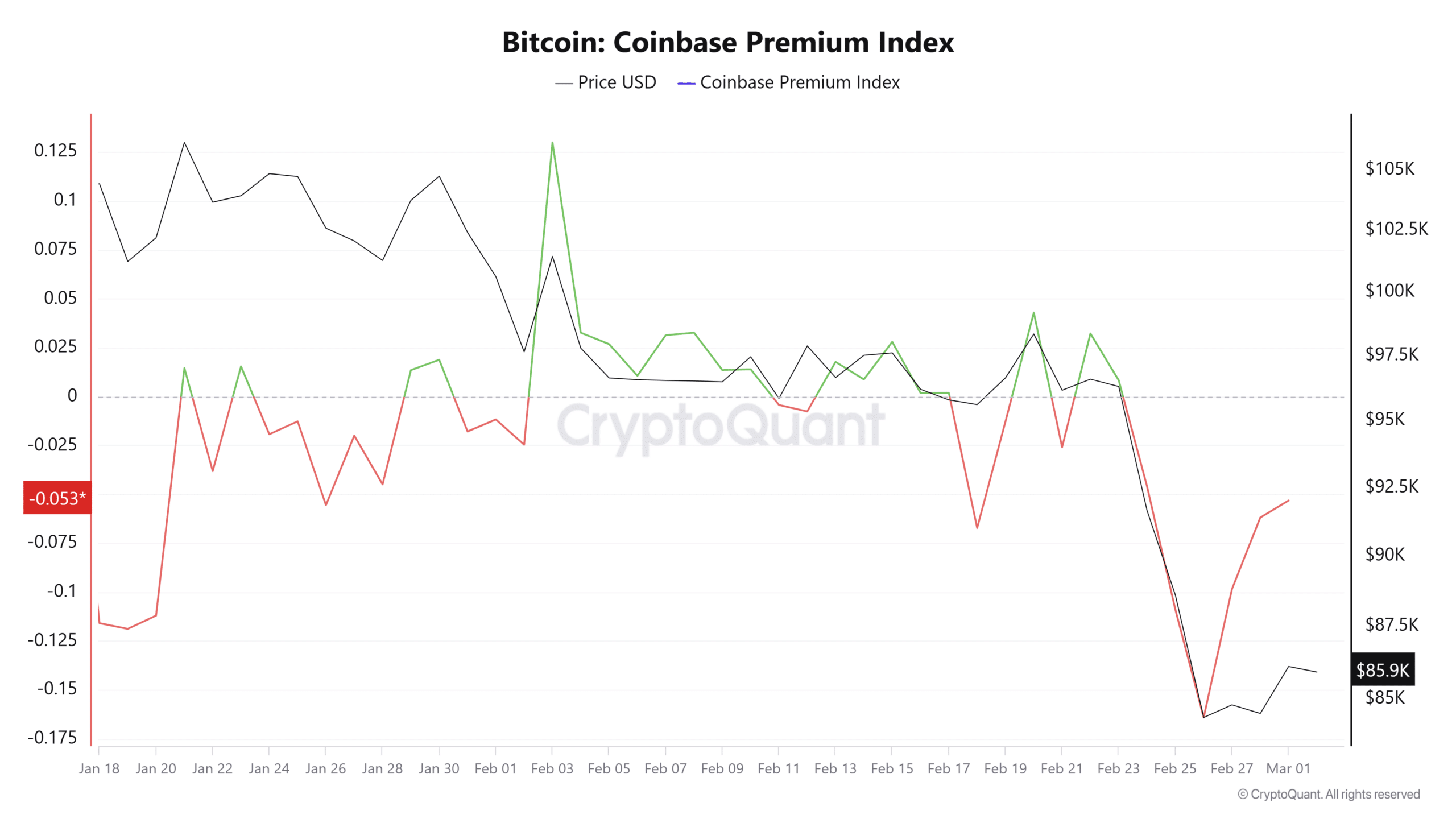

At the time of writing, American investors in the market took advantage of this decrease and they started collecting it as the Coinbase Premium Index -Spikes to -0.053, Trending.

Usually, when this index is in the negative region, this indicates the sale of American investors. However, when the assets trends are higher and are on their way to intersection above 0, this indicates that buying sentiment gradually builds up.

Source: Cryptuquant

If the index crosses above 0, another wave of BTC -purchases could occur, because investors at this level will be confident that it will probably probably collect on the basis of its performance and other market sentiment.

On the graph, BTC on the edge of the movement of the movement that led to its price shed after a sharp decrease in August would be marked in the orange circle. A similar drop has currently occurred.

According to this pattern, the bullish would be confirmed for BTC as soon as it actively breaks the purple resistance line above it, which may lead to a new of all time.

Source: TradingView

While activity on the chain and the graph suggest a potential rally for Bitcoin, derivatives sell, who can hinder the expected revival.

Derived traders bet on BTC

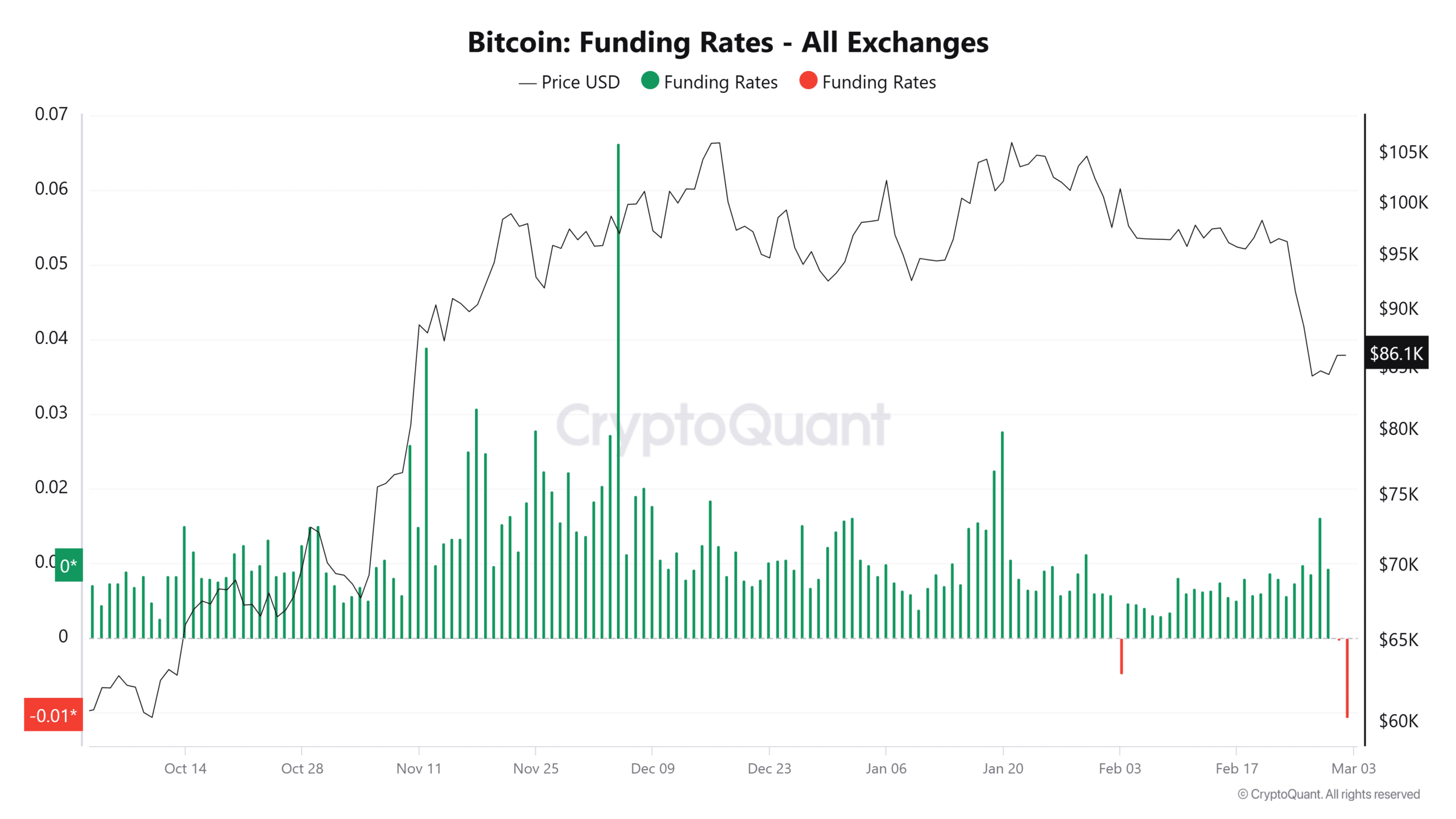

The conviction in the derivative market is low, whereby the financing interest rate drops and sells volume that sees a large increase, which suggests that these traders have impeded the most important price movement of BTC.

The current Bitcoin financing figure in the exchanges of Cryptocurrency has been seen since the 3 February decrease in the decrease in February, with a speed time reading of -0.01.

A negative financing rate means that sellers on the market pay a premium to retain their positions pending further price falls.

Source: Cryptuquant

With the Taker Buy/Sell Ratio, used to determine whether buying or selling volume dominates, analysis shows that sellers in the market are in control, because their sales pressure outweighs the pressure.

With important fundamental indicators that become bearish, BTCs can be confronted with a small setback. However, if other important indicators become bullish, sellers can be liquidated on the derivative market as it acts actively.