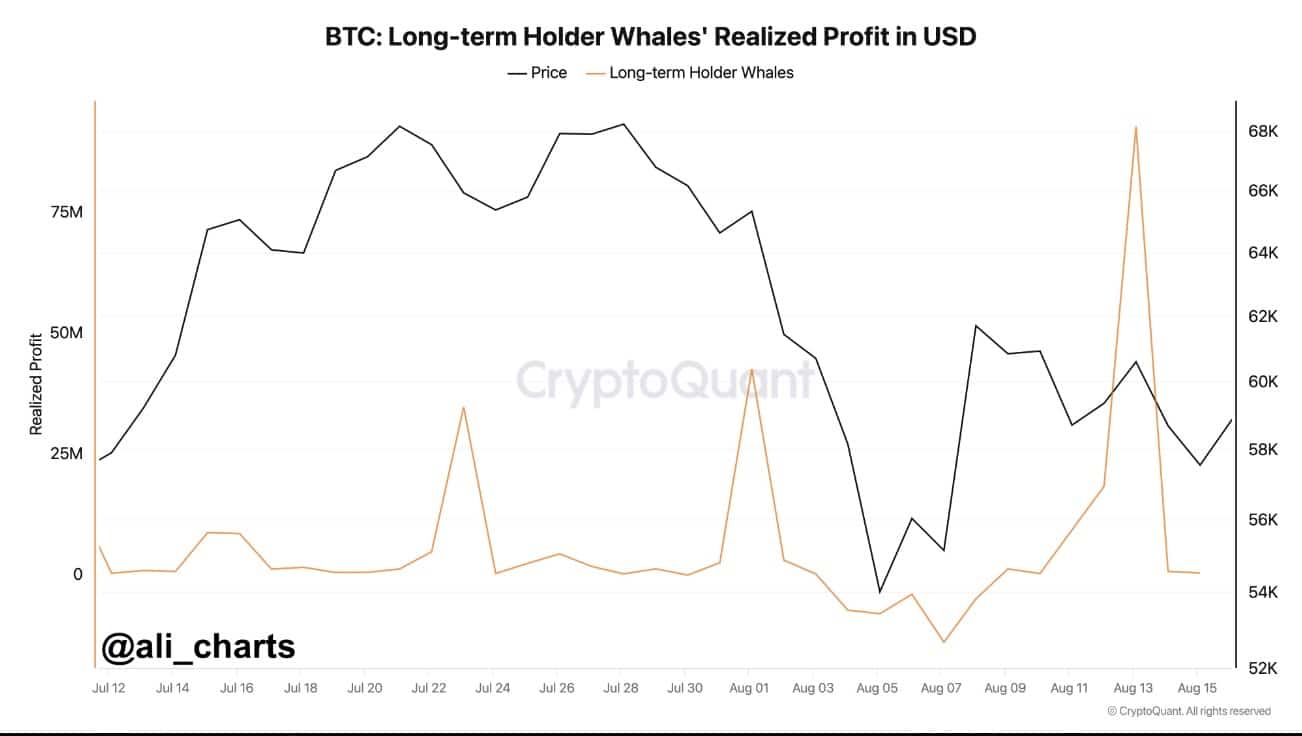

- Long-term holders of Bitcoin realize a significant profit of 92.7 million.

- Figures and indicators point to possible price corrections in the short term.

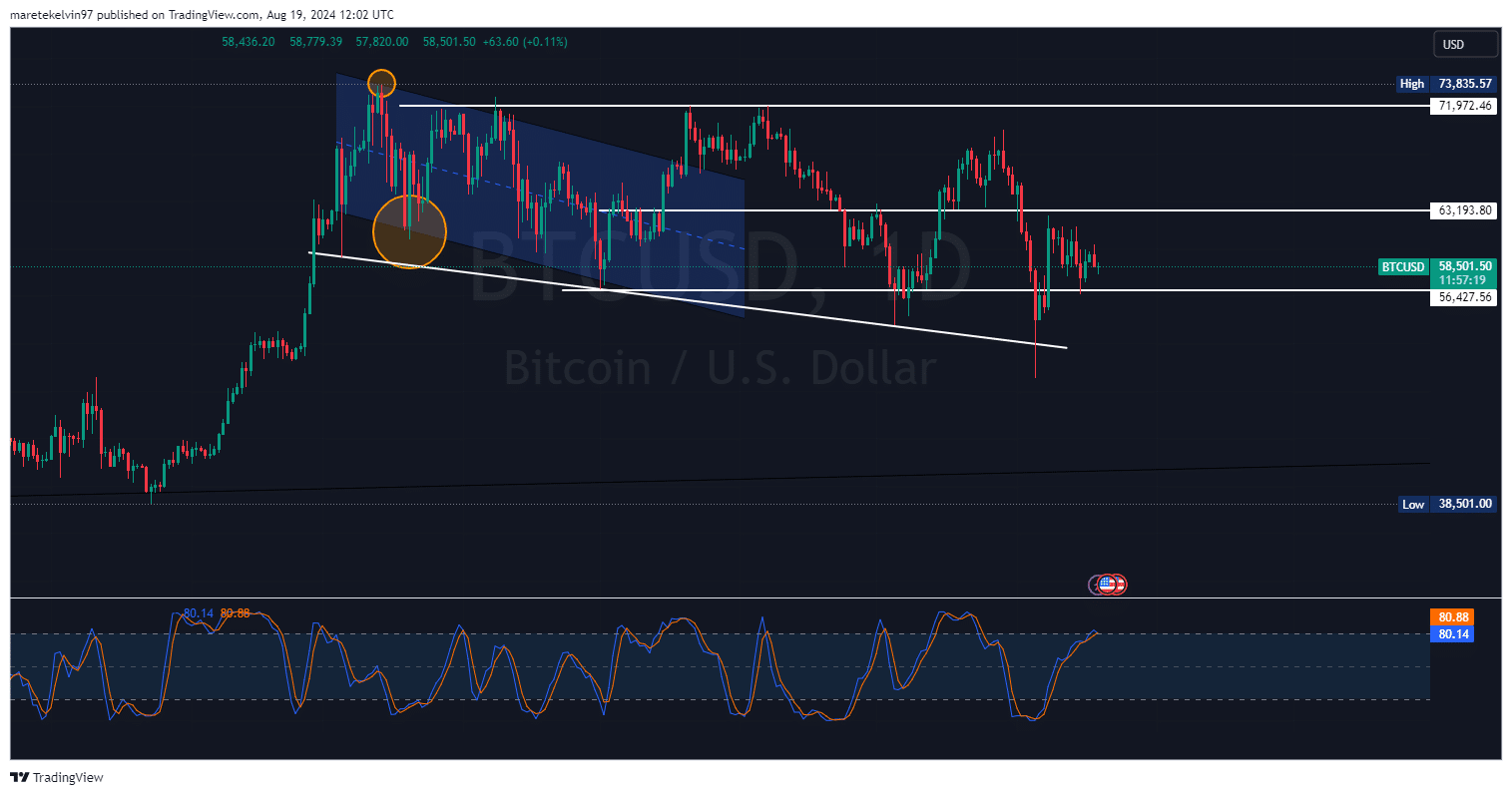

Bitcoin [BTC] was trading around $58,185 at the time of writing. The king of crypto was testing a key support level at $56,427 at the time of writing. This all-important level corresponds to a significant trendline that has historically acted as strong support in the past.

Source: Tradingview

Source: Tradingview

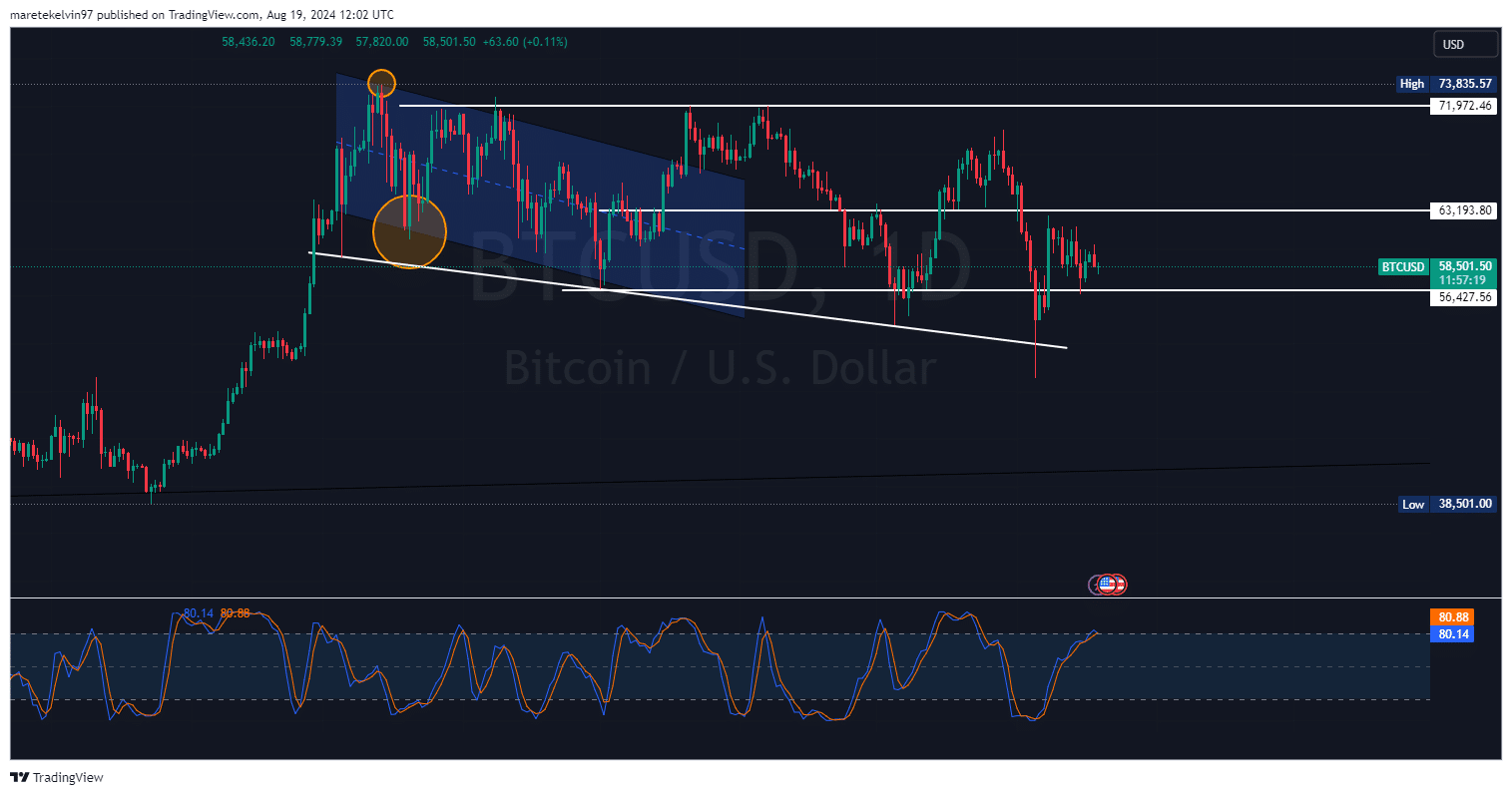

Whales benefit, should we be cautious?

According to long-term profit data, whales recently made over $92.7 million in profits. Such huge profit-taking indicates cautious signals among these players and could be a harbinger of a bearish trend in the future.

Historically, when the big market players take their money home, there can be some short-term selling pressure. This resulting increased pressure could in turn create market uncertainty on Bitcoin.

Source: CryptoQuant

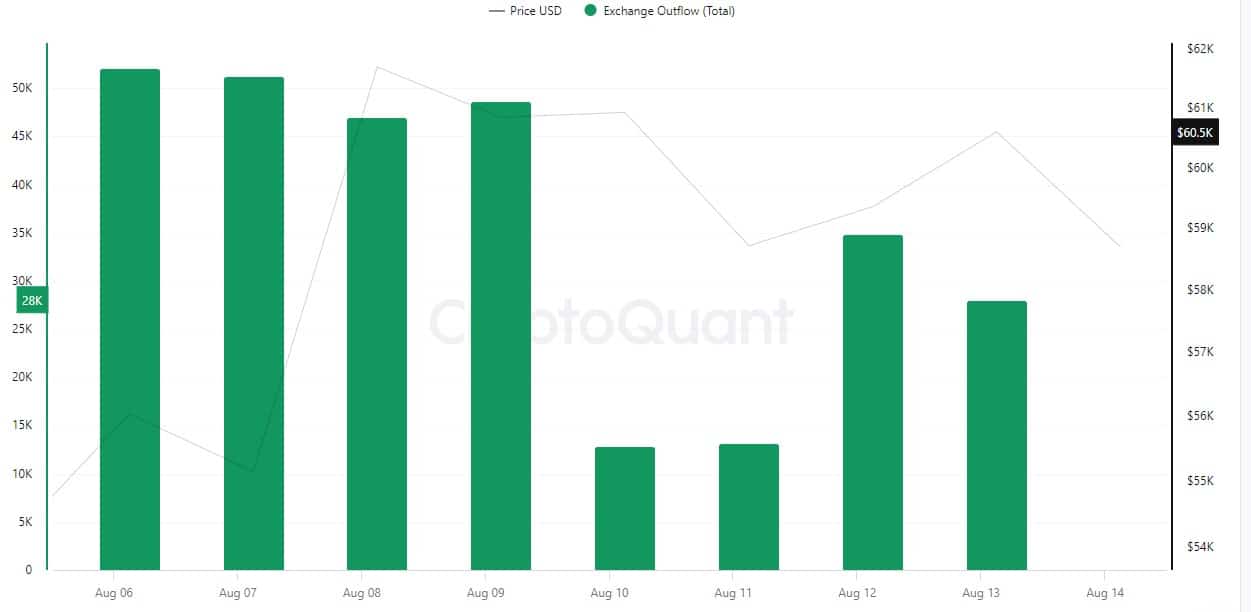

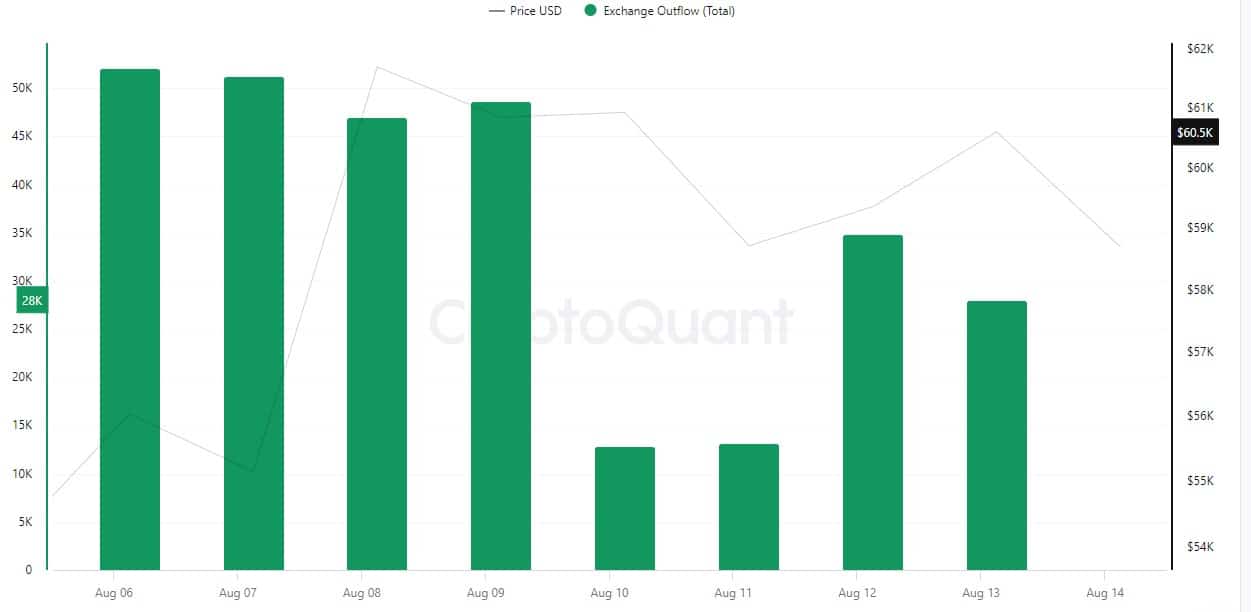

Exchange outflows indicate bullish sentiment

In contrast, the exchange’s outflow data shows that significant amounts of Bitcoin have disappeared from the exchanges, with a peak around August 9 reaching over 50,000 BTC.

Generally, this is taken positively as it means investors are moving coins to cold storage, reducing the chance of an immediate sale.

Normally, lower BTCs across exchanges translate into reduced selling pressure, which would keep prices steady or even initiate a rally.

Source: Cryptoquant

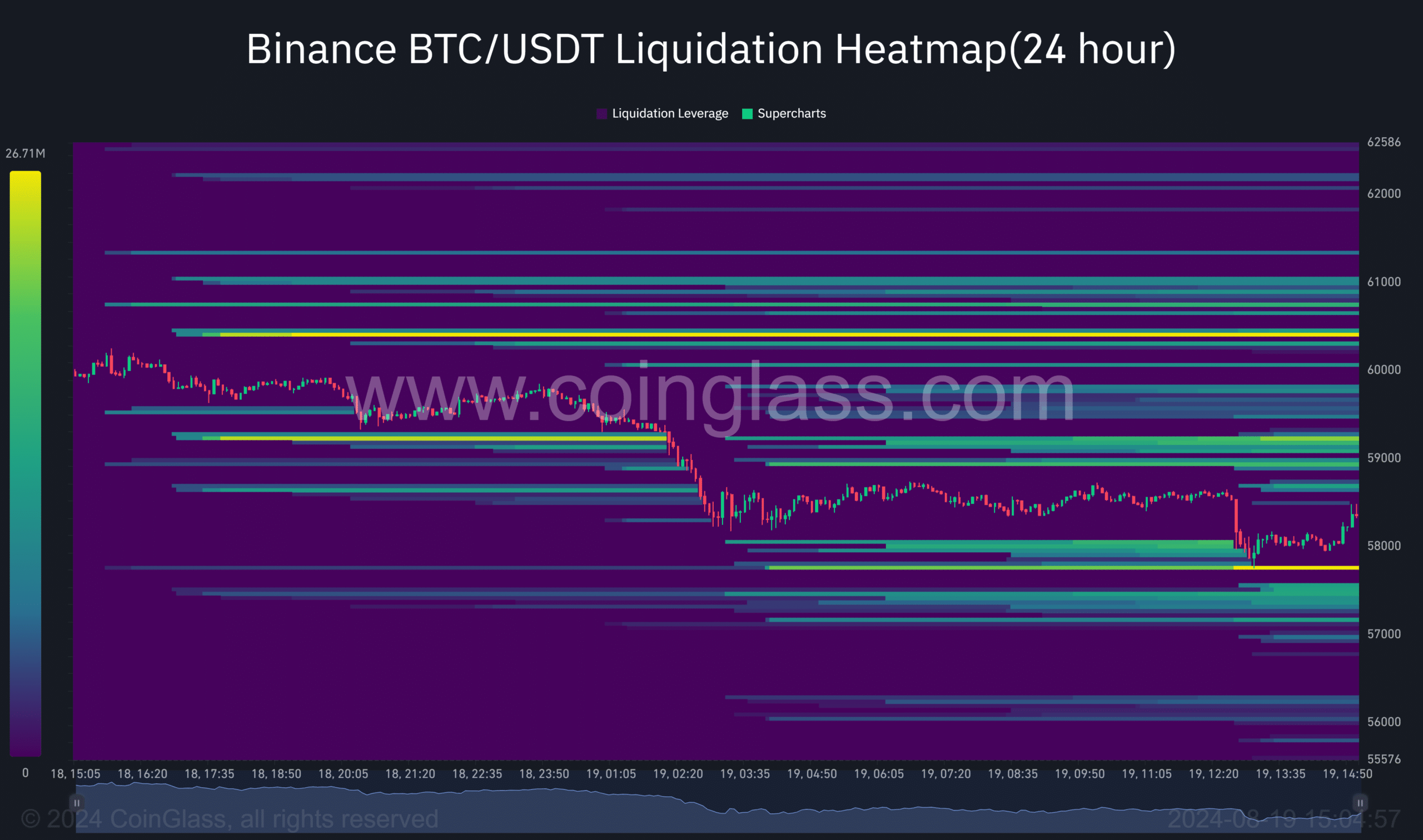

The risks of Bitcoin liquidation are high

Yet there is a serious risk on the horizon. If the price rises above $60,000, the liquidation heatmap shows that more than $100 million worth of BTC will be sold in no time.

Any upward movement will therefore lead to massive liquidations, resulting in sharp price fluctuations.

Source: Coinglass

Volatility Ahead for Bitcoin

Finally, Bitcoin’s recent price action implies that the market may experience greater volatility.

Is your portfolio green? Check out the BTC profit calculator

The support level at $56,427 still remains significant; However, the $60k spot should be watched as there is significant liquidation pressure at the moment.

In general, whale behavior, currency outflows and some technical aspects indicate an alert market status.