- Whale activity increased as Bitcoin formed a double bottom pattern and tested key resistance levels

- Market sentiment was boosted by rising active addresses, declining foreign exchange reserves and the bullish buy/sell ratio

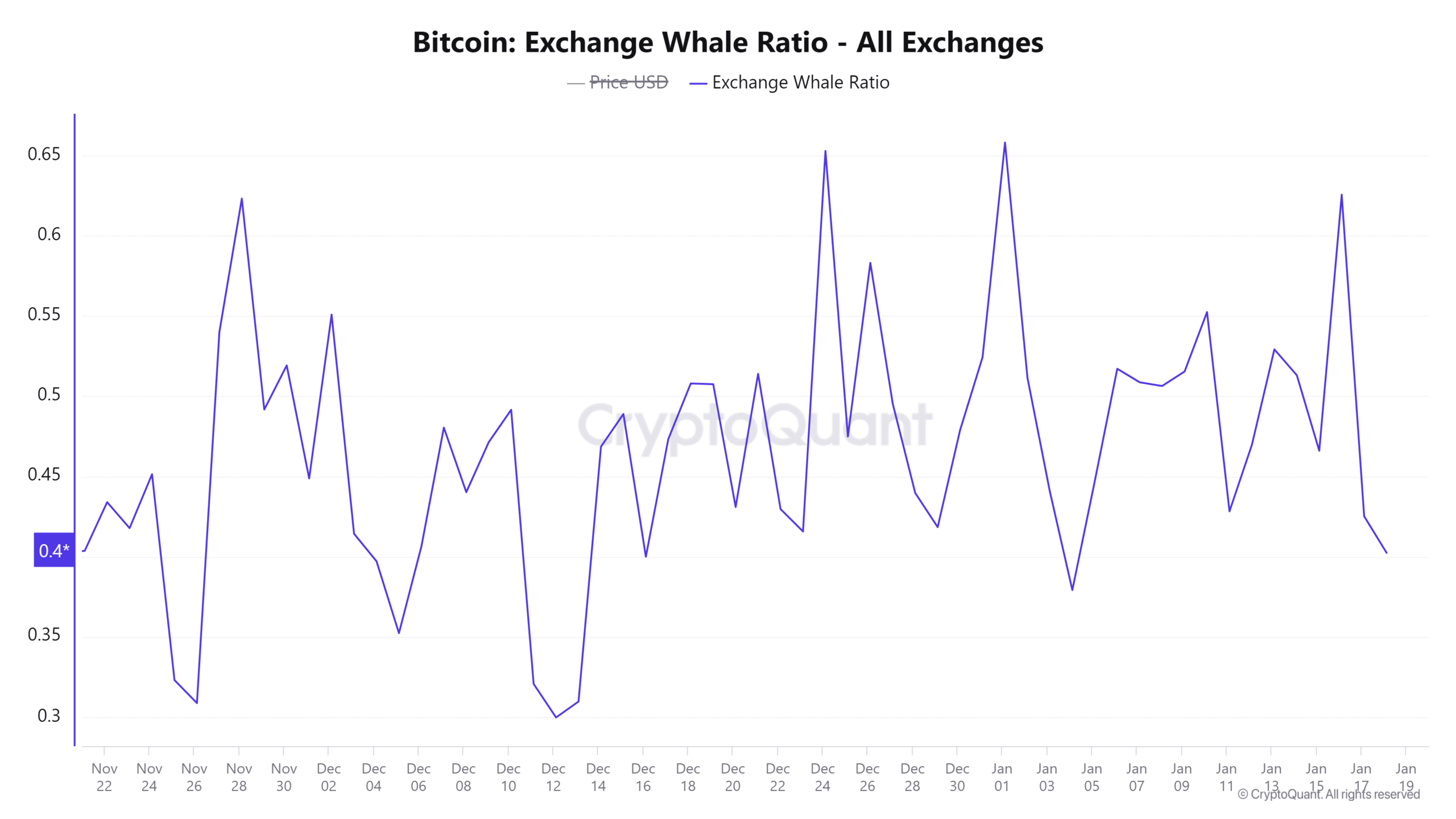

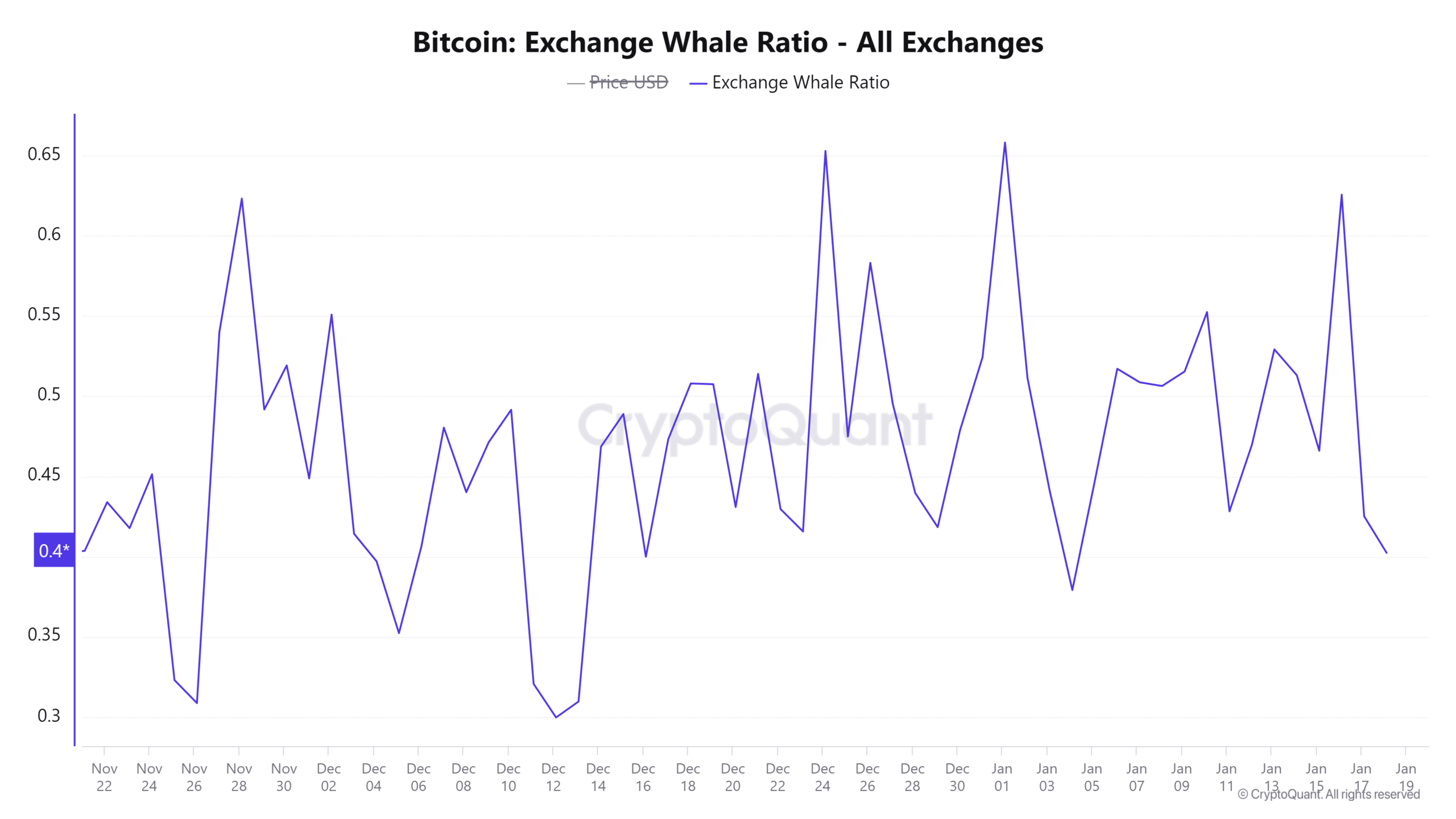

Whale activity on Binance has increased significantly recently, with the whale ratio increasing by over 1.02%. This metric, which tracks the highest inflows compared to total inflows, is used to assess large moves by large Bitcoin holders.

Historically, such increased whale activity is often seen as a precursor to large-scale buying or selling. In fact, this often precedes major price movements in the charts.

Needless to say, the latest wave has raised questions about whether this is the case Bitcoin [BTC] is on the cusp of a significant market shift or just a temporary rally.

Source: CryptoQuant

Is Bitcoin Ready to Test New Highs?

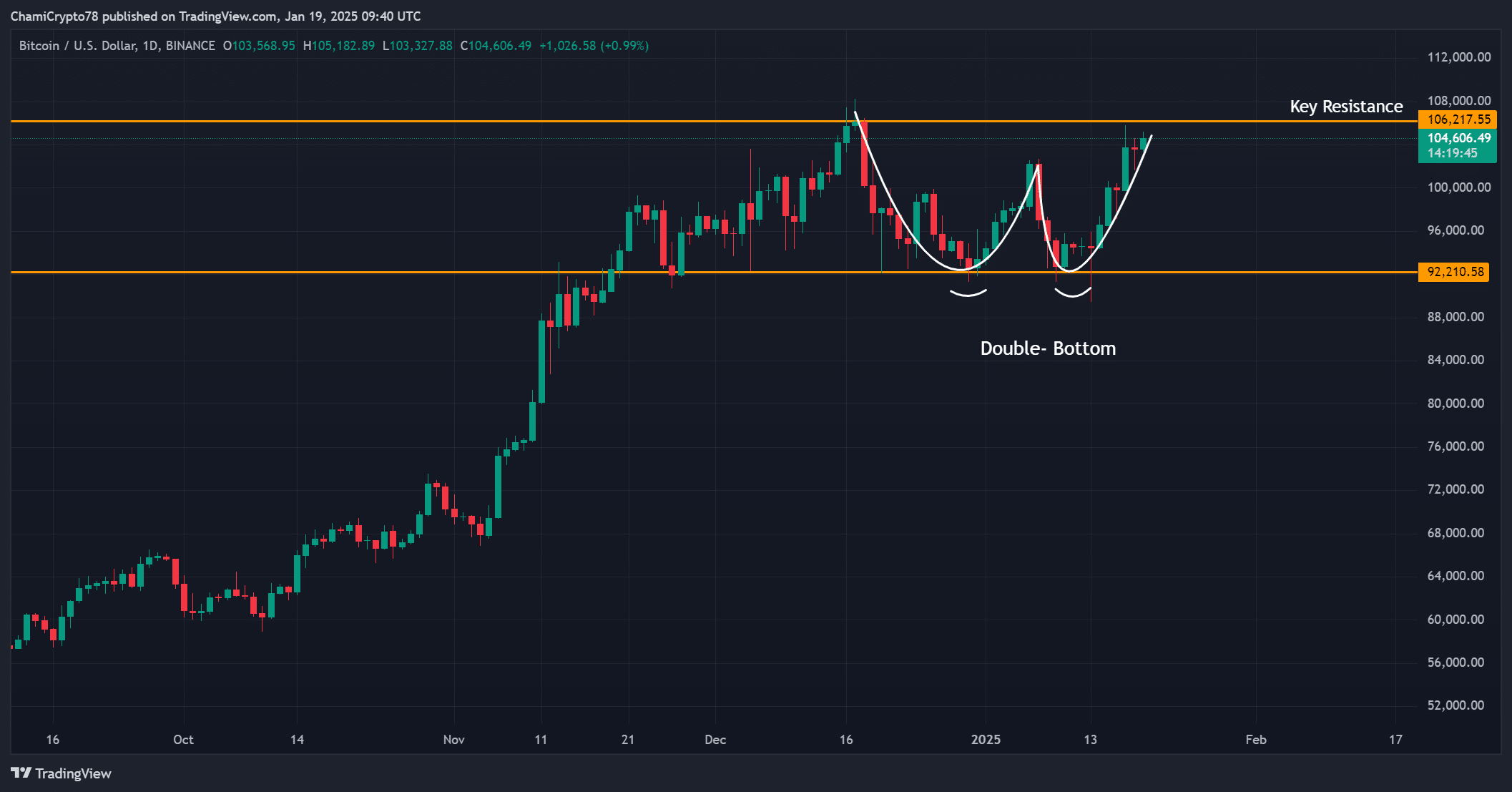

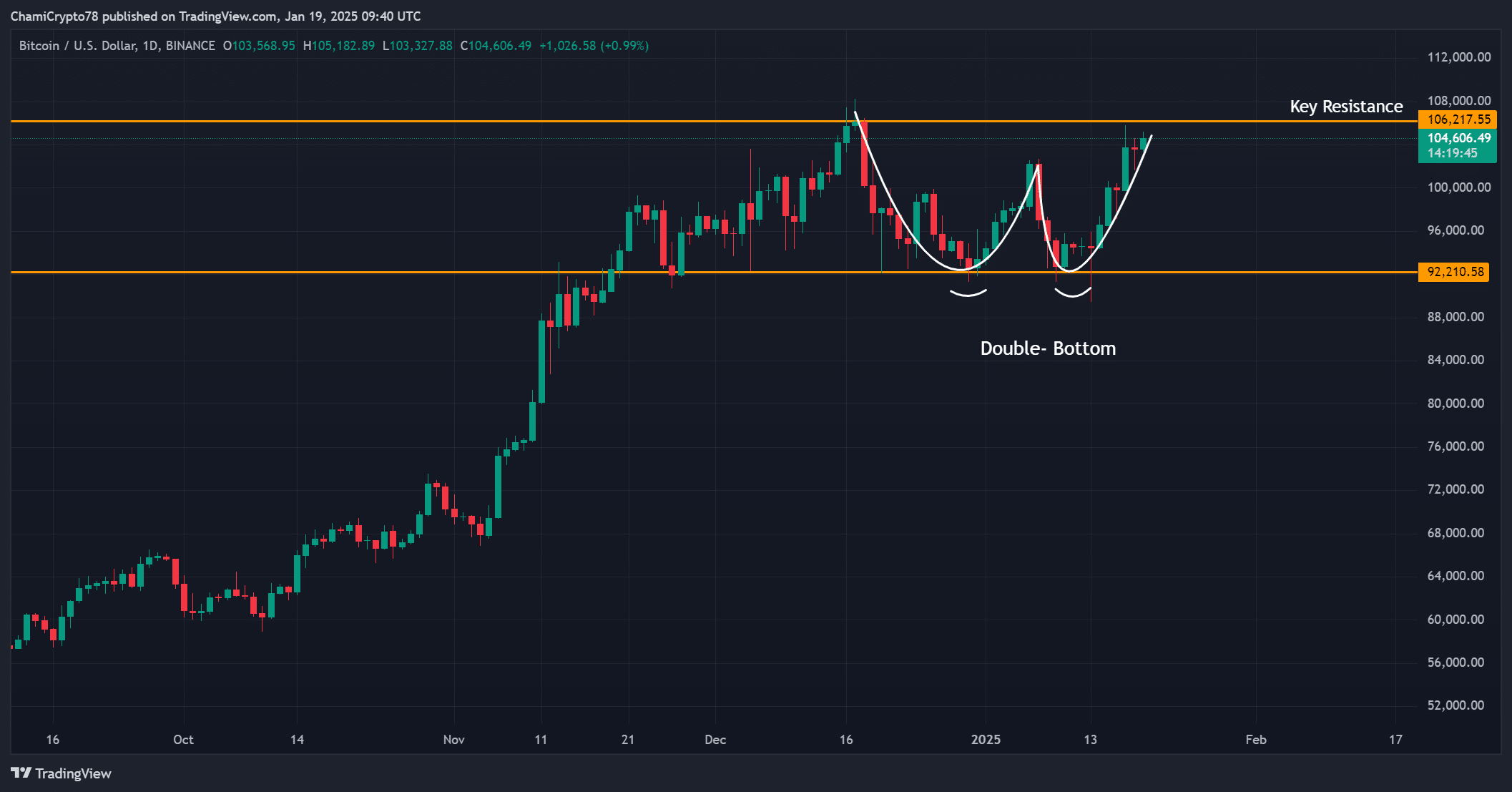

Bitcoin was trading at $104,473.77 at the time of writing, having risen 1.39% in the past 24 hours. The price action on the charts revealed a double bottom pattern that formed strong support around $92,000, while resistance at $106,200 remained a key obstacle.

If BTC can break through this resistance, it could pave the way for a major breakout. However, the inability to maintain upward momentum could lead to a retest of lower levels, which would represent a critical moment for traders to watch closely.

Source: TradingView

How can active addresses shape the market?

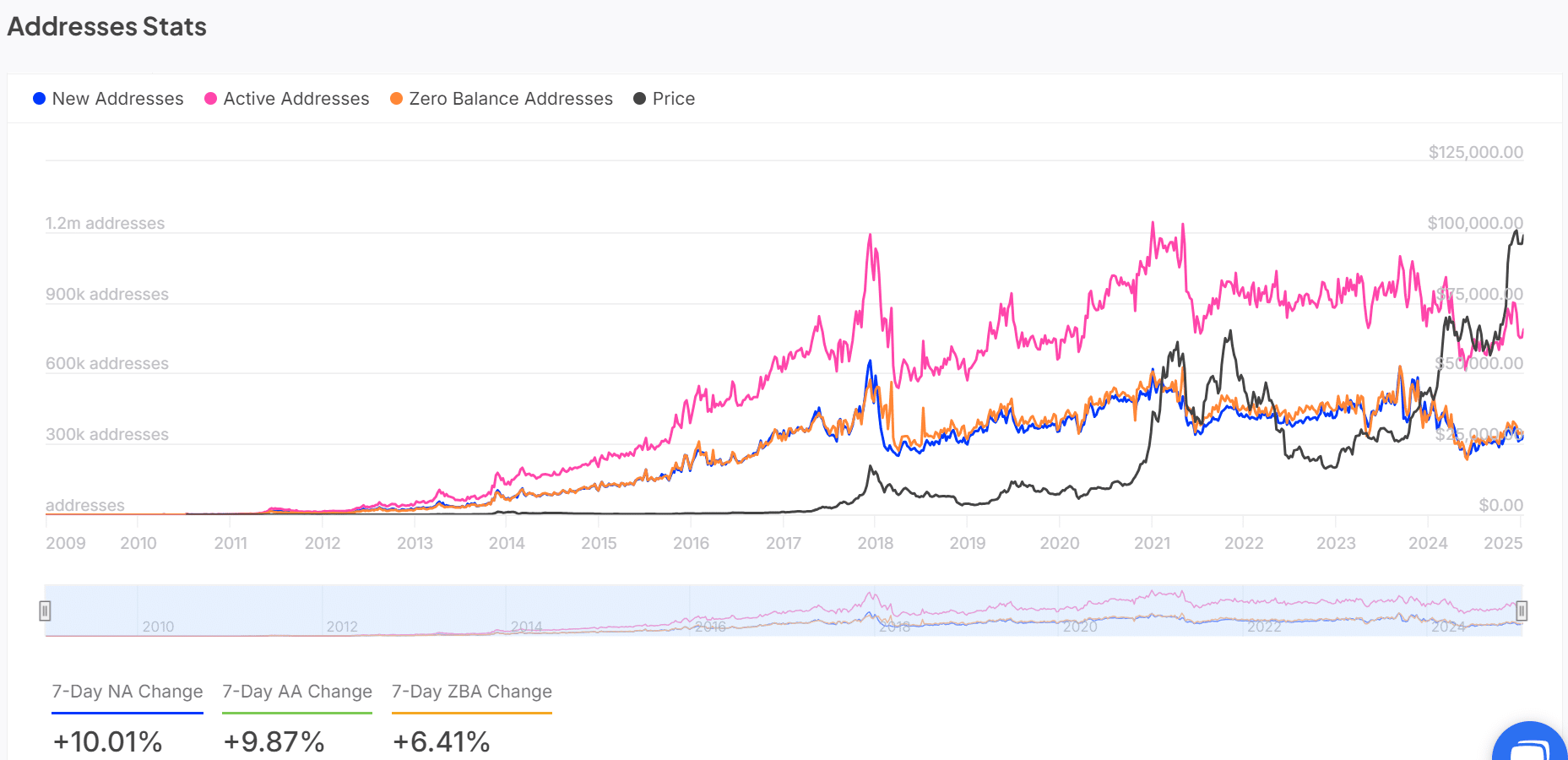

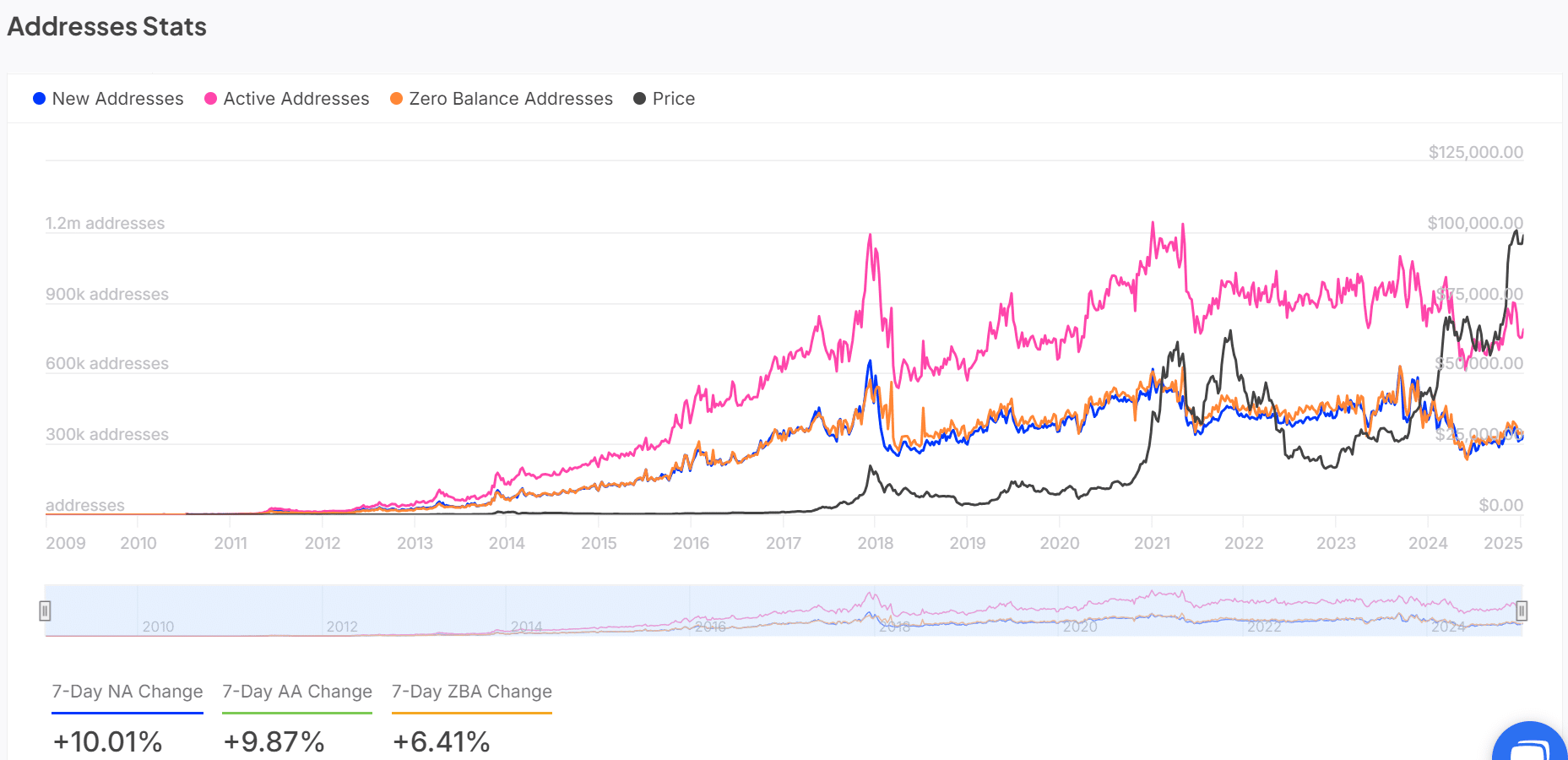

Bitcoin active addresses are up 9.87% over the past seven days, reflecting growing interest in this crypto asset. Such an increase is a crucial indicator of market activity, indicating increased demand for transactions from both retail and institutional investors.

An increase in the number of active addresses is also often seen as a measure of market confidence. If this trend continues, it could provide the transactional support needed to push BTC to higher price levels.

Source: IntoTheBlock

Foreign exchange reserves indicate reduced selling pressure

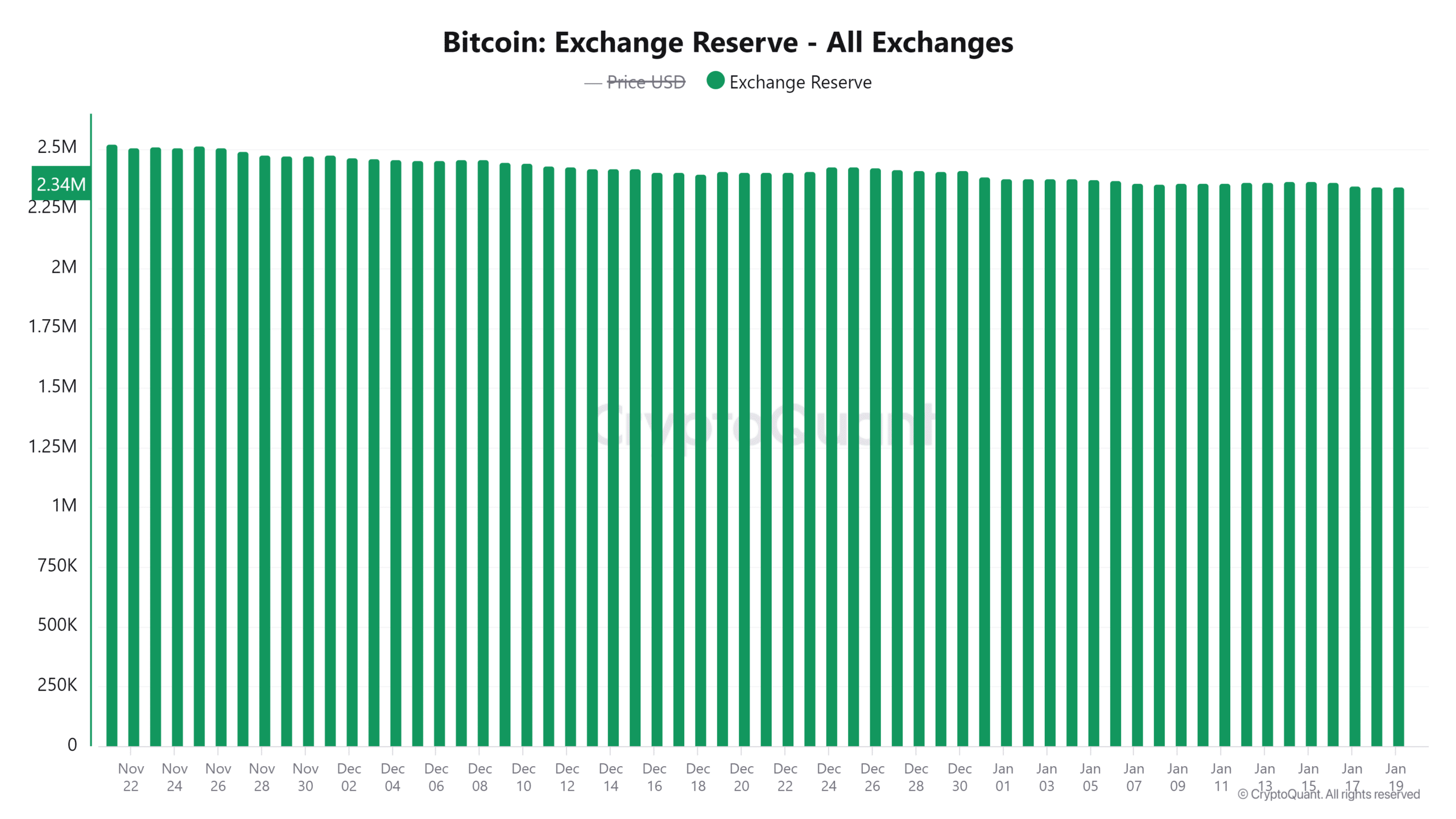

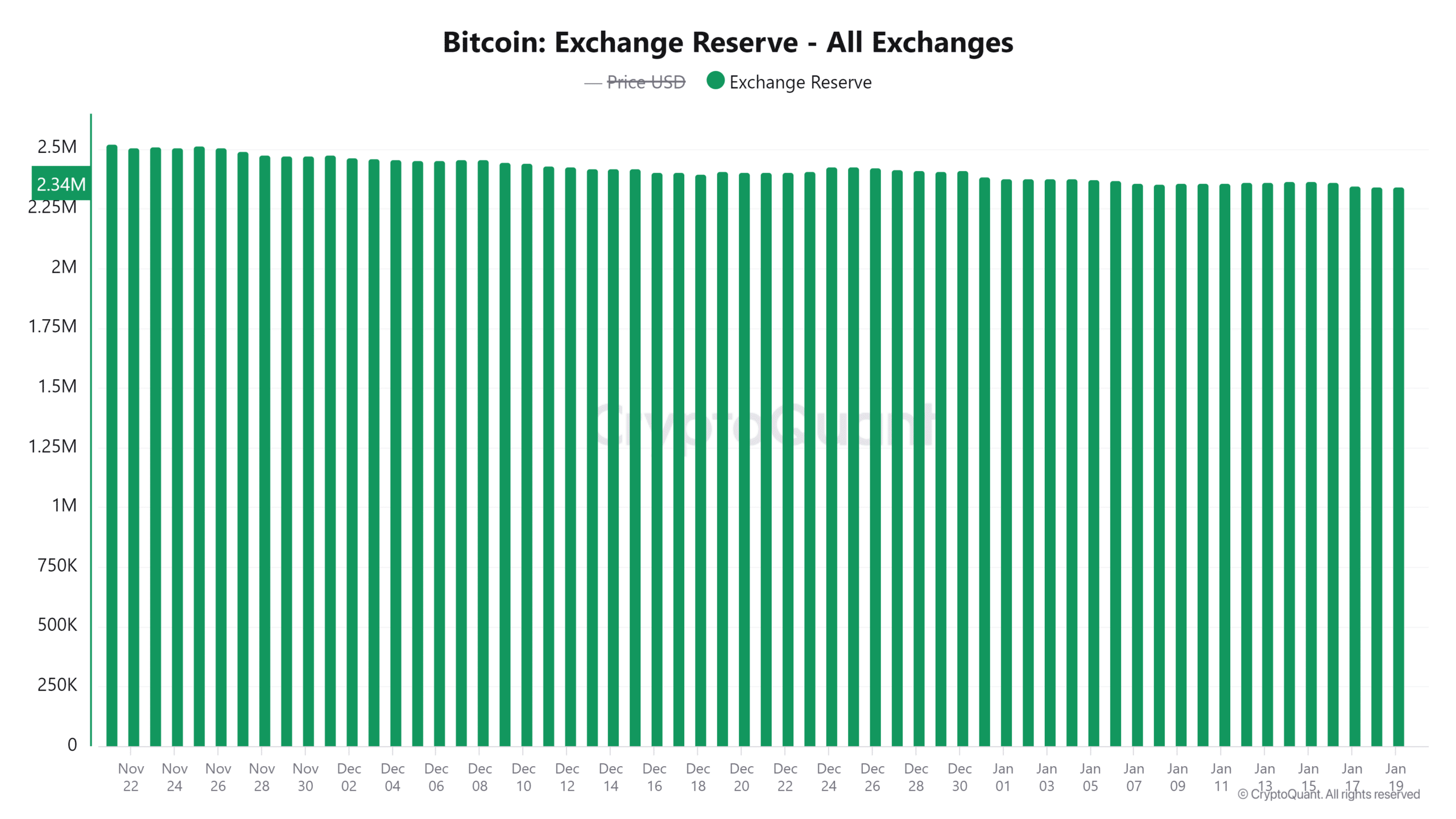

More than 20,000 BTC, worth more than $2 billion, have been withdrawn from the exchanges in the past 96 hours. At the time of writing, foreign exchange reserves stood at 2.344 million BTC, reflecting a continued decline.

This trend indicated that investors have been moving their holdings into private wallets – a sign of long-term bullish sentiment.

Here it is worth noting that reduced foreign exchange reserves tend to correlate with a drop in selling pressure, a finding that could further support a potential BTC rally.

Source: CryptoQuant

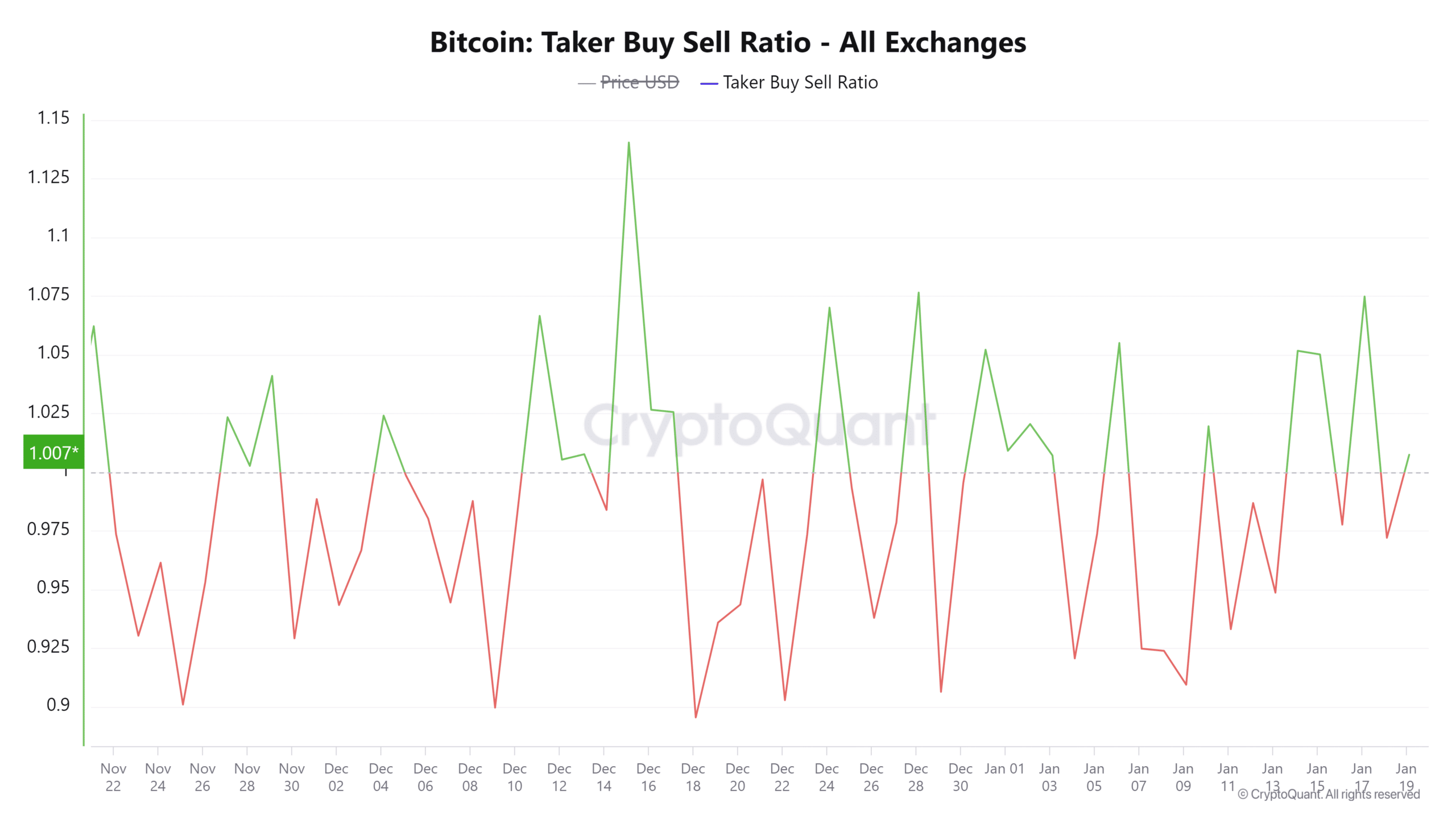

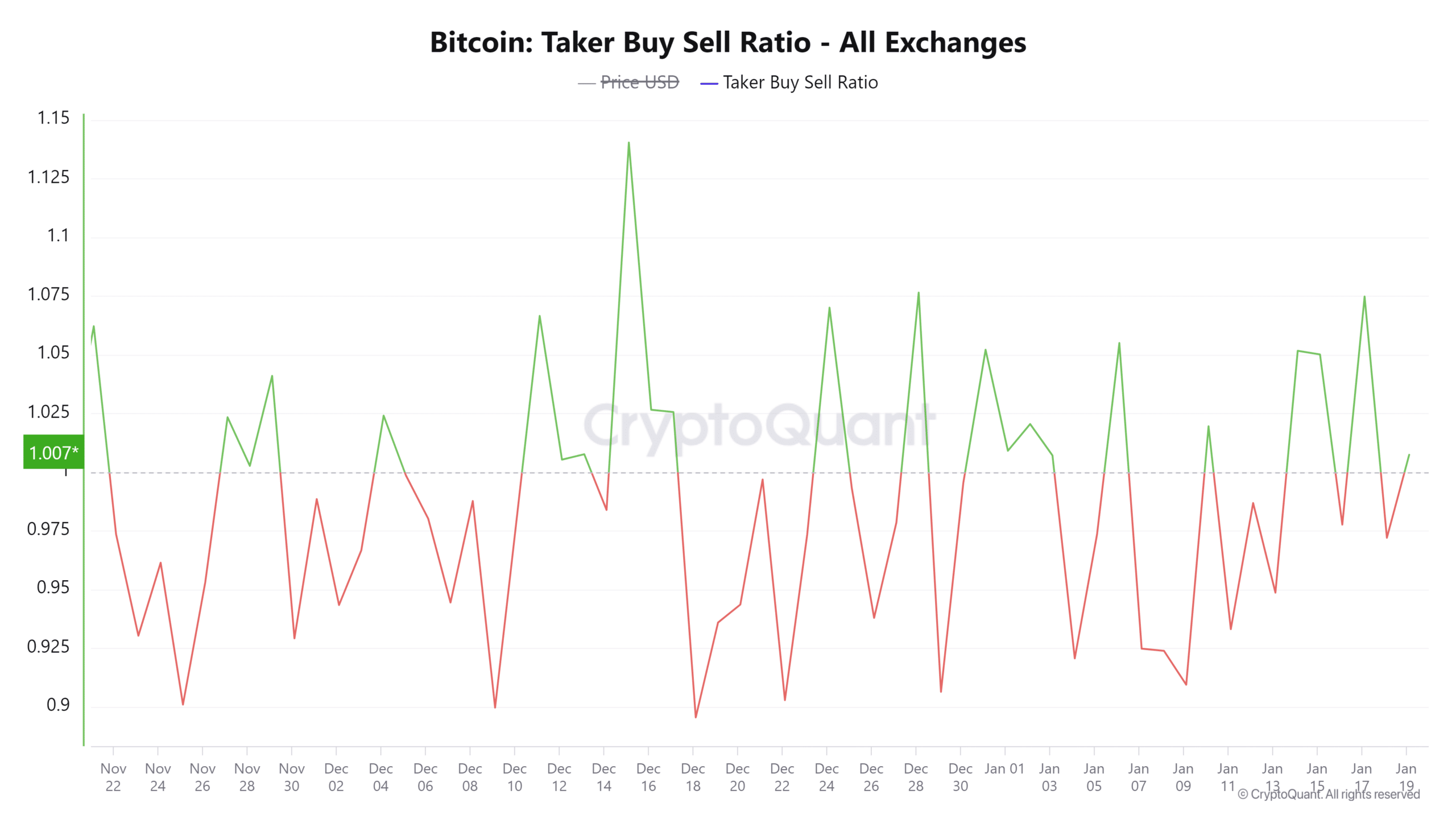

The taker buy/sell ratio indicates bullish momentum

At the time of writing, the buyer buy/sell ratio was 1.01, with buyer dominance increasing by 0.99%. This metric highlighted that market participants have been actively purchasing Bitcoin at higher prices – a sign of growing demand.

Furthermore, this bullish sentiment complemented the broader story of rising interest in BTC, further strengthening the possibility of near-term upside momentum.

Source: CryptoQuant

Is your portfolio green? Check out the Bitcoin profit calculator

Given the surge in whale activity, increasing number of active addresses, dwindling foreign exchange reserves, and bullish taker buy/sell ratios, Bitcoin appears poised for a breakout.

While the risk of a pullback remains, the data strongly supported a bullish case for the cryptocurrency.