- Bitcoin’s apparent demand, measured on the basis of the 30-day sum of daily block subsidies minus one year inactive delivery changes, indicated Beerarish print

- Holders accelerated sales, strengthening Bearish market conditions

Bitcoin’s [BTC] Recent price movements reflected a complex interplay between demand, the sentiment of leverage workers and the actions of important stakeholders. While BTC fell from $ 84,600, traders calculated the market feature, with many taking long positions at the wrong time.

At the same time, large Bitcoin holders reduced their positions, increasing sales pressure across the board. In addition, demand indicators seemed to point to one of the weakest periods of 2025, with a new offer that is larger than inactive supply.

Bitcoin’s apparent demand, measured on the basis of the 30-day sum of daily block subsidies minus a year inactive delivery changes, was put on the pressure on Beerarish. Between December 2, 2024 and March 10, 2025, the question peaked on December 16, 2024 at 105k BTC, with the price at $ 97.5k.

However, by March 3, 2025, the question had fallen to -100k BTC when the cryptocurrency dropped to $ 80k in the charts. The 30-day simple advancing average (SMA) of demand also fell from 105k BTC to 77.5K BTC, which strengthened it down.

A shift from a positive question for negative question took place after mid -January 2025, with a persistent negative question that came into force on 17 February 2025. This shift suggested that new offer surpassed the preservation of inactive BTC, which led to downward pressure on the price.

If the question remains negative, Bitcoin can test $ 75k, which may fall to $ 70k. A reversal above 0 can stabilize the crypto at $ 85k, although sustainable purchasing pressure would be needed to confirm a recovery.

Wrong alignment with market trends

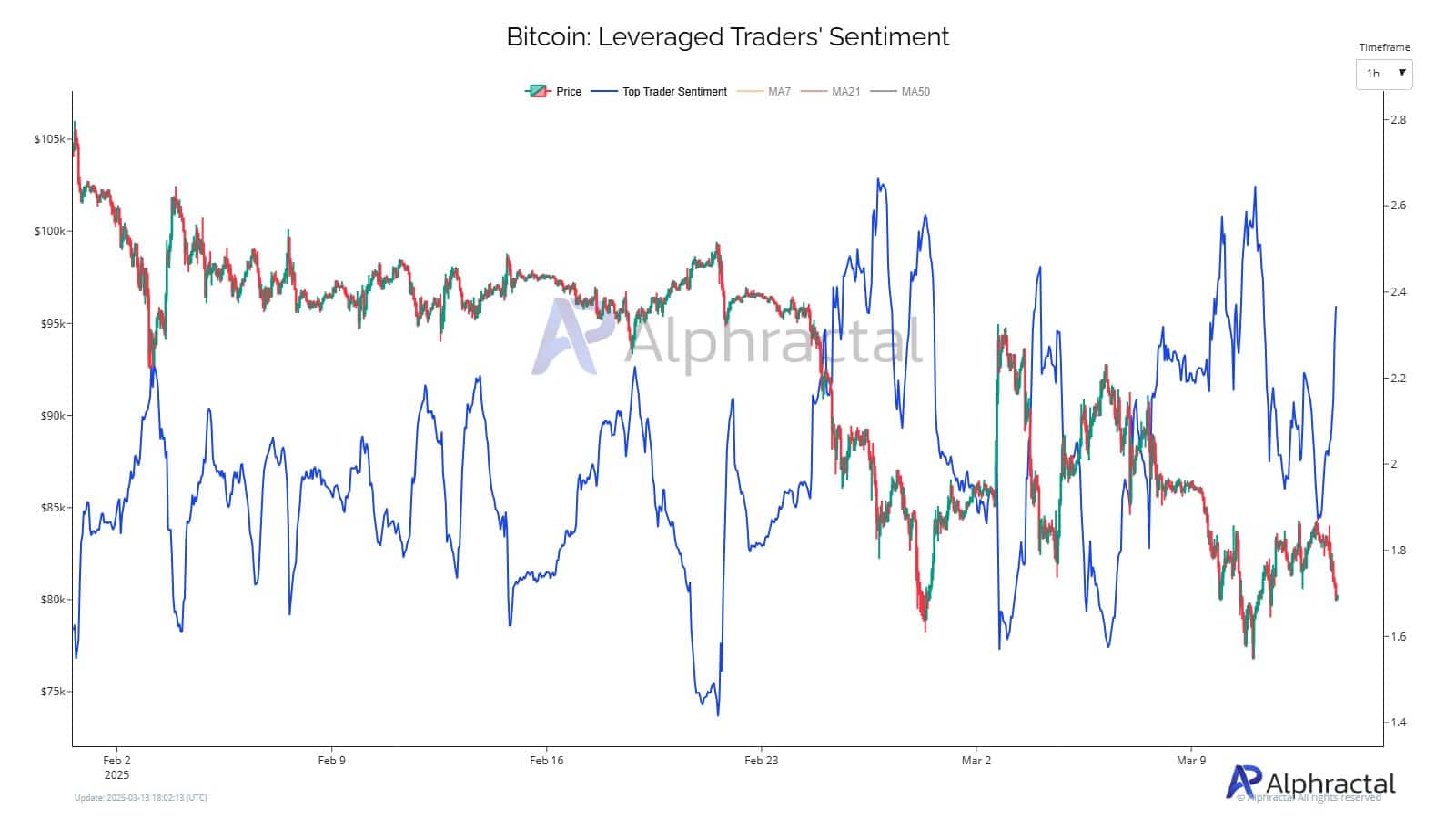

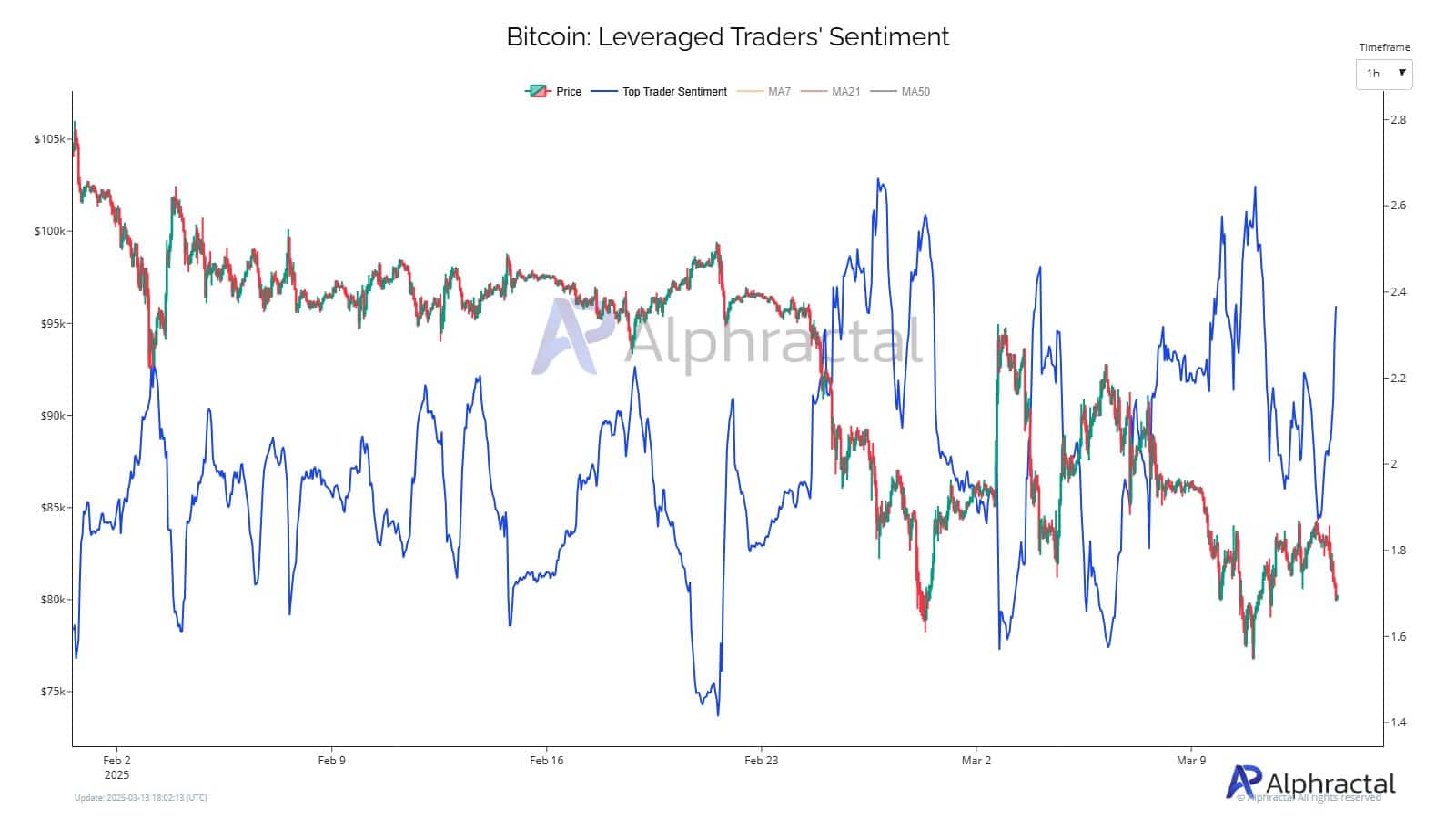

However, that is not all. Leveraged Traders assessed the price movement of Bitcoin, because the sentiment shifts were not in accordance with the price action. From 2 February to 9 March, Bitcoin traded at $ 95k, while Top Trader sentiment registered -2.8 -a sign of extreme areas.

By February 16, the sentiment turned to 2.8 when the price dropped to $ 85k, indicating that traders went long despite the downward trend.

Source: Alfractaal

The progressive averages (MA7, MA21, MA50) of sentiment fluctuate, with the MA50 peaks on February 23 on February 23, even when the crypto dropped to $ 80k. On March 9, the sentiment fell to 1.4, while Bitcoin recovered to $ 84k, again wrongly signed with the price direction.

This continuing incorrect estimate is a sign of recklessness in a rally that did not come out. If traders continue this pattern, further liquidations can push BTC to $ 78k. However, a recasting sentiment with price trends can support a recovery, although market behavior remains unpredictable.

The sale of stakeholders adds pressure

Finally, large Bitcoin holders accelerated the sale, which strengthens Beerarish market conditions. In the past three months, portfolios with 100-1,000 BTC reduced their participations by 50,625 BTC, reducing their market share from 23.48% to 22.94%.

Likewise, portfolios are shifting 10-100 BTC 7,062 BTC, which fell from 21.84% to 21.71%.

Source: Santiment

This sales trend coincided with the price fall from Bitcoin from $ 97k to $ 84k between January 21 and March 2. The sales pressure increased when the crypto approached $ 80k on February 22 – a sign that great stakeholders had no confidence in the price that higher levels lasted.

If this trend persists, Bitcoin can test $ 75k. However, if large holders start to accumulate again, BTC can come back to $ 88k.

Bitcoin’s way forward

The prospects of Bitcoin remain uncertain, with a weak question, incorrectly aligned trader’s intiment and great stakeholders who form his process. The question fell to -100k BTC on March 3, which reflects the weakness of the market.

Leverage traders have consistently incorrectly calculated trends, where sentiment shifts are not in accordance with price movements. In the meantime, stakeholders loaded 57,687 BTC, which increased the downward pressure.

If these trends persist, Bitcoin can continue to fall to $ 75k. However, a shift in the question of whether improving the trader sentiment could cause a recovery to $ 90k.