- The price of BTC has fallen by more than 3% in the past 24 hours.

- Selling pressure on BTC subsided, which could cause a trend reversal.

After being bullish for a while, Bitcoin [BTC] once again witnessing a major price correction. The recent price drop may have reignited fear among BTC investors.

However, a look at the bigger picture revealed that BTC was far from reaching the peak of this cycle.

Bitcoin’s Coming Peak

CoinMarketCaps facts revealed that the price of BTC has fallen 13% in the past seven days. Over the past 24 hours, the value of the coin has fallen by almost 3%.

At the time of writing, BTC was trading at $55,412.77 with a market cap of over $1.09 trillion.

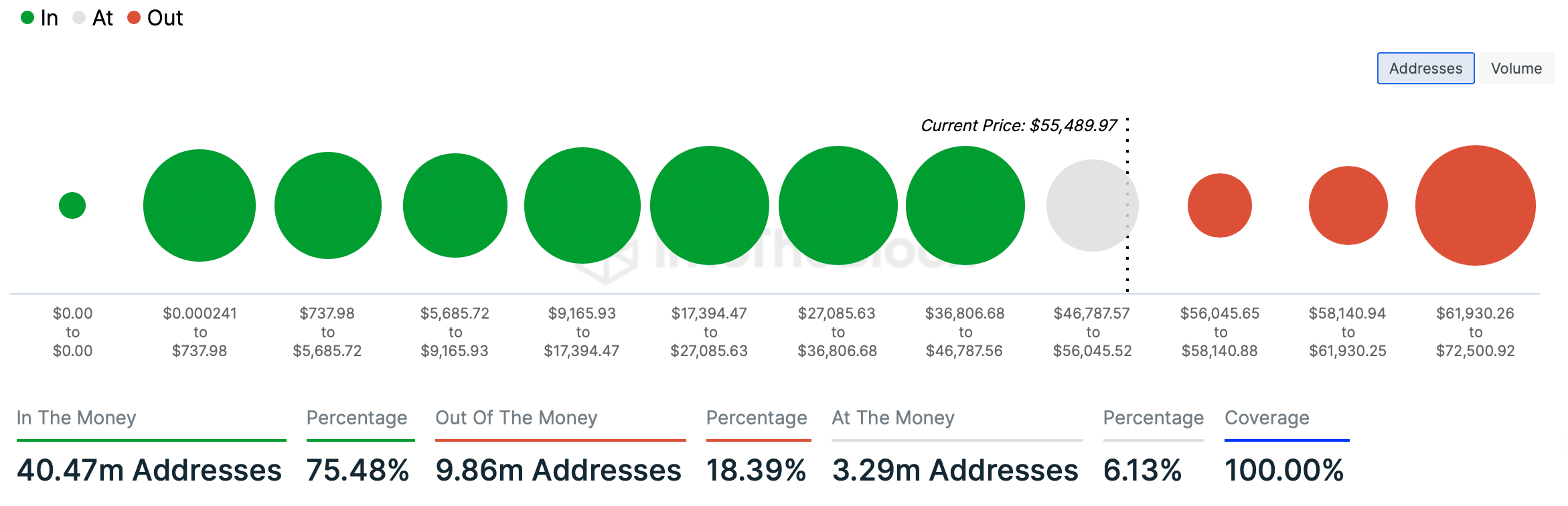

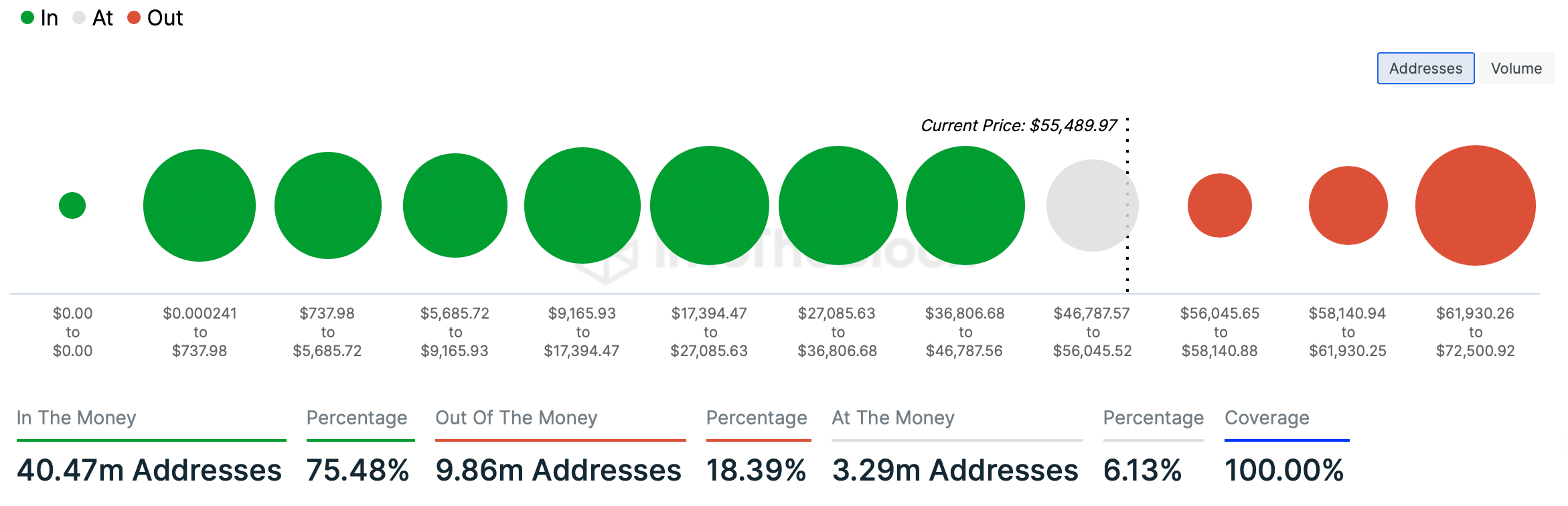

AMBCrypto’s look at IntoThebLock’s data revealed that after the last price correction, only 75% of BTC investors made a profit, accounting for more than 40.47 million addresses.

Source: IntoTheBlock

However, the entire trend may change in the coming months.

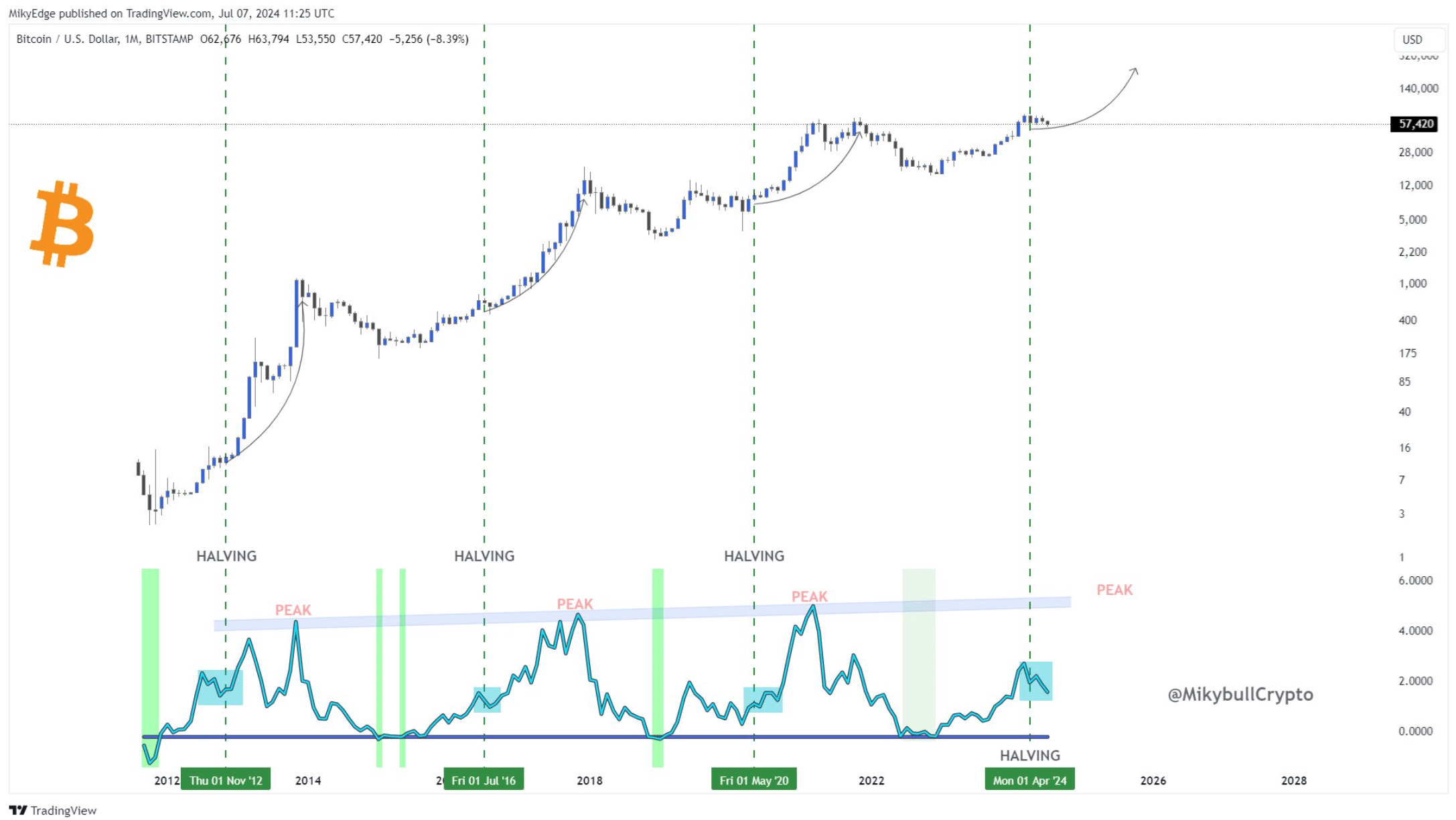

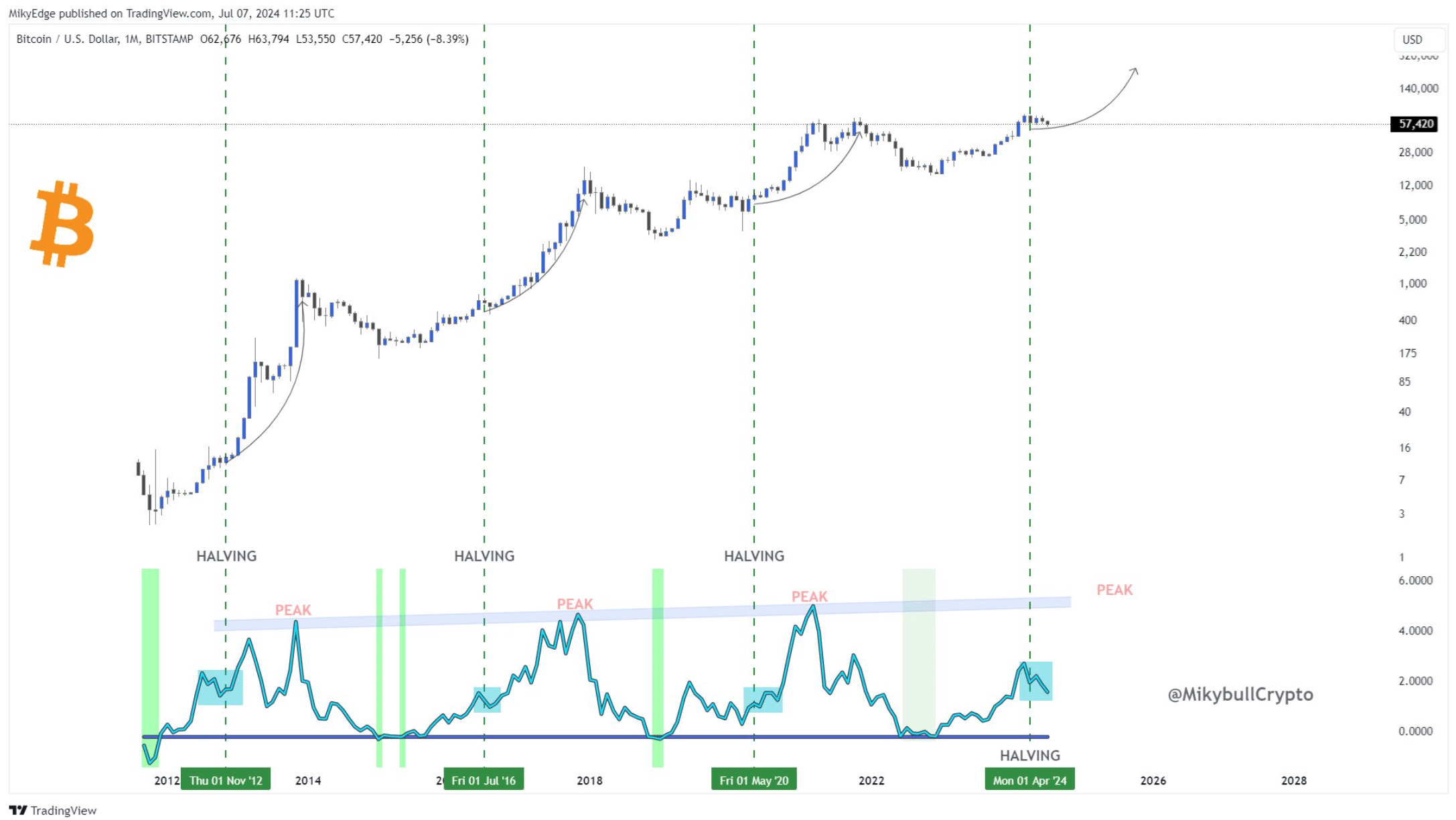

Milkybull, a popular crypto analyst, recently posted tweet highlighting the relationship between Bitcoin’s halving and the cycle peak.

According to the analysis, the price of BTC has always peaked almost two years after the halving. For example, after the 2012 halving, BTC peaked in 2014.

After BTC’s third halving in 2020, its price reached a cycle peak in 2022. Therefore, if history repeats itself, investors could witness BTC reaching a cycle high in 2026 as the fourth halving occurred in 2024.

Source:

This latest analysis suggested that investors should remain confident that the king of cryptos has chosen HODL, as the profits they could make in the coming years could be huge.

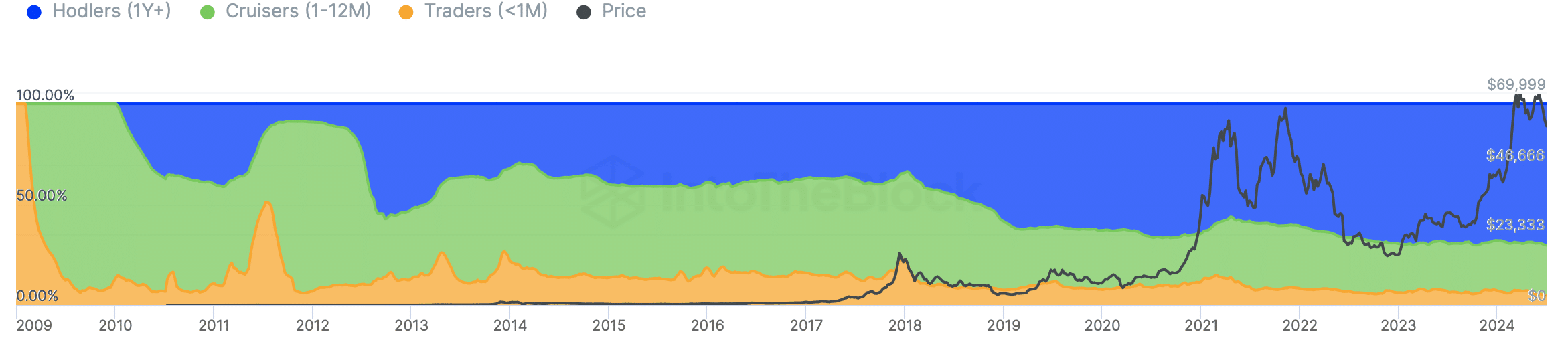

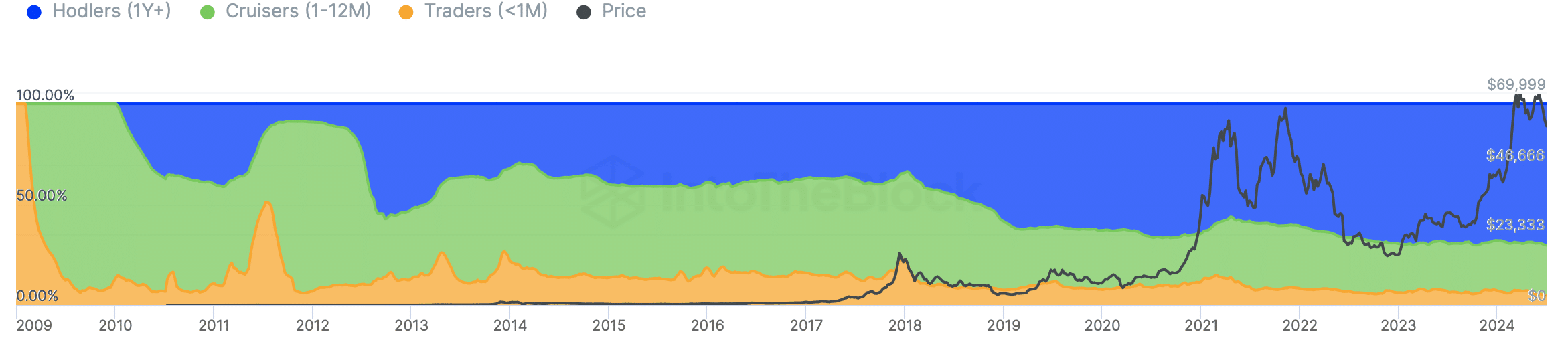

AMBCrypto’s look at IntoTheBlock’s data revealed that investors actually showed tremendous confidence in the coin.

This seemed to be the case as more than 70% of BTC holders were long-term holders, meaning they held the coin for more than a year.

Source: IntoTheBlock

What you can expect in the short term

Since things were looking quite optimistic in the long term, AMBCrypto planned to check BTC’s on-chain data to see what to expect in the short term as a correction recently occurred.

Our look at CryptoQuant’s facts revealed that BTC’s exchange reserve fell, meaning selling pressure on the token decreased.

The binary CDD was green, which meant that long-term holders’ moves over the past seven days were lower than average. They have a motive to hold on to their coins.

Read Bitcoins [BTC] Price prediction 2024-2025

These statistics suggested that Bitcoin’s price chart could soon turn green.

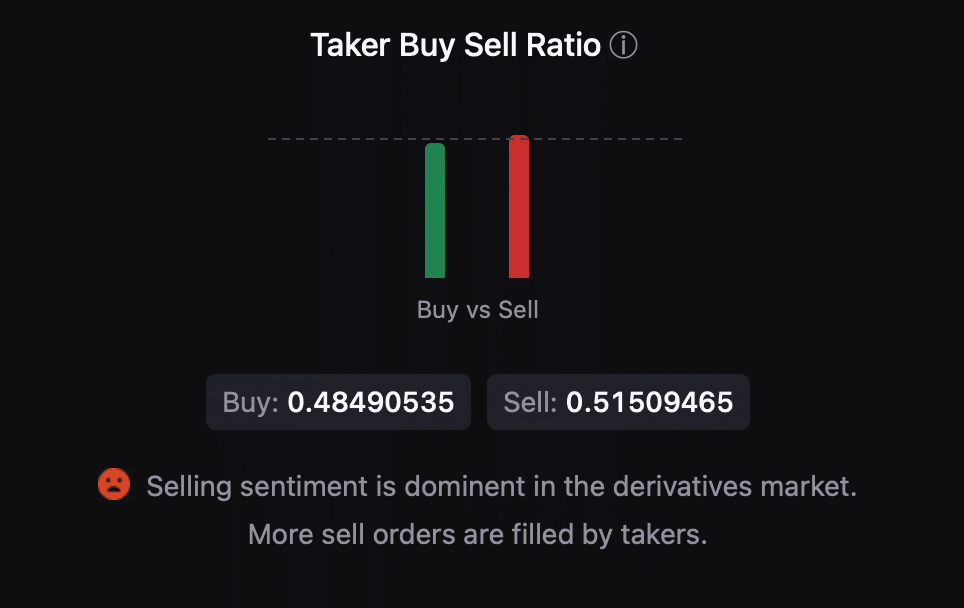

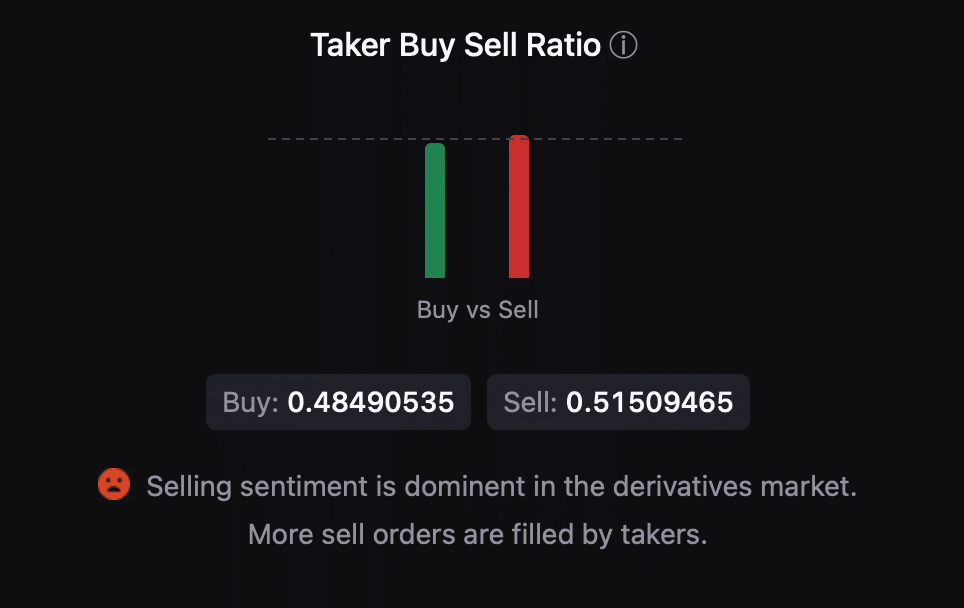

However, derivatives metrics were bearish. For example, BTC’s buy/sell ratio was red, indicating that selling sentiment was dominant in the market.

Source: CryptoQuant